Intuit Inc. (INTU) is strategically positioning itself for consistent growth by focusing on innovation and providing substantial value to its customers. INTU reported an impressive total revenue of $2.98 billion for the fiscal first quarter ended October 2023, a notable increase of 14.7% from the prior-year period. Remarkably, these figures surpassed the expected consensus estimate of $2.88 billion.

The company disclosed a significant surge in operating income, which skyrocketed by 304% to reach $307 million. Further, its Non-GAAP Earnings Per Share (EPS) escalated by 48.8% to $2.47, notably outperforming analysts’ projections by a margin of 24.8%.

CEO Sasan Goodarzi, expressing optimism, said, "We had a very strong first quarter, starting our fiscal year with momentum. With data and AI core to our strategy, we're accelerating innovation across our global financial technology platform to power the prosperity of consumers and small businesses."

Navigating a dynamic financial technology market, the company's robust first-quarter performance and its reaffirmed commitments show promise for a positive outlook.

INTU offered reiterated guidance for the fiscal year of 2024, anticipating overall revenues to fall between $15.89 billion and $16.11 billion, while the non-GAAP EPS is forecasted to range from $16.17 to $16.47.

Given these projections, INTU presents a compelling case for potential investors and might be a valuable addition to your watchlist. The following are key metrics demonstrating my bullish stance.

Tracking Intuit Inc's Financial Performance: An In-depth Analysis of Key Metrics (2021-2023)

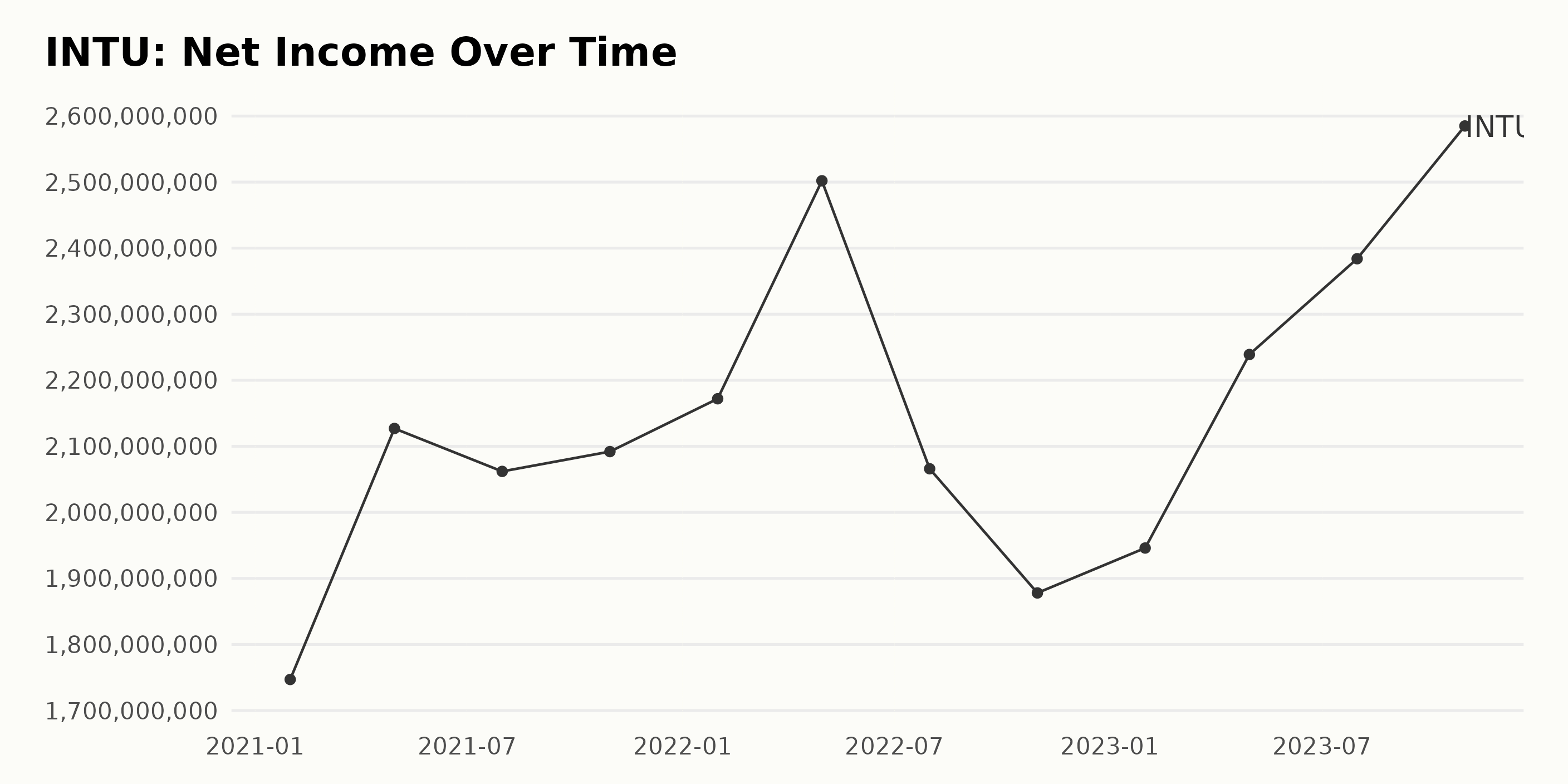

- Intuit Inc. (INTU) started the year 2021 with a trailing-12-month Net Income of $1.75 billion in January. This figure increased slightly to $2.13 billion by April 2021. However, there was a slight decline to $2.06 billion by July but it slightly moved up again to hit $2.09 billion in October 2021.

- In 2022, INTU's Net Income trend indicated a significant rise in the first half of the year. In January, the Net Income was $2.17 billion, it rose significantly to $2.50 billion in April but fell back to $2.07 billion in July. By October 2022, the Net Income was $1.88 billion.

- The year 2023 began with a Net Income of $1.95 billion for INTU in January. A substantial increase was noted in this period, reaching $2.24 billion in April and then surging further to reach its peak of $2.38 billion in July. By the end of this series, in October 2023, the Net Income had exceeded the earlier peak, closing at $2.58 billion.

- Over this period, INTU’s Net Income reflects an overall upward trend with some periodic fluctuations. From January 2021 to October 2023, there has been a significant growth in Net Income of approximately 47.89%.

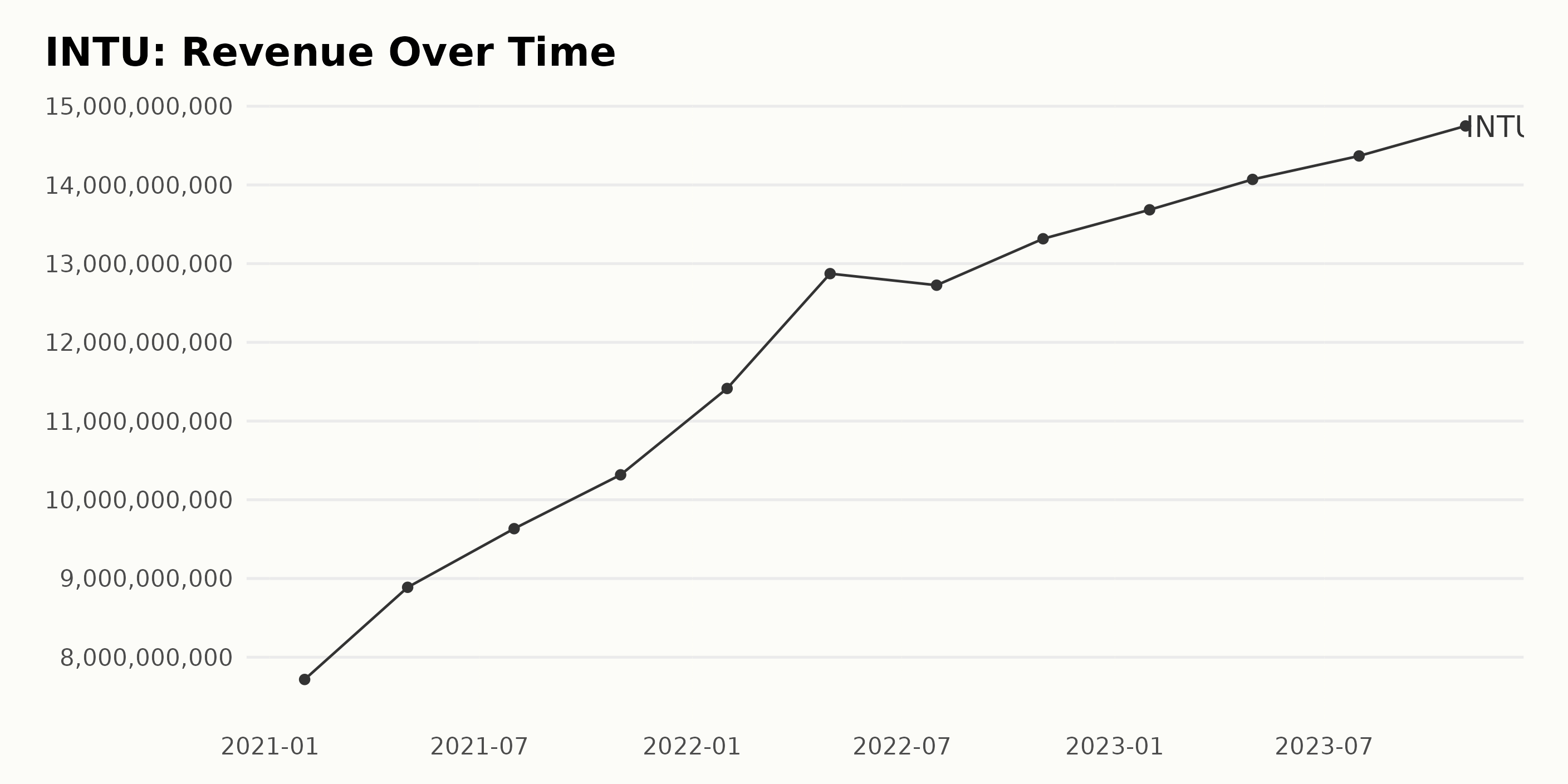

The trailing-12-month revenue trend for Intuit Inc. (INTU) over the reported period indicates a consistent growth trajectory, albeit with some fluctuations. Here's a brief breakdown:

- In January 2021, the Revenue stood at $7.72 billion.

- It grew to $8.89 billion by April 2021, further increasing to $9.63 billion by July 2021.

- In October 2021, Revenue reached $10.32 billion.

- In January 2022, it was reported as $11.41 billion and rose significantly to $12.87 billion by April 2022.

- A slight dip was observed in July 2022, where Revenue reduced to $12.73 billion.

- However, the trend resumed its upward path, reaching $13.32 billion in October 2022 and $13.68 billion in January 2023.

- In April 2023, the Revenue rose to $14.07 billion, followed by a slight increase to $14.37 billion in July 2023.

- The last value in the series was recorded in October 2023 when the Revenue peaked at $14.75 billion.

Over the entire reported period, there was an appreciable growth rate in the company's Revenue. The Revenue increased from $7.72 billion in January 2021 to $14.75 billion in October 2023, representing a growth rate of approximately 91%. While some fluctuations were encountered mid-2022, the overall trend underscores Intuit Inc.'s sustained Revenue growth.

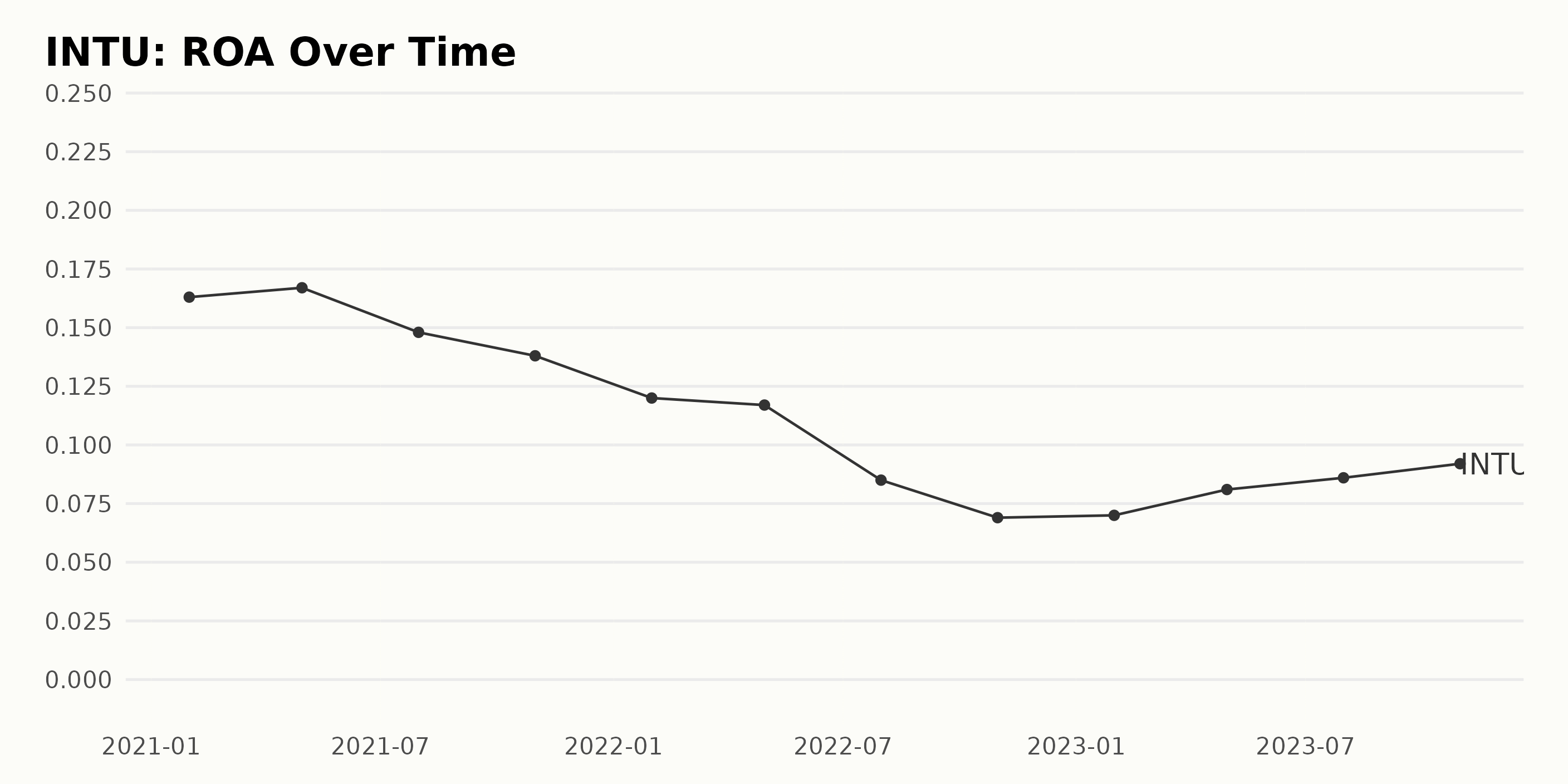

This data series describes the ROA (Return on Assets) of Intuit Inc. (INTU) in a period spanning from January 2021 to October 2023. Overview:

- In January 2021, INTU reported a ROA of 16.3%.

- The highest value recorded during this period was 16.7% in April 2021.

- The lowest value was 6.9% in October 2022.

- By October 2023, the ROA had risen back up to 9.2%.

Trend and Fluctuations:

- From January 2021 until October 2022, there was a general downward trend in INTU's ROA, falling from 16.3% to 6.9%.

- April 2021 saw the peak value before the gradual decline began.

- The most significant drop occurred between April and July of 2022 where the ROA fell from 11.7% to 8.5%.

- However, since November 2022, the ROA began to recover, showing an upward trend until the end of this reported period in October 2023.

- This recovery peaked at 9.2% in October 2023.

Growth Rate Calculation:

- Comparing the last value (October 2023: 9.2%) with the first value (January 2021: 16.3%), it indicates a decrease by approximately 44% over the analysed period.

Overall, the data suggests some volatility in INTU’s ROA over the given period. Significant events might have triggered the large drop mid-2022 and subsequent recovery.

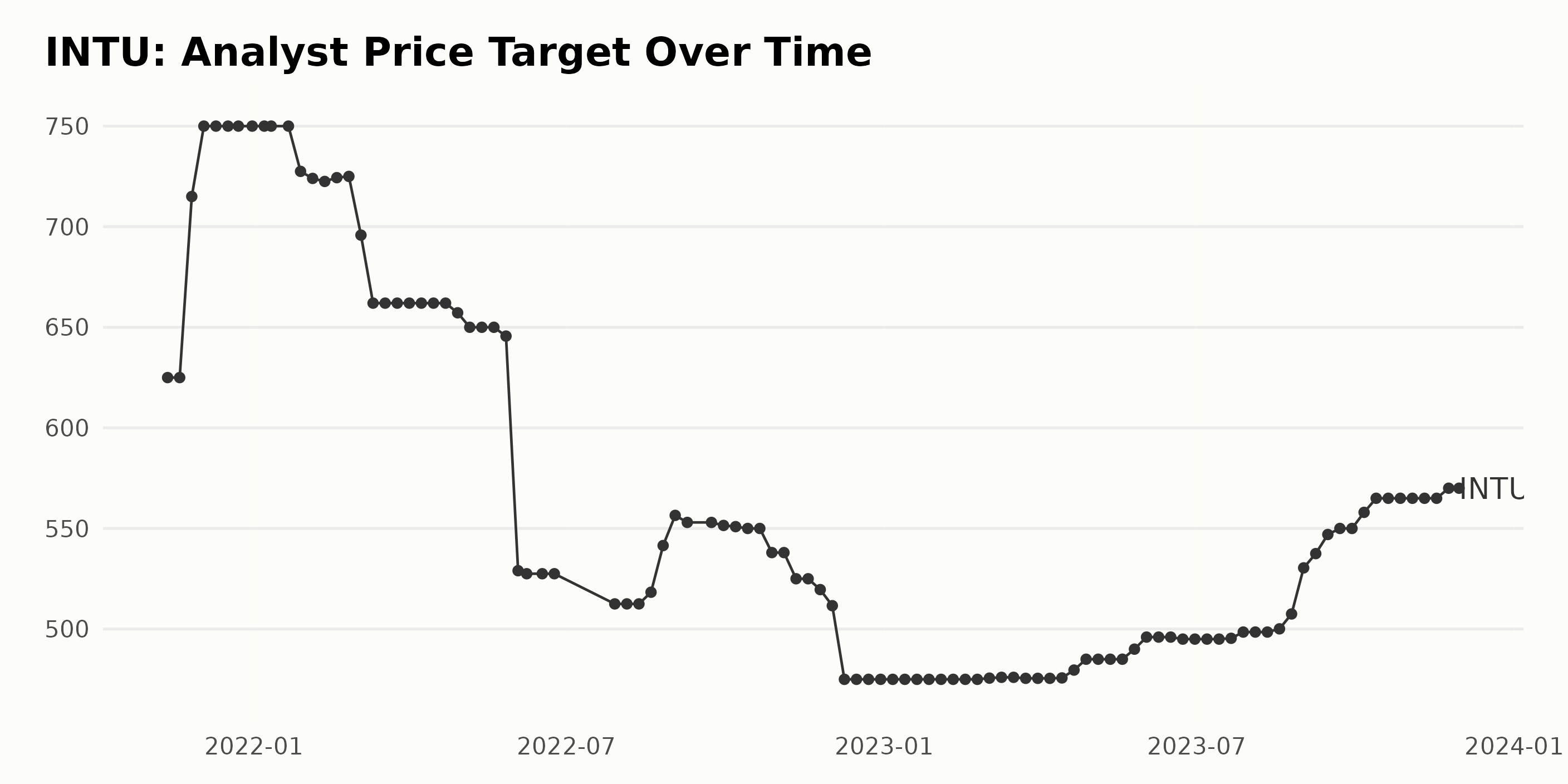

The Analyst Price Target data series for INTU reflects fluctuations and a general decreasing and later increasing trend from November 12, 2021 to November 30, 2023. Here's the summarized data:

- From November 12, 2021 to December 31, 2021, INTU's Analyst Price Target witnessed an increase, peaking at $750.

- Beginning January 2022, a steady decline was observed, bottoming out to $475 by December 9, 2022. This reflects a significant dip from the previous peak.

- The value remained stagnant at $475 for quite some time, until exhibiting minor fluctuations between March and April 2023.

- A steady uptrend commenced around May 2023, which saw the Analyst Price Target rise to $570 by November 30, 2023.

Recent trends from October 2023 to November 2023 show relative stability, with the Analyst Price Target displaying minor yet largely positive fluctuations, ultimately settling at $570. These insights illustrate that while the Analyst Price Target for INTU has encountered periods of declining patterns, a slight recovery trajectory is noteworthy towards the end of the series.

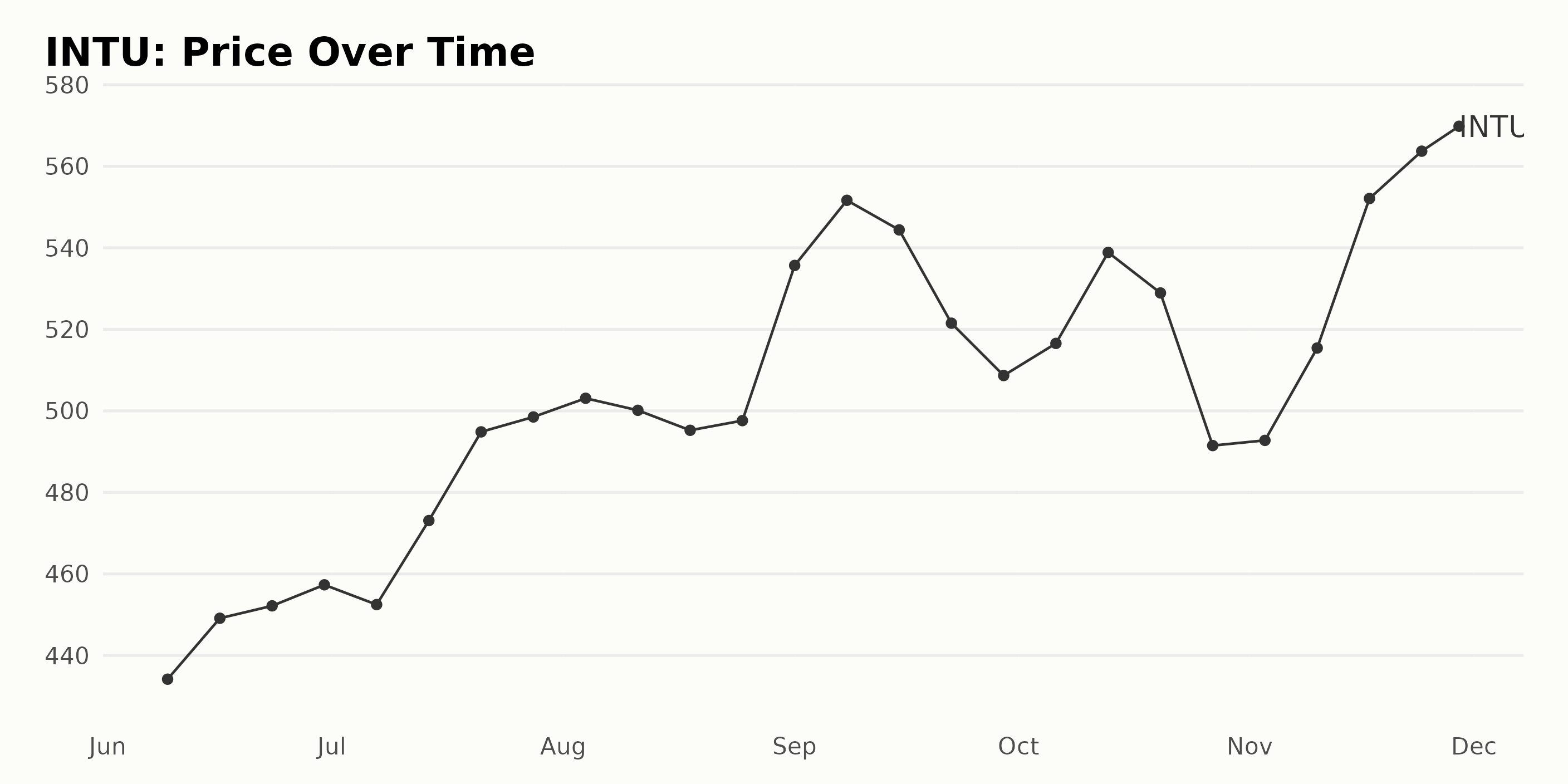

Intuit Inc.'s Stock Journey: Six Months of Fluctuating Acceleration and Deceleration

The share price of Intuit Inc. (INTU) has shown a generally upward trend with periods of acceleration and deceleration between June and November 2023.

- Starting from $434.18 on June 9, 2023, the price gradually increased to $457.33 by the end of the month. This demonstrated a consistent weekly growth.

- The pace of growth accelerated in July, leaping from $452.48 on the 7th to an impressive $498.51 by the end of the month.

- The growth rate decelerated slightly in August, fluctuating between $500.14 and $495.24. However, the price still showed a net increase, ending the month at $497.61.

- The highest acceleration was observed in September when the price rocketed from $535.68 at the start of the month to peak at $551.65 on the week of September 8, 2023. However, this was followed by a significant deceleration and decrement over the subsequent weeks, dropping to $508.67 by the end of the month.

- The price saw volatility in October, soaring initially to $538.87, then dipping to $491.49 by the end of the month. This indicated another period of deceleration in growth rate.

- In November, there was a renewed acceleration in the growth rate taking the price from $492.77 to a high of $569.82 by the end of the month.

In conclusion, over this six-month period, Intuit's shares have shown an overall increasing trend with alternating periods of growth acceleration and deceleration. Here is a chart of INTU's price over the past 180 days.

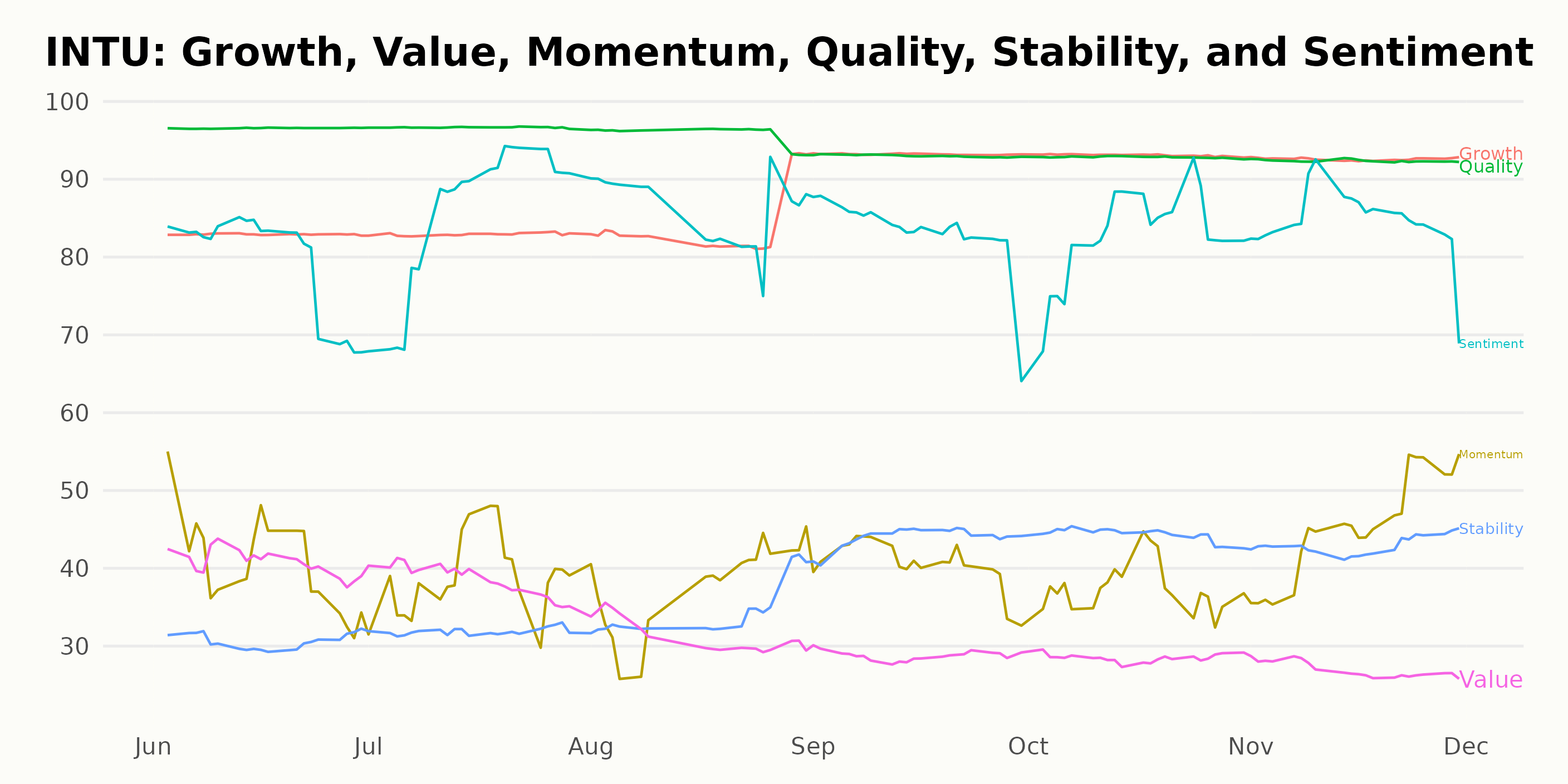

Analyzing Intuit's Performance: Trends in Quality, Growth, and Sentiment

INTU has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #32 out of the 132 stocks in the Software - Application category.

The POWR Ratings for Intuit Inc. (INTU) shows varying levels across different dimensions for the period extending from June to November 2023. The three noteworthy dimensions are Quality, Growth, and Sentiment.

Quality: The Quality dimension consistently stands out with the highest rating across all months, though it slightly decreases over time.

- In June 2023, Quality started with a rating of 97.

- From July to August, it maintained at 97 then dipped to 96.

- September 2023 saw a further decrease to 93, a rating that is sustained to October.

- By November 2023, Quality fell to a still respectable rating of 92.

Growth: Growth ranks second in terms of highest ratings and displays an upward trend over the observed period.

- Its initial rating was 83 in June 2023.

- This remained steady through July to August, after which it shot up to 93 in September.

- The elevated position of 93 was held through November 2023.

Sentiment: Lastly, Sentiment also bears mentioning with decent high ratings and a mixed trend.

- In June 2023, Sentiment started with a rank of 80, then increased to 86 in July.

- This heightened ranking continued through August 2023 after which it decreased to 83 in September.

- The 83 rating remained until October, then rose slightly to 85 in November 2023.

These ratings over different months provide a picture of Intuit's performance along multiple dimensions. They indicate that while the firm consistently exhibits high Quality, its Growth is improving and Sentiment towards the firm is generally positive over this period.

How does Intuit Inc. (INTU) Stack Up Against its Peers?

Other stocks in the Consumer Financial Services sector that may be worth considering are Regional Management Corp. (RM), eGain Corporation (EGAN), and 360 Finance, Inc. (QFIN) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

INTU shares were trading at $569.82 per share on Thursday afternoon, down $7.41 (-1.28%). Year-to-date, INTU has gained 47.47%, versus a 19.89% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Intuit (INTU) Post-Earnings Assessment: A Software Stock to Watch? appeared first on StockNews.com