Carnival Corporation & plc (CCL) engages in the provision of leisure travel services and operates a fleet of more than 90 ships that visit approximately 700 ports. In addition to providing port destinations and other services, it owns and operates hotels, lodges, glass-domed railcars, and motorcoaches.

Although it lags in some areas due to geopolitical and macroeconomic uncertainties that are undermining consumer confidence, the travel trade’s post-pandemic resurgence has been remarkable on the backs of pent-up travel demand,

As per the 2023 Cruise Industry News Annual Report, it is projected that over 60 newly-built vessels will be integrated into the global cruise fleet from 2023 through 2028, resulting in an aggregate of 499 cruise ships. This development anticipates passenger capacity swelling to nearly 38 million by the close of 2028.

Amid this, CCL plans to augment its current offerings with Jubilee, the succeeding sister ship to Mardi Gras and Celebration, supplemented by two vessels acquired from Costa Cruise Line.

CCL’s CEO Josh Weinstein said, “We are already executing on our strategy to grow revenue by taking up ticket prices, even while maintaining record onboard spending levels, building occupancy and growing capacity."

On the other hand, cruise companies have made a major bet on increased demand for cruises. The notable acceleration in new ship introductions outpaces those leaving service, which could become problematic.

As of May 31, 2023, CCL’s long-term debt stood at $31.92 billion, whereas its accumulated deficit came in at $841 million, compared to retained earnings of $269 million as of November 30, 2022.

Given this backdrop, let us look at the trends of CCL’s key financial metrics to understand why it might be wise to avoid the stock.

Analysis of CCL's Financial Condition and Performance Trends (2020 - 2023)

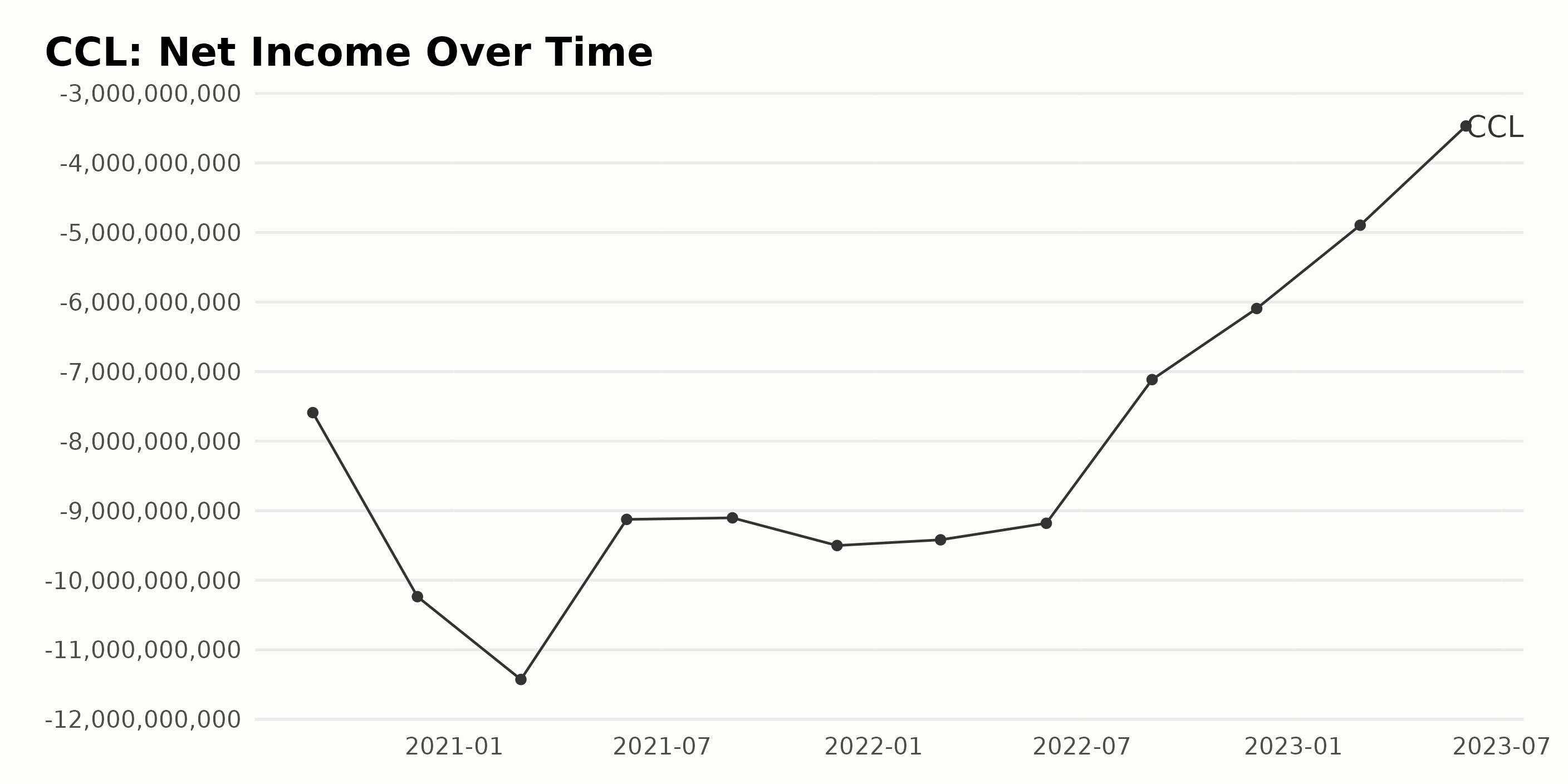

Below is a summary of the trend and fluctuations regarding the CCL’s trailing-12-month net income:

- August 2020: negative $7.59 billion

- November 2020: negative $10.24 billion

- February 2021: negative $11.43 billion

- May 2021: negative $9.13 billion

- August 2021: negative $9.10 billion

- November 2021: negative $9.50 billion

- February 2022: negative $9.42 billion

- May 2022: negative $9.18 billion

- August 2022: negative $7.12 billion

- November 2022: negative $6.09 billion

- February 2023: negative $4.90 billion

- May 2023: negative $3.47 billion

The overall trend suggests a gradual recovery in the financial health of CCL following heavy losses initially. The net income growth during the period from August 2020 to May 2023 has been approximately $4.12 billion.

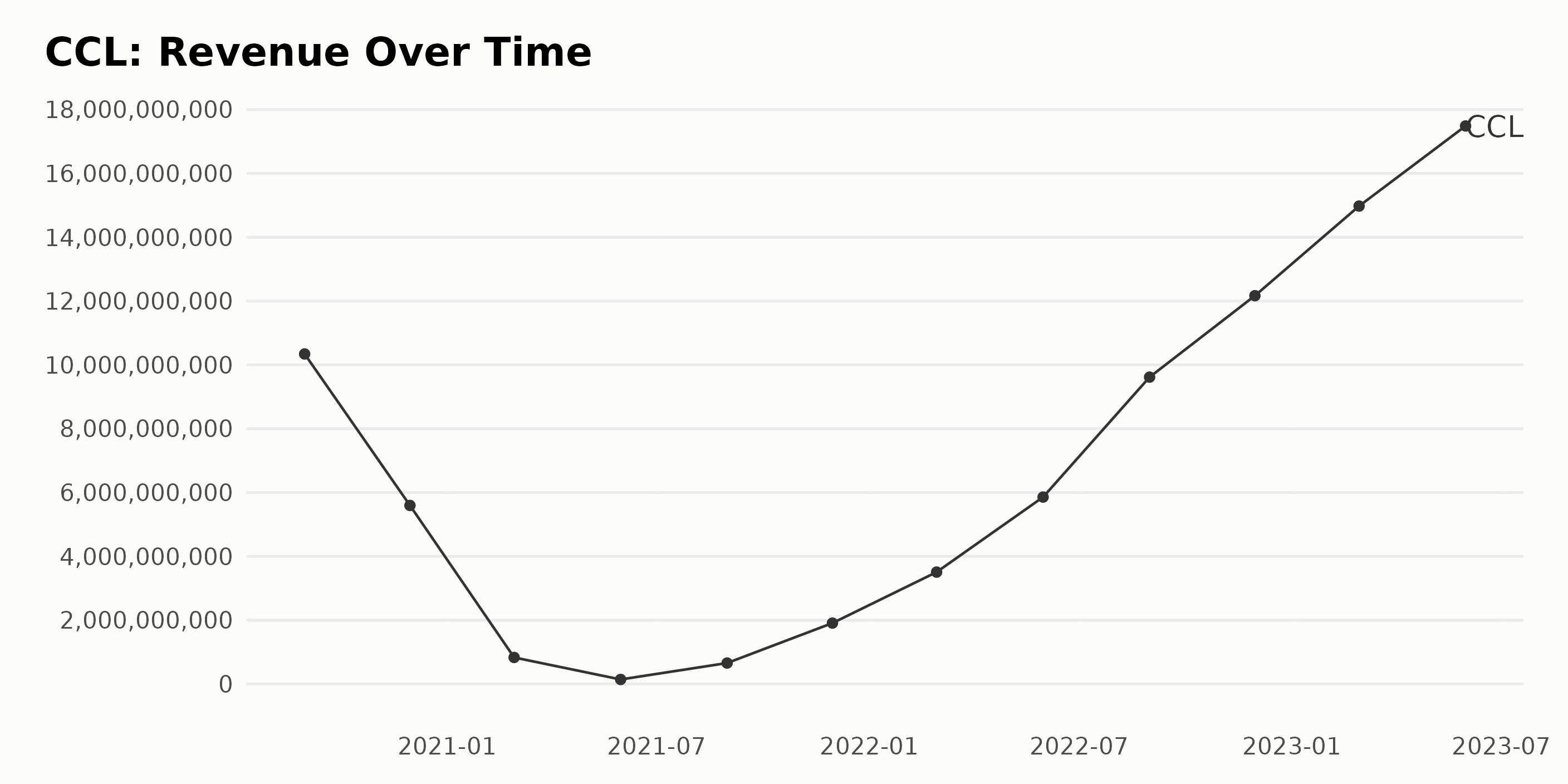

CCL’s trailing-12-month revenue reflects a fluctuating trend over the course of the observed period.

- August 2020: $10.34 billion

- November 2020: $$5.60 billion

- February 2021: $831 million

- May 2021: $141 million

- August 2021: $656 million

- November 2021: $1.91 billion

- February 2022: $3.51 billion

- May 2022: $5.86 billion

- August 2022: $$9.62 billion

- November 2022: $12.17 billion

- February 2023: $14.98 billion

- May 2023: $17.49 billion

Overall, from August 2020 to May 2023, the growth rate of CCL's revenue shows an increase of approximately 69%, marking a positive long-term recovery despite initial significant fluctuations.

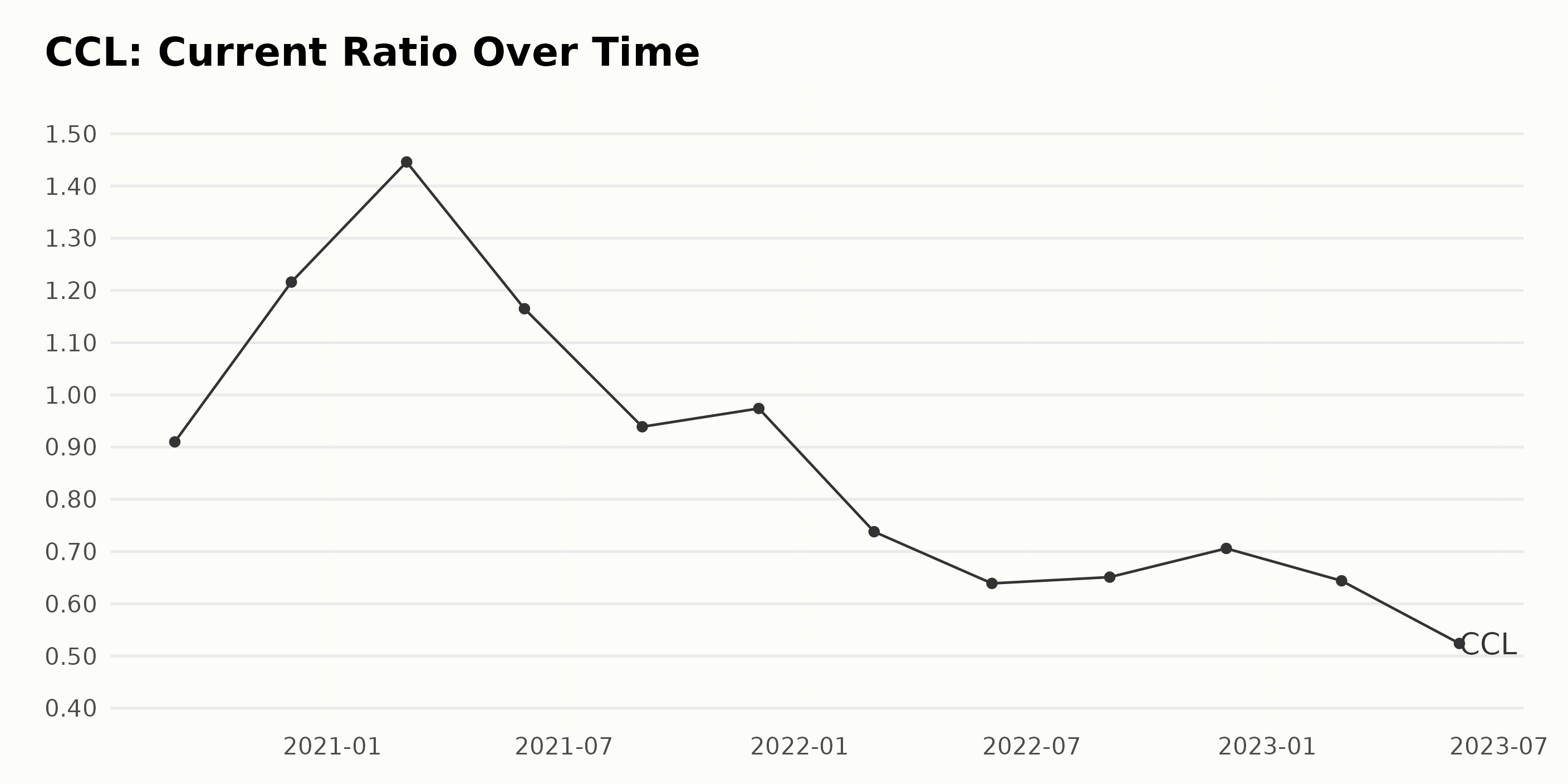

The current ratio of the CCL shows a general downward trend over the given period, indicating a deterioration of the company's short-term financial health. Key Observations:

- In August 2020, the current ratio stood at 0.91. It increased to 1.446 by February 2021, representing a significant improvement in just six months.

- From February 2021 to May 2023, the current ratio faced a steady decline with fluctuations, reaching its lowest point of 0.524 in May 2023. This declining pattern suggests the company was gradually finding it harder to pay off its short-term obligations.

- The most recent data from May 2023 reflects that the company is not ideally poised, as a current ratio of 0.524 indicates its current liabilities exceed its current assets.

Fluctuations:

- A significant fluctuation is observed between February 2021 (1.446) and May 2021 (1.165), where the ratio waned. Then it saw a mild recovery in November 2021 (0.974).

- Another noteworthy fluctuation occurred in the first half of 2022, where the current ratio dipped to 0.738 in February and further to 0.639 in May before experiencing a slight upward tick in August (0.651).

By comparing the first data point in August 2020 (0.91) and the last data point in May 2023 (0.524), it can be deduced that there was a growth rate of approximately -42%. This accentuates the aforementioned downward trend in the current ratio of CCL.

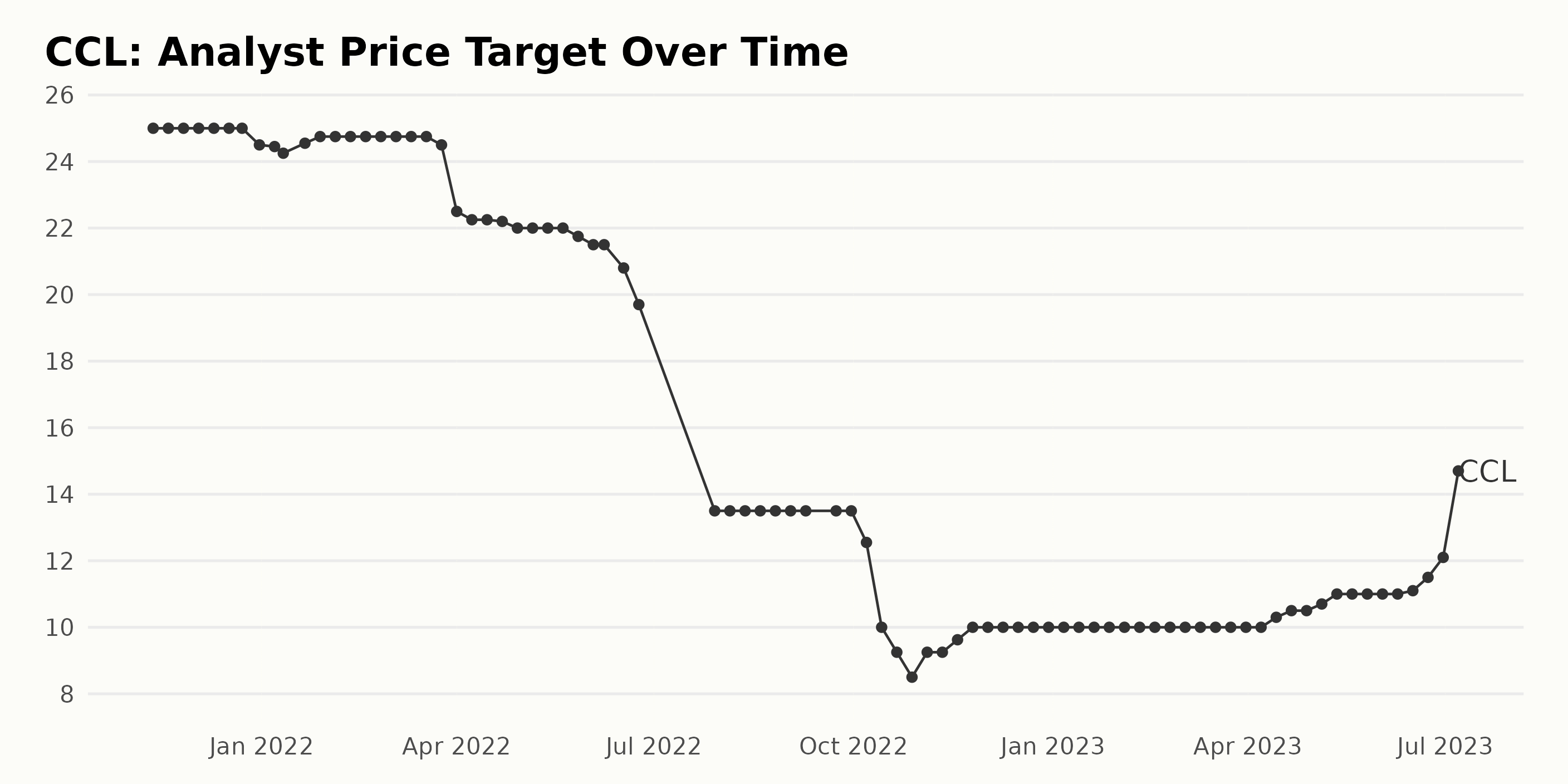

CCL’s analyst price target has seen an overall decrease from November 2021 to July 2023, albeit with some fluctuations. Notably:

- On November 12, 2021, the price target was set at $25. It remained steady until December 31, 2021, when it dropped slightly to $24.5.

- During the early months of 2022, the target generally hovered around the mid-$24 range before gradually decreasing to $22 by May. A notable dip in price happened on June 24, 2022, dropping it to $19.7 and even further down to $13.5 by July 29, 2022.

- For a considerable period from late July 2022 to September 2022, the target stayed constant at $13.5. The lowest recorded value occurred on October 28, 2022, with a target of $8.5.

- In the final quarter of 2022, the target began to recover slightly, increasing to $10 and maintaining this value well into the first quarter of 2023.

- Since April 14, 2023, the analyst price target once again showed signs of an upward trajectory, reaching $11.5 by June 23, 2023, and peaking at $14.7 on July 7, 2023.

In terms of growth rate, between November 2021 and July 2023, CCL’s analyst price target decreased by approximately 41.2%. This indicates an overall down-trending performance based on the analyst's views but with recent positive recovery signs.

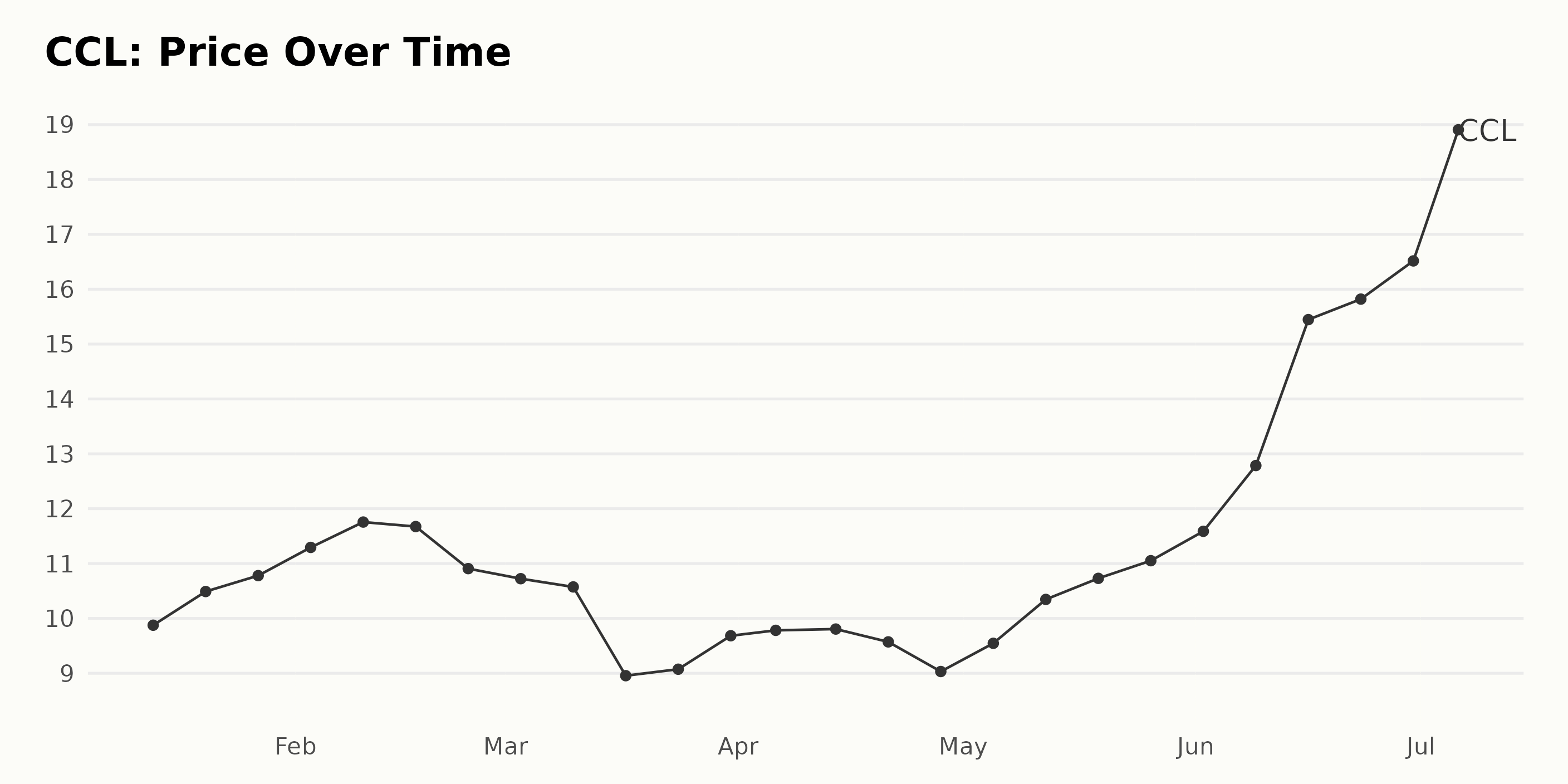

Analyzing Carnival Corporation's Six-Month Stock Trajectory: Gradual Increases, Decreases, and Marked Acceleration

The stock price of CCL shows a clear upward trend over the six-month period from January to July 2023, which can be summarized as follows:

- The value of CCL’s stock was $9.88 on January 13, 2023, which increased gradually to reach $11.29 by February 3, 2023.

- A slight dip occurred in the value during late February and continued till mid-March, hitting a low of $8.96 on March 17, 2023,

- There was a modest recovery in April, with the stock value fluctuating around the $9 range, and in May, the growth picked up pace, with the stock value rising to $11.05 by May 26, 2023.

- In June, an accelerating trend was observed, where the stock value surged to $15.82 by June 23, 2023.

- By July 6, 2023, the stock value had notably increased, reaching a high of $18.86.

To summarize, in terms of growth rate, there were periods of gradual increase, specific periods of decline, and periods of accelerated growth. The stock price grew approximately 91% from its beginning value in January to its highest value in July, even considering slight decreases.

This significant growth rate and the dramatic increase in June suggest an accelerating upward trend. Here is a chart of CCL's price over the past 180 days.

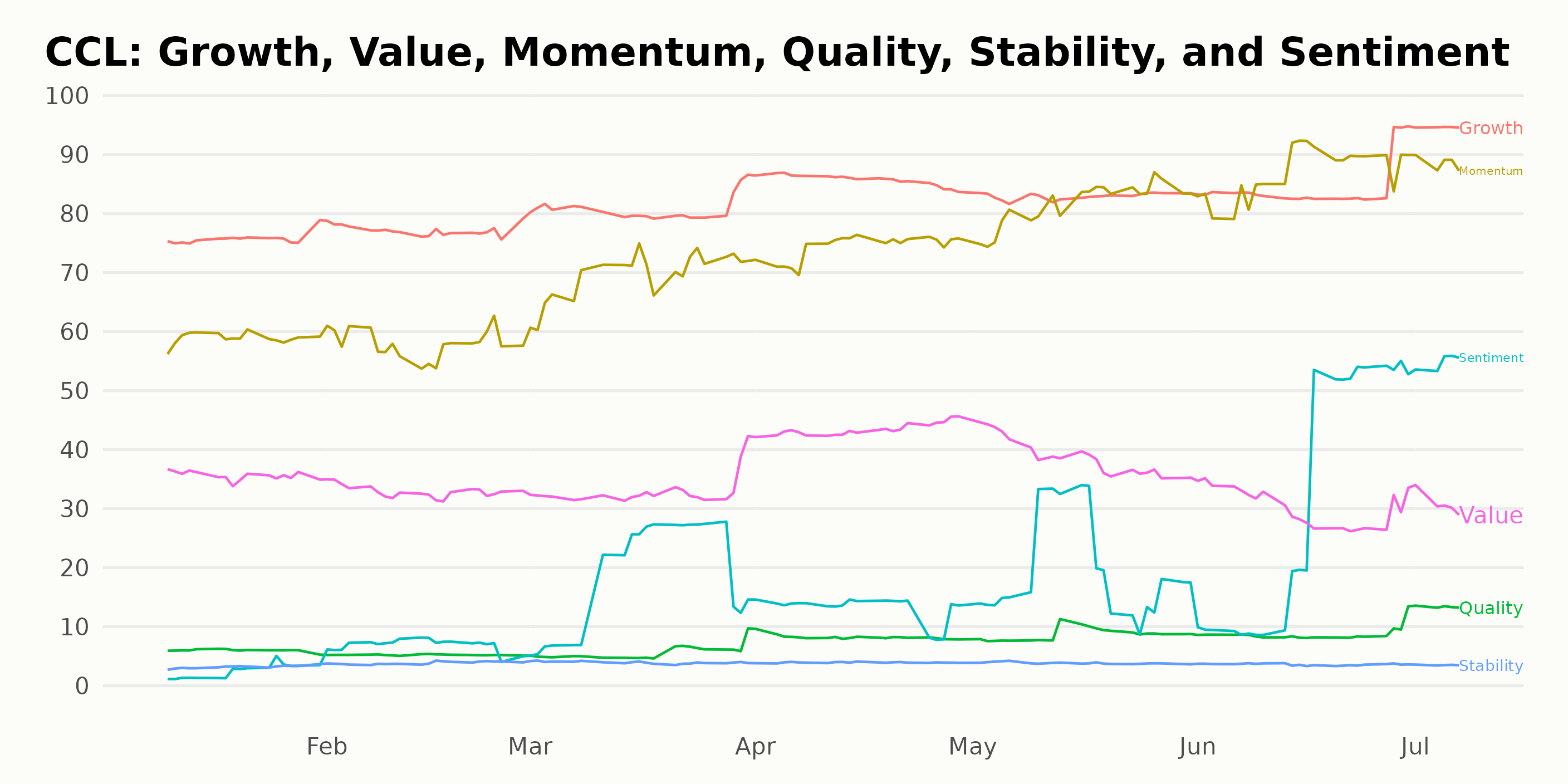

Analyzing Carnival Corporation's Rising Trends in Growth, Momentum, and Sentiment

The overall POWR Ratings grade of CCL in the F-rated Travel - Cruises category has shown an unstable performance across several weeks. As of the latest available data on July 7, 2023, CCL’s overall POWR Ratings grade is a D, equating to Sell, with its rank in the category being #3 out of four stocks. As per the data available below, here are a few notable points:

- Since the start of the year 2023 till around mid-March, CCL maintained a rank of #2 in the category, indicating a decent performance relative to other stocks within the Travel - Cruises category.

- However, from the third week of March 2023 onwards, its rank fluctuated between #3 and #4, denoting a relatively lower performance.

- Throughout the recorded period, CCL consistently had an overall grade of D (Sell), suggesting its potential issues or weaknesses as an investment option based on the POWR Ratings system.

The POWR Ratings highlight several important aspects of CCL along six dimensions. After analyzing the data, the three most noteworthy for CCL are Growth, Momentum, and Sentiment. A breakdown of these dimensions over time is as follows:

Growth: - The Growth dimension for CCL shows an increasing trend over the period from January 2023 to July 2023.

- January 2022: 76

- July 2023: 95

Momentum: - A similar increasing trend is visible in the Momentum dimension over this period.

- January 2023: 59

- July 2023: 89

Sentiment: - The Sentiment dimension exhibits a much clearer rising trend than others.

- January 2023: 2

- July 2023: 55.

In conclusion, these observations suggest that among the dimensions considered, Growth, Momentum, and Sentiment are not only the highest-rated but also exhibit consistent positive trends for CCL. This indicates a significant positive outlook for these dimensions over the observed timeframe.

How does Carnival Corporation & plc (CCL) Stack Up Against its Peers?

Other stocks in the travel sector that may be worth considering are Bluegreen Vacations Holding Corporation (BVH), Genting Berhad (GEBHY), and Marriott International, Inc. (MAR) - they have better POWR Ratings.

Is the Bear Market Over?

43 year investment veteran Steve Reitmeister shares his updated stock market outlook & top picks for the rest of 2023. Spoiler Alert: Steve still believes bear case most likely.

Get Stock Market Outlook & Top Picks >

CCL shares were trading at $19.16 per share on Friday afternoon, up $0.30 (+1.59%). Year-to-date, CCL has gained 137.72%, versus a 16.14% rise in the benchmark S&P 500 index during the same period.

About the Author: Sristi Suman Jayaswal

The stock market dynamics sparked Sristi's interest during her school days, which led her to become a financial journalist. Investing in undervalued stocks with solid long-term growth prospects is her preferred strategy. Having earned a master's degree in Accounting and Finance, Sristi hopes to deepen her investment research experience and better guide investors.

The post Is July the Time to Buy Carnival (CCL)? appeared first on StockNews.com