Headquartered in Tel Aviv, Israel, Wix.com Ltd. (WIX) is a web development platform that enables businesses and organizations to take businesses, brands, and workflow online. The company provides solutions that business owners can use to operate various aspects of their businesses online, such as selling goods, taking reservations, and scheduling and confirming appointments.

Although WIX’s total revenue increased 14% year-over-year for the first quarter ended March 31, 2022, its net loss widened, exceeding analyst expectations. To fuel its growth, the company has been making significant investments, which led to its bottom-line deterioration. The company believes that the significant investments made in the past will soon generate profits. WIX’s President Nir Zohar said that there had been a slowdown in internet activity after two years of steep growth.

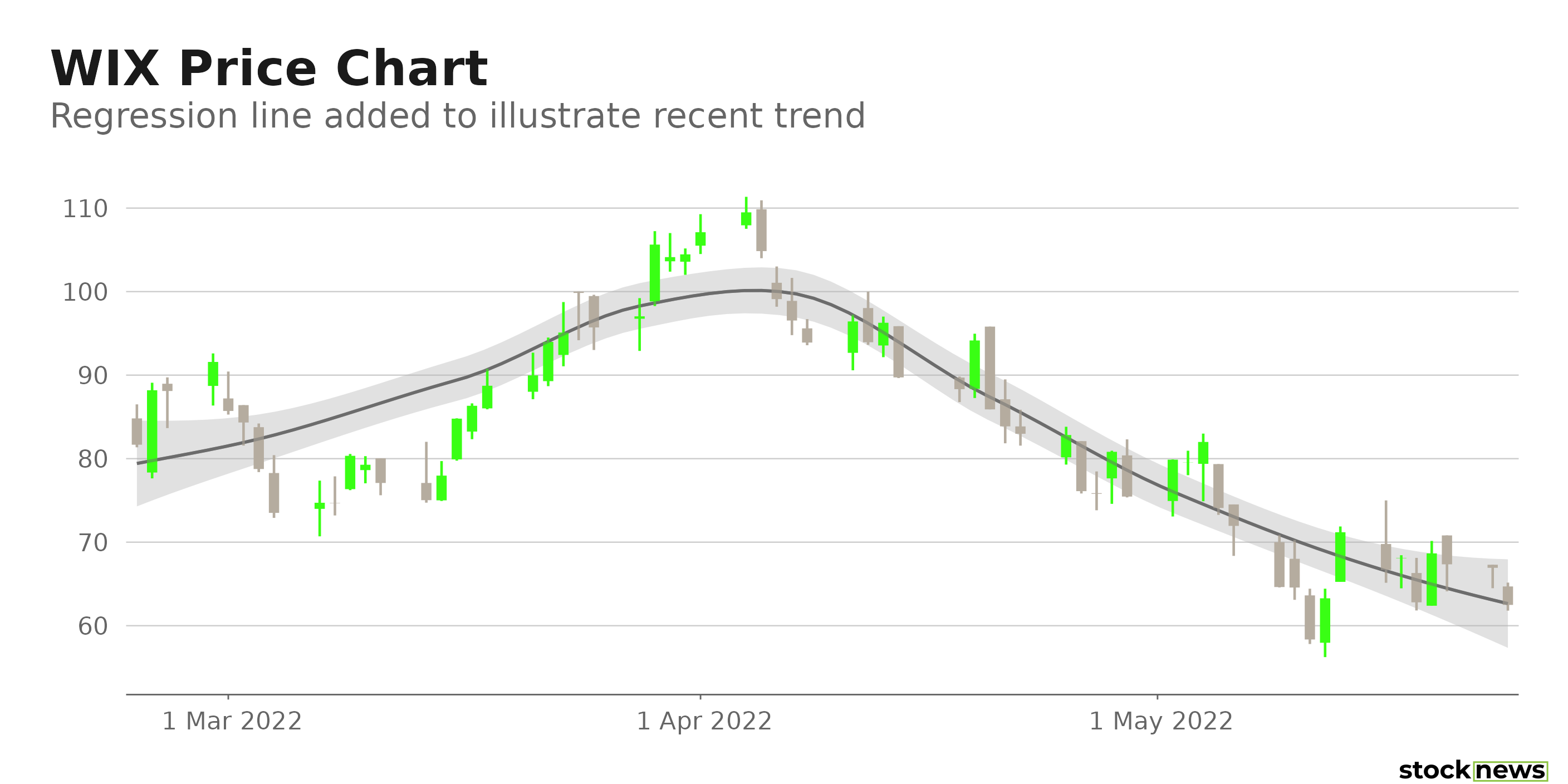

WIX’s shares have declined 57.5% in price year-to-date and 73% over the past year to close the last trading session at $66.93.

Here is what could influence WIX’s performance in the upcoming months:

Disappointing Financials

WIX’s non-GAAP operating loss widened 35.7% year-over-year to $50.98 million for the first quarter, ended March 31, 2022. The company’s non-GAAP net loss widened 31.5% year-over-year to $41.39 million. Also, its non-GAAP loss per share widened 28.5% year-over-year to $0.72. In addition, the company’s total operating expenses increased 17.6% year-over-year to $322.26 million.

Unfavorable Analyst Estimates

Analysts expect WIX’s EPS for its fiscal year 2022 and 2023 to remain negative. The company’s EPS is expected to decline 0.8% per annum over the next five years.

Stretched Valuation

In terms of forward EV/EBITDA, WIX’s 24.27x is 101.3% higher than the 12.05x industry average. And its 58.63x forward P/CF is 253.7% higher than the 16.57x industry average.

Lower-than-industry Profitability

WIX’s trailing-12-month net income margin and EBITDA margin are negative, versus the 5.56% and 13.35% respective industry averages Also, its trailing-12-month levered FCF margin is negative compared to the 9.13% industry average. Furthermore, the stock’s trailing-12-month ROA is negative compared to the 3.48% industry average.

POWR Ratings Reflect Bleak Prospects

WIX has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. WIX has an F grade for Sentiment, which is in sync with analysts’ negative EPS estimates for fiscal 2022 and 2023.

It has a D grade for Growth, which is consistent with its weak fundamentals and growth prospects.

WIX is ranked #23 out of 33 stocks in the F-rated Internet - Services industry. Click here to access WIX’s ratings for Value, Momentum, Stability, and Quality.

Bottom Line

The shares of WIX are currently trading below their 50-day and 200-day moving averages of $84.49 and $145.12, respectively, indicating a downtrend. Furthermore, given its weak fundamentals, lower-than-industry profitability, and high valuation, the stock could witness a further retreat. So, we think it could be wise to avoid the stock now.

How Does Wix.com Ltd. (WIX) Stack Up Against Its Peers?

WIX has an overall POWR Rating of D, which equates to a Sell rating. Therefore, one might want to consider investing in other Internet – Services stocks with an A (Strong Buy) or B (Buy) rating, such as Liquidity Services, Inc. (LQDT), Perion Network Ltd. (PERI), and Shutterstock, Inc. (SSTK).

Note that SSTK is one of the few stocks handpicked currently in the Reitmeister Total Return portfolio. Learn more here.

WIX shares were trading at $61.99 per share on Tuesday morning, down $4.94 (-7.38%). Year-to-date, WIX has declined -60.71%, versus a -17.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets.

The post Down More Than 50% YTD, is Now a Good Time to Buy Shares of Wix.com? appeared first on StockNews.com