Communications technology company Casa Systems, Inc. (CASA) in Andover, Mass., provides solutions for next-generation physical, virtualized, and cloud-native architectures for cable broadband, fixed-line broadband, and wireless networks. The company announced on April 18 that it had been awarded a multi-year purchase contract from Verizon Communications Inc. (VZ), under which CASA will provide 5G Core Network Functions to Verizon, helping power the company’s public Mobile Edge Compute (MEC) service offering. In addition, VZ will invest approximately $40 million in CASA common stock, resulting in a 9.9% ownership stake.

“This announcement is an important milestone for our 5G Core and Security Gateway technology, as well as the growth potential of our business,” said Jerry Guo, President, and CEO of Casa Systems. “Our cloud-native approach is at the foundation of today’s agreement and represents an important pivot in the telecommunications industry,” the CEO added.

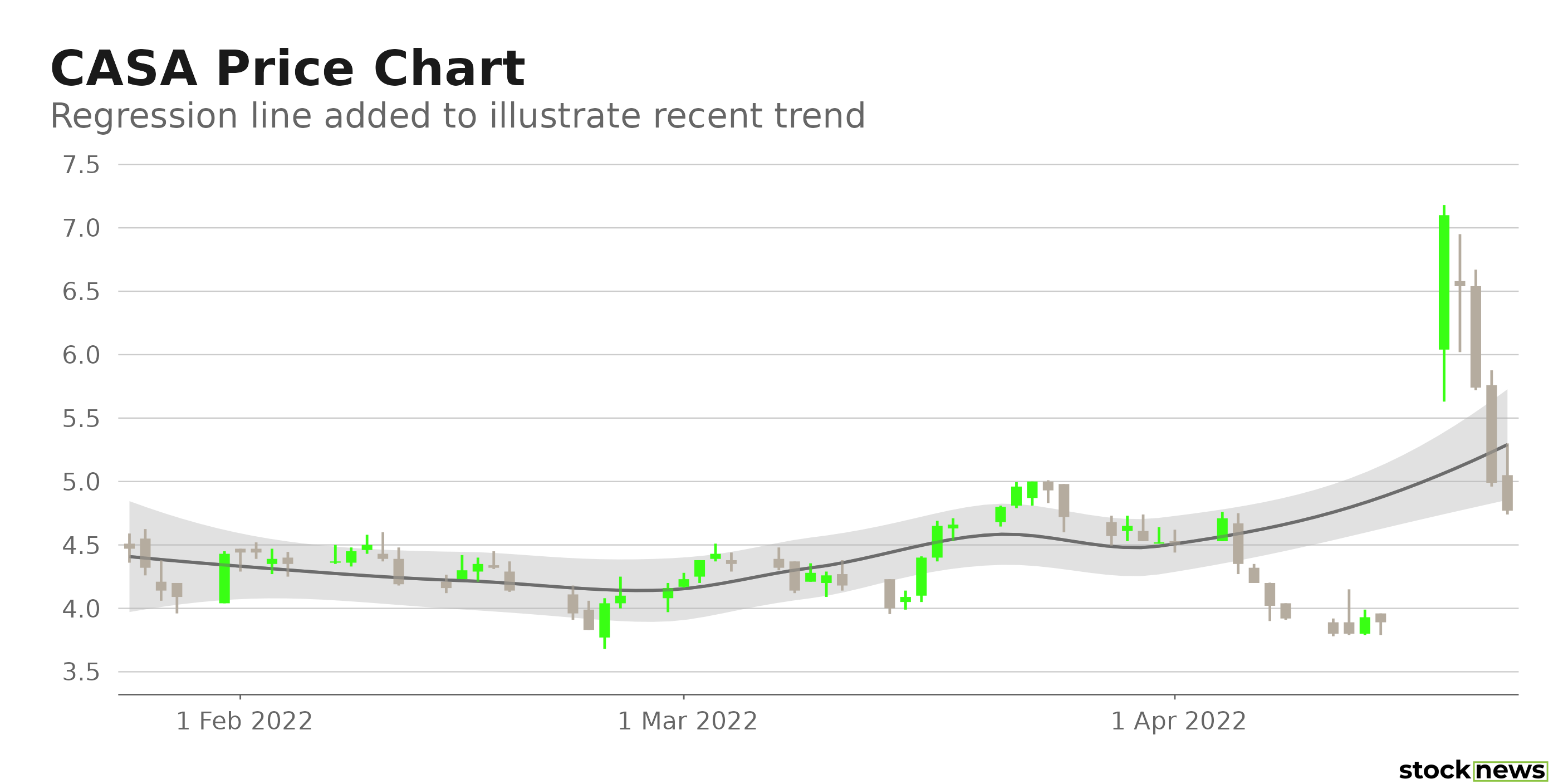

The news caused CASA shares to rally more than 80% in price last Monday. The stock has since gained 22.4%. However, the stock is down 15.9% year-to-date. CASA shares have slumped 47.2% over the past year to close the last trading session at $4.77.

Click here to checkout our 5G Industry Report for 2022

Here is what could shape CASA’s performance in the near term:

Declining Financials

CASA’s EBITDA has declined at a 30.9% CAGR over the past three years, while its EBIT has declined at a 44.6% CAGR over the same period. Its net income and EPS have decreased at CAGRs of 64.7% and 63.8%, respectively, over the past three years. Also, its levered FCF has declined at a 29.6% CAGR over the same period.

For its fiscal fourth quarter ended Dec. 31, 2021, CASA’s revenues declined 12.8% year-over-year to $105.10 million. Its income from operations stood at $4.05 million, down 76.6% from the year-ago value. And its non-GAAP net income came in at $6.55 million, reflecting a 71.4% decline year-over-year, while its non-GAAP EPS decreased 74.1% year-over-year to $0.07. The company’s adjusted EBITDA decreased 55.2% from the prior-year quarter to $11.32 million.

Lower-Than-Industry Profit Margins

CASA’s 46.74% gross profit margin is 7.2% lower than the 50.38% industry average, while its 0.80% net income margin is 85.3% lower than the 5.45% industry average. Also, its levered FCF margin is 45.9% lower than the10.21% industry average.

Furthermore, CASA’s 4.05%, 0.68%, and 2.32% respective ROE, ROA, and ROTC compare with the .28%, 3.28%, and 4.73% industry averages.

Trading Cheap Compared to its Peers

In terms of forward non-GAAP P/E, CASA is currently trading at 14.97x, which is 20.3% lower than the 18.78x industry average. Also, its 1.28 forward EV/Sales ratio is 57.7% lower than the 3.03 industry average. CASA’s forward Price/Sales and Price/Cash Flow multiples of 0.99 and 9.22, respectively, are 68.5% and 48.7% lower than the industry averages.

POWR Ratings Reflect Uncertainty

CASA has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a C grade for Momentum. This is justified because it is currently trading above its 50-day moving average but below its 200-day moving average.

CASA has an F grade for Growth, which consistent with its declining financials.

Among the 54 stocks in the Technology - Communication/Networking industry, CASA is ranked #14.

Beyond what I have stated above, one can also view CASA’s grades for Quality, Sentiment, Value, and Stability here.

View the top-rated stocks in the Technology - Communication/Networking industry here.

Click here to checkout our 5G Industry Report for 2022

Bottom Line

The deal with VZ could help CASA to grow its business in North America while opening new opportunities with other North American carriers. However, it might take some time for CASA to generate significant revenues from this deal. Furthermore, these revenues are “not guaranteed and subject to a number of executables by Casa and the acceptance of deliverables from Verizon,” Raymond James analyst Simon Leopold stated. Also, the duration/length of the agreement is also unclear. Also, the Street expects CASA’s revenues to decline 13.7% year-over-year in the quarter ended March 31, 2022. Its declining financials and lean margins are also concerning. So, I think it could be wise to wait for more clarity on this deal and its prospects before investing in the stock.

How Does Casa Systems, Inc. (CASA) Stack Up Against its Peers?

While CASA has an overall POWR Rating of C, one might want to consider taking a look at its industry peers, Extreme Networks, Inc. (EXTR), Viavi Solutions Inc. (VIAV), and AudioCodes Ltd. (AUDC), which have an A (Strong Buy) rating.

CASA shares fell $0.07 (-1.47%) in premarket trading Monday. Year-to-date, CASA has declined -17.11%, versus a -10.44% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Casa Systems a Buy After Announcing a Multi-Year Contract with Verizon? appeared first on StockNews.com