Generation Income Properties, Inc. (NASDAQ:GIPR) ("GIPR" or the "Company") today announced its financial and operating results for the period ended June 30, 2022.

Highlights

(For the 3 months ended June 30, 2022)

- Generated net loss attributable to GIPR of $1.05 million, or ($0.46) per basic and diluted share.

- Generated Core FFO of ($206) thousand, or ($0.09) per basic and diluted share.

- Generated Core AFFO of $36 thousand, or $0.02 per basic and diluted share.

Commenting on the quarter, CEO David Sobelman stated, “This quarter has demonstrated our ability to exercise patience and discipline in this changing market environment, while strengthening our balance sheet and stabilizing our capital structure to allow us the platform to focus on acquiring assets accretive to our growth through the latter half of the year. We are hyper-focused on identifying new opportunities consistent with our current portfolio of tenants that we believe continues to prove its resiliency during economic headwinds.”

Core FFO and Core AFFO are supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation containing adjustments from GAAP net income to Core FFO and Core AFFO are included at the end of this release.

Portfolio (as of June 30, 2022, unless otherwise stated)

- Approximately 85% of our portfolio’s annualized base rent ("ABR") as of June 30, 2022 was derived from tenants that have (or whose parent company has) an investment grade credit rating from a recognized credit rating agency of “BBB-” or better. Our largest tenants are the General Service Administration (Navy & FBI), PRA Holdings, Inc., Pratt and Whitney, and Kohl’s, all who have an ‘BB+’ credit rating or better from S&P Global Ratings and contributed approximately 66% of our portfolio’s annualized base rent.

- The Company’s portfolio is 100% rent paying and has been since our inception.

- Approximately 92% of our portfolio’s annualized base rent in our current portfolio provide for increases in contractual base rent during future years of the current term or during the lease extension periods.

- The average annualized base rent (ABR) per square foot at the end of the quarter was $15.53.

Liquidity and Capital Resources

- $3.6 million in total cash and cash equivalents as of June 30, 2022.

- Total debt, net was $35.5 million as of June 30, 2022.

Financial Results

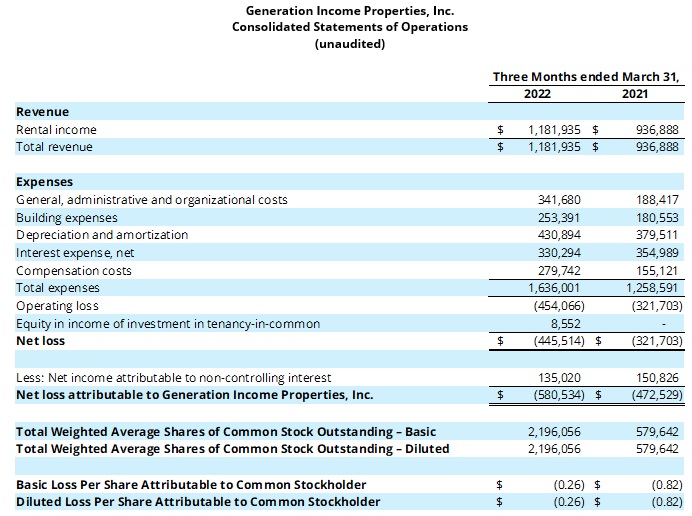

- Total revenue from operations was $1.4 million during the three-month period ended June 30, 2022, as compared to $988 thousand for the three-month period ended June 30, 2021. This represents a year-over-year increase of 40% driven primarily by the acquisition of properties.

- Operating expenses, including G&A, for the same periods were $2.0 million and $1.3 million, respectively, due to increases in G&A, recoverable expenses and depreciation/amortization from recent acquisitions, and compensation costs.

- Net operating income (“NOI”) for the same periods was $1.1 million and $824 thousand, a 28% increase from the same period last year, which is a direct result of the acquisition of properties.

- Net loss attributable to GIPR for the three months ended June 30, 2022 was $1 million as compared to $370 thousand for the same period last year.

Distributions

On June 27, 2022, the Company’s Board of Directors declared a monthly distribution of $0.054 per common share and operating partnership unit to be paid monthly to holders of record as of July 15, August 15, and September 15, 2022.

2022 Guidance

The Company is not providing guidance on FFO, Core FFO, AFFO, Core AFFO, G&A, NOI, or acquisitions and dispositions at this time. However, the Company will provide timely updates on material events, which will be broadly disseminated in due course. The Company’s executives, along with its Board of Directors, continue to assess the advisability and timing of providing such guidance to better align GIPR with its industry peers.

Conference Call and Webcast

The Company will host its second quarter earnings conference call and audio webcast on Monday, August 15, 2022, at 9:00 a.m. Eastern Time.

To access the live webcast, which will be available in listen-only mode, please follow this link. If you prefer to listen via phone, U.S. participants may dial: 877-407-3141 (toll free) or 201-689-7803 (local).

A replay of the conference call will be available after the conclusion of the live broadcast and for 30 days after. U.S. participants may access the replay at 877-660-6853 (toll free) or 201-612-7415 (local), using access code 13732104.

About Generation Income Properties

Generation Income Properties, Inc., located in Tampa, Florida, is an internally managed real estate corporation formed to acquire and own, directly and jointly, real estate investments focused on retail, office and industrial net lease properties in densely populated submarkets. The Company intends to elect to be taxed as a real estate investment trust. Additional information about Generation Income Properties, Inc. can be found at the Company's corporate website: www.gipreit.com.

Forward-Looking Statements

This press release, whether or not expressly stated, may contain "forward-looking" statements as defined in the Private Securities Litigation Reform Act of 1995. The words "believe," "intend," "expect," "plan," "should," "will," "would," and similar expressions and all statements, which are not historical facts, are intended to identify forward-looking statements. These statements reflect the Company's expectations regarding future events and economic performance and are forward-looking in nature and, accordingly, are subject to risks and uncertainties. Such forward-looking statements include risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements which are, in some cases, beyond the Company’s control which could have a material adverse effect on the Company's business, financial condition, and results of operations. These risks and uncertainties include the risk that we may not be able to timely identify and close on acquisition opportunities, our limited operating history, potential changes in the economy in general and the real estate market in particular, the COVID-19 pandemic, and other risks and uncertainties that are identified from time to in our SEC filings, including those identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed on March 18, 2022, which are available at www.sec.gov. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company's business, financial condition, and results of operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Any forward-looking statement made by us herein speaks only as of the date on which it is made. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as may be required by law.

Notice Regarding Non-GAAP Financial Measures

In addition to our reported results and net earnings per diluted share, which are financial measures presented in accordance with GAAP, this press release contains and may refer to certain non-GAAP financial measures, including Funds from Operations ("FFO"), Core Funds From Operations ("Core FFO"), Adjusted Funds from Operations (“AFFO”), Core Adjusted Funds from Operations ("Core AFFO"), and Net Operating Income (“NOI”). We believe the use of Core FFO and Core AFFO are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and related measures including NOI should not be considered alternatives to net income as a performance measure or to cash flows from operations, as reported on our statement of cash flows, or as a liquidity measure, and should be considered in addition to, and not in lieu of, GAAP financial measures. You should not consider our Core FFO or Core AFFO as an alternative to net income or cash flows from operating activities determined in accordance with GAAP. Our reconciliation of non-GAAP measures to the most directly comparable GAAP financial measure and statements of why management believes these measures are useful to investors are included below.

Note 1:

Subsequent to the issuance of the Company’s 2021 Form 10-K and Q1 2022 Form 10-Q, management of the Company identified an immaterial error in application of Accounting Standards Codification (ASC) 480-10, Distinguishing Liabilities from Equity. Specifically, the Company incorrectly classified the partnership interest of GIP Fund 1, LLC as Redeemable non-controlling interest rather than Non-controlling interest within Equity. The Company has accordingly corrected certain numbers in the prior year presentation above.

Our reported results are presented in accordance with GAAP. We also disclose funds from operations ("FFO"), adjusted funds from operations ("AFFO"), core funds from operations ("Core FFO") and core adjusted funds of operations ("Core AFFO") all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs.

FFO and related measures do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income or loss as a performance measure or cash flows from operations as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures.

We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts ("NAREIT"). NAREIT defines FFO as GAAP net income or loss adjusted to exclude extraordinary items (as defined by GAAP), net gains from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, and real estate related depreciation and amortization, including the pro rata share of such adjustments of unconsolidated subsidiaries. We then adjust FFO for non-cash revenues and expenses such as amortization of deferred financing costs, above and below market lease intangible amortization, straight line rent adjustment where the Company is both the lessor and lessee, and non-cash stock compensation to calculate Core AFFO.

FFO is used by management, investors, and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that AFFO is an additional useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. FFO and AFFO may not be comparable to similarly titled measures employed by other companies. We believe that Core FFO and Core AFFO are useful measures for management and investors because they further remove the effect of non-cash expenses and certain other expenses that are not directly related to real estate operations. We use each as measures of our performance when we formulate corporate goals.

As FFO excludes depreciation and amortization, gains and losses from property dispositions that are available for distribution to stockholders and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, providing a perspective not immediately apparent from net income or loss. However, FFO should not be viewed as an alternative measure of our operating performance since it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties which could be significant economic costs and could materially impact our results from operations. Additionally, FFO does not reflect distributions paid to redeemable non-controlling interests.

Contact Details

Investor Relations

+1 813-448-1234