Online advertising giant Alphabet (NASDAQ:GOOGL) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 11.8% year on year to $96.47 billion. Its GAAP profit of $2.15 per share was 1.2% above analysts’ consensus estimates.

Is now the time to buy Alphabet? Find out by accessing our full research report, it’s free.

Alphabet (GOOGL) Q4 CY2024 Highlights:

- Revenue: $96.47 billion vs analyst estimates of $96.6 billion (in line)

- Operating Profit (GAAP): $30.97 billion vs analyst estimates of $30.46 billion (1.7% beat)

- EPS (GAAP): $2.15 vs analyst estimates of $2.13 (1.2% beat)

- Google Search Revenue: $54.03 billion vs analyst estimates of $53.4 billion (1.2% beat)

- Google Cloud Revenue: $11.96 billion vs analyst estimates of $12.17 billion (1.8% miss)

- YouTube Revenue: $10.47 billion vs analyst estimates of $10.22 billion (2.4% beat)

- Google Services Operating Profit: $32.84 billion vs analyst estimates of $31.79 billion (3.3% beat)

- Google Cloud Operating Profit: $2.09 billion vs analyst estimates of $1.98 billion (5.9% beat)

- Operating Margin: 32.1%, up from 27.5% in the same quarter last year

- Free Cash Flow Margin: 25.7%, up from 9.1% in the same quarter last year

- Market Capitalization: $2.47 trillion

Key Topics & Areas Of Debate

AI is likely the hottest topic in the world of investing today. Regarding Alphabet, the debate is about how AI’s advancement will impact the company’s bread-and-butter Search business. It is a business where Alphabet has dominant market share, and it is also highly profitable.

Will the development of AI hurt Alphabet because OpenAI’s ChatGPT and even Microsoft’s Bing will take market share from Google, once thought to be nearly invincible in the online search market? Or will Alphabet’s Gemini product, first announced in December 2023, allow the company to dominate the Search market for years or even decades to come given its brand recognition?

As background, Gemini is designed to advance natural language understanding and meet certain thresholds in conversational and contextual understanding. In short, it is meant to provide even more accurate and personalized results, which would be a replay of what made Google so successful decades ago.

Despite its scale and dominance, Alphabet doesn’t operate in a vacuum. ChatGPT and Microsoft’s (NASDAQ:MSFT) new and improved Bing engine are current competitors to Google Search while Meta (NASDAQ:META) is extending beyond social media and into the online search market with its AI-powered assistant.

Alphabet runs into Microsoft often, as it is also one of its primary adversaries in the public cloud services market along with Amazon’s formidable AWS (NASDAQ:AMZN). Finally, Netflix (NASDAQ:NFLX), Disney (NYSE:DIS), and many other video streaming platforms go head-to-head against the company’s YouTube segment.

Revenue Growth

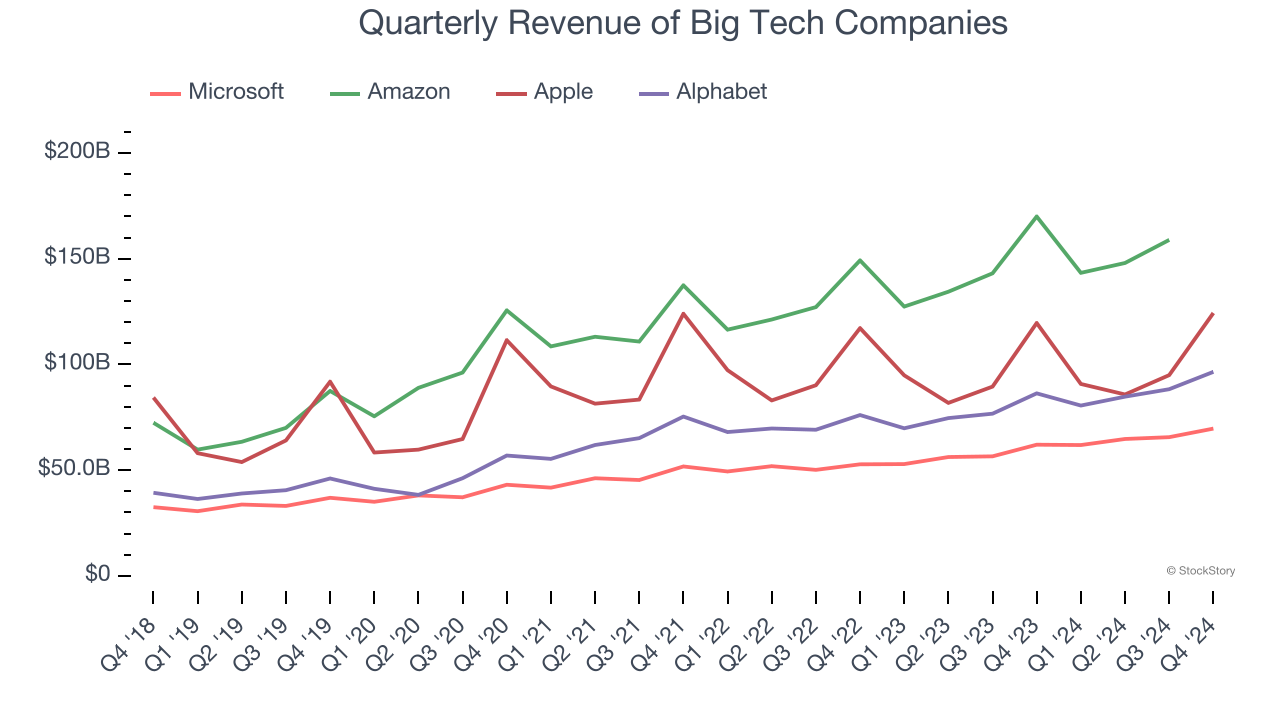

Alphabet proves that huge, scaled companies can still grow quickly. The company’s revenue base of $161.8 billion five years ago has more than doubled to $350 billion in the last year, translating into an incredible 16.7% annualized growth rate.

Alphabet’s growth over the same period was also higher than its big tech peers, Amazon (18.5%), Microsoft (14.3%), and Apple (8.1%). Comparing the four is relevant because investors often pit them against each other to derive their valuations. With these benchmarks in mind, we think Alphabet’s price is attractive.

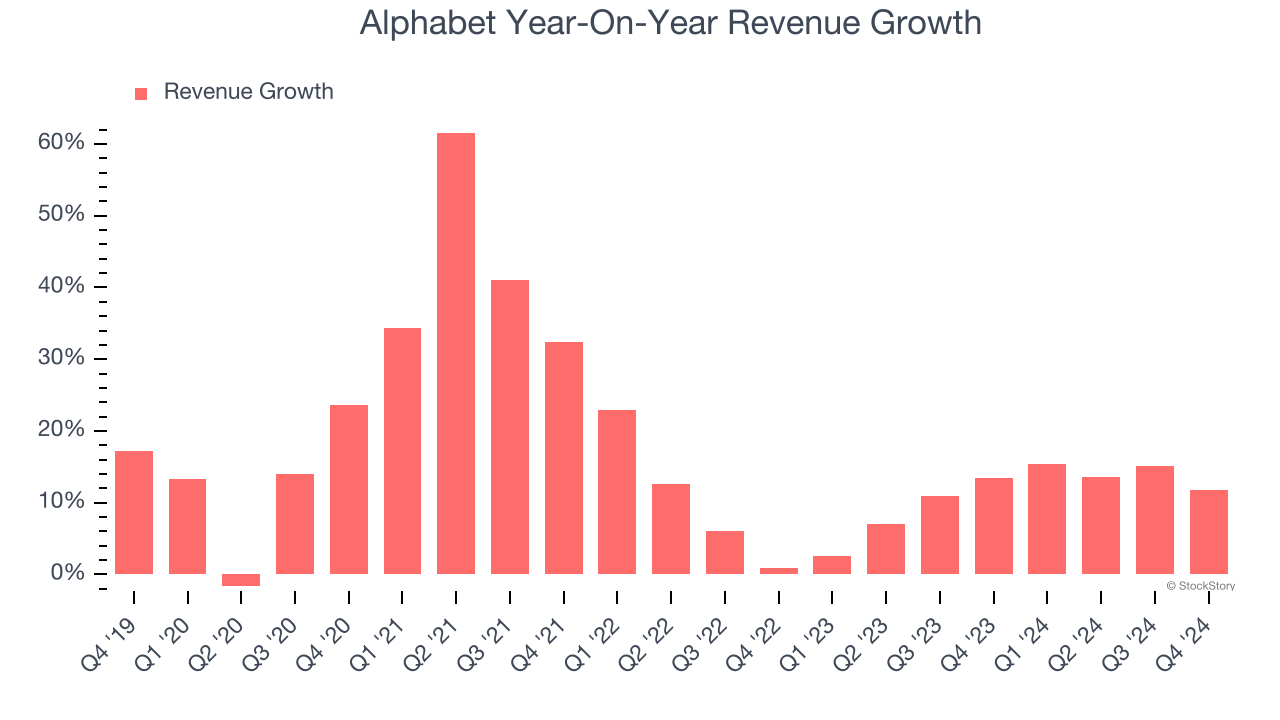

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Alphabet’s annualized revenue growth of 11.2% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Alphabet’s year-on-year revenue growth was 11.8%, and its $96.47 billion of revenue was in line with Wall Street’s estimates. Looking ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, similar to its two-year rate. This projection is admirable for a company of its scale and illustrates the market sees some success for its newer AI-enabling products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Google Search: Alphabet’s Bread-and-Butter

The most topical question surrounding Alphabet today is: “Will new Generative-AI products like ChatGPT and Meta AI disrupt Google Search and its 80%+ market share?”.

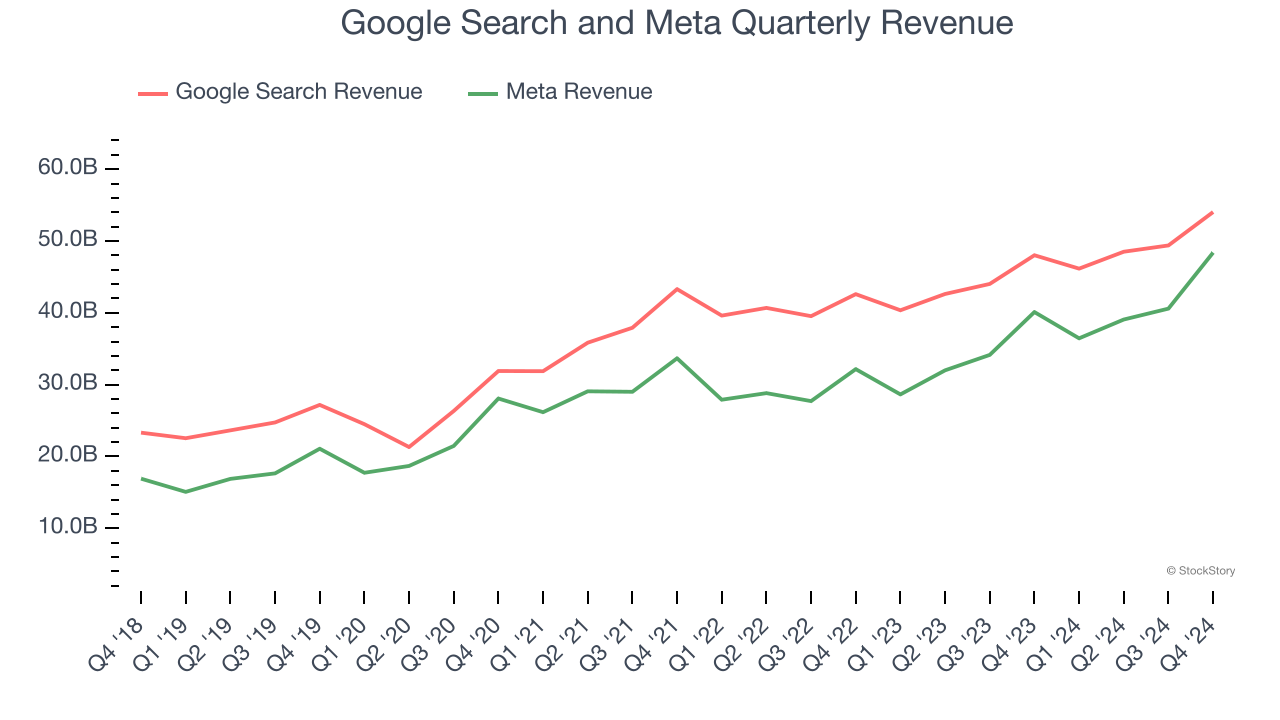

Although OpenAI (creator of ChatGPT) doesn’t disclose its financials, we can gain further insight by comparing Google Search to Meta and Microsoft’s Bing. Meta essentially has a monopoly in social media advertising and is creeping into search with Meta AI, which is powered by its Llama large language model, while Bing is the distant number two search engine that benefits from its integration with ChatGPT.

Starting with Alphabet, Google Search is by far the most considerable portion of its revenue at 56.6%, and it grew at a 15.1% annualized rate over the last five years, slower than total revenue. The previous two years also saw deceleration as it grew by 10.4% annually, though this isn’t concerning since it’s still expanding quickly.

On the other hand, its two-year result was lower than Meta’s 18.8%, showing digital advertising dollars could be flowing to Meta because of its improved AI algorithms and targeting capabilities. Alphabet bulls would argue this trend could reverse because the return on investment from keyword-driven advertising is more tangible, but that hasn’t been the case lately.

Quarterly performance is particularly relevant for Alphabet because it captures the growth of AI and signals whether investors are overestimating its competitive impact. Bulls can rejoice as Google Search revenue exceeded expectations in Q4, outperforming Wall Street Consensus by 1.2%. The segment recorded a hearty year-on-year increase of 12.5%.

While this was slower than Bing’s 20%, it’s important to consider that Bing has a much smaller revenue base and doesn’t pose a significant threat yet. Still, Alphabet must continue topping Wall Street’s Google Search projections and performing well in other segments like Google Cloud Platform and YouTube to win the debate.

Key Takeaways from Alphabet’s Q4 Results

It was encouraging to see Alphabet beat analysts’ operating income expectations this quarter. On the other hand, its total revenue was in line and its all-important Google Cloud revenue missed, spooking some investors with high expectations. We note that Microsoft's Azure division also posted worse-than-anticipated results, signaling the market was overly optimistic about cloud computing for Q4. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 6.5% to $192.76 immediately after reporting.

Is Alphabet an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.