Carbonate fuel cell technology developer FuelCell Energy (NASDAQ:FCEL) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 120% year on year to $49.33 million. Its GAAP loss of $2.21 per share was 27% below analysts’ consensus estimates.

Is now the time to buy FuelCell Energy? Find out by accessing our full research report, it’s free.

FuelCell Energy (FCEL) Q3 CY2024 Highlights:

- Revenue: $49.33 million vs analyst estimates of $39.66 million (120% year-on-year growth, 24.4% beat)

- Adjusted EPS: -$2.21 vs analyst expectations of -$1.74 (27% miss)

- Adjusted EBITDA: -$25.34 million vs analyst estimates of -$16.43 million (-51.4% margin, 54.2% miss)

- Operating Margin: -83.2%, up from -162% in the same quarter last year

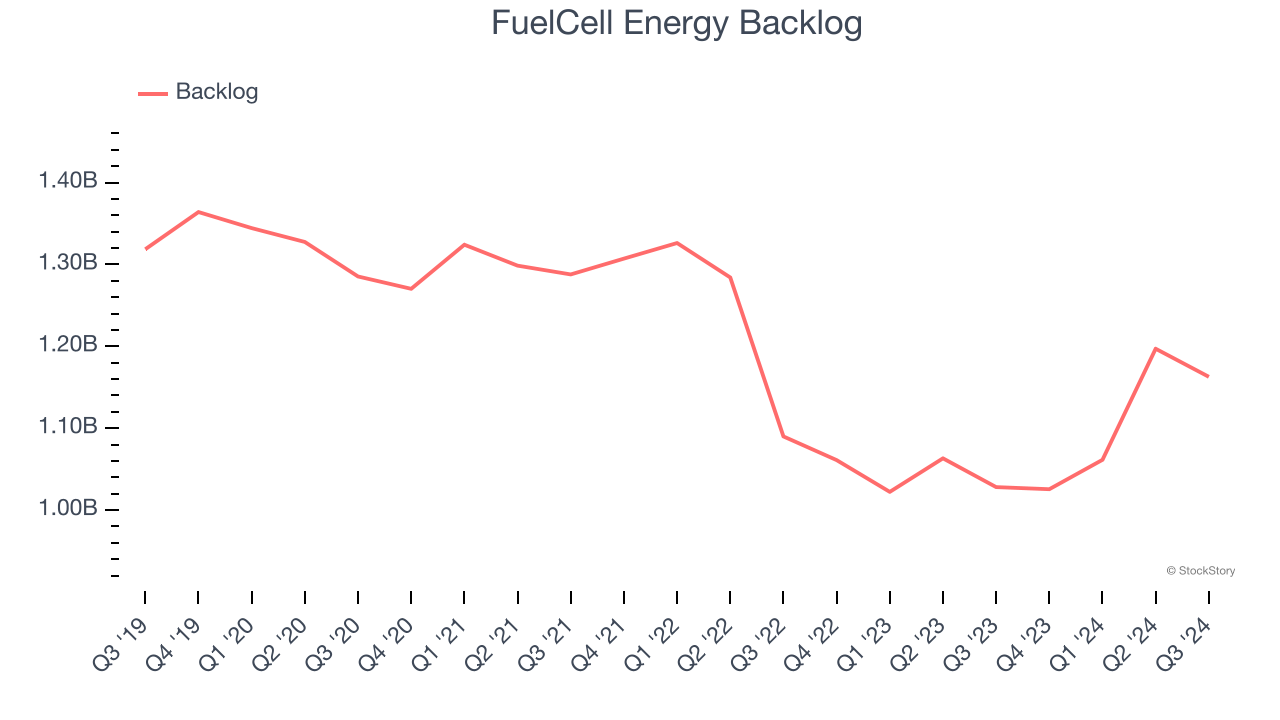

- Backlog: $1.16 billion at quarter end, up 13.1% year on year

- Market Capitalization: $200.1 million

“In the fourth quarter, our revenue more than doubled, year over year, mainly driven by module sales to Gyeonggi Green Energy Co., Ltd. in South Korea,” said Jason Few, President and Chief Executive Officer.

Company Overview

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

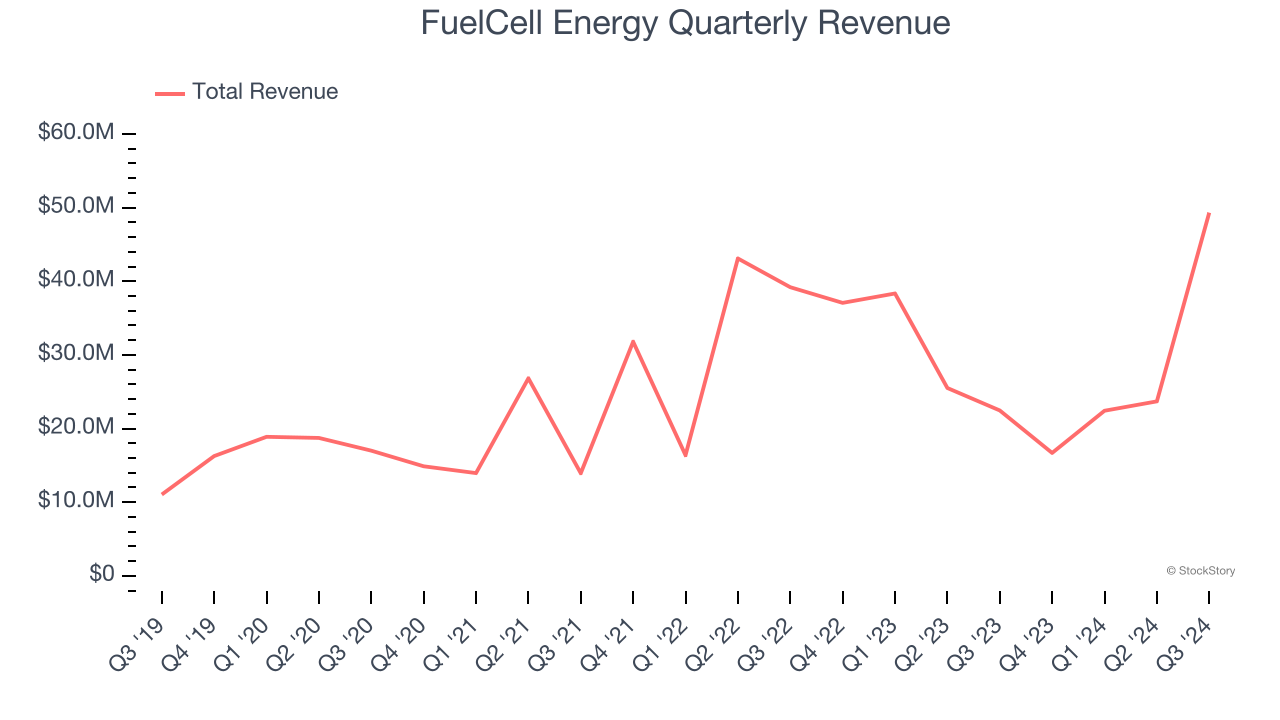

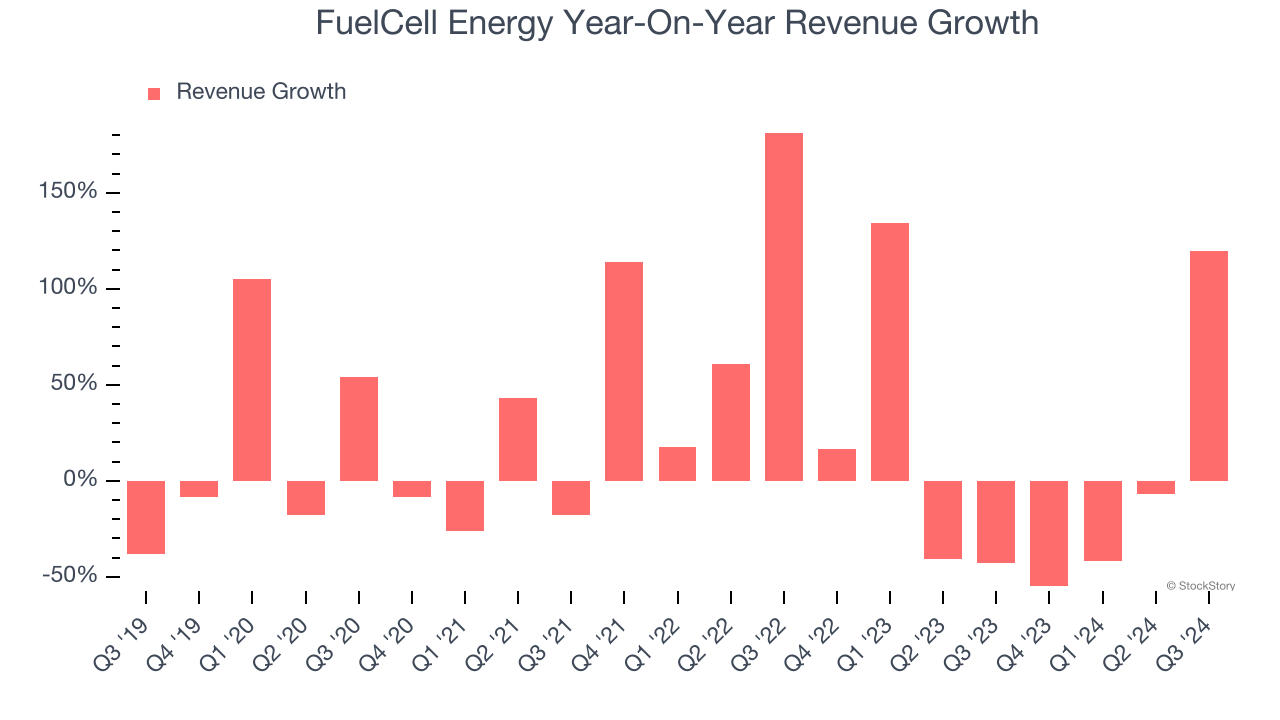

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, FuelCell Energy’s sales grew at an excellent 13% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FuelCell Energy’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 7.3% over the last two years.

FuelCell Energy also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. FuelCell Energy’s backlog reached $1.16 billion in the latest quarter and averaged 4.8% year-on-year declines over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for FuelCell Energy’s products and services but raises concerns about capacity constraints.

This quarter, FuelCell Energy reported magnificent year-on-year revenue growth of 120%, and its $49.33 million of revenue beat Wall Street’s estimates by 24.4%.

Looking ahead, sell-side analysts expect revenue to grow 65.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

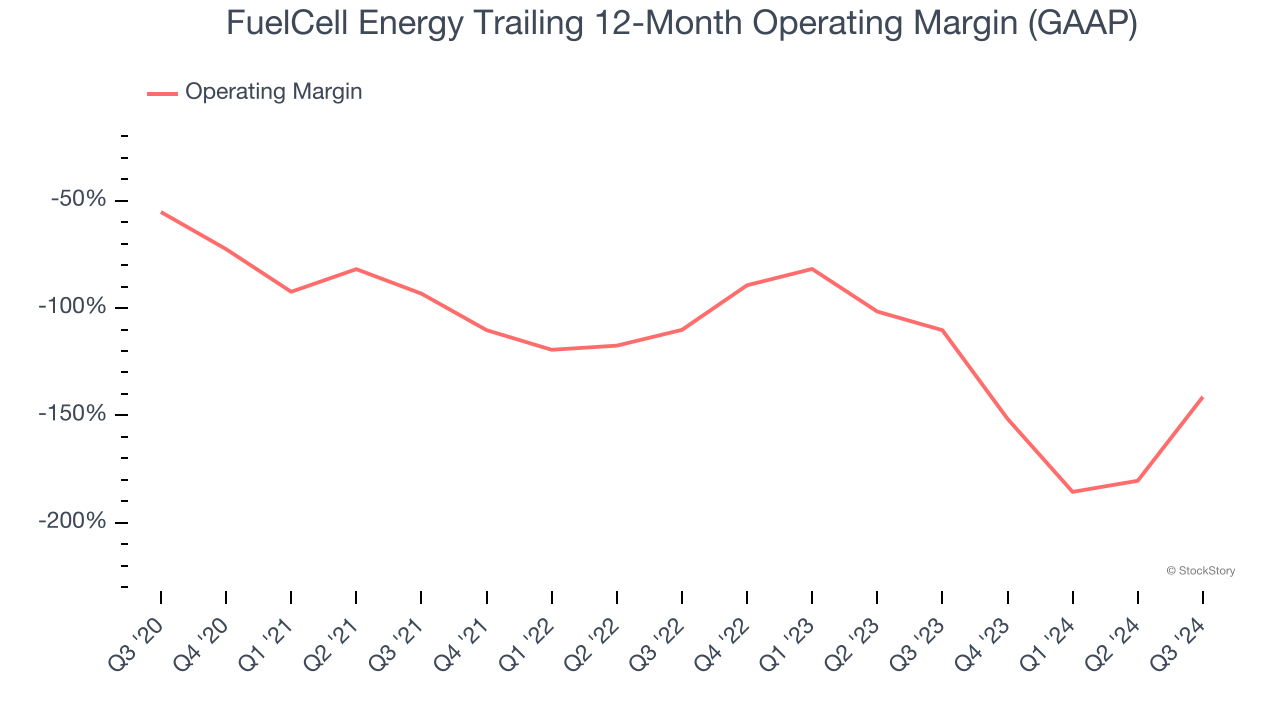

FuelCell Energy’s high expenses have contributed to an average operating margin of negative 107% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, FuelCell Energy’s operating margin decreased by 86.1 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, FuelCell Energy generated a negative 83.2% operating margin. The company's consistent lack of profits raise a flag.

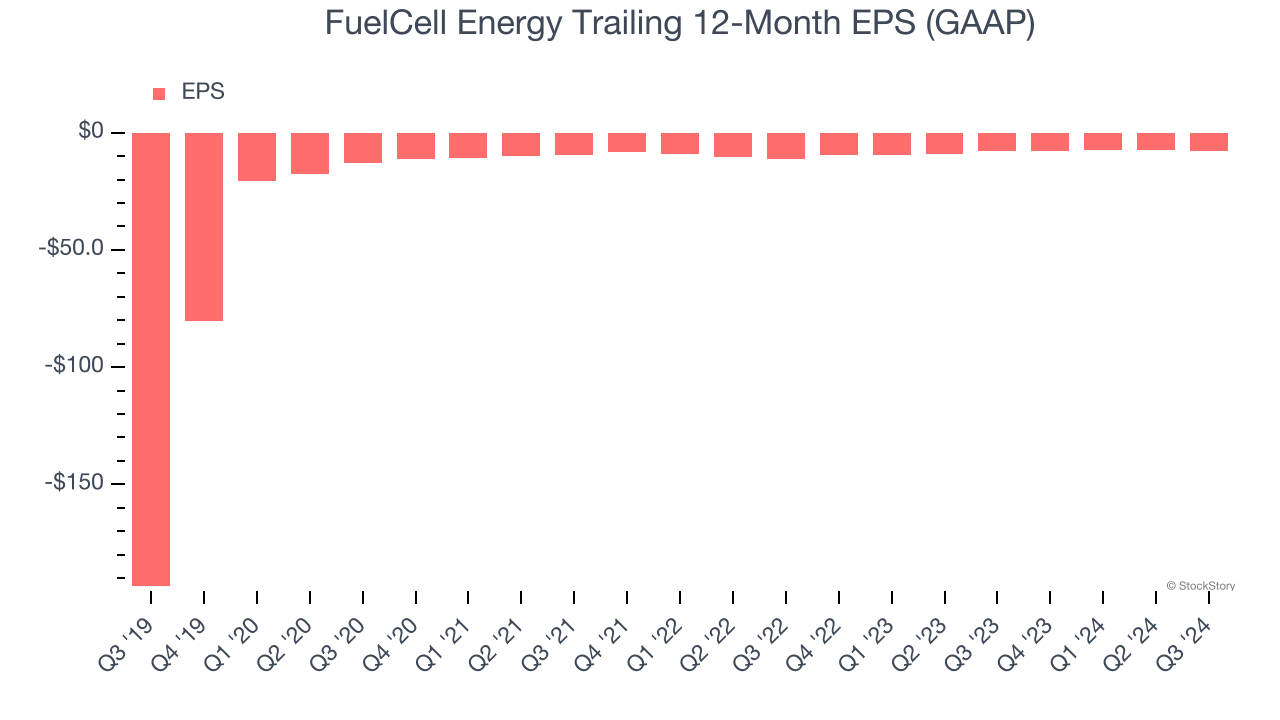

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although FuelCell Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 47.5% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For FuelCell Energy, its two-year annual EPS growth of 17.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, FuelCell Energy reported EPS at negative $2.21, down from negative $2.07 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects FuelCell Energy to improve its earnings losses. Analysts forecast its full-year EPS of negative $7.75 will advance to negative $5.35.

Key Takeaways from FuelCell Energy’s Q3 Results

We were impressed by how significantly FuelCell Energy blew past analysts’ revenue expectations this quarter. We were also happy its backlog narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed significantly, showing that profitability is still lacking in the business. Management struck an upbeat tone on demand, though, saying "In 2025, we expect that our business will be on stronger financial footing as a result of our previously announced global restructuring that will focus our core technologies on distributed power generation, grid resiliency, and data center growth”. Overall, this was a mixed quarter, but topline strength seems to be the market focus. The stock traded up 6% to $10.42 immediately after reporting.

So should you invest in FuelCell Energy right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.