Battery manufacturer EnerSys (NYSE:ENS) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 1.9% year on year to $883.7 million. On the other hand, next quarter’s revenue guidance of $940 million was less impressive, coming in 2% below analysts’ estimates. Its non-GAAP profit of $2.12 per share was 2.4% above analysts’ consensus estimates.

Is now the time to buy EnerSys? Find out by accessing our full research report, it’s free.

EnerSys (ENS) Q3 CY2024 Highlights:

- Revenue: $883.7 million vs analyst estimates of $887.8 million (in line)

- Adjusted EPS: $2.12 vs analyst estimates of $2.07 (2.4% beat)

- EBITDA: $129 million vs analyst estimates of $131.2 million (1.7% miss)

- The company dropped its revenue guidance for the full year to $3.72 billion at the midpoint from $3.81 billion, a 2.4% decrease

- Management lowered its full-year Adjusted EPS guidance to $8.90 at the midpoint, a 1.1% decrease

- Gross Margin (GAAP): 28.5%, up from 26.6% in the same quarter last year

- Operating Margin: 11.2%, up from 9.8% in the same quarter last year

- EBITDA Margin: 14.6%, in line with the same quarter last year

- Free Cash Flow Margin: 0.4%, down from 10.1% in the same quarter last year

- Market Capitalization: $3.99 billion

Company Overview

Supplying batteries that power equipment as big as mining rigs, EnerSys (NYSE:ENS) manufactures various kinds of batteries for a range of industries.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

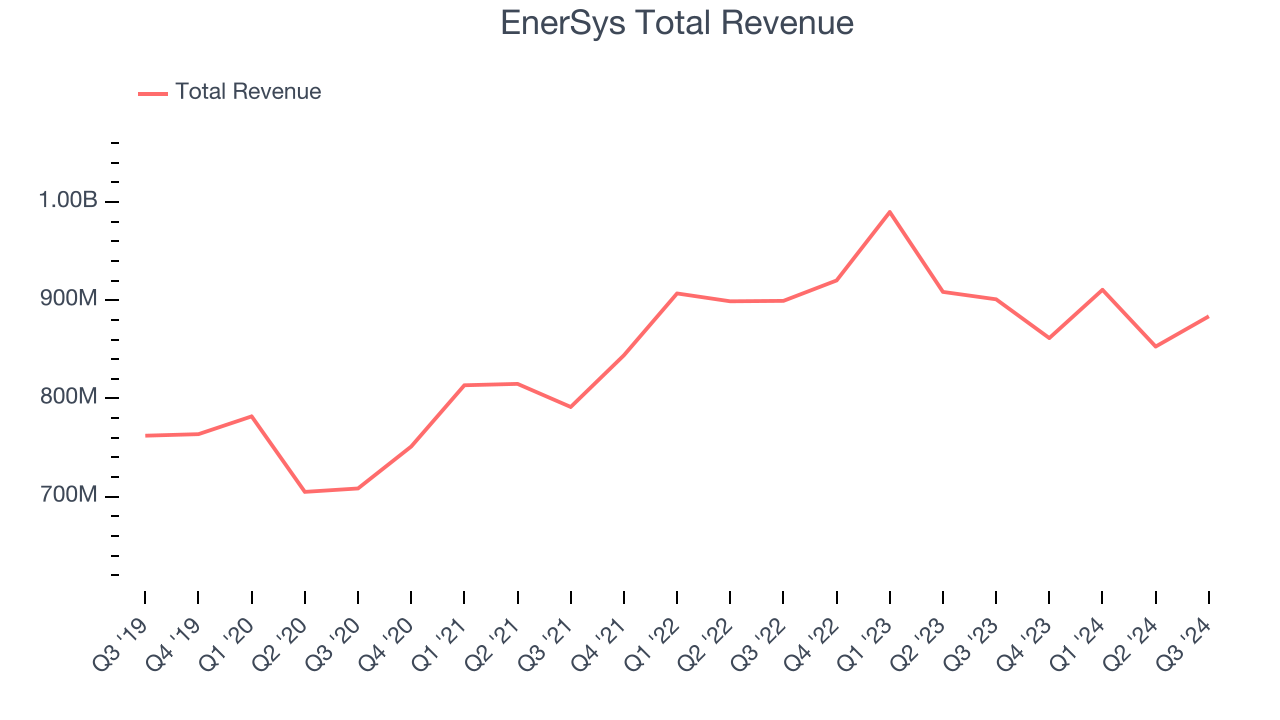

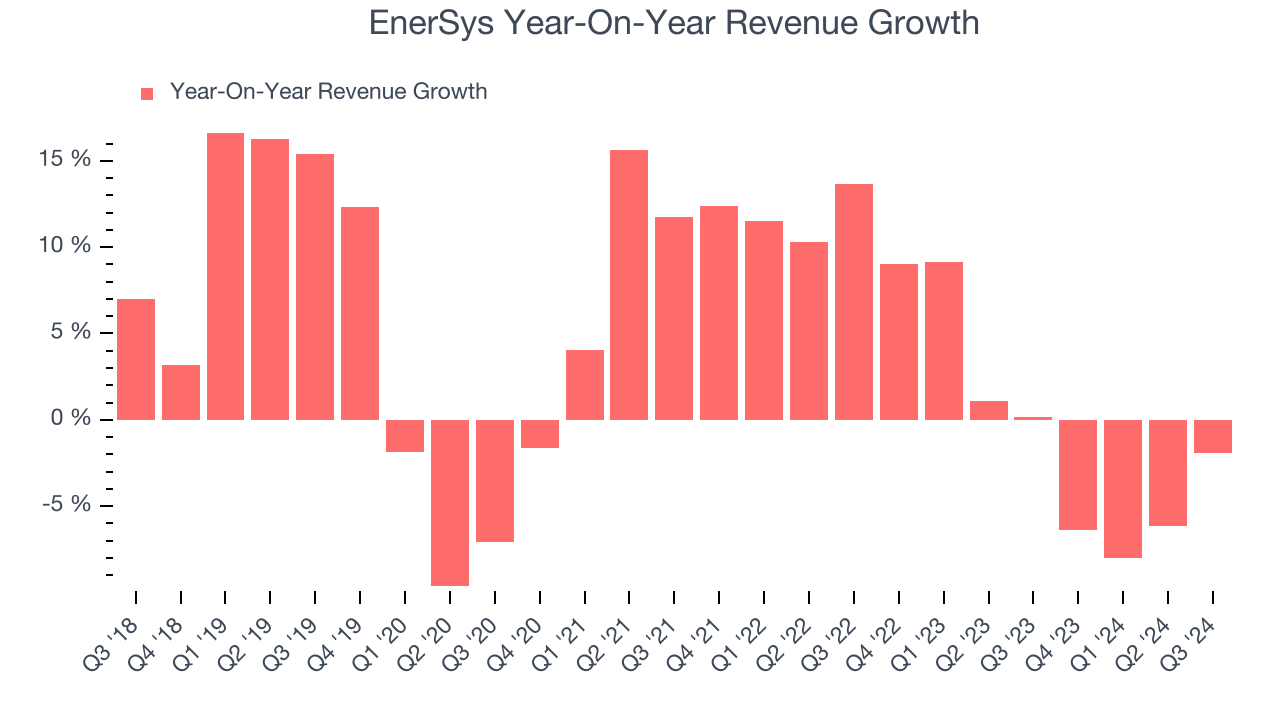

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, EnerSys’s sales grew at a sluggish 3.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. EnerSys’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, EnerSys reported a rather uninspiring 1.9% year-on-year revenue decline to $883.7 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 9.1% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, an improvement versus the last two years. This projection is admirable and illustrates the market believes its newer products and services will catalyze higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

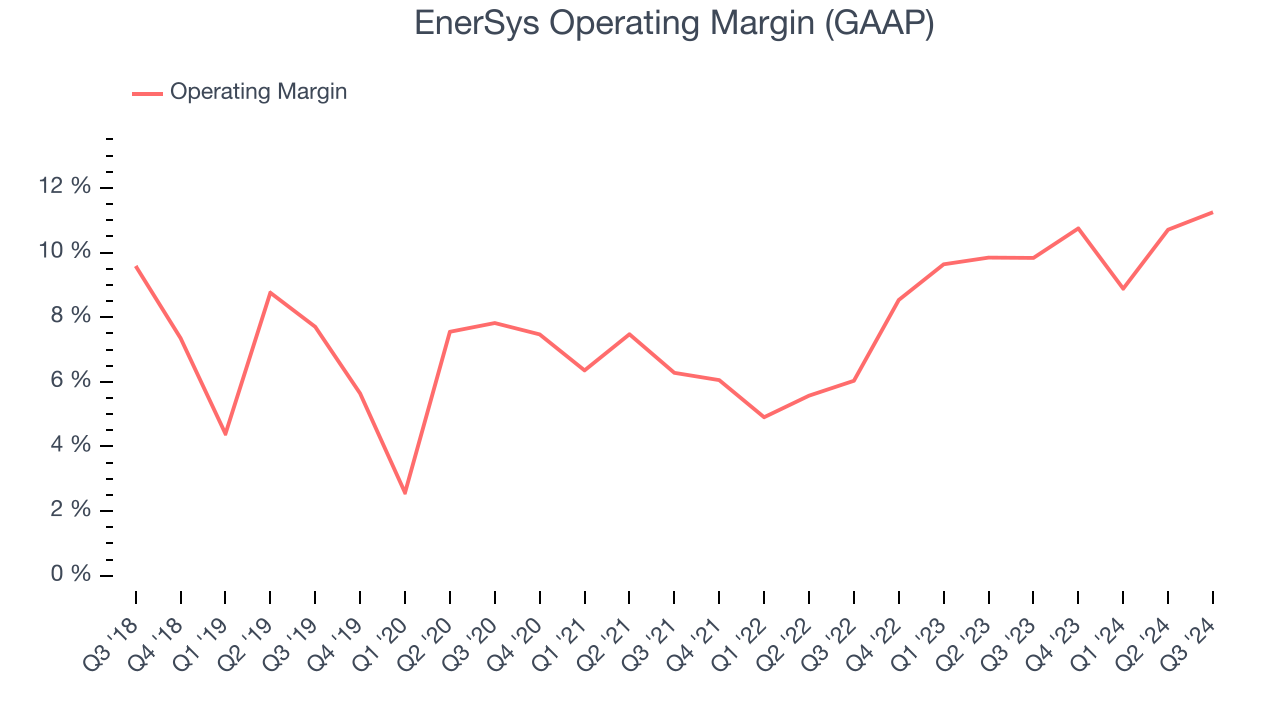

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

EnerSys was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, EnerSys’s annual operating margin rose by 4.6 percentage points over the last five years.

This quarter, EnerSys generated an operating profit margin of 11.2%, up 1.4 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

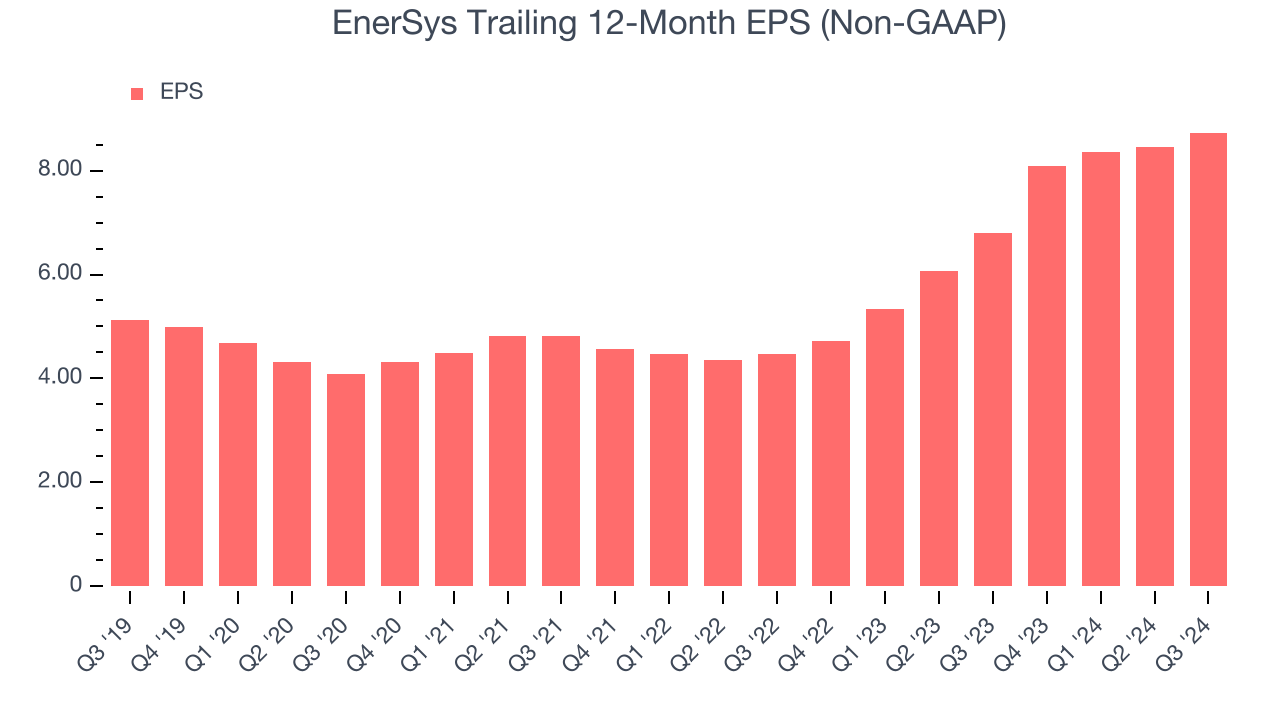

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

EnerSys’s EPS grew at a solid 11.2% compounded annual growth rate over the last five years, higher than its 3.1% annualized revenue growth. This tells us the company became more profitable as it expanded.

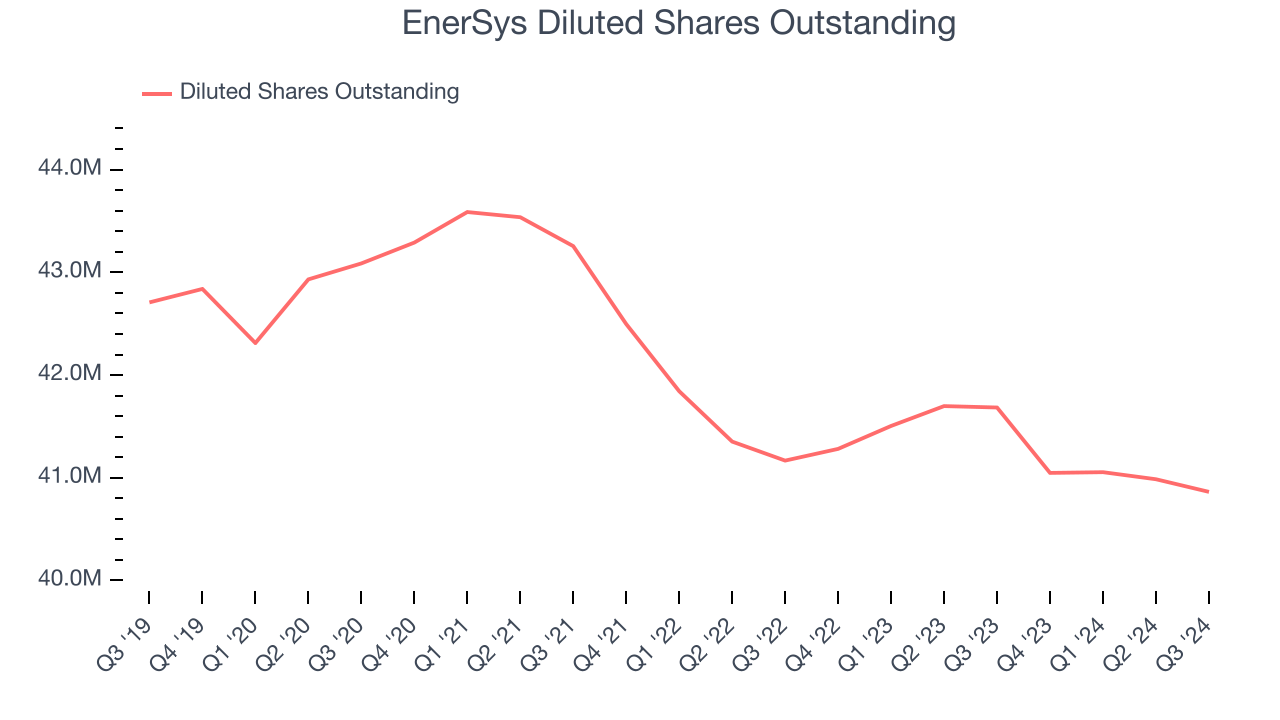

Diving into the nuances of EnerSys’s earnings can give us a better understanding of its performance. As we mentioned earlier, EnerSys’s operating margin expanded by 4.6 percentage points over the last five years. On top of that, its share count shrank by 4.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For EnerSys, its two-year annual EPS growth of 39.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, EnerSys reported EPS at $2.12, up from $1.84 in the same quarter last year. This print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects EnerSys’s full-year EPS of $8.73 to grow by 5.7%.

Key Takeaways from EnerSys’s Q3 Results

We struggled to find many strong positives in these results. Its EPS forecast for next quarter missed and its revenue guidance for next quarter came in slightly below Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $101.90 immediately after reporting.

Is EnerSys an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.