Wrapping up Q2 earnings, we look at the numbers and key takeaways for the data and analytics software stocks, including C3.ai (NYSE:AI) and its peers.

Data is the lifeblood of the internet and software, and its importance to businesses continues to accelerate. Tracking sensors, ubiquitous mobile devices, and every action in every app are producing an explosion of analyzable data which increasingly gets stored in public cloud environments. This drives demand for a variety of software solutions, from databases to analytics software, which help companies derive actionable insights from the data to better understand customer preferences, supply chains, and forecast at ever more granular levels to improve their competitive advantage.

The 14 data and analytics software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Luckily, data and analytics software stocks have performed well with share prices up 17.8% on average since the latest earnings results.

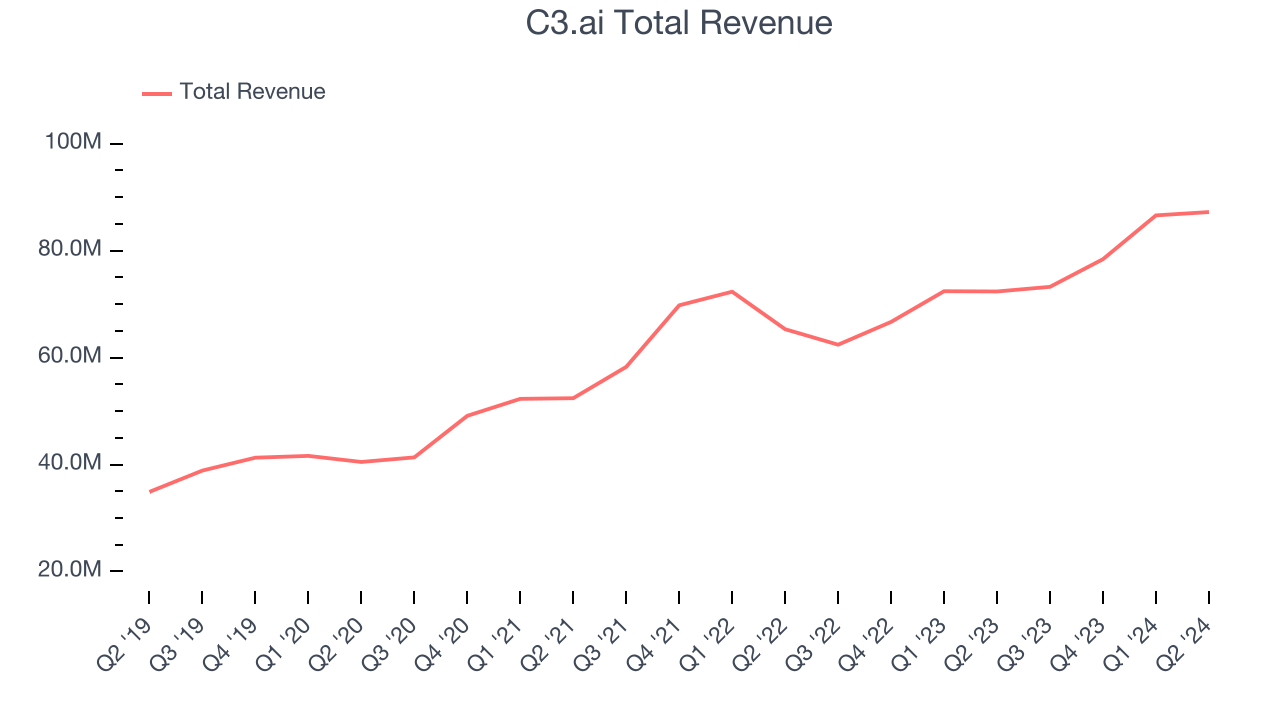

C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $87.21 million, up 20.5% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA and billings estimates.

“We had a solid start to the fiscal year, with rising demand for Enterprise AI driving our sixth consecutive quarter of accelerating revenue growth,” said Thomas M. Siebel, Chairman and CEO, C3 AI.

Interestingly, the stock is up 9.8% since reporting and currently trades at $25.27.

Is now the time to buy C3.ai? Access our full analysis of the earnings results here, it’s free.

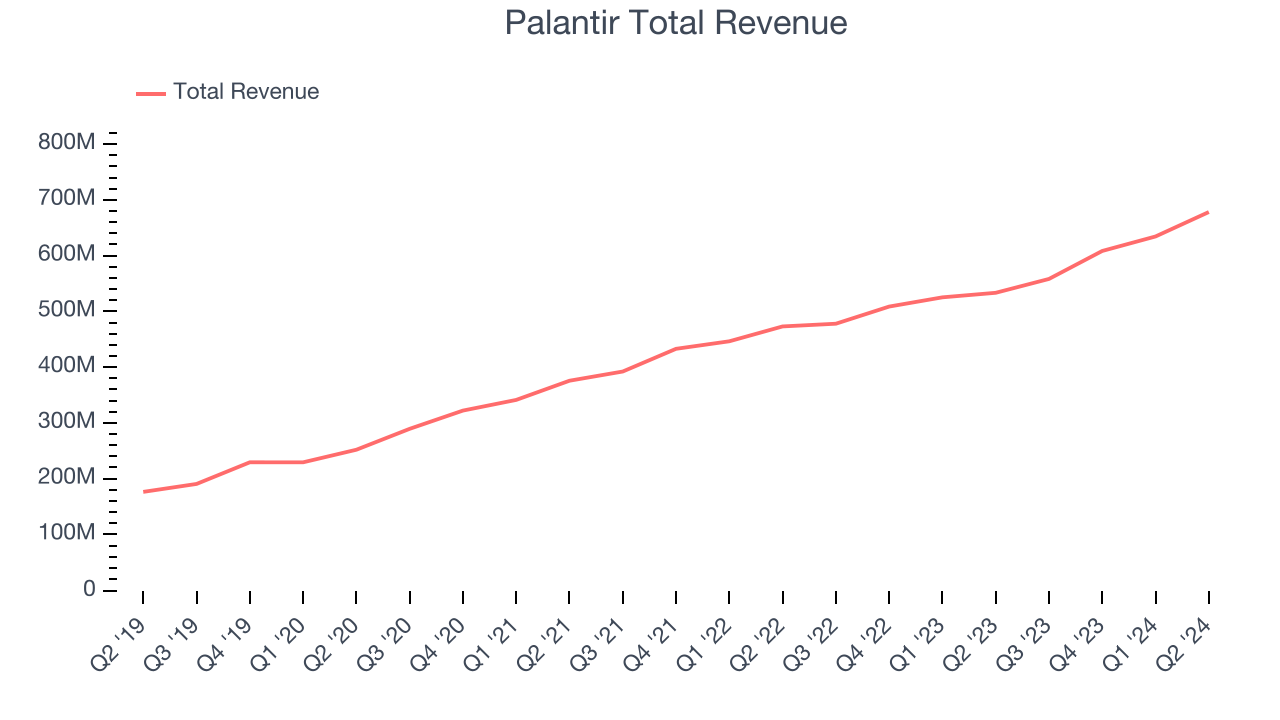

Best Q2: Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $678.1 million, up 27.2% year on year, outperforming analysts’ expectations by 3.9%. The business had a very strong quarter with an impressive beat of analysts’ billings and EBITDA estimates.

Palantir pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 77.8% since reporting. It currently trades at $42.83.

Is now the time to buy Palantir? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: MicroStrategy (NASDAQ:MSTR)

Founded in 1989 with an initial contract with DuPoint, MicroStrategy (NASDAQ:MSTR) started as a data mining and business intelligence software platform, but in 2020, the company made waves by investing heavily in Bitcoin.

MicroStrategy reported revenues of $111.4 million, down 7.4% year on year, falling short of analysts’ expectations by 8.6%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA estimates.

MicroStrategy delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 44.8% since the results and currently trades at $218.96.

Read our full analysis of MicroStrategy’s results here.

Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $78.41 million, down 1.6% year on year. This result beat analysts’ expectations by 2.4%. It was a strong quarter as it also put up optimistic earnings guidance for the next quarter.

The stock is down 3.8% since reporting and currently trades at $7.42.

Read our full, actionable report on Domo here, it’s free.

Samsara (NYSE:IOT)

One of the few public companies where Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Samsara reported revenues of $300.2 million, up 36.9% year on year. This number surpassed analysts’ expectations by 3.7%. Overall, it was an exceptional quarter as it also produced an impressive beat of analysts’ billings estimates and optimistic earnings guidance for the next quarter.

Samsara delivered the fastest revenue growth among its peers. The stock is up 20.2% since reporting and currently trades at $46.60.

Read our full, actionable report on Samsara here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.