Casino stocks are the proverbial “rough neighborhood” in 2024, with the major players like Las Vegas Sands Co. (NYSE: LVS) and Wynn Resorts Ltd. (NASDAQ: WYNN) trading down 14.4% and 9.22%, respectively. The best house in the rough neighborhood could be MGM Resorts International (NYSE: MGM), whose shares are down 3.67% YTD. The consumer discretionary sector has seen a migration in consumer spending from goods and products to services and experiences, as evidenced by the travel boom, which has been driving positive normalization in the travel, entertainment, and lodging industries.

MGM Resorts Portfolio of Properties

MGM operates 18 properties in the United States and Macau. Its iconic Las Vegas properties include the Bellagio, Mandalay Bay, Luxor, Excalibur, The Cosmopolitan, Aria, NoMad, New York-New York, and various MGM brands. Each property has its experiential theme with top in-house entertainment, including shows and artist residences ranging from Cirque Du Soleil to Aerosmith and Lady Gaga. Outside of Las Vegas, MGM has seven hotel and casino properties located from Northfield Park, Ohio, to Springfield, Massachusetts, and the National Harbor in Oxon Hill, Maryland. Its two luxury properties in Macau have a combined 17% market share.

MGM has also partnered with Marriott International Inc. (NASDAQ: MAR) to launch the MGM Collection with the Marriott Bonvoy program. This enables loyalty plan members of both programs, including the 180 million members of Marriott's Bonvoy, to access and earn loyalty points across 16 properties, including up to 37,000 converted rooms at MGM properties.

MGM's Strategic Moves: Expanding BetMGM and Acquiring Tipico

MGM is determined to grow its online sports betting and iGaming business. The company owns 50% of US-BetMGM with partner Entain PLC (OTCMKTS: GMVHF), one of the largest online betting technology companies. The US BetMGM is a 50/50 partnership. MGM completely owns all international BetMGMs, including BetMGM UK. They plan to open in the Netherlands in 2024.

MGM also owns 100% of LeoVegas, a Scandinavian online sports betting platform, which is its gateway into the European market. MGM announced the acquisition of Tipico’s US sportsbook and technology platform through its LeoVegas subsidiary. The acquisition enables them to control the entire technology ecosystem and is expected to close in Q3 2024. This deal has also sparked rumors of the potential breakup of its Entain partnership in BetMGM since LeoVegas' digital sportsbook and iGaming platform will be available worldwide.

BetMGM Offers Live Dealer Casino Table Games

Critics of iGaming will argue that it doesn’t compare to the live experience of playing at a casino table with players next to you and a live dealer. Since MGM operates physical and digital casinos, it has added live dealer table games, including baccarat, blackjack, Ultimate Texas hold 'em and lightning dice. This enables customers to place real time bets with the actual table in an MGM casino. Players will be able to watch the dealer shuffle, deal and turn over cards just as a live game would entail.

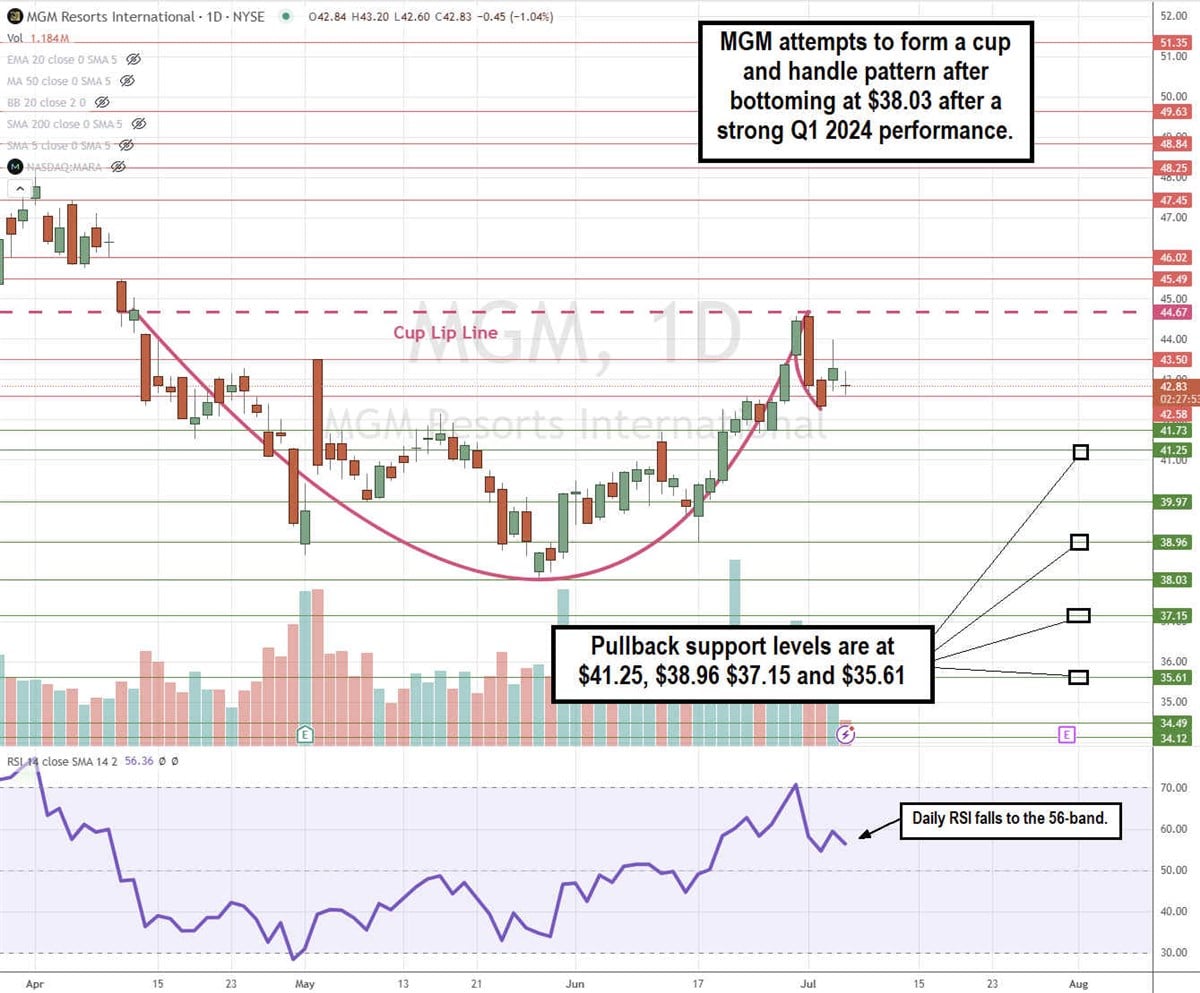

MGM Completes the Cup Pattern and Starts to Form a Handle

The daily candlestick chart for MGM completed a cup pattern. The cup lip line formed at $44.67 on April 11, 2024, as shares fell to a swing low of $38.03 on May 29, 2024. MGM staged a rally back up to retest the cup lip line on July 1, 2024. Shares peaked and pulled back as a handle started to form. The cup and handle pattern breakout triggers if MGM can surge back up through the cup lip line. The daily relative strength index (RSI) pulled back to the 58-band as the market awaits a bounce or further sell-off. Pullback support levels are at $41.25, $38.96, $37.15, and $36.15.

Q1 2024 Earnings Break Several Records

MGM Resorts International reported stellar Q1 2024 results. The company posted EPS of 78 cents, beating 56 cents consensus estimates by 18 cents. Revenues rose 13.2% YoY to $4.4 billion, beating the $4.24 billion consensus estimates driven by revenue growth in MGM. China continues to experience positive normalization from the removal of COVID-19-related entry restrictions in the year-ago period. Consolidated adjusted EBITDAR was $1.2 billion. The company bought back 12 million shares and has $1.7 billion in remaining availability under the November 2023 buyback plan, which is around $1.7 billion.

Las Vegas Strip and MGM China Were the Top Producing Locations

Las Vegas Strip resorts generated revenues of $2.3 billion, up from $2.2 billion in the year-ago period. Adjusted property earnings before interest taxes, depreciation and amortization, and rent (EBITDAR) were $828 million compared to $836 million in the year-ago period. Hotel room revenue rose 10% to $827 million with a 93% occupancy. The average daily rate rose 7% YoY to $277. Revenue per available room (RevPAR) rose 8% YoY to $258.

MGM China generated $1.1 billion in revenues, up 71% from $618 million in the year-ago period. Adjusted property EBITDAR rose 78% to $301 million compared to $169 million in the year-ago period. Casino revenues surged 66% to $920 million. The main floor table games drop rose by 76% to $4.38 billion. The main floor table games win rate was 24.9%, up from 29% in the year-ago period.

MGM Resorts CEO Bill Hornbuckle commented, "We achieved record consolidated revenues in the first quarter. The January launch of our license agreement with Marriott has surpassed our initial expectations with over 130,000 room nights booked, and we expect the strategic relationship will be a growth driver this year."

Analysts Like What They See

The analysts came out with favorable ratings for MGM stock after its Q1 2024 results. Susquehanna raised the rating from Neutral to Positive with a $54 price target. Most recently, on July 3, 2024, BTIG initiated its coverage with a Buy rating and a $52 price target. They expect the digital segment to be a key driver and expect upward estimate revisions primarily driven by Las Vegas and China operations. There's also potential for sales of regional locations. MGM shares trade at 14.25x forward earnings. MarketBeat’s consensus price target of $54.66 has a 27% upside.