Alphabet shares (NASDAQ: GOOGL) are finding support at a previous area of resistance, pointing toward a potential upside in the stock if buyers can continue to stand firm. On the year, shares of the tech giant are up 35.42%, trading near a previous breakout level of $116. The stock has shown relative strength to the broader market and is trading near an attractive risk: reward long entry if the uptrend remains intact.

The Relative Strength In GOOGL

Year-to-date, the shares of GOOGL have experienced an impressive increase of 35.42%, clearly surpassing the performance of the benchmark SPDR S&P 500 ETF Trust (NYSE: SPY), which has gained a respectable 14.67% during the same period. However, this growth is not limited to just the current year. Since hitting its lowest point in March 2020, GOOGL has surged 91.43%, demonstrating its resilience and ability to outpace the market. The SPY has also witnessed a notable increase of 59.84% during the same timeframe. These impressive figures highlight the remarkable relative strength and outperformance of GOOGL, making it a standout performer in the market.

Regarding performance, GOOGL is closely aligned with the Invesco QQQ (NASDAQ: QQQ) ETF, as both have witnessed significant growth. The technology-focused QQQ ETF has surged by an impressive 37.54% year-to-date. Within the ETF, GOOGL holds a substantial weighting of 7.41% when combining its class A and C common stock. This places GOOGL among the top holdings in the ETF, with only Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) boasting higher weightings.

Heavy Institutional Buying Over 12 Months

Over the last twelve months, GOOGL has experienced tremendous institutional buying, thanks to last year's third quarter. In the previous twelve months, total institutional inflows have been $234.70 billion and $18.92 billion in outflows. $192 billion of the total inflow came in the third quarter of last year.

Analyst Predict Upside

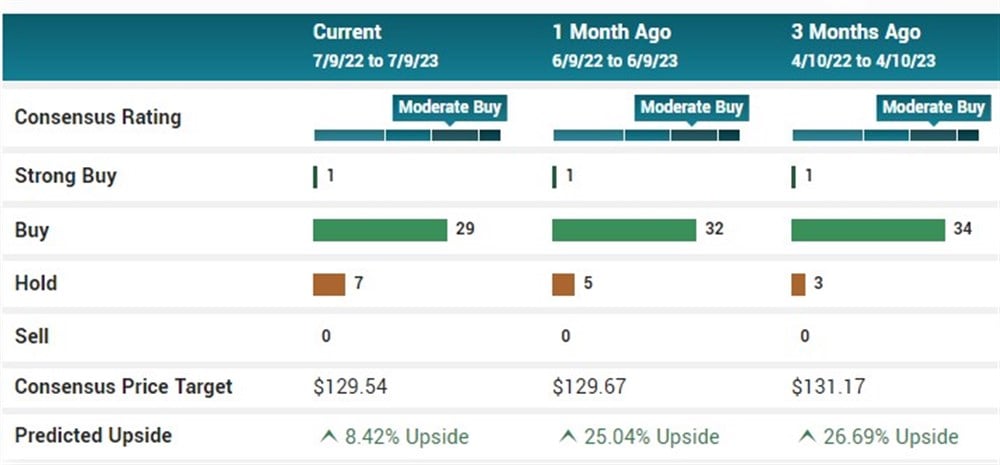

GOOGL has a Moderate Buy rating based on 37 analyst ratings and a consensus price target of $129.54, which predicts an 8.42% upside. The stock has a high price target prediction of $160 and a low prediction of $113.

Month over month, since April, analysts have been steadily reducing their Rating from Buy to Hold. In April, 34 analysts had GOOGL as a Buy. That figure decreased to 32 in June and is currently 29. Currently, 29 analysts have GOOGL as a Buy, 7 as a Hold, and 1 as a Strong Buy.

Technical Analysis

Between May and September last year, shares of GOOGL resisted the $120 area and failed to hold above on four separate attempts, thereby turning that area into a significant resistance zone. After breaking out in May, the stock broke above $120 resistance and has since firmly held above. Short-term key moving averages have converged as the stock has consolidated near the level, like the 5-day SMA and 50-day SMA.

Together with the contraction in range and volume, a breakout in the stock seems likely to be an outcome. If the volume can increase and GOOGL can break over last week's high of $122.61, the breakout will be confirmed, and a move toward $130 could be achievable in the short term. Of course, given the stock's close correlation to the QQQs, keeping an eye on the broader sector and the ETF will be important.