Bellwether PPG Industries (NYSE: PPG) is moving higher on raised guidance. The company expects earnings to exceed its prior guidance and the consensus estimates on better-than-forecast sales and margin recovery. The news has the stock up about 5.0% in early trading and bodes well for competitor RPM International and the broader economy. PPG Industries will report results later this month, while RPM International will report later this week.

“The pace of our operating margin recovery accelerated during the quarter, driven by higher sales volumes and additional selling price capture,” said Tim Knavish, PPG president and chief executive officer. “Our stronger sales volume performance compared to our guidance was led by the aerospace and automotive original equipment manufacturer coatings businesses. In addition, we delivered higher year-over-year earnings across most of our business portfolio including Europe.”

The Analysts Could Lead PPG And RPM Higher

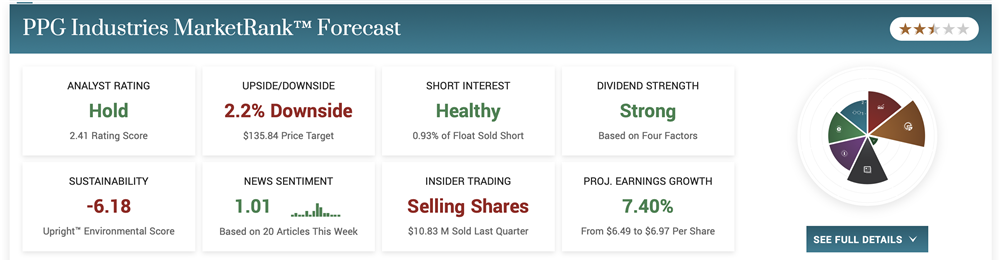

The analysts have yet to speak out about PPG Industries’ improved guidance, but we have to assume they will view it favorably. Until the next wave of reports comes out, the sentiment for both names is pegged at a Firm Hold with a price target that has bottomed after a year of downtrending. The difference is that analysts view PPG as fairly valued at the new highs, while RPM International could rise by as much as 10% before reaching a similar valuation.

RPM International is expected to post a small YOY gain in revenue but for earnings to contract in FQ3/CQ1. This is despite the company’s upbeat guidance and expectation for margin expansion. Assuming it benefits from the same tailwinds and efforts to navigate the environment, this company could significantly outperform its top and bottom-line results.

“The second quarter was a positive one for RPM with record sales and significant margin expansion resulting in record adjusted EBIT,” commented RPM Chairman and CEO Frank C. Sullivan in the Q2 report. “We generated these impressive results despite several macroeconomic challenges. We also introduced our MAP 2025 operating improvement program at an investor day during the quarter and are off to a promising start with year-to-date MAP benefits exceeding our targets.”

RPM International Or PPG Industries? How Do You Pick?

It’s hard to tell the difference between PPG Industries and RPM International because they are so evenly matched, and that goes for the value, dividends and institutional interest. Both stocks pay about 1.85% regarding the value and dividends, with shares trading nearly 20X their earnings. That is no value compared to the broad market, but the dividends are backed up by healthy balance sheets and come with 50-year track records of dividend payments and increases.

Regarding the institutions, institutions own about 80% of both companies and have been buying them on balance for the last year. That is a tailwind for price action, with stocks trading at bottoms and ready to move higher. PPG is already breaking out of its trading range, and RPM may follow the move higher. PPG has been leading the pair since the pandemic bottom, and there is no reason to expect that to change now.