The stock market has changed over the last year, and it no longer favors unprofitable fad stocks. These days, companies with yield, quality assets, and resilient business models are reaping the rewards. It's a shift that value investors say comes about a decade late.

After all, why bother with stock investing when you can earn a risk-free rate of 5.2%? Any potential investments need to clear a high hurdle rate.

Many yield-seeking investors are taking shelter in the energy sector, which offers several opportunities in the wake of the Russia/Ukraine war. Despite natural gas prices taking a bath over the last 6 months, plenty of firms still have favorable backdrops for high yields due to industry-wide capacity constraints.

This article reviews 3 MLPs in the oil and gas sector, which offer both abnormally high yields and the potential for solid price appreciation.

Why High-Yield Investors Should Consider Master Limited Partnerships (MLPs)

When you buy a master limited partnership (MLP), you're not purchasing shares of a company. Instead, you're buying units of a partnership interest, which entitles you to cash distributions of partnership profits.

While these differences sound minute, they’re considerable in practice.

For one, MLPs force management to be prudent. Because MLPs are required to distribute most of their cash to shareholders, investors don't bear the risk of management squandering profits on value-destroying M&A or other investments. If the partnership generates profits, unitholders don't have to wonder if they'll receive cash distributions.

MLPs also hold significant tax advantages compared to high-dividend stocks. MLPs are pass-through entities, meaning they’re not taxed at the corporate level. Partners are taxed on their cash distributions at the individual level, escaping the double-taxation problem that investors in high-dividend stocks face.

However, remember that these tax advantages are limited when investing in MLPs within an IRA.

Energy Transfer LP (ET)

Energy Transfer LP (NYSE: ET) is a midstream oil and gas partnership primarily operating natural gas pipelines and storage facilities. The partnership earns fees by charging companies to transport gas using its ~90,000 miles of pipelines. It's a volume business. The more gas they move, the more profits they make.

Despite the steep decline in natural gas prices, owing mainly to an abnormally warm winter, Energy Transfer's stock has moved in the opposite direction of natural gas. While natural gas futures peaked in August 2022 at $10.78 and now trade at $2.76, Energy Transfer's stock rose 13% over the same period and hiked its dividend.

This is because Energy Transfer tends to enter long-term, fixed-fee contracts to rent its pipelines. This fee-based revenue might not yield home runs like picking the right exploration stock could. Still, it leads to smoother cash flows throughout the energy market cycle. As such, the stock isn't directly correlated with natural gas prices.

While Energy Transfer is known for its stable pipeline business and fat cash distributions, it’s considered quite aggressive among pipeline MLPs. The company is known for pursuing new projects at a much higher rate than other pipeline firms like Enterprise Products Partners (NYSE: EPD), which we cover in this article.

The partnership currently pays a 9.6% cash distribution, paid quarterly just as dividends are. And if you're looking for signs of confidence from management, they hiked the dividend back to pre-COVID levels in January.

Enterprise Products Partners (EPD)

Enterprise Products Partners (NYSE: EPD) is a midstream oil and gas MLP that operates several businesses in the midstream oil and gas space but primarily operates natural gas liquids (NGL) pipelines. Like Energy Transfer, the partnership collects fees by renting out its pipelines to natural gas firms.

While Enterprise and Energy Transfer are often viewed similarly by investors, the two MLPs have different strategies. Energy Transfer is the more aggressive of the two, willingly taking on additional debt to build new projects. On the other hand, Enterprise carries less debt and makes less of an attempt to grow.

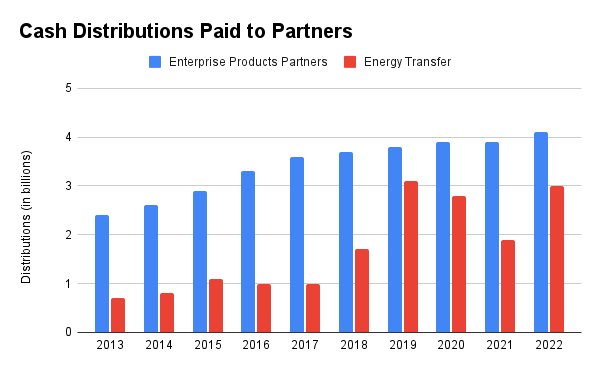

Energy Transfer is the more leveraged player, experiencing more volatility in distributions paid, while Enterprise is much more steady. As a result, each partnership fits a different risk appetite. For instance, below is a chart showing the last nine years of distributions paid by each partnership:

Source: 10-K filings

As you can see, Enterprise has steadily grown its distributions over time, while Energy Transfer is far more volatile. Energy Transfer offers a leveraged play on pipelines for investors seeking more risk. In contrast, Enterprise offers a much more predictable and smooth stream of returns.

Given the partnership’s more conservative approach, it's no surprise that EPD has a lower yield than Energy Transfer at 7.56%.

Alliance Resource Partners LP (ARLP)

Alliance Resource Partners (NASDAQ: ARLP) is the second-largest coal producer in the eastern United States. The company operates coal mines and sells the coal to electric utilities as a fuel source for power generation.

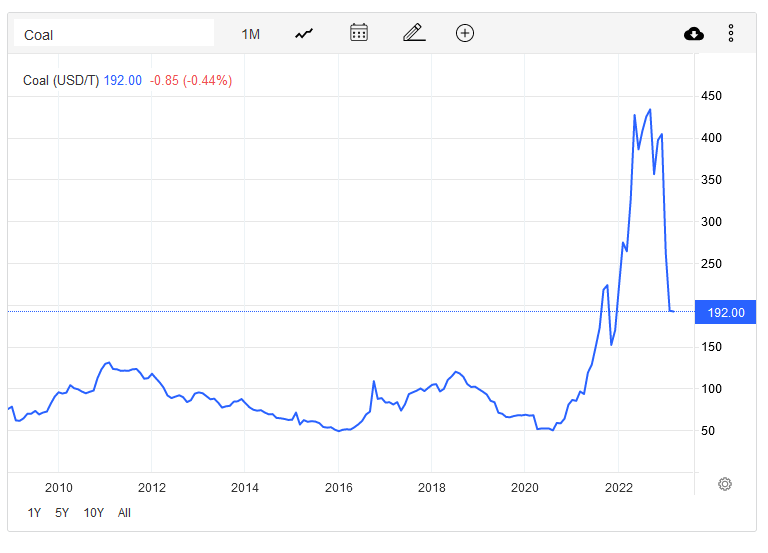

While the consensus says that coal's best days are behind us, market prices tell a different story. Despite recent declines, coal prices remain up 275% from the COVID lows. European nations like Germany are consuming more coal as European energy prices get prohibitive.

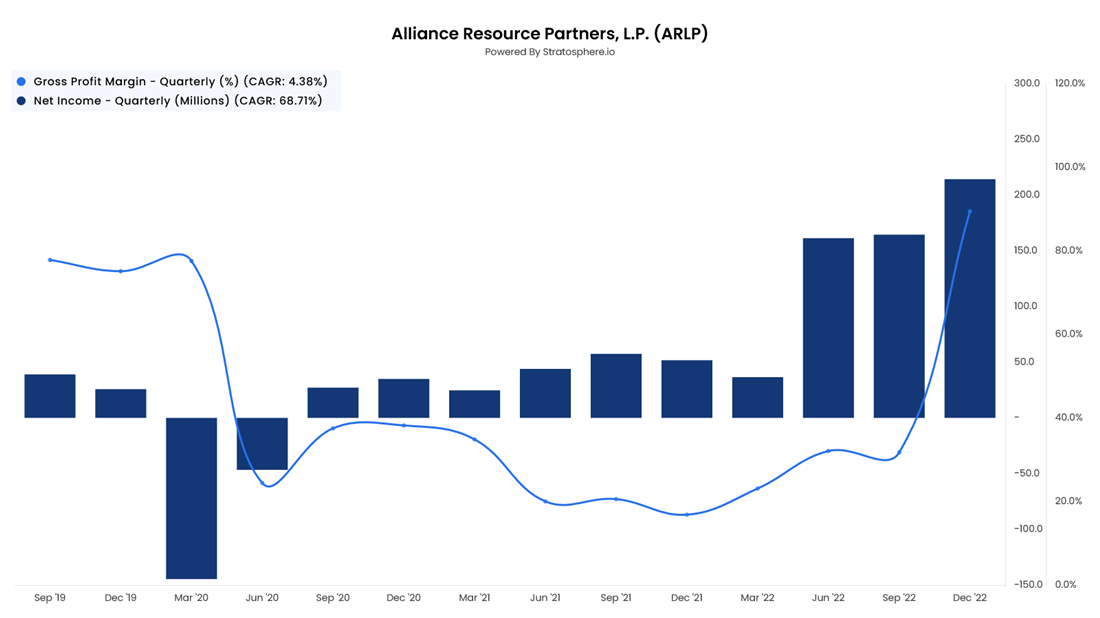

With the Russia/Ukraine war sending prices to levels not seen in over a decade, Alliance cashed in on 2022. The company realized a shocking 89% gross margin, selling coal at record prices.

The company issued strong guidance for 2023, expecting strong margins to continue. And as a result, Alliance hiked its dividend to $2.80 per unit, making for a 13.3% yield at current share prices.

Bottom Line

Most of the energy sector remains attractive. Many companies still book record profits even as energy prices have cooled off since 2022. You can take your pick in the energy world, swim with the sharks and try to time the tanker trade, or perhaps attempt to pick the next successful exploration company.

But MLPs offer the best of both worlds. Relatively stable companies with high yields provide an opportunity for modest capital appreciation.