In recent years, blockchain technology has gained significant traction across various industries, and the wealth management sector is no exception. Major companies are increasingly recognizing the potential of blockchain and actively seeking collaborations to tap into its transformative power. A wave of partnerships has emerged, heralding a new era in finance.

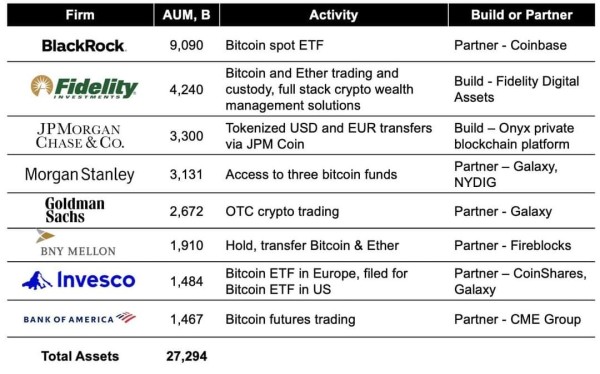

Leading the charge is BlackRock, the world's largest asset manager, which has entered into a strategic collaboration with Coinbase, a prominent cryptocurrency exchange. This partnership aims to leverage blockchain technology to enhance the efficiency and security of asset management operations. By embracing blockchain, BlackRock aims to provide its clients with new investment opportunities and streamline processes, ensuring transparency and trust in wealth management.

Not to be outdone, other industry giants such as Fidelity and J.P. Morgan have also joined the blockchain revolution. These companies understand the potential of distributed ledger technology in reshaping the financial landscape. By collaborating with blockchain startups and implementing innovative solutions, Fidelity and J.P. Morgan aim to improve their offerings and stay ahead of the curve in a rapidly evolving industry.

Additionally, established financial institutions like Goldman Sachs, Invesco, and Morgan Stanley have formed a partnership with Galaxy, a leading blockchain investment firm. This collaboration seeks to explore the integration of blockchain technology into asset management, opening up avenues for new investment products and strategies. The combined expertise of these industry powerhouses and the cutting-edge capabilities of Galaxy are set to redefine the wealth management experience.

Even traditional banking institutions are recognizing the potential of blockchain. BNY Mellon and Bank of America are among the major players actively exploring blockchain-based solutions for wealth management. By embracing this technology, these banks aim to streamline processes, reduce costs, and provide their clients with enhanced security and transparency.

Aleksey Daniel Danilovich, the founder of COFC Technologies Ltd, a well-established and renowned blockchain company, believes that the entry of leading asset management firms, collectively managing nearly $27 trillion in funds and assets, will propel the new era of decentralized digital payment methods into the mainstream. This, in turn, will encourage millions of new users to join the financial revolution.

As of today, Bitcoin is traded at around $30,000 per coin, COFC Cash at $19,000 per coin, and Ethereum at nearly $2,000 per coin. These price points reflect the growing interest and demand for cryptocurrencies and blockchain-based assets.

In conclusion, the entrance of major wealth management companies into the blockchain space signifies a paradigm shift in the financial industry. Collaborations between industry leaders and blockchain startups are driving innovation, efficiency, and accessibility in wealth management. As blockchain technology continues to mature and gain acceptance, it is poised to revolutionize the financial landscape and attract millions of new users to the digital financial ecosystem.

Media Contact

Company Name: COFC technologies Company, Ltd

Contact Person: Media Relations

Email: Send Email

Country: United States

Website: https://tevel.io/