Cardiol Therapeutics (NasdaqCM: CRDL) (TSX: CRDL) stock is higher by over 76% YTD*. But don't think this rally is over. From the looks of it, far from it. In fact, CRDL is in its best-ever position to accelerate its clinical ambitions, especially with the precedent set by potential category rival Kiniksa Pharmaceuticals (NasdaqGS: KNSA) fast-tracked to jump from its mid-Phase II directly to Phase III, something that Cardiol Therapeutics leadership expects could happen by the end of this year. Here's the potentially better news- CRDL appears to be fully funded, with a cash runway able to extend into 2026. Ironically, despite the blue sky potential and its pace toward entering two Phase III trials, CRDL's market cap is below its $60 million in cash on hand. However, that disconnect could change sooner rather than later. (*share price change calculated using opening price on 01/03/23 thru closing price on 09/29/23, $0.51 - $0.90, Yahoo! Finance)

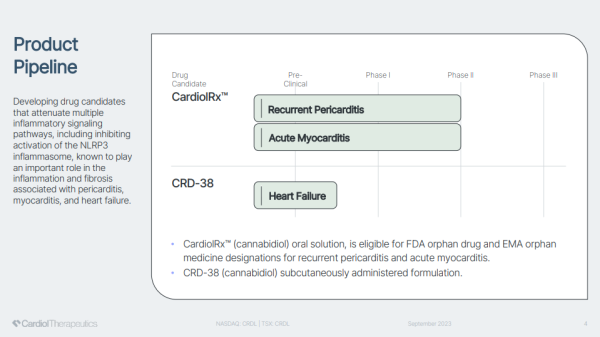

Analysts think so. Four covering CRDL have set price targets between $2.21 and $6.00, with the median target at $3.47, over 285% higher than its current price. A common theme throughout coverage is that CRDL's lead treatment candidate, CardiolRx, could earn the front-line designation, becoming the standard of care to treat certain cardiovascular diseases, which, as a whole, cause over 17 million deaths globally each year. In addition to that potential, orally administered CardiolRx is on a pathway toward earning FDA orphan drug and EMA orphan medicine designations, providing seven years of market exclusivity to protect potentially significant revenue streams.

Moreover, debt-free CRDL is demonstrating that its drug can do what others can't- fight effectively against myopericardial diseases due to its anti-inflammatory and anti-fibrotic properties. In fact, those latter differences are also significant advantages compared to drugs developed by Big Pharma, including Novo Nordisk (NYSE: NVO), Eli Lilly (NYSE: LLY), and Novartis (NYSE: NVS). Most of those include patients needing to take immunosuppressants, sometimes for several years, creating side effects that can sometimes be worse than the cardiovascular condition targeted. Remember, while sometimes a necessary evil, immunosuppressants inhibit or decrease the intensity of the immune response in the body, leaving patients susceptible to infection, treatment rejection, and other conditions that can lead to death. CRDL intends to change the practice of making dosing them a condition of getting additional treatment.

Video Link: https://www.youtube.com/embed/LI6TeOzmIQM

Accelerating Through Phase II With Milestones In-Play

And they are on the right track by developing CardiolRx with anti-inflammatory and anti-fibrotic properties to treat particular cardiovascular diseases. Cardiol Therapeutics' immediate focus is to create better solutions for patients with recurrent pericarditis and acute myocarditis. So far, it's only good news, evidenced by CardiolRx posting an excellent data scorecard fighting against myopericardial diseases, including recurrent pericarditis, acute myocarditis, and heart failure.

That success adds to the bullish proposition, knowing that milestones reached by CRDL can become catalysts to exploit a multi-billion dollar treatment market opportunity. Three are currently in play. The first relates to its Phase II Recurrent Pericarditis Study, with CRDL potentially announcing completed enrollment and interim analysis this year. That's not all. Speculation supports CRDL also initiating its Phase III program by year's end. If so, those who follow biotechs know that the valuation difference between a Phase II and III company can be substantial. The better news is that more than one trial may advance to late-stage.

Cardiol is also expected to complete enrollment and report topline data from its Phase II Acute Myocarditis Study. That one could also jump directly to Phase III based on its data supporting the need for this drug candidate to get to patients quickly. A third milestone relates to its advancing research for CRD-38, with the company expecting to complete IND-enabling (Investigational New Drug Application) studies, submit the IND, and initiate the Phase I Clinical Program.

Collaborations To Fight Recurrent Pericarditis

Here's something else to consider when appraising the CRDL value proposition. Unlike most go-it-alone microcap biotechs, CRDL is getting plenty of research help. The company has joined forces with world-class researchers and clinicians to better understand inflammation and fibrosis, drug development processes, and clinical trial protocols that can lead to expedited approvals. The list of collaborators comprises an enviable Who's Who list of heart disease research contributors, including Cleveland Clinic, Mayo Clinic, Houston Methodist DeBakey Heart & Vascular Center, VCU Health, and UVA Health. Internationally, CRDL is working with Tecnológico de Monterrey, UPMC, Charité, University of Ottawa Heart Institute, Tel-Aviv Sourasky Medical Center, McGill University Health Centre, and InCor HCFMUSF Ciência e Humanismo. In other words, CRDL has plenty of research expertise to tap into when they need it.

Invariably, that's helped facilitate progress, likely expediting Phase II studies that evaluated CardiolRx' tolerability, safety, and efficacy in patients with recurrent pericarditis. Pericarditis is the membrane inflammation surrounding the heart, which leads to fluid accumulation and pericardial thickening. It becomes recurrent if symptoms reappear after a symptom-free period of 4-6 weeks. The symptoms of pericarditis include chest pain, shortness of breath, and depression. Severe cases affect quality of life and physical activity abilities and can even lead to emergency department visits or hospitalizations. It touches many lives.

Pericarditis affects 38,000 Americans and leads to 18,000 hospitalizations annually. While bad enough, recurrent pericarditis is much worse, usually lasting anywhere from 4-6 years in difficult-to-treat cases. If granted FDA orphan and/or EMA approval, CardiolRx could, therefore, treat the patient throughout that entire treatment life-cycle, with revenues generated in the hundreds of thousands, not tens of dollars, per complete treatment. Moreover, CardiolRx can fill an unmet medical need for an oral drug that treats patients intolerant to therapy, colchicine resistant, or corticosteroid dependent.

Current pharmacotherapy solutions include NSAIDs or aspirin that don't contain colchicine and corticosteroids for patients with continued recurrence. One FDA-approved therapy is over $150,000/year, a cost that's multiplied to patients with repeated occurrences of pericarditis. That's only part of the cost. Pericarditis often results in a 6-8 day stay in the hospital, adding upwards of $20,000-$30,000 to get treatments needed. Since roughly 30% of the estimated 160,000 annual cases will experience a recurrence, the combined cost to get a currently imperfect treatment can be devastating financially.

The Battle Against Acute Myocarditis

Battling Acute Myocarditis can be equally devastating to a patient's health and finances. Acute Myocarditis is an inflammatory heart muscle condition, often resulting from a viral infection. Symptoms include chest pain, impaired heart function, arrhythmia, and conduction disturbances. Most troubling about this condition is that it generally affects young adults from adolescence to mid-thirties. Still, while the affliction age is wide, most cases are recorded in patients in their early twenties, with acute and fulminant heart failure occurring in young adults. In fact, Acute Myocarditis is a leading cause of sudden cardiac death in people under 35 years of age. Athletes, despite being in top physical condition, have died from this. Thus, diet and exercise won't stop an attack. But a better drug can save lives.

Here's more excellent news. CardiolRx can also earn FDA orphan drug and EMA approvals for treating acute myocarditis. It, too, takes a personal and financial toll. An estimated 46,000 Americans are impacted by acute myocarditis annually. Hospitalizations can be upwards of 7 days and tally $110,000 or more in hospital charges. Intensive care is often the case, noting that complications of this condition include heart failure, cardiogenic shock, arrhythmia, or cardiac arrest. In the most severe cases, ventricular assist devices, extracorporeal oxygenation, or a heart transplant may be needed. Even if patients escape the worst, acute myocarditis can and often does lead to further future health complications.

Thus, a treatment to address problems early on would benefit patients significantly. As importantly, an approved drug from CRDL could fill a clear unmet medical need for a well-tolerated therapeutic that targets myocardial inflammation. There are no FDA-approved therapies for acute myocarditis, only guideline-directed therapies and management. These therapies include decreasing cardiac workload, reducing congestion, and improving how blood flows through arteries and veins and the forces that affect a patient's blood flow. Currently, corticosteroids are used to treat inflammation. However, the issue with those drugs is that they are widely intolerable, can have adverse side effects, and have an inconsistent record of optimal dosing.

A Rally Likely To Continue

In simplest terms, CRDL is timely to a massive market and treatment opportunity. Better still, they have excellent candidates with intrinsic strength and inherent potential to change the treatment landscape for specific cardiac diseases. That's needed. It's estimated that in the United States, over six million people over 20 years old currently live with heart failure. And this number is projected to increase to eight million by 2030. That does more than take a physical toll on patients; it also strains the medical system from the over 1.9 million physician visits, 414,000 emergency department visits, and estimated 1.2 million hospitalizations annually.

Thus, the YTD rally in CRDL is more than warranted; it's deserved. By potentially filling significant unmet medical needs, CRLD is in the sweet spot of opportunity from drug candidates that can earn more than a prescriber's interest; they can earn front-line standard-of-care designations. If so, the current share price could be a springboard, not a platform for higher prices. In fact, being the best drug standing in a sector worth billions, anything less than an exponential increase in the CRLD share price would be, in a word, disappointing.

Disclaimers: Hawk Point Media Group, Llc. is responsible for the production and distribution of this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point Media Group, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. HPM, LLC has been compensated three-thousand-dollars via bank wire by Trending Equities, LLC. to provide research and coverage of Cardiol Therapeutics, Inc. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/