One of the cornerstone trades in the POWR Options program is our POWR Pairs Trade.

A traditional pairs trade would be to buy one stock that you believe will do well in the future and short a similar stock that you feel will do poorly in that same time frame. It is an even more powerful approach when the long and short stocks selected are in the same industry and highly correlated.

For example, buying GM and selling Ford would be a classic example of a pairs trade. Indeed, the first hedge fund (or hedged fund) was created by Alred Winslow Jones in 1949 using this strategy.

Instead of using stocks in the pairs trade, we use options to take a long position (buying bullish calls) and an offsetting short position (buying bearish puts). This option-based approach has much lower initial cost along with defined risk.

Let’s take a walk through our latest POWR Pairs Trade. It will help highlight how we find the potential opportunities and what we focus on to put it all together. The goal is to best optimize the probability of profit.

The pairs trade involved buying bullish calls on Box Inc. (BOX) and bearish puts on Affirm Holdings (AFRM).

POWR Ratings

BOX was an A Rated (Strong Buy) stock in the POWR Ratings. AFRM was a D Rated (Sell) stock in the POWR Ratings. Both were in the same industry- Technology-Services. BOX stock was ranked at number 7 out of 76 in the industry while AFRM was ranked 61 spots lower at number 68.

Given this wide disparity in both the POWR Ratings and ranking within the industry, one would certainly expect BOX to be doing better from a price perspective than AFRM.

Comparative Performance

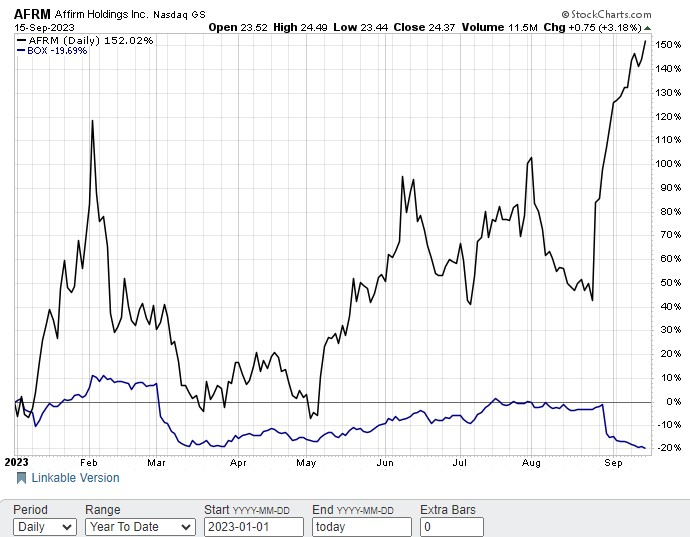

Instead, it was AFRM that was trouncing BOX in the first three quarters of 2023, as shown in the comparative performance chart below from September 15.

Affirm was up just over 150% so far in 2023. BOX was down nearly 20%. (170% differential)

This set up ideally for a pairs trade based on this massive outperformance to begin to converge back to a more normal relationship, as it did back in February when AFRM had a similar spike versus BOX.

So, we would look to buy bullish calls on BOX and buy bearish puts on AFRM to position to profit from the performance spread narrowing. But before we do that, and since we are trading options, it is always vital to take a closer examination of implied volatility (IV).

Implied Volatility (IV)

Implied volatility (IV), for those not familiar, is just a fancy way to say the price of the options. Higher IV levels cause option prices to be more expensive. Lower IV equates to cheaper options.

And since we are buying both calls and puts together to create our pairs trade, we definitely prefer cheap!

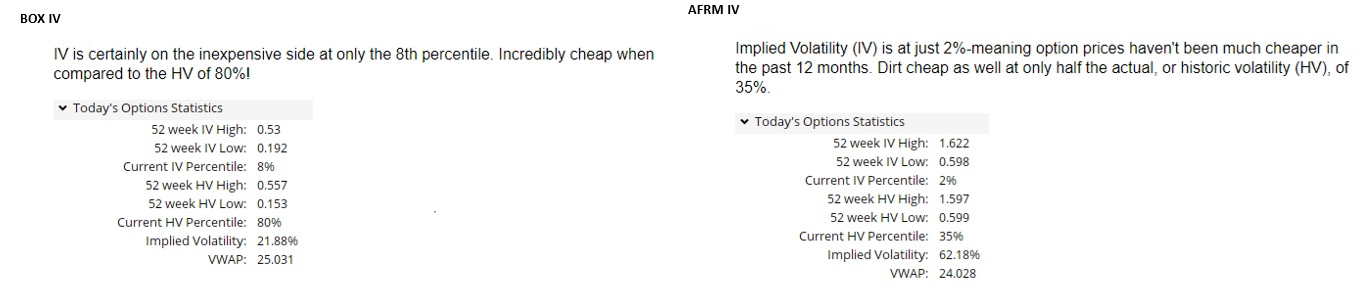

Below are the IV levels of both the BOX calls and AFRM puts on the day of the trade, Monday September 18.

Both the BOX calls and AFRM are trading at extremely low levels of IV-meaning both the calls and puts used to put the POWR Options Pairs trade together are really cheap.

That gives the final go ahead to send out the POWR Options trade recommendation-buying BOX Calls and AFRM Puts. Actual instructions follow.

-----------------------------------------------------------------------------------------------

Action To Take

- Buy to open BOX 1/19/2024 $23 call for $3.10 w.10 discretion

Each option will cost roughly $310 per contract

Action To Take

- Buy to open AFRM 1/19/2024 $25 put @ $4.30 w .10 discretion

Each option will cost roughly $430 per contract

-----------------------------------------------------------------------------------------

The combined cost of the trade is about $750 ($310 for the call and $430 for the put). This is also the most you could theoretically lose on the trade.

If stock was used instead of options, the margin requirement on buying 100 shares of BOX would have been $1250 and the margin on shorting AFRM would have been similar since both stocks were around $25 per share at the time. The combined margin requirement for the pairs trade would come to about $2500.

You can see that using options in place of stock in this case is about 70% less expensive. For higher priced stocks this comparative advantage would be even greater. Plus, you know your maximum risk up front with the options trade.

Fast forward a few days to September 21st. The expected convergence in price between BOX and AFRM has started and IV has popped-both a benefit to our pairs trade. The close out on 9/21 was sent out as shown below.

----------------------------------------------------------------------------------------------------------------------

Market is getting hit, especially the higher beta names, and IV has popped. Let's take advantage and close out our most recent pairs trade for a decent gain in a few days.

Action To Take

- Sell to close AFRM 1/19/2024 $25 put @ $5.80 w .10 discretion

- Sell to close BOX 1/19/2024 $23 call @ $3.10 w.10 discretion

AFRM now up under 110% and BOX down just over 20%. So even though BOX fell about 2%, AFRM got clobbered by over 40%. The spread between the two narrowed, or converged, from over 170% earlier to under 90% now.

Plus, the IV on both the BOX calls and AFRM puts increased. BOX went from 8% initially to 20%. AFRM followed suit with a rise from 2% at inception to 18% at close out. This IV pop increased the price on both the calls and puts from an IV perspective.

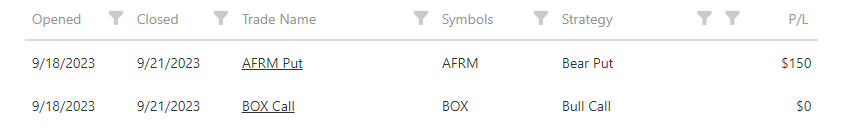

Even though BOX stock dropped slightly, we were able to scratch the BOX calls at close out due to the increased IV. We also realized a gain on the AFRM puts from both the price drop and the IV pop. Results below.

Net gain on the trade was $150 per each pairs trade. This equates to about a 20% return ($150 gain/ $750 combined cost) in just 3 days.

Using this POWR Option Pairs approach greatly dampens both the overall market and sector exposure by buying the best stocks and selling the worst using the POWR ratings.

Identifying extremes of divergences when the bad stocks are outperforming the good stocks also puts the odds in our favor.

Buying cheap options helps to get into the trade at a better price and benefits when IV pops off the lows.

This lower risk way to trade is something that will continue to create potential profit opportunities in a stock market environment that continues to consolidate in a here today/gone tomorrow manner.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

AFRM shares closed at $20.18 on Friday, down $-1.07 (-5.04%). Year-to-date, AFRM has gained 108.69%, versus a 13.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post 3 Keys To The Profitable POWR Pairs Process appeared first on StockNews.com