Over the past decade, BlackBerry Limited (BB) has transitioned significantly from a smartphone manufacturer to a cybersecurity and Internet of Things (IoT) software solutions provider. Despite making inroads within these new business segments, BB competes fiercely with established industry heavyweights such as CrowdStrike Holdings, Inc. (CRWD) and Fortinet, Inc. (FTNT).

The company reported encouraging growth in the quarter ending May 2023, with revenues exceeding analysts’ predictions by $213.71 million. Additionally, BB’s non-GAAP EPS outpaced the consensus estimate by $0.11.

Revenues came in at $373 million, reflecting a year-over-year uptick of 122%. Investors largely celebrated this surge, but it’s worth noting that patent sales mainly fueled the leap. Meanwhile, revenues from its cybersecurity and IoT businesses saw a year-over-year contraction in the same quarter.

Looking at BB’s performance over the past three years, there’s a discernible downward trend, with revenues shrinking at a CAGR of 4.8%. The increasingly competitive landscape also clouds the company’s short-term outlook. Given these factors, it might be prudent for potential investors to wait for a more suitable entry point into the stock.

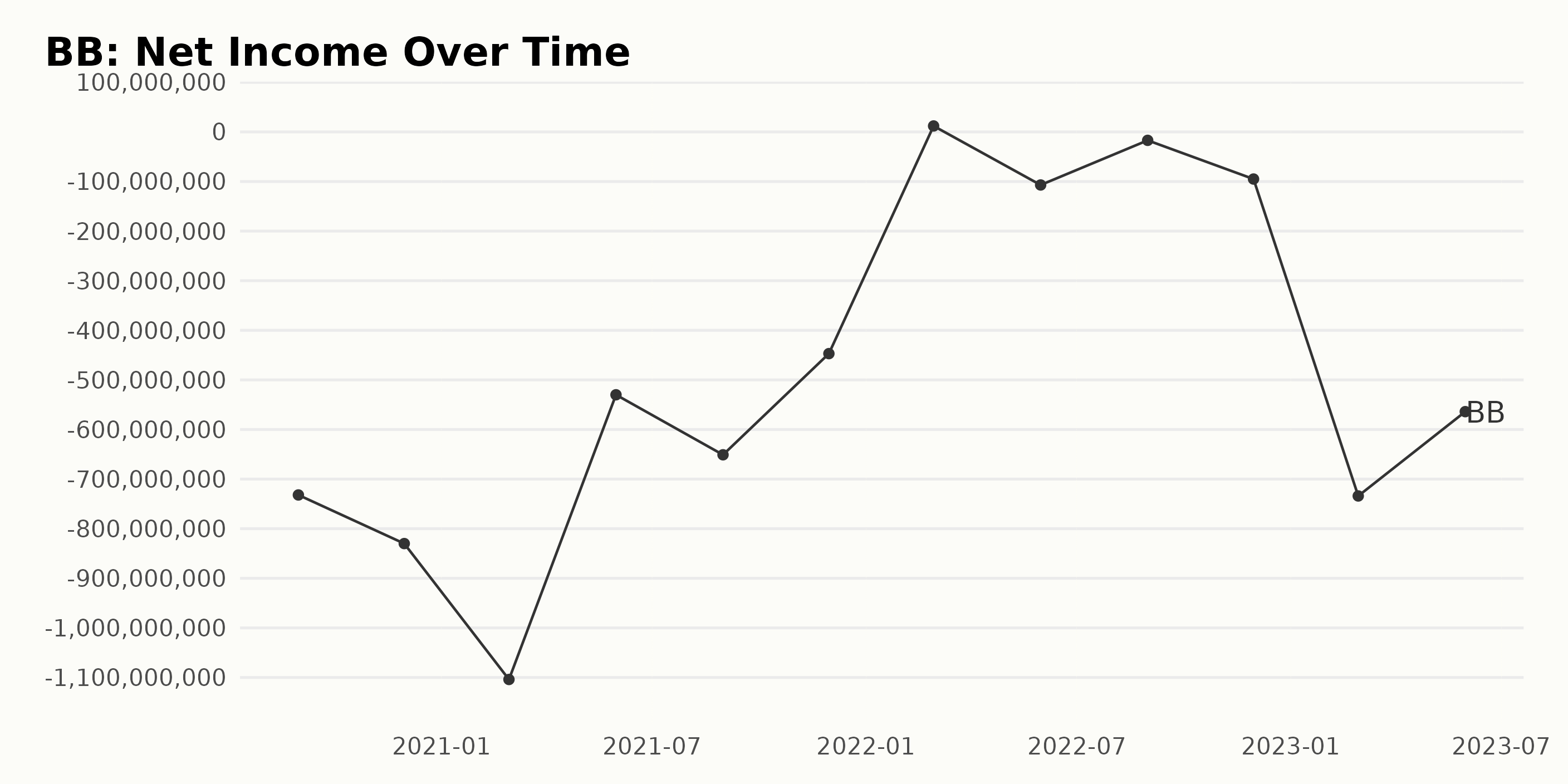

Analyzing BB’s Financial Performance from August 2020 to May 2023

The trailing-12-month net income of BB has displayed glaring fluctuations over the trajectory from August 2020 to May 2023. The data, as summarized below, indicates a significant variability in the net income:

- As of August 2020, the net income was -$732 million.

- There was a slight loss escalation to -$830 million by November 2020.

- The highest reported loss was in February 2021 at -$1.10 billion, followed by a less severe loss of -$530 million in May 2021.

- August 2021 again witnessed an increased loss at -$651 million, which then declined to -$447 million by November 2021.

- A remarkable turnaround was observed in February 2022, as BB reported a positive net income of $12 million.

- However, May 2022 indicated a fall back into losses at -$107 million, leading to a lesser loss of -$17 million by August.

- Unfortunately, November saw an escalation in losses yet again to -$95 million.

- 2023 began with a sharp loss spike for BB, with February marking a setback of -$734 million. Furthermore, the most recent data point from May 2023 reports a loss of -$564 million.

Consistently representing substantial negative values, the net income of BB presents a downward trend across the analyzed period. This negative growth from -$732 million in August 2020 to -$564 million in May 2023 highlights the financial vulnerabilities faced by BB.

The trailing-12-month revenue of BB shows an overall declining trend from August 2020 to February 2023. Here’s the pattern and fluctuations in the company’s revenue during this period:

- On August 31, 2020, the revenue was $1.01 billion.

- By November 30, 2020, there was a slight decrease to $965 million.

- BB experienced consistent revenue dips in the following months, dropping to $893 million (February 2021), then $861 million (May 2021).

- The drop continued through 2021, with August and November reporting revenues of $777 million and $743 million, respectively.

- A downward trend persisted into 2022; as of May 31, 2022, revenue fell to $712 million.

- On August 31, 2022, the revenue dipped slightly to $705 million, followed by another decline to $690 million by November 30, 2022.

- The downward trajectory continued until February 2023, when the revenue was reported as $656 million. Interestingly, the series closes with a sudden increase, as on May 31, 2023, BB saw its revenue surge back to $861 million, marking a significant deviation from the earlier trend.

Between August 2020 and February 2023, BB’s revenue dropped from $1.01 billion to $656 million, signifying a decrease of approximately 35%. However, due to the rise in revenue in May 2023 to $861 million, the total decline from the starting value is around 15%. Though it’s important to highlight the recurring declines, the rise in revenue at the end of the series is certainly noteworthy.

The gross margin of BB has shown a general trend of a gradual decrease over the last few years. Here are the key fluctuations:

- August 31, 2020: Gross margin was at 74.2%.

- November 30, 2020: There was a slight decrease to 72.8%.

- February 28, 2021: Gross margin further decreased to 72.0%.

- May 31, 2021: A minor decline was witnessed to 71.3%.

- August 31, 2021: A significant drop to 67.8% occurred.

- November 30, 2021: Gross margin decreased slightly to 66.6%.

- February 28, 2022: Gross margin decreased again marginally to 65.0%.

- May 31, 2022: The gross margin remained almost steady at 64.2%.

- August 31, 2022: Only a minor decrease occurred, with the gross margin being 64.0%.

- November 30, 2022: Unlike previous months, a minor growth to 64.2% was witnessed.

- February 28, 2023: Gross margin reduced slightly to 63.9%.

- May 31, 2023: A significant decrease was seen in the gross margin, which fell to 57.4%.

The overall growth rate from August 31, 2020, to May 31, 2023, is negative, reflecting a decrease in BB’s gross margin by approximately 16.8%. This figure has been calculated using the beginning value of 74.2% and the final value of 57.4%. Therefore, recent data suggests that BB continues to experience a reduction in its gross margin, with minor fluctuations.

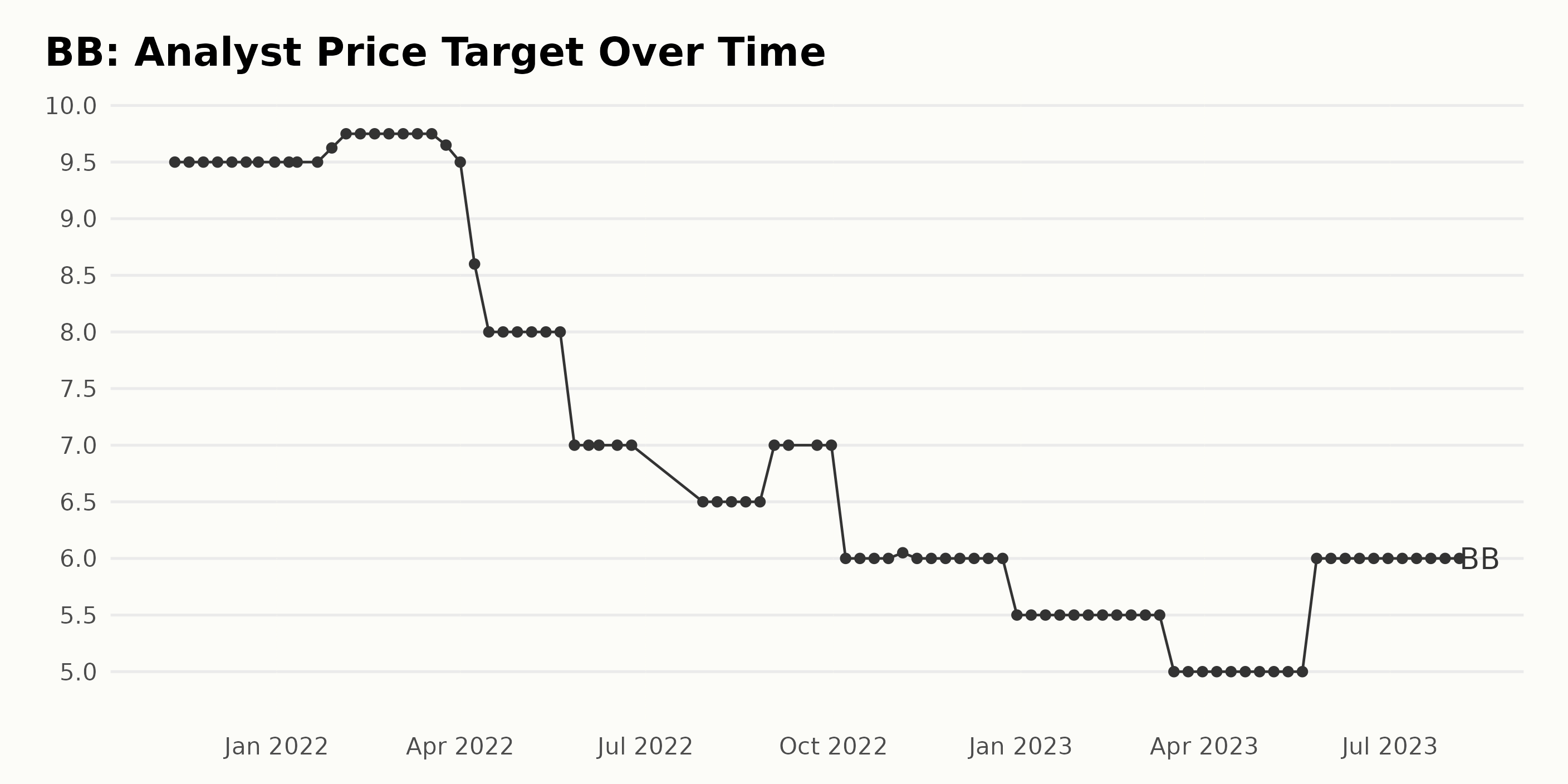

The data series provides the trend and fluctuations in the Analyst Price Target of BB from November 2021 to August 2023. The data shows a general decline in the price target over this period, with some notable trends and fluctuations:

- From November 2021 to January 2022, the analyst price target remained constant at $9.50. There was a minor increase to $9.75 in February 2022, which held steady until the end of March 2022.

- In April 2022, there was a significant drop in the analyst price target, falling from $9.50 to $8, and by the end of May 2022, it had dropped further to $7.

- A major decline occurred between June and July 2022, when the analyst price target dropped to a remarkable low of $6.5.

- The analyst price target rose slightly to $7 in September 2022 but fell again to $6 in October, steadily remaining at this level for the rest of 2022.

- In 2023, a steady decline can be seen, where the price target falls from $6 in January to $5 in March.

- However, the analyst price target modestly picked up to $6 in May 2023, maintaining this level till August 2023.

The overall growth rate in this series, calculated from the first and last value, indicates a significant price target reduction (-36.8%). Attention should be paid to the most recent data showing an upward change to $6; however, even this is significantly lower than the analyst’s price target at the beginning of this data series.

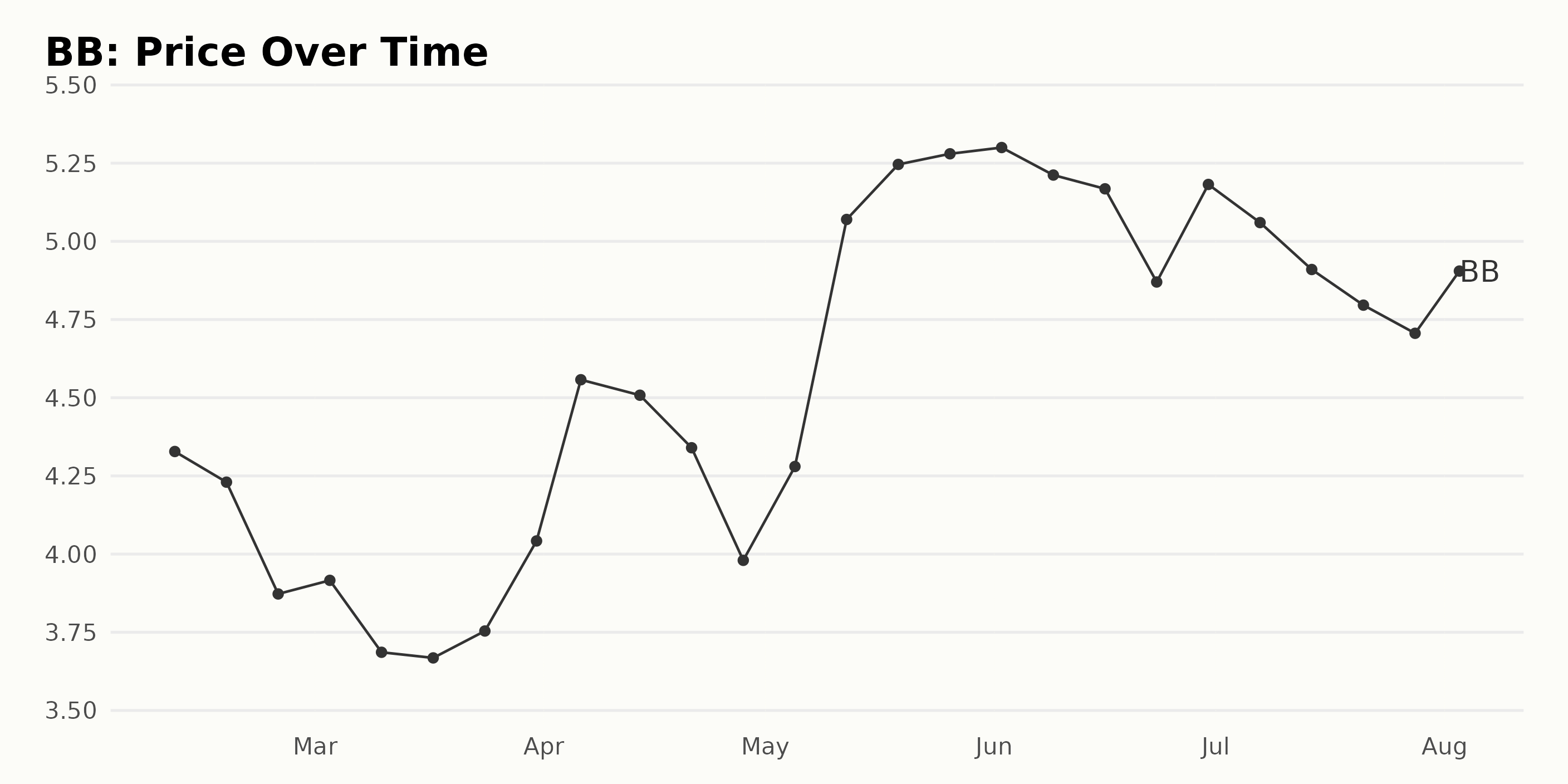

Analyzing Six-Month Price Fluctuations of BlackBerry Limited’s Shares in 2023

The data provided represent BB's weekly closing share price from February 10, 2023, to August 3, 2023. Here is a summarized analysis of the fluctuations noticed in BB’s share price:

- In February 2023, there is a gradual decrease from $4.33 (February 10, 2023) to $3.87 (February 24, 2023).

- The price marginally appreciated to $3.92 as on March 3, 2023, but again dropped to $3.67 by mid-March 2023.

- From the end of March 2023 till early April 2023, there was a noticeable rise in stock from $4.04 to peak at $4.56 (April 6, 2023).

- This increment quickly plateaued, with prices falling back to around the $4 range in late April 2023.

- May and June 2023 saw a growth spurt in BB’s share value, with prices rising from $4.28 (May 5, 2023) to $5.30 (June 2, 2023), marking the highest in the given period.

- A slight dip is observed from mid to late June, rallying back briefly to around $5.18 at the end of the month, followed by a downward trend through July, reaching $4.71 at the end of that month.

- The data ends with a slight rebounding to $4.77 by August 3, 2023.

Thus, from February to August 2023, BB’s shares witnessed a mix of decrement and growth periods with significant overall volatility. It can be concluded that the trend over these six months is fluctuating, with the stock peaking in early June, but overall it seems to depict a slight downward trend in the latter months analyzed. Here is a chart of BB’s price over the past 180 days.

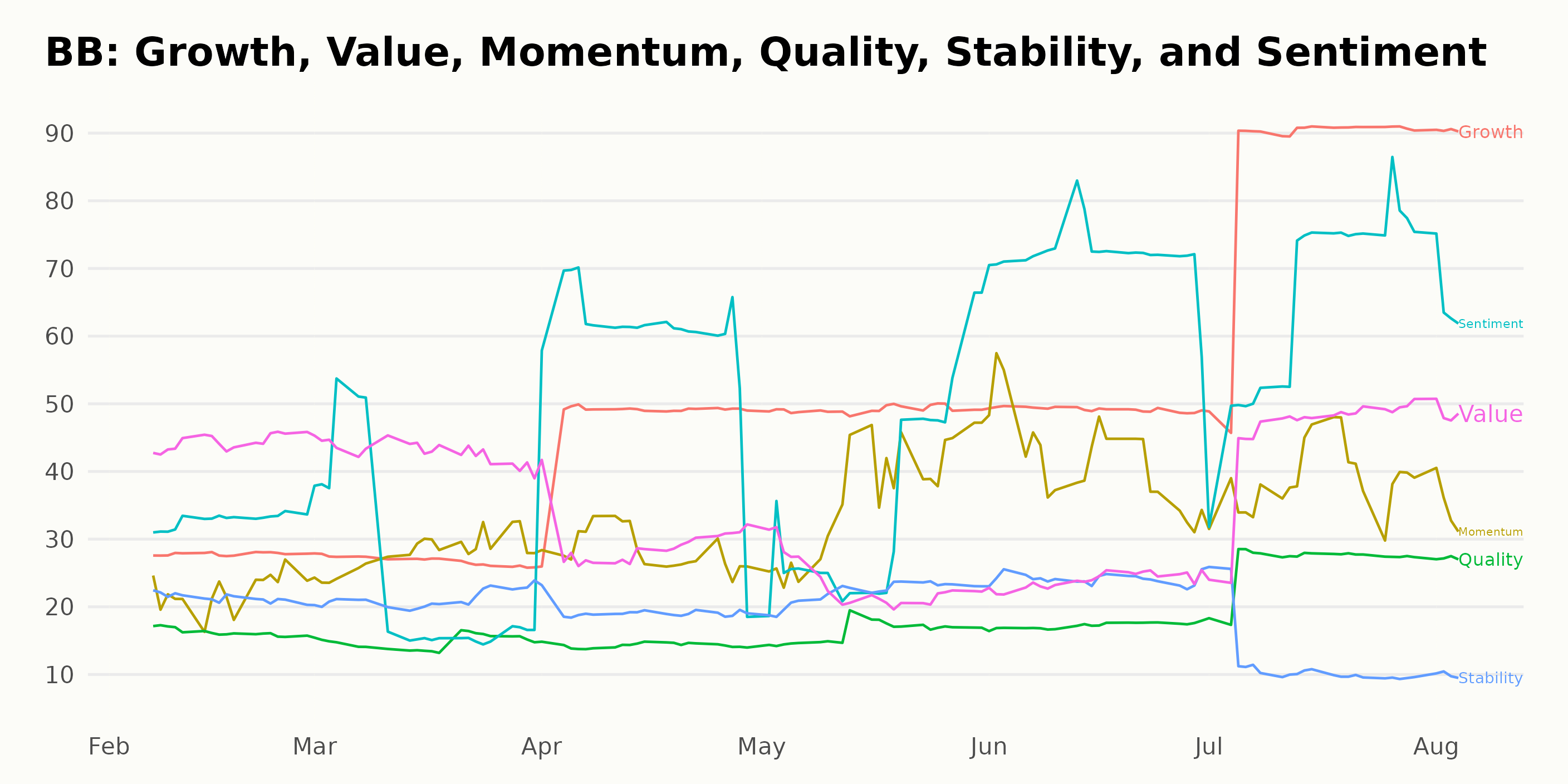

Analyzing BB’s POWR Ratings

BB has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #36 out of the 52 stocks in the Technology - Communication/Networking category. It also has a C grade for Value, Momentum, Sentiment, and Quality.

The POWR Grade of the BB stock has shown some variations over the weeks, as per the data provided. Starting from February 2023 up to the week of July 1, 2023, the POWR Grade for BB was consistently D. In terms of ranking within its category Technology - Communication/Networking, it mainly hovered around the 47 to 49 range, occasionally dipping to a slightly better position of 46. It’s worth noting that lower ranks are considered superior in this context.

There was, however, a noticeable shift in performance starting from the week of July 8, 2023. The POWR Grade upgraded to a C and maintained this grade up till the last data point provided, which is for the week of August 3, 2023. This change was also reflected in its rank within the category, which saw improvement.

How does BlackBerry Limited (BB) Stack Up Against its Peers?

Other stocks in the Technology - Communication/Networking sector that may be worth considering are Extreme Networks, Inc. (EXTR), PC-Tel Inc. (PCTI), and Cisco Systems, Inc. (CSCO) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

BB shares were trading at $4.89 per share on Friday afternoon, up $0.12 (+2.52%). Year-to-date, BB has gained 50.00%, versus a 19.09% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is August the Month to Buy or Hold BlackBerry Limited (BB)? appeared first on StockNews.com