Cruise company Royal Caribbean Cruises Ltd. (RCL) got a boost in its share price after reporting robust quarterly results thanks to high ticket prices and pent-up travel demand. The company also raised its guidance for adjusted profit from $3.00-$3.60 per share to $4.40-$4.80 per share.

However, its stretched valuation is concerning. In terms of forward EV/Sales, it is trading at 3.59x, 201.8% higher than the industry average of 1.19x, while its forward Price/Sales multiple of 2.00 is 124.4% higher than the industry average of 0.89. In terms of its forward Price/Book, it is trading at 6.49x, 150% higher than the 2.60x industry average.

Let’s look at the trends of some of its key financial metrics to understand why it could be wise to wait for a better entry point in the stock.

Deciphering Royal Caribbean Cruises' Financial Trends from 2020 to 2023

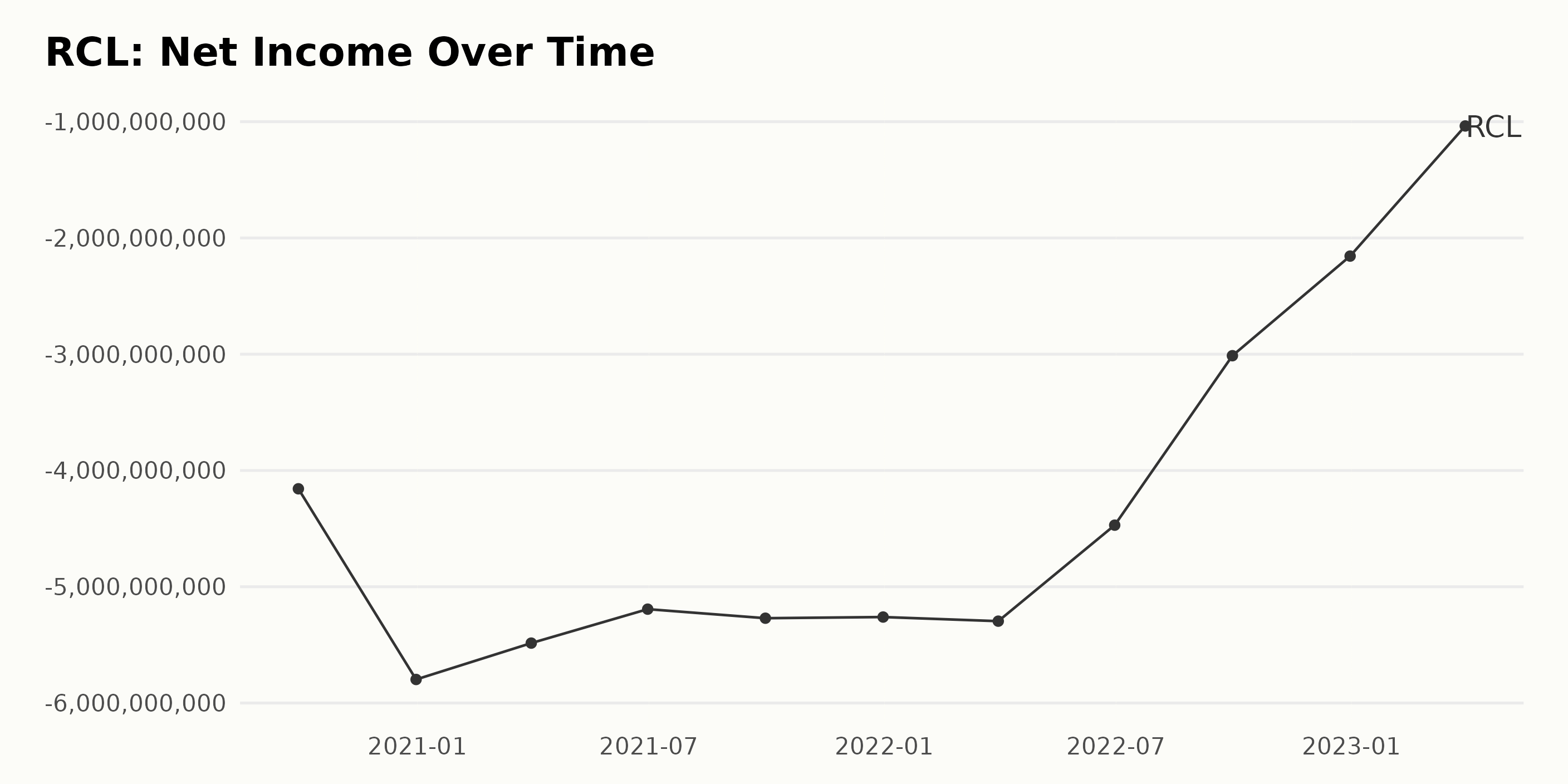

An examination of the trailing-12-month net income of RCL over the time period from September 2020 to March 2023 reveals a substantial and consistent decrease, despite experiencing minor intermittent fluctuation.

- The net income plunged dramatically from -$4.16 billion in September 2020 to -$5.80 billion in December 2020.

- It continued to reduce, albeit at a slower pace, amounting to -$5.28 billion in December 2021.

- An increase in net loss was recorded as $5.30 billion in March 2022 before witnessing considerably smaller losses compared to previous periods over the middle and late 2022. This was shown as $4.47 billion in June 2022 and mitigated to $3.01 billion and $2.16 billion by September and December, respectively.

- Most notably, the data shows a marked improvement in recent months, with a significant reduction in net loss to $1.04 billion by March 2023. Comparatively, the net income at the end of the first reported quarter (September 2020), i.e., -$4.16 billion to the final reported quarter (March 2023), i.e., -$1.04 billion, implies that RCL has seen some recovery in its financial position.

However, it should be noted that it continues to report losses despite improvements in the recent quarters measured.

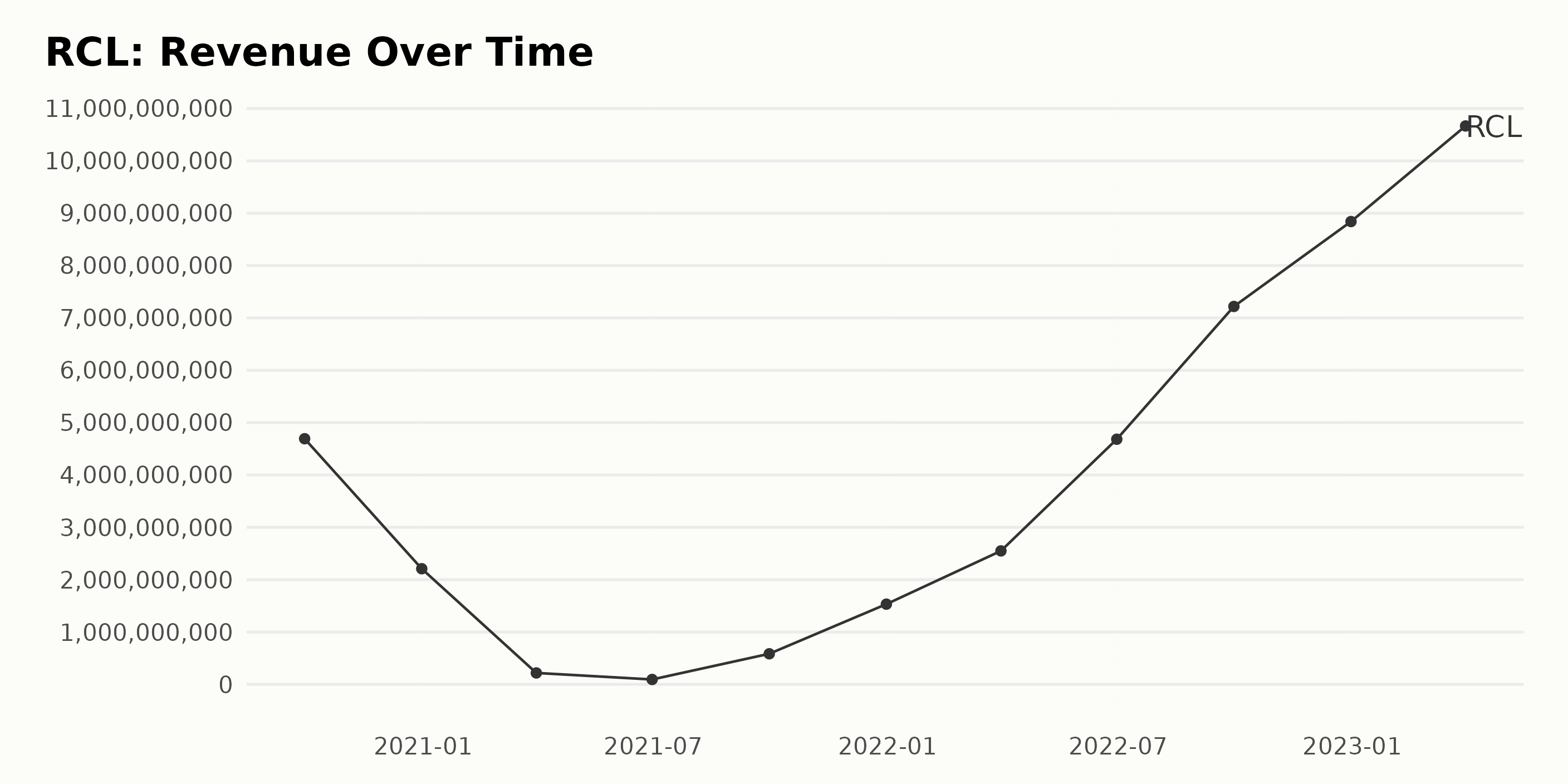

The trend and fluctuations of the recorded trailing-12-month revenue of RCL can be explicitly outlined as follows:

Between September 2020 and September 2023, the company's revenue reached several peaks and troughs.

On September 30, 2020, RCL reported revenue of $4.69 billion. This, however, showed a significant decrease by the end of December 2020 to $2.21 billion.

A steep dip in revenue was observed on March 31, 2021, at $218.07 million, which was followed by a further decline to $93.38 million by June 2021.

Recovery began to manifest by the end of September 2021 when RCL reported revenue amounting to $584.02 million, which was further bolstered to hit $1.53 billion by the end of December 2021.

The company started 2022 on a higher note, with the revenue for the first quarter ending on March 31 being $2.55 billion, which increased significantly to $4.68 billion by the end of June of the same year.

The trend continued upward, with revenues clocking $7.22 billion and $8.84 billion for the quarters ended September and December, respectively.

As of March 31, 2023, RCL reported its highest figure in the series, with revenue amounting to $10.67 billion. Summarizing the data,

- From $4.69 billion (September 30, 2020) to a low point of $93.38 million (June 30, 2021)

- Then steadily climbing back up to its peak of $10.67 billion (March 31, 2023)

Calculating the growth rate from the first value to the last gives us an impressive approximate increase of 127%. This ultimately demonstrates a recovering and growing trend after overcoming a period of significant revenue declines.

The upward trajectory in recent years reveals a positive trend, with the emphasis on the last value of $10.67 billion, underscores a potentially strong future performance.

The data pertaining to the current ratio of RCL exhibits a general downward trend from September 2020 to March 2023, with periodic fluctuations. Here are some key points based on the data:

- The current ratio began at 0.76 in September 2020, reaching a notable peak of 1.70 by March 2021, showing substantial improvement.

- By the end of 2021, there was a significant dip to 0.49 in December.

- The continuous decline is observed in subsequent quarters of 2022, with the lowest point of 0.29 in September 2022.

- The trend shows a mild improvement by the end of 2022, with a value of 0.37 in December.

- However, the current ratio drops again and reaches the lowest point of the series at 0.25 by March 2023.

Observing the initial and final values reveals an overall decrease in the current ratio from 0.76 to 0.25. This indicates that RCL’s liquidity position has deteriorated over the observed period. The growth rate measured as the percentage change from the first to the last value in the series is about -66%, suggesting a strong downward trend.

The fluctuation within this declining trend reflects the dynamic nature of the company's financial health and liquidity risk amidst possible market factors. It is important to note that the data appears to place greater emphasis on more recent trends, particularly the drop leading up to March 2023.

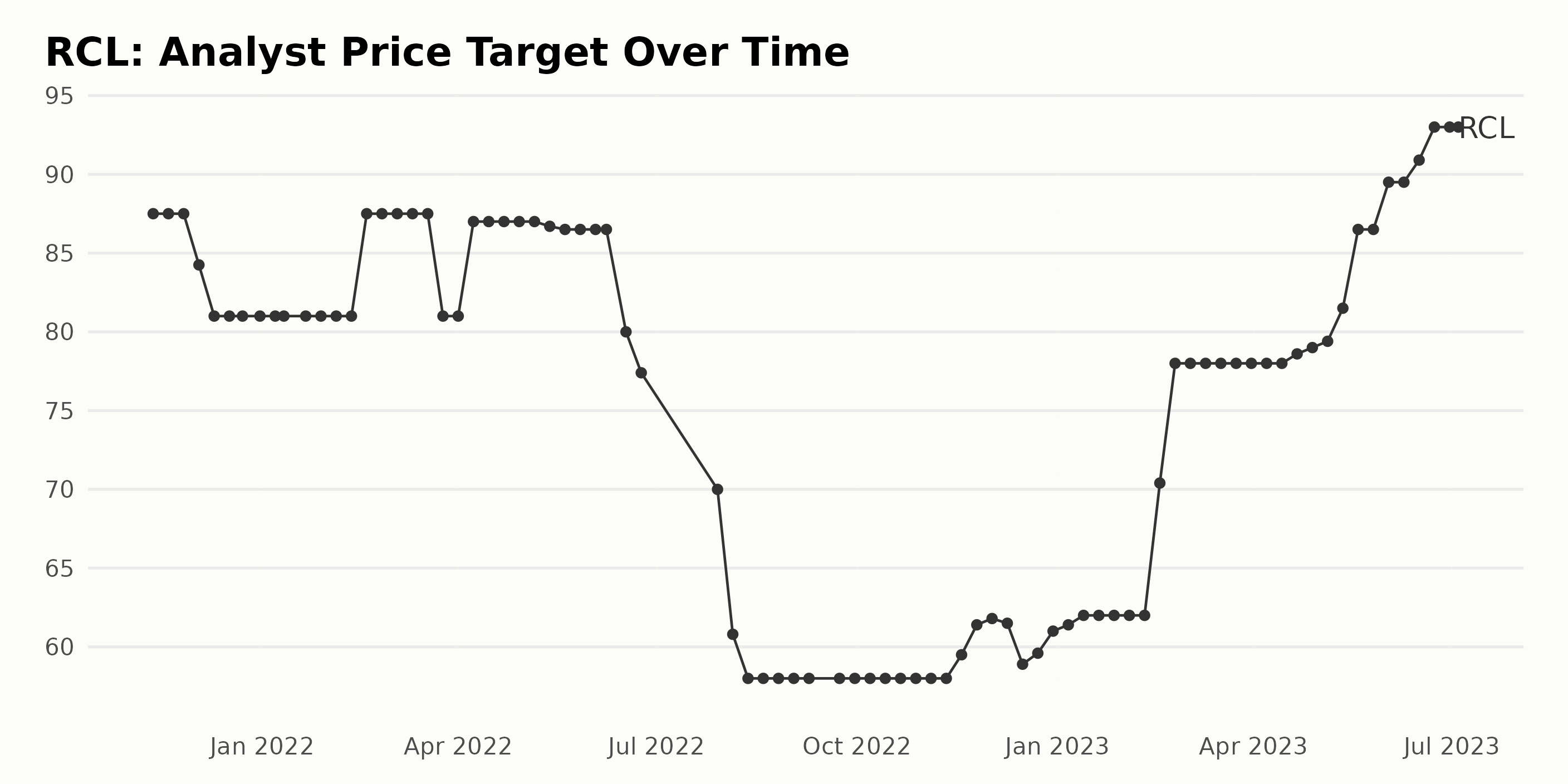

RCL’s analyst price target showed a dynamic trend with several fluctuations over the data series provided from November 2021 to July 2023. Here are some noteworthy trends and events in the provided dataset:

Beginning at $87.5 in November 2021, the price target exhibited a steady decline, reaching $81 by December 2021, where it remained constant until mid-February 2022.

Subsequently, the price target rose back to $87.5 in February and fluctuated near that level until mid-June, when it decreased sharply to around $60 by August 2022.

The analyst price target experienced its lowest point in August 2022 at $58, then slowly increased back to $62 by January 2023.

Interestingly, there was a significant increase in the half of February 2023, boosting the price target from $62 to $70.4 within a week. This upward surge didn't stop there, and by the end of February 2023, the price target had risen to $78.

From March 2023 to mid-April 2023, the analyst price target remained stable at $78. After that, it incrementally increased, reaching $79.4 in early May 2023.

A sharper rise was observed in late May 2023, pushing the price target to $86.5.

By the end of the provided dataset in early July 2023, the price target reached its highest value at $93, indicating an overall increase from the start of the dataset.

Regarding the growth rate, measuring from the first provided value of $87.5 in November 2021 to the last provided value of $93 in July 2023, the analyst price target for RCL experienced a growth rate of approximately 6.3%.

Royal Caribbean Cruises Ltd. Stock Price: A Six-Month Journey of Growth and Fluctuations

The data reflects the share price trend of RCL from January 2023 to July 2023.

On January 6, 2023, the price was $53.71. Over the course of the month, the share price saw a gradual increase, reaching $63.63 by January 27, 2023.

In February 2023, the share price saw a more noticeable incline, starting at $66.35 and peaking at $74.21 by mid-month on February 17, 2023. However, by the end of February 2023, the price slightly decreased to $71.32.

Shortly, in March 2023, the share price saw a slight increase before reaching a monthly high of $71.736 but ended up decreasing to $61.92 by March 24, 2023. By the end of the month, the price had increased slightly to $63.314.

April 2023 showed minor fluctuations in the share price once again, showing a decline to $61.784 by the end of the month.

From May 2023, the share price demonstrated a clear escalating trend. It started from $69.946 and rapidly increased throughout the month, ending at $78.776 by May 26, 2023.

This escalating trend continued into June 2023, with the share price initially at $82.2025, and attaining a remarkable increase reaching $101.318 by June 30, 2023.

The data ended on July 3, 2023, when the share price stood steady at $103.20.

Overall, there is a clear accelerating growth trend in the stock price of RCL during this period, despite some fluctuations in the earlier months. Here is a chart of RCL's price over the past 180 days.

Examining Royal Caribbean's Performance: Growth, Momentum, and Sentiment Insights

The POWR Ratings grade for RCL, a company in the Travel - Cruises category of stocks, fluctuated from January 2023 to July 2023.

The company starts 2023 with a grade of D (Sell), which continues till mid-May. During this period, its rank within the four total stocks in the category remained mostly the third, showing an improvement to second place between February 11 and April 14.

In the week of April 15, RCL reached the best position within its category, being ranked as number one, but it fell back to second place in the following week. In the week of May 6, 2023, there was a noticeable change: RCL's POWR grade improved to C (Neutral). Along with this upgrade, RCL experienced a leap into first place again during the week of May 13, 2023.

However, the superior rank is brief and drops back to the second position again on May 20, 2023. The company maintains this POWR grade and category rank status until the last data point on July 1, 2023.

To conclude, based on the latest data, as of the week of July 4, 2023, RCL has an overall rating of C (Neutral) and stands at the #2 rank within the Travel - Cruises category of stocks.

Based on the POWR Ratings provided, the three most noteworthy dimensions for RCL are Growth, Momentum, and Sentiment.

The Growth dimension consistently held the highest rating across all dates, indicating a strong growth trajectory for RCL. The Growth rating began at 78 in January 2023, progressed to 82 and 83 in March and April of the same year, respectively, and ultimately reached its peak at 94 in June 2023 before slightly declining to 93 in July 2023.

The Momentum dimension also displayed a consistent upward trend. Starting from 58 in January 2023, it had grown to 90 by July 2023. This steady increase suggests a positive forward momentum for RCL during this time frame.

While not as high as Growth or Momentum, the Sentiment dimension showed a clear upward trend similar to Momentum. It started from 25 in January 2023 and rose to 67 by July 2023. This indicates improving market sentiment towards RCL during these six months. Here are the important highlights:

- In the Growth rating, there was a sharp increase from 78 in January 2023 to a peak of 94 in June 2023.

- The Momentum rating consistently rose from 58 in January 2023 to 90 in July 2023, indicating strong forward momentum.

- The Sentiment rating showed a significant upward trend, rising from 25 in January 2023 to 67 in July 2023, reflecting improving market sentiment.

How does Royal Caribbean Cruises Ltd. (RCL) Stack Up Against its Peers?

Other stocks in the travel sector that may be worth considering are Bluegreen Vacations Holding Corporation (BVH), Genting Berhad (GEBHY), and Marriott International, Inc. (MAR) -- they have better POWR Ratings.

Is the Bear Market Over?

43 year investment veteran Steve Reitmeister shares his updated stock market outlook & top picks for the rest of 2023. Spoiler Alert: Steve still believes bear case most likely.

Get Stock Market Outlook & Top Picks >

RCL shares were trading at $103.20 per share on Tuesday morning, down $0.54 (-0.52%). Year-to-date, RCL has gained 108.78%, versus a 16.92% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Does Royal Caribbean Cruises (RCL) Still Have Some Growth Ahead? appeared first on StockNews.com