$2,693,308!

$2,693,308!

That is down $315,599 (10.5%) in our paired Long-Term and Short-Term Portfolios since our April 14th review. That is EXACTLY where we want to be as the purpose of the STP hedges (see Tuesday's review) is to MITIGATE the damages on the way down – not completely eradicate them. If you try not to have any losses at all you end up trading yourself into a neutral corner and – if you are doing that – why not just be in CASH!!!?

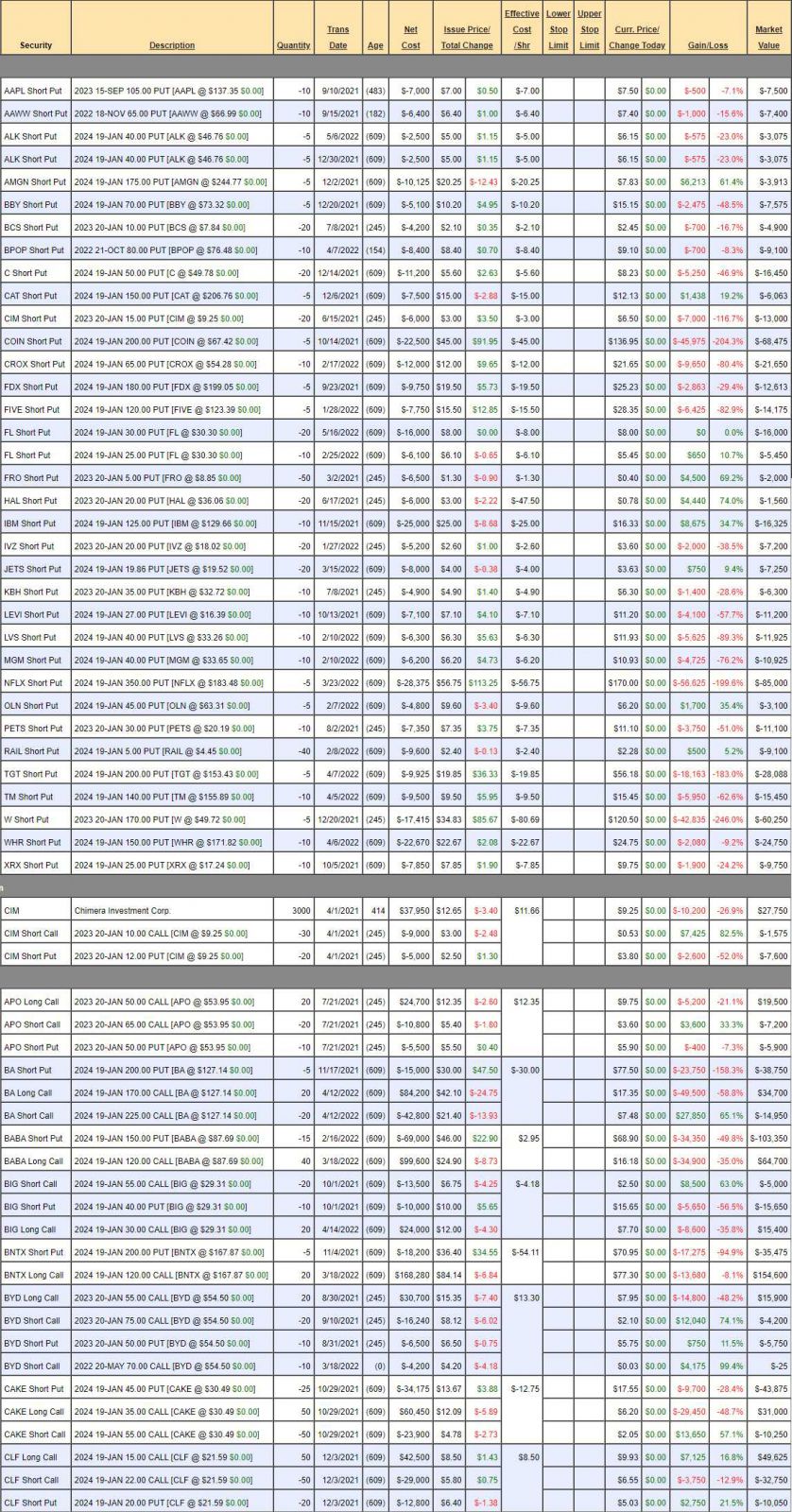

And we are mainly in CASH!!! with $1,770,488 of it in the LTP and $1,182,271 in the STP – there's actually more cash than equity in both. Because we sell a lot of puts, having low equity doesn't take out our risk of loss in a downturn but the cash helps us make adjustments – which is what we'll be concentrating on today.

Losing 10% in a 20% down market indicates we are properly hedged and ready to take advantage of the dip. We don't need our sideline money for more hedges and our positions are fundamentally sound – dropping less overall than the broad market. Now we have to do the real work of going over them, one by one, and seeing who needs help and who needs to go – although we've purged this portfolio so many times it's full of nothing but strong, strong stock choices.

Short Puts – We are happy to own C, CIM, CROX, KBH, LEVI, LVS, MGM or TM if they go lower. W we don't like but it's a leftover from a short. The only put side adjustment is going to be:

- COIN – We're obligated to own 500 shares at $200 ($100,000) less the $22,500 we sold them for so $77,500 committed here and it costs us $68,475 to close it out. We can instead sell 15 of the 2024 $100 puts for $52 and that's $78,000 so the roll costs nothing and we still have $22,500 in our pockets so the net is $85 if we are assigned ($127,500). So we're increasing our obligation by 50% but we'll have 200% more shares for our money if assigned.

IN PROGRESS