Autonomous vehicle (AV) technology company Cyngn Inc. (CYN) in Menlo Park, Calif., develops autonomous driving software that can be deployed on multiple vehicle types in various environments. The company is focused on developing an enterprise autonomy suite (EAS) that controls in-vehicle autonomous driving technology and incorporates supporting technologies. The stock began trading on Nasdaq Capital Market under the symbol “CYN” on October 20, 2021.

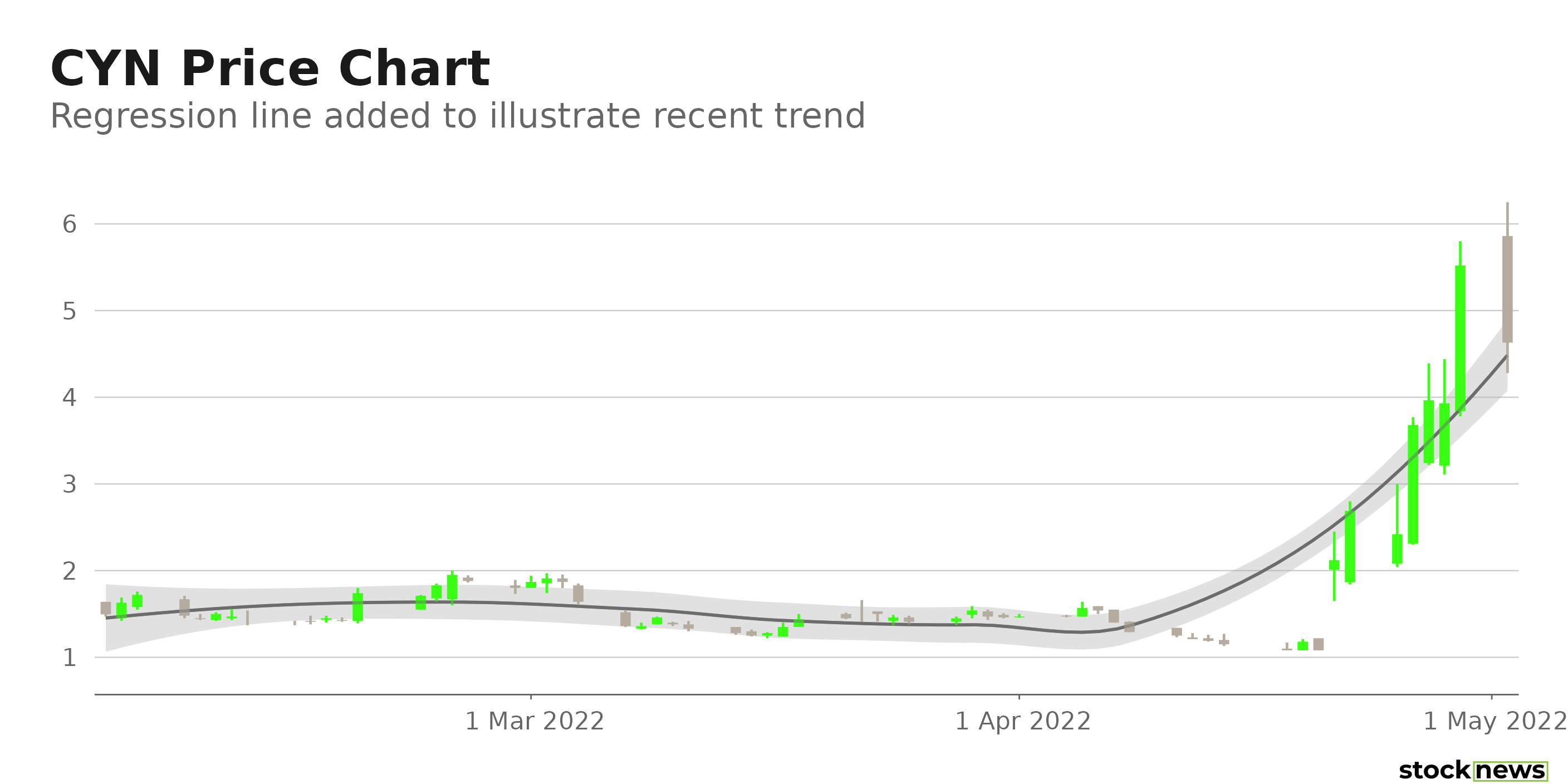

CYN shares have slumped 37.3% over the past six months. However, the stock has been surging in price lately after the company revealed a new product. CYN announced the official launch of DriveMod Kit, a turnkey autonomous vehicle solution, last month, for which the company filed a patent last February. According to CYN, the Kit’s inaugural manufacturing run began rolling off the assembly early last month. The new product features human-machine interfaces and a lighting system that communicates vehicle status, mode, battery status, route obstruction, and more, in addition to the self-driving vehicle technology. “DriveMod Kit is a complete AV integration solution, a game-changer that eliminates traditional barriers to autonomous vehicle adoption,” said Lior Tal, Cyngn’s CEO.

The autonomous driving software solutions developer’s shares are up 209.7% in price over the past three months and 215% for the past month, closing yesterday’s trading session at $4.63.

Here is what could shape CYN’s performance in the near term:

Stretched Valuation

In terms of forward EV/Sales, CYN is currently trading at 148.54x, which is 4,923.3% higher than the 2.96x industry average. Also, its 170.48 forward Price/Sales ratio which is 5,497% higher than the 3.05 industry average, while its 3.05 forward Price/Book of 6.57x is 57.8% higher than the industry average of 4.16x.

Zero-Revenue Company

CYN did not record any revenue over the last year. The company’s loss from operations increased 12.3% year-over-year to $9.40 million for its fiscal year ended December 2021. Its net loss and net loss per share came in at $7.80 million and $1.33, respectively, compared to their year-ago values of $8.34 million and $8.76. AIts net loss per share was based on approximately 5.9 million weighted average shares for the year ended Dec. 31, 2021, compared to approximately 1.0 million weighted average shares in the prior year. In addition, its net cash used in operating activities increased 9.1% year-over-year to $8.64 million. And its trailing-12-month levered free cash flow stood at a negative $4.82 million.

Furthermore, CYN’s ROE, ROA, and ROTC of negative 56.02%, 34.43%, and 41.17%, respectively, compare with the 7.39%, 3.40%, and 4.76% industry averages.

Unfavorable POWR Ratings

CYN has an overall D rating, which translates to Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a C grade for Momentum. This is justified because the stock is currently trading above its 50-day moving average.

Among the 159 stocks in the F-rated Software – Application industry, CYN is ranked #100.

Beyond what I have stated above, you can also view CYN’s grades for Sentiment, Growth, Stability, Value, and Quality here.

View the top-rated stocks in the Software – Application industry here.

Click here to check out our Software Industry Report for 2022

Bottom Line

The company’s new product launch triggered investors’ optimism, helping the stock skyrocket in price. However, CYN is still an early-stage company that is still developing its business and as yet boasts no revenues. And based on its fundamentals, the stock looks overvalued at its current price level. Thus, we think it could be wise to wait for the company to make further progress in productizing and commercializing its solutions before investing in the stock.

How Does Cyngn Inc. (CYN) Stack Up Against its Peers?

While CYN has an overall POWR Rating of D, one might want to consider investing in the following Software – Application stocks with an A (Strong Buy) rating: Commvault Systems, Inc. (CVLT), Rimini Street Inc. (RMNI), and Progress Software Corporation (PRGS).

Want More Great Investing Ideas?

CYN shares fell $0.27 (-5.83%) in premarket trading Tuesday. Year-to-date, CYN has gained 2.89%, versus a -12.46% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Cyngn: Is the Stock Still a Buy After its Recent Surge? appeared first on StockNews.com