Contributed by Rogér Baylon, Clean Energy Associates

Despite last year’s reinstatement of US tariffs on bifacial modules, solar developers are often considering bifacial modules for their utility-scale solar projects. But the promise of bifacials’ higher energy yield of 6% to 10% – or more – compared to traditional monofacial PERC technology comes at a higher dollar-per-watt module cost, as well as increased expenses for balance of system (BOS) and installation.

To truly understand whether selecting a bifacial module will bring more revenue over time, clients often ask CEA to make an apples-to-apples, levelized cost of energy (LCOE) comparison that takes into account project design, location, insolation, BOS, trackers, and many other factors.

CEA’s approach to calculating the LCOE of different kinds of technologies and pricing is designed to account for a range of variables affecting system performance while providing a clear picture of the increased module value of bifacial systems. This same LCOE methodology can be used for comparing bifacial modules not only to mono PERC but also to the new crop of larger-format modules. However, this case study will focus on comparing bifacials to mono PERC modules.

Consider Which PV Technology is Best for You

Consider Which PV Technology is Best for YouBefore calculating LCOE, the first step is to identify two to three solar module products that have already been assessed for quality, reliability, and bankability. This can be done by identifying some of the most widely used panels with a proven record of production in existing projects.

Second, consider the goal. For example, some clients may be making a large purchase of bifacial panels for different locations. On an LCOE basis, bifacials may be perfect for Massachusetts, where the reflexivity of white snow cover will take advantage of bifacials’ back side and generate more kilowatt-hours (kWh). However, bifacials may not be cost-effective for a similarly sized project in Hawaii, where the state’s greener ground cover may yield less energy and not justify the bifacials’ higher upfront cost.

Another client may be exploring whether purchasing a lower-cost tracker paired with bifacial panels will have a lower upfront cost and higher LCOE. Similarly, a higher-priced tracker with sophisticated, yield-boosting technology may provide more revenue with or without bifacials over 25 years.

With CEA’s LCOE and module value comparison methodology and system modeling, these financial puzzles can be answered, helping developers to make the most informed purchasing decisions.

Calculating the LCOE Value of Bifacial ModulesCapturing bifacial’s value and its impact on a project’s bottom line over a 25 to 30-year life cycle begins with the basic LCOE formula:

To create a baseline for the apples-to-apples module evaluation, CEA uses Pvsyst to model optimized layouts for the modules and locations being analyzed. We then price all equipment, labor, design, and engineering, permitting, overhead and margin, and other costs–except the module.

The formula also inputs the estimated annual kWh generated, the power purchase agreement (PPA) price, the investment tax credit, and operations and maintenance (O&M) cost. Variables include the longer life cycles of bifacials – 25 to 30 years – and their higher BOS and installation costs, while degradation and O&M are set at about 0.5% per year.

To compare different panels, the first step is to set a benchmark or “hurdle price” — the price below which a bifacial panel will provide additional value, based on the LCOE of a sample monofacial system.

The hurdle price is then used to back-calculate the price-per-watt module value for one or more bifacial panels, incorporating the specific performance that results from backside output. System parameters, such as site insolation and PPA price, are held constant, although changing them will generally not affect module value.

All LCOE calculations and comparisons are based on projects with a BOS using a uniform set of top-tier, high-quality components. However, as noted, if a client’s goal is to compare trackers or inverters, for example, the model can also evaluate the impact on LCOE.

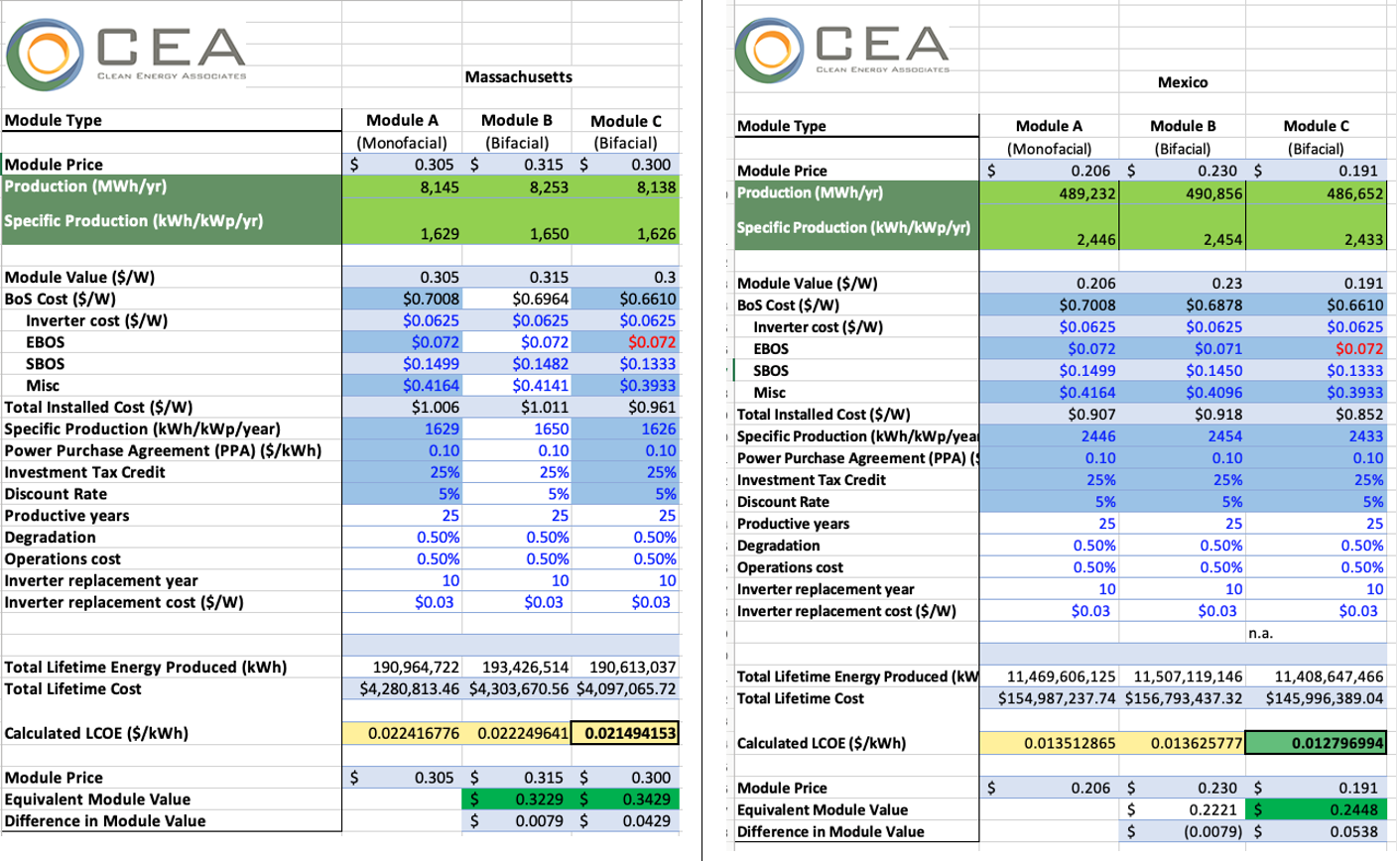

The charts below show the results of a hypothetical comparison between monofacial Module A, and two bifacials, Module B and Module C, calculated for projects in Massachusetts and Mexico. In this example, the goal is to see if purchasing a large supply of one of the selected bifacial panels will make financial sense for the two locations.

Note that even with the very large differences in production and base LCOE related to location, Bifacial Module C delivers higher and comparable module value, in both cases within a cent of each other.

LCOE of Monofacial vs Bifacial Modules vs New Technologies

LCOE of Monofacial vs Bifacial Modules vs New TechnologiesWhile the popularity of bifacial panels is relatively new, the technology is not. The difference between monofacial PERC modules and bifacial modules is based more on materials and structure — white back sheet versus glass — than technology, and the industry is becoming increasingly comfortable with bifacials’ long-term performance. Moreover, CEA’s LCOE evaluations used to compare multiple monofacials and one bifacial module, but the situation has since been reversed.

The move toward larger cell formats and larger monofacial panels presents another opportunity to compare the LCOE of bifacial panels to the new formats and cell technologies. For example, larger modules require wider row spacing, which in turn could mean longer wire lengths and a resulting voltage drop. An LCOE module comparison can reveal the positive or negative value of these tradeoffs.

Another key point is that as bifacial module prices continue to come down, the bifacial boost in production needed to offset higher upfront costs will also come down. While bifacials’ increased production is generally estimated at 6% to 10% per year, a much lower percentage could be needed to cover the upfront costs. The exact number will depend on a project’s location and other factors.

It should also be noted that fluctuations in module pricing are occurring due to constraints in the supply of glass. As of this writing, such supply shortages are elevating module pricing for all technologies, but especially for bifacial modules, which have an extra layer of glass on the backside.

As system modeling and data on bifacial performance improve, the timing of these kinds of panel evaluations should also shift. By integrating LCOE and module value comparisons into supply chain management, developers and asset owners can streamline design and procurement, further reducing the time and cost of project development.

About the author:

Rogér Balyon, Senior Manager, Engineering Services, Clean Energy Associates

Based in the Portland Oregon area, Mr. Balyon joined CEA as a project engineer / project manager. He has over 14 years of extensive Solar PV experience including Solar PV system project management, financial modeling, system design and optimization, performance modeling, sales, and as a balance of system engineer. Mr. Balyon is responsible for project management and technical support to Solar PV projects as well as performing technical due diligence of system design, testing and commissioning procedures, quality assurance, and quality control.