| |||||||||

|  |  |  |  | |||||

November 7, 2023 – TheNewsWire – Global Stocks News – On November 2, 2023 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) announced that it has closed a deal where Hecla Canada invested $10 million in DV Silver, raising its stake in DV Silver from 10.6% to 15.7%.

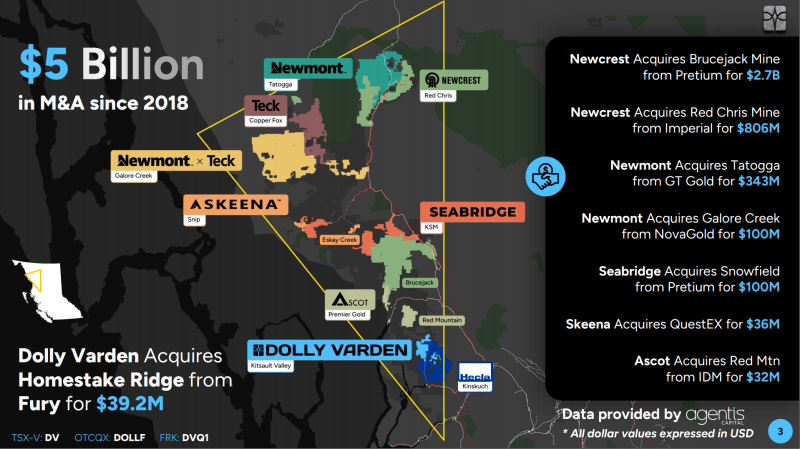

DV Silver is developing its 100% held Kitsault Valley Project located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water.

The Golden Triangle hosts one of the world’s largest concentrations of minerals,” confirms The Deep Dive with “1.2 billion ounces silver estimated reserves, with 214 million proven and probable.”

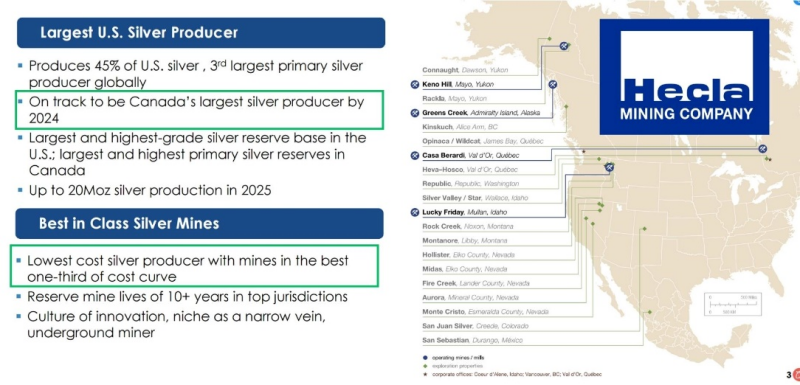

Hecla Mining, the parent company of Hecla Canada was founded in 1891. It has a market cap of USD $2.59 billion and trades on the New York Stock Exchange (NYSE). It has produced 11.4 million ounces of silver this year so far.

Hecla operates mines in Alaska, Idaho, and Quebec, Canada. Hecla is also developing a mine in the Yukon, Canada, and owns “a number of exploration and pre-development projects in world-class silver and gold mining districts throughout North America”.

Hecla’s Silver All In Sustaining Silver Costs (AISC) are $11.30/ounce, lower than peers Silvercrest, Coeur, Fortuna, Fresnillo, Pan American Silver, First Majestic Silver and Endeavour Silver. [1]

Hecla has a disciplined business model: it operates in low political risk jurisdictions that do not depend on high silver prices to generate profit. It is expanding aggressively into Canada.

The Hecla and Dolly Varden Silver relationship goes back about a decade. Seven years ago, Hecla tried to take over DV Silver for .69 per share. There was a fierce court battle which was eventually resolved in Dolly Varden’s favour. The take-over offer was rejected.

“In a battle likened to David defeating Goliath, two provincial regulators have confirmed a junior mining exploration company [DV Silver] in British Columbia can proceed with a $6 million private placement offering, despite a hostile takeover bid by a bigger American silver mining company [Hecla],” reported Canadian Lawyer Magazine.

“There's was a contentious relationship between Hecla and the four management teams that ran DV Silver before I took over,” Shawn Khunkhun, CEO of DV Silver told Guy Bennett, CEO of Global Stocks News. “I have tried to usher in a new era of communication and respect.”

“For DV Silver to be successful,” continued Khunkhun. “The Indigenous people and the community have to win. Retail and institutional investors have to win. And Hecla has to win. There’s enough meat on the bone for all stakeholders.”

With Hecla’s increased stake in DV Silver, there is a speculation that Dolly Varden will again be Hecla’s buyout target. “Hecla basically put down a down payment today,” stated one shareholder on an investor bullboard, echoing the general sentiment.

Hecla owns 156 mining claims totaling 59,400 hectares next door to DV’s property. So it already has a demonstrated interest BC’s Golden Triangle.

Hecla’s strategy of targeting assets in low-risk jurisdictions may be pushing DV Silver higher on their radar.

The world’s biggest silver producer, Mexico is becoming an increasingly challenging environment for resource companies.

“Concerns about political meddling by Mexico’s President Lopez Obrador’s government have caused activity in the mining sector to stall,” reports Forbes Magazine.

“Mexico’s president is strangling exploration,” stated Douglas Coleman, CEO of the Mexican Mining Center. “We’ll feel the effects of that for years to come. The actual investment going into Mexico is about half of what it was ten years ago.”

“The political environment in Mexico along with the narcotics trade are creating challenges for precious metal companies operating there,” confirmed Khunkhun. “There is also labour unrest”. A labour dispute at Newmont’s Penasquito mine in Mexico cost Newmont about $3.7 million day.

Dolly Varden has agreed with Hecla that it will not complete any further debt or equity financings for the remainder of 2023.

“Additionally, Dolly Varden has agreed that between January 1, 2024 and September 1, 2024, without the prior consent of Hecla, it will not complete any debt or equity financings other than equity financings for net proceeds to the Company of up to $15 million and provided that the issue price under such financing is greater than $0.65 per security,” stated DV Silver.

The current resource expansion drilling at the Kitsol Vein has intersected high grade silver mineralization over wide intervals, that is potentially amenable to bulk underground mining methods.

The Kitsault Valley asset is a volcanogenic, strata-bound system with 1,000-gram veins. The system is also disseminated with 200 gram/tonne silver. Bulk mining would enable DV Silver to boost the average grade and the tonnage per day, improving mine economics.

“Hecla is the world’s fastest growing established silver producer, the largest in the US and soon to be in Canada,” stated Shawn Khunkhun, CEO of Dolly Varden Silver.

“$6 million of the net proceeds from the Offering will be used for exploration expenditures, mineral resource expansion and related costs in the Kitsault Valley project, located in northwestern British Columbia, Canada, with the balanced to be used for working capital and G&A costs,” stated DV Silver.

“We celebrate Hecla agreeing to increase their stake in Dolly from 10% to 15% and want to extend our gratitude for their financial and technical support,” added Khunkhun.

“We will have more drill results from the Wolf Deposit to report soon,” Khunkhun told GSN. “After the latest batch released November 6, 2023 - there’s still another 70 holes to report. With Hecla’s strategic $10 million investment – we are well funded to continue exploring, drilling and building our silver inventory.”

References:

1. Hecla October 2023 corporate update: https://s29.q4cdn.com/244919359/files/doc_presentations/2023/Oct/09/october-ir-update_final.pdf

Contact: guy.bennett@globalstocksnews.com

Copyright (c) 2023 TheNewswire - All rights reserved.