Health insurance company UnitedHealth (NYSE:UNH) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 6.8% year on year to $100.8 billion. Its non-GAAP profit of $6.81 per share was 1.1% above analysts’ consensus estimates.

Is now the time to buy UnitedHealth? Find out by accessing our full research report, it’s free.

UnitedHealth (UNH) Q4 CY2024 Highlights:

- Revenue: $100.8 billion vs analyst estimates of $101.7 billion (6.8% year-on-year growth, 0.9% miss)

- Adjusted EPS: $6.81 vs analyst estimates of $6.74 (1.1% beat)

- Adjusted EBITDA: $9.3 billion vs analyst estimates of $9.76 billion (9.2% margin, 4.7% miss)

- Operating Margin: 7.7%, in line with the same quarter last year

- Free Cash Flow was $1.46 billion, up from -$6.15 billion in the same quarter last year

- Customers: 53.73 million, up from 53.72 million in the previous quarter

- Market Capitalization: $502.1 billion

“The people of UnitedHealth Group remain focused on making high-quality, affordable health care more available to more people while making the health system easier to navigate for patients and providers, positioning us well for growth in 2025,” said Andrew Witty, Chief Executive Officer of UnitedHealth Group.

Company Overview

Serving individuals, employers, and government programs like Medicare and Medicaid, UnitedHealth (NYSE:UNH) offers health insurance plans that cover medical, dental, and vision needs.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Sales Growth

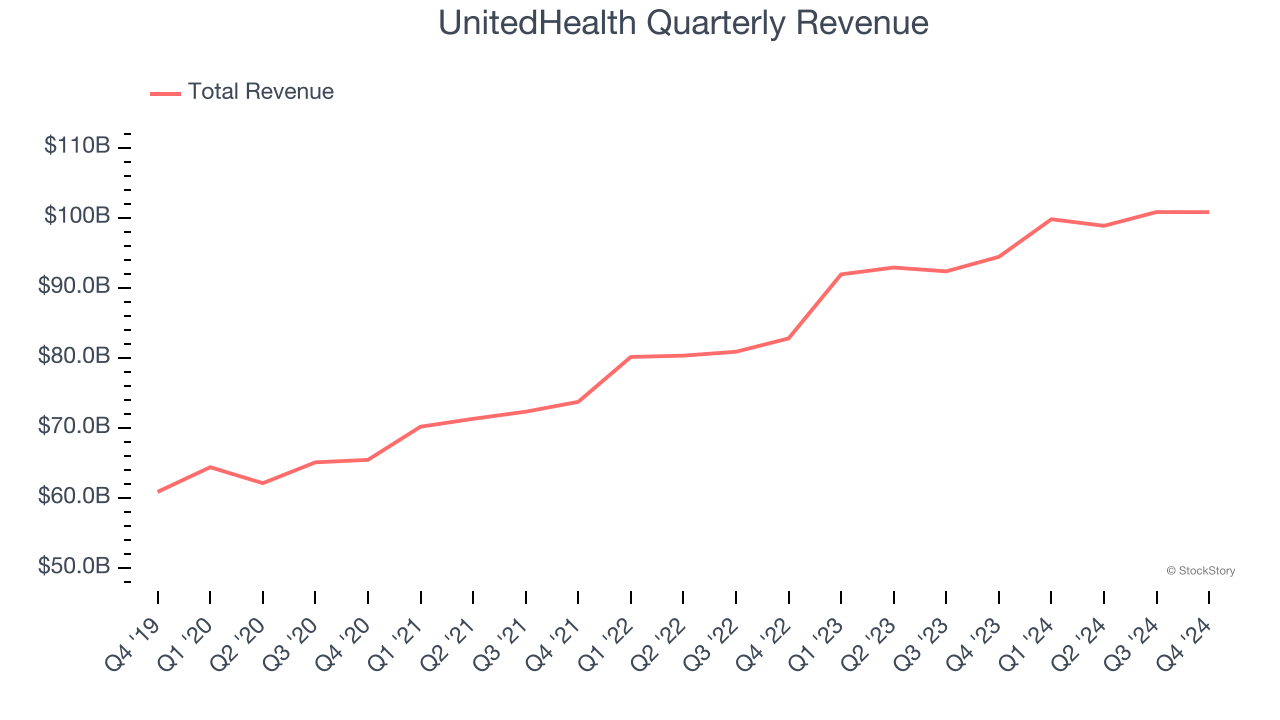

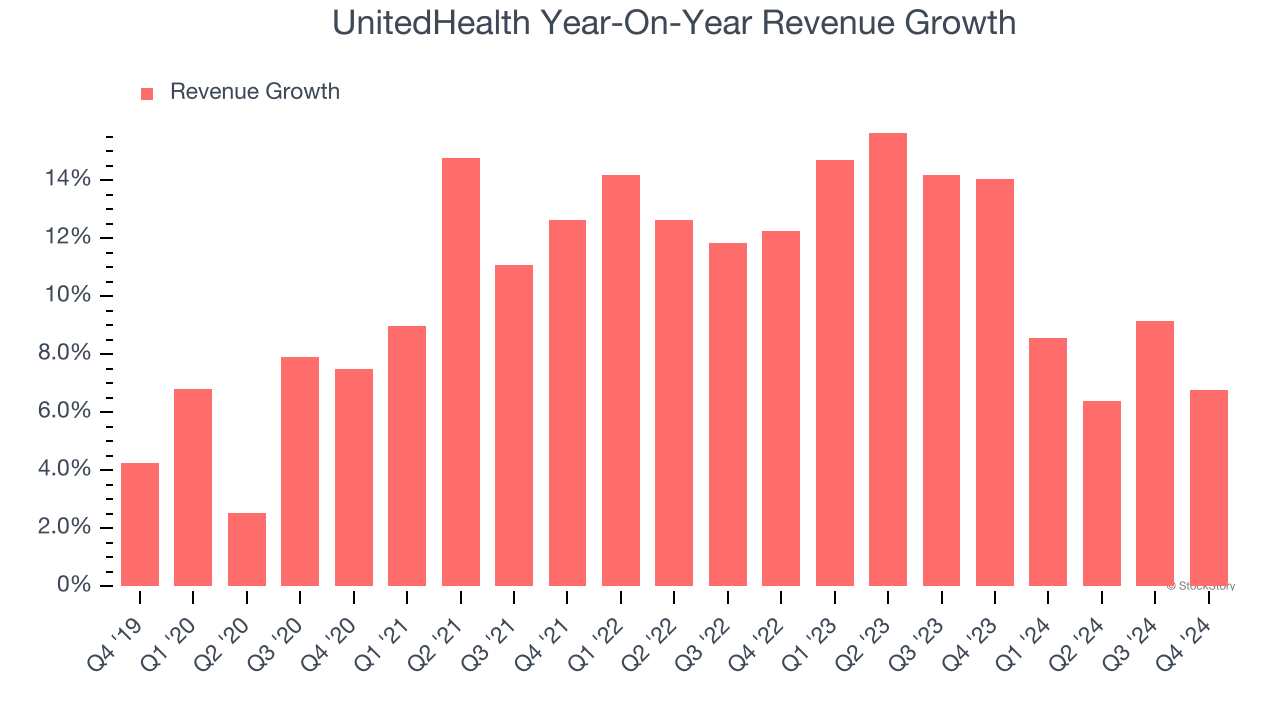

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, UnitedHealth’s 10.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. UnitedHealth’s annualized revenue growth of 11.1% over the last two years aligns with its five-year trend, suggesting its demand was stable.

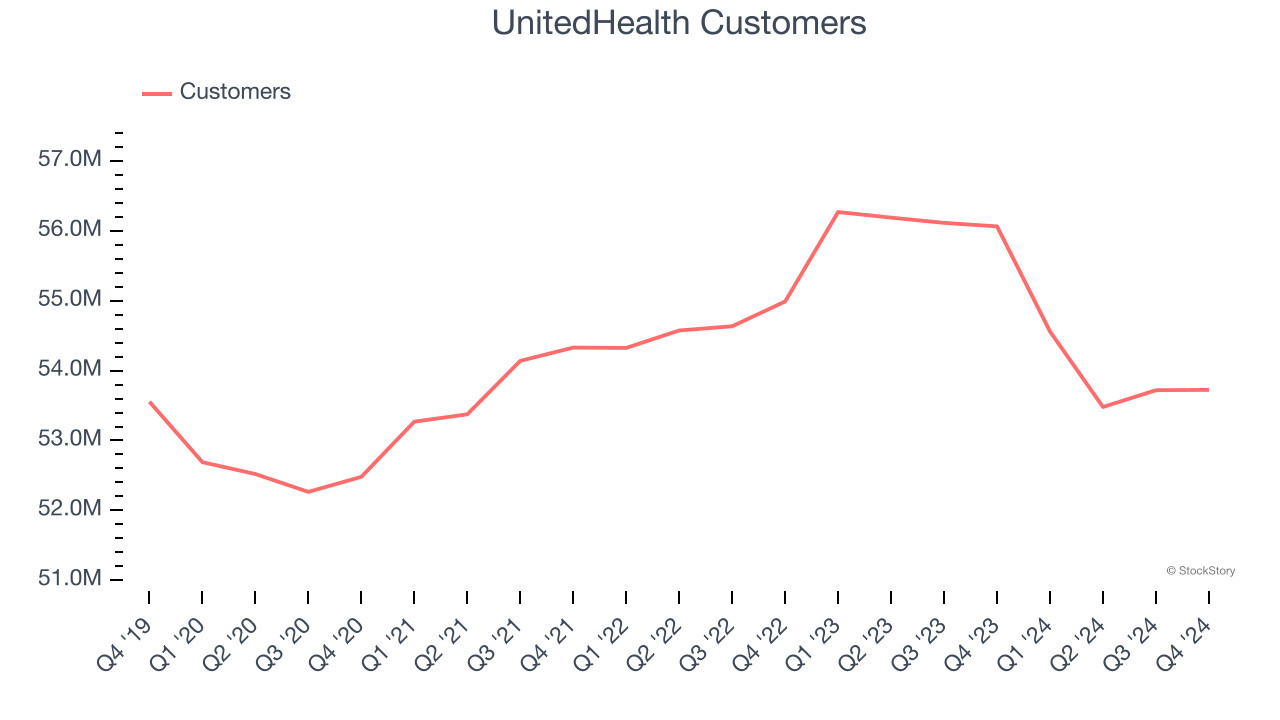

UnitedHealth also reports its number of customers, which reached 53.73 million in the latest quarter. Over the last two years, UnitedHealth neither added nor lost customers. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, UnitedHealth’s revenue grew by 6.8% year on year to $100.8 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

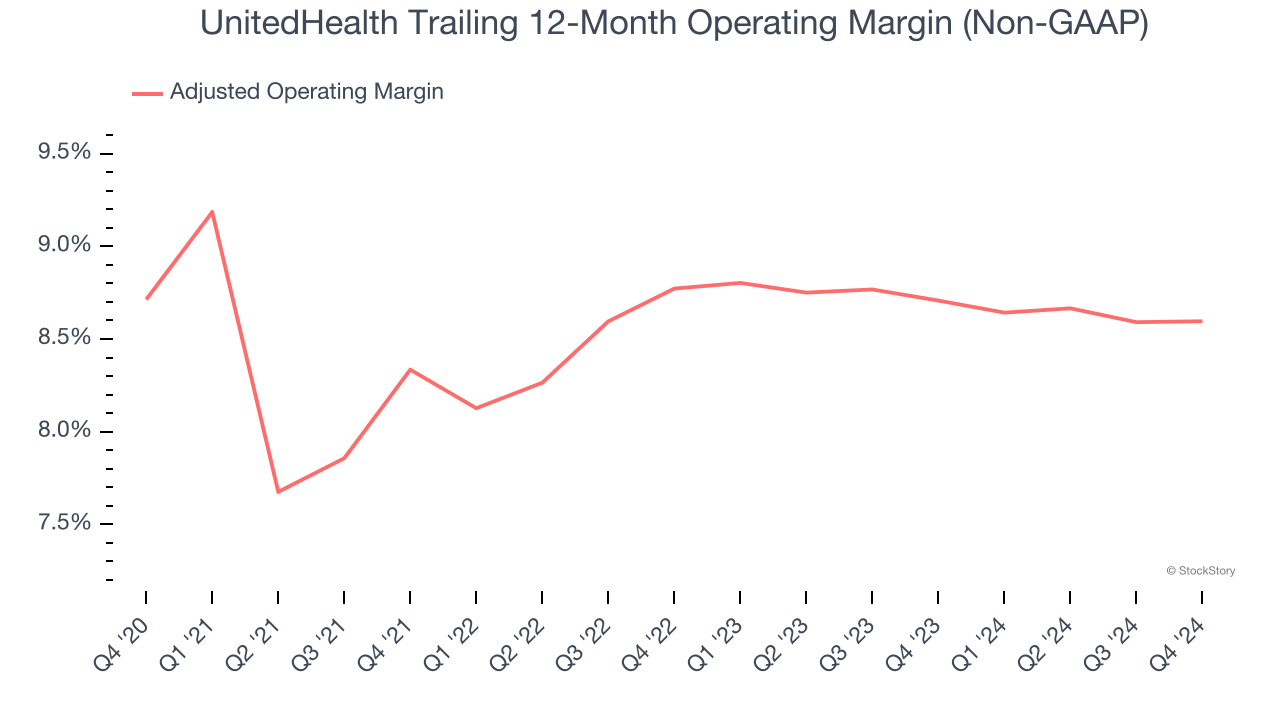

UnitedHealth was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 8.6% was weak for a healthcare business.

Looking at the trend in its profitability, UnitedHealth’s adjusted operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q4, UnitedHealth generated an adjusted operating profit margin of 8.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

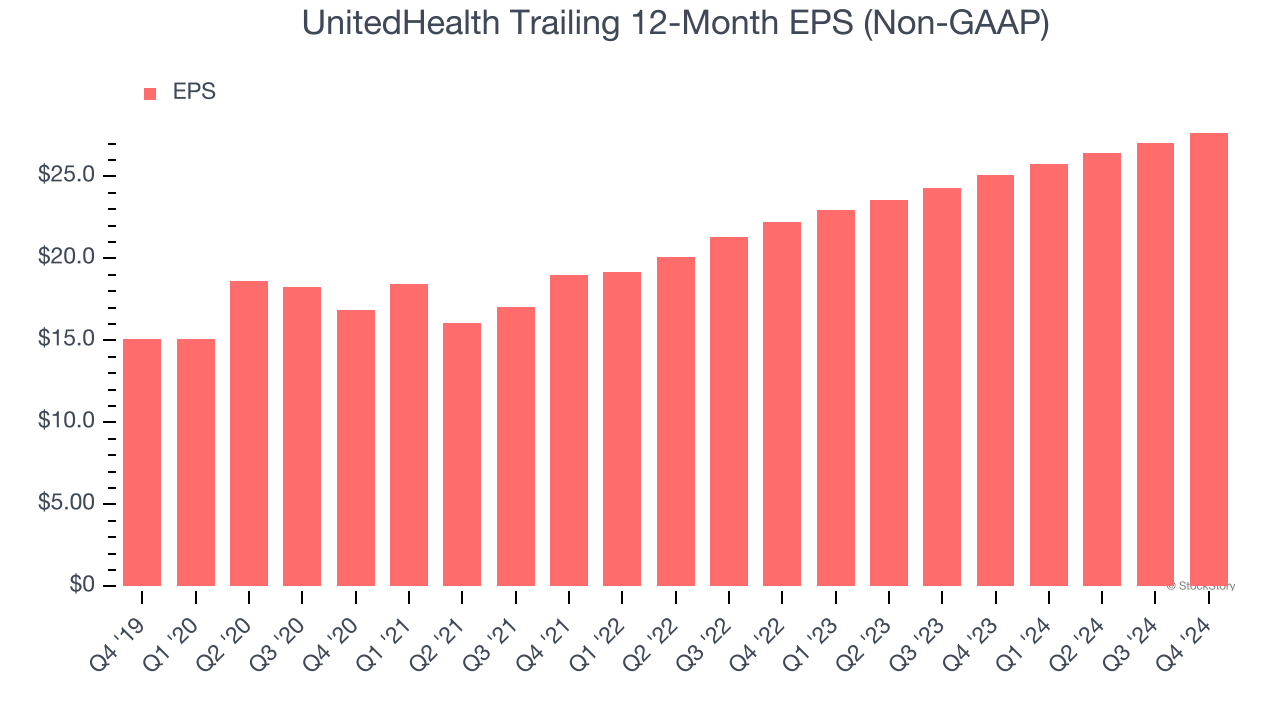

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

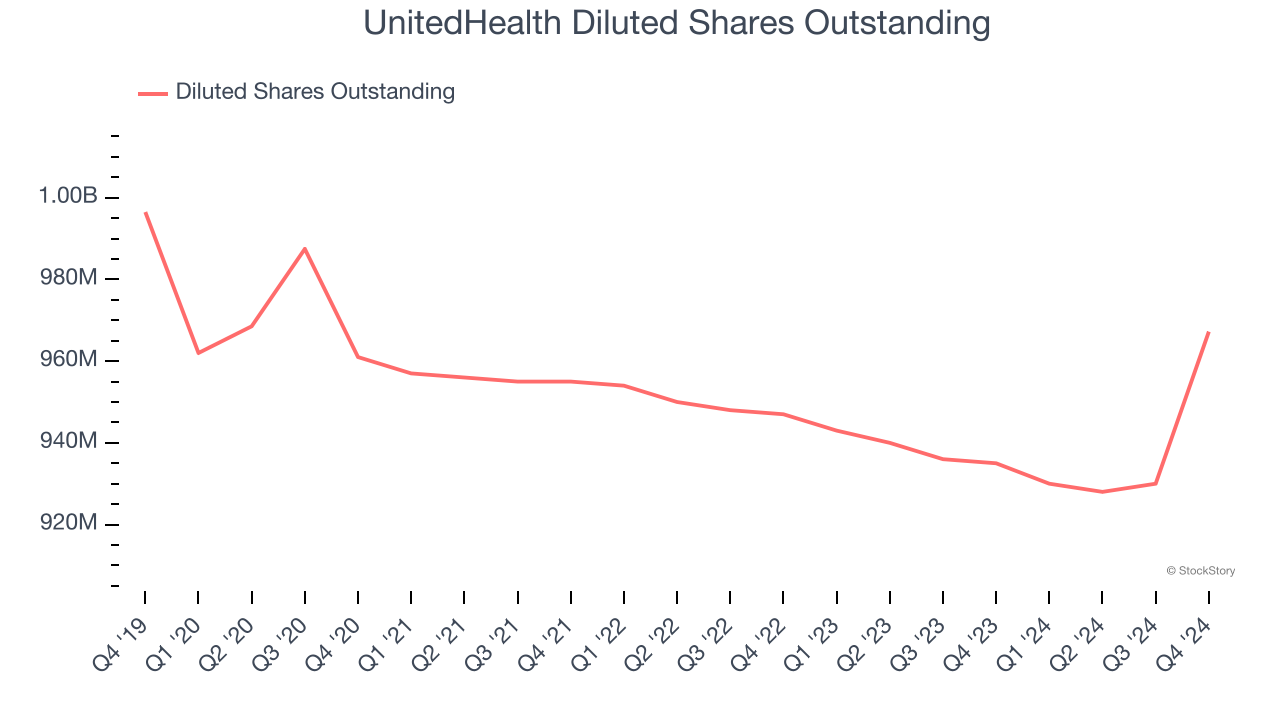

UnitedHealth’s EPS grew at a spectacular 12.9% compounded annual growth rate over the last five years, higher than its 10.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t expand.

We can take a deeper look into UnitedHealth’s earnings to better understand the drivers of its performance. A five-year view shows that UnitedHealth has repurchased its stock, shrinking its share count by 2.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, UnitedHealth reported EPS at $6.81, up from $6.16 in the same quarter last year. This print beat analysts’ estimates by 1.1%. Over the next 12 months, Wall Street expects UnitedHealth’s full-year EPS of $27.67 to grow 7.4%.

Key Takeaways from UnitedHealth’s Q4 Results

We struggled to find many positives in these results as its EPS was in line and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter.

UnitedHealth didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.