Life sciences company Revvity (NYSE:RVTY) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.8% year on year to $729.4 million. On the other hand, the company’s full-year revenue guidance of $2.83 billion at the midpoint came in 1.3% below analysts’ estimates. Its non-GAAP profit of $1.42 per share was 3.1% above analysts’ consensus estimates.

Is now the time to buy Revvity? Find out by accessing our full research report, it’s free.

Revvity (RVTY) Q4 CY2024 Highlights:

- Revenue: $729.4 million vs analyst estimates of $727.5 million (4.8% year-on-year growth, in line)

- Adjusted EPS: $1.42 vs analyst estimates of $1.38 (3.1% beat)

- Adjusted EBITDA: $228.8 million vs analyst estimates of $242.7 million (31.4% margin, 5.7% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.83 billion at the midpoint, missing analyst estimates by 1.3% and implying 2.5% growth (vs 0.2% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.95 at the midpoint, missing analyst estimates by 1%

- Operating Margin: 16.3%, up from 11.1% in the same quarter last year

- Free Cash Flow Margin: 20.7%, down from 24.8% in the same quarter last year

- Organic Revenue was up 6% year on year

- Market Capitalization: $15.44 billion

“We finished last year on a strong note positioning us well as we head into 2025,” said Prahlad Singh, President and CEO of Revvity.

Company Overview

Formerly known as PerkinElmer, Revvity (NYSE:RVTY) offers advanced diagnostic tools, scientific instruments, and services designed to support the pharmaceutical and biotechnology industries.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

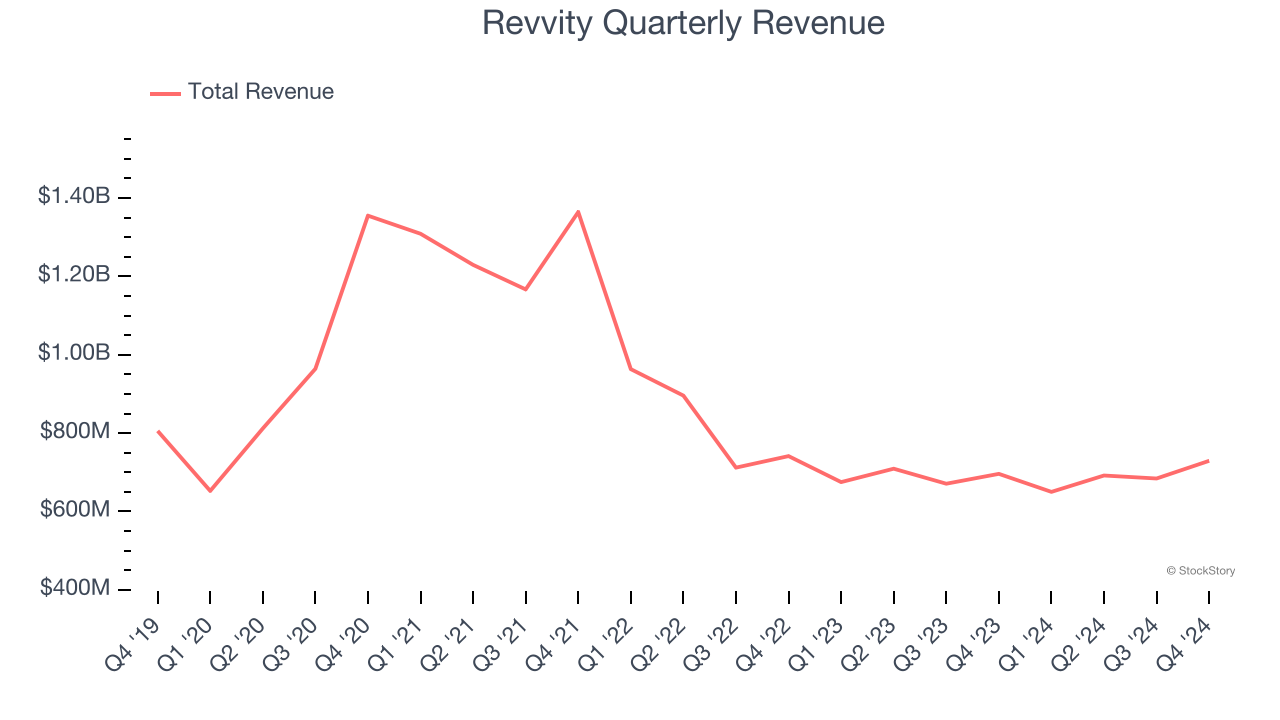

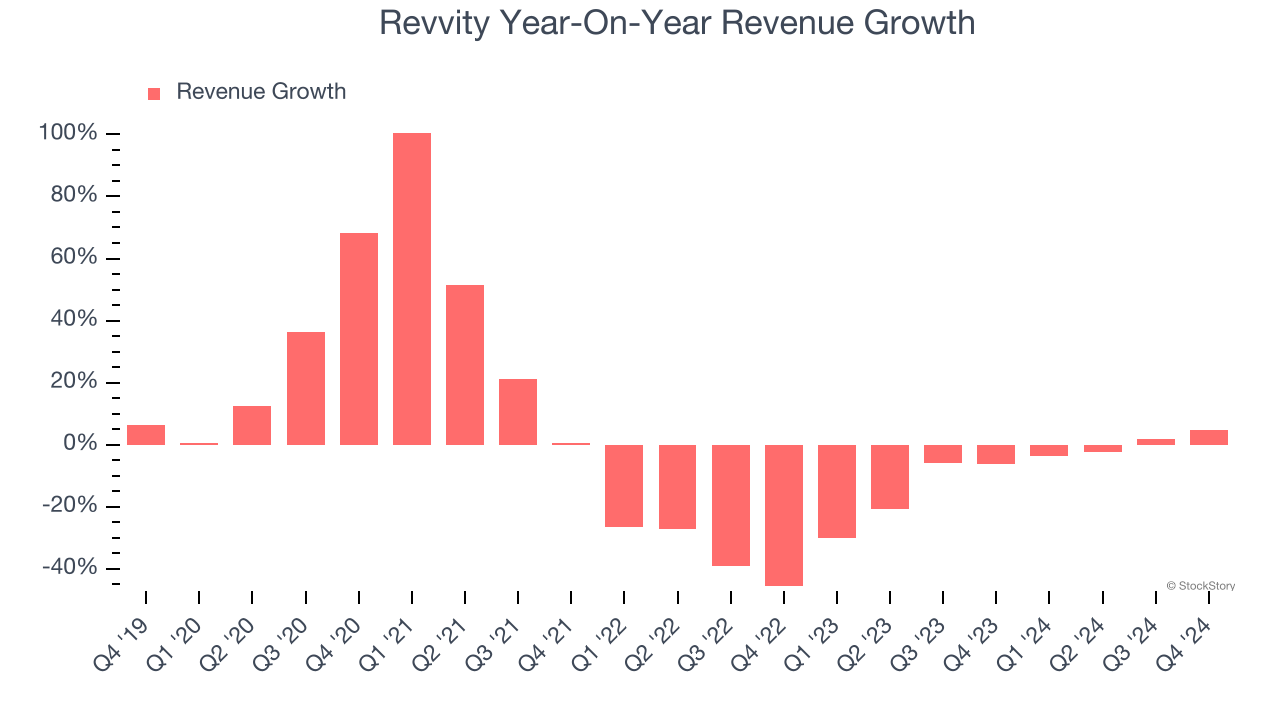

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Revvity struggled to consistently increase demand as its $2.76 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and signals it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Revvity’s recent history shows its demand has stayed suppressed as its revenue has declined by 8.8% annually over the last two years.

This quarter, Revvity grew its revenue by 4.8% year on year, and its $729.4 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

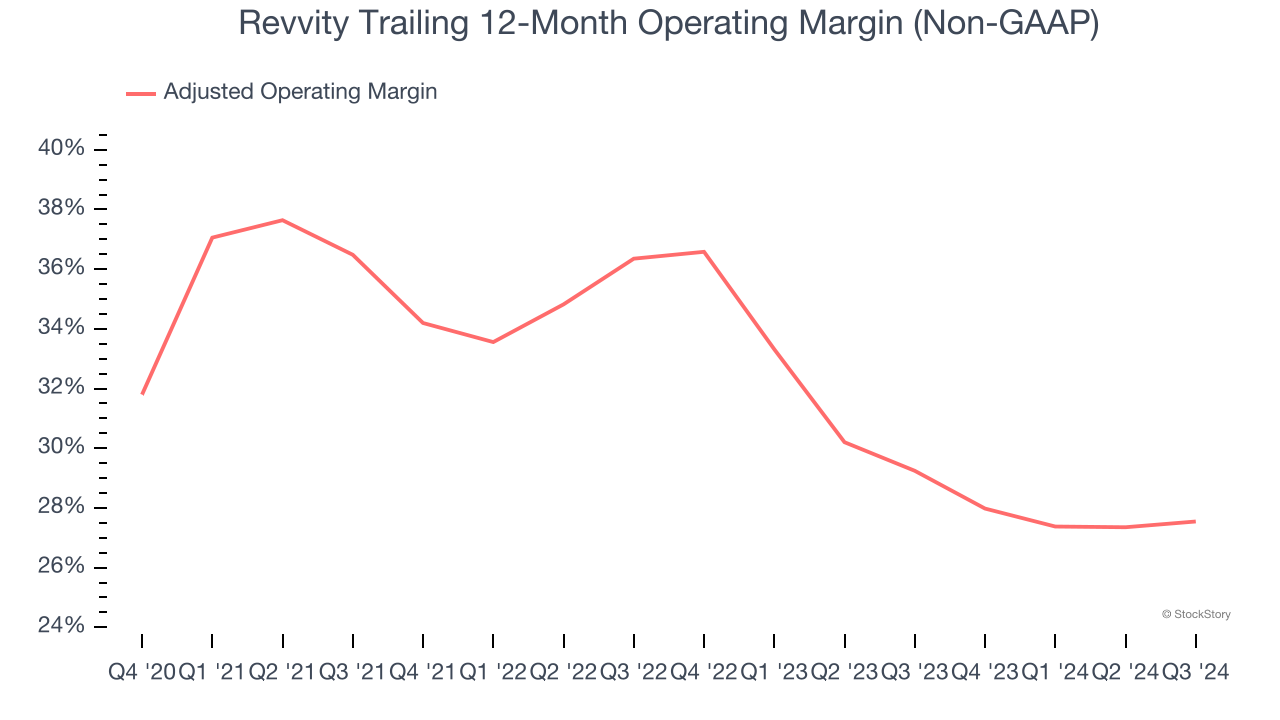

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Revvity has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 32.3%.

Analyzing the trend in its profitability, Revvity’s adjusted operating margin rose by 1.5 percentage points over the last five years. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 10.3 percentage points on a two-year basis. If Revvity wants to pass our bar, it must prove it can expand its profitability consistently.

This quarter, Revvity generated an adjusted operating profit margin of 31.4%, up 3.8 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

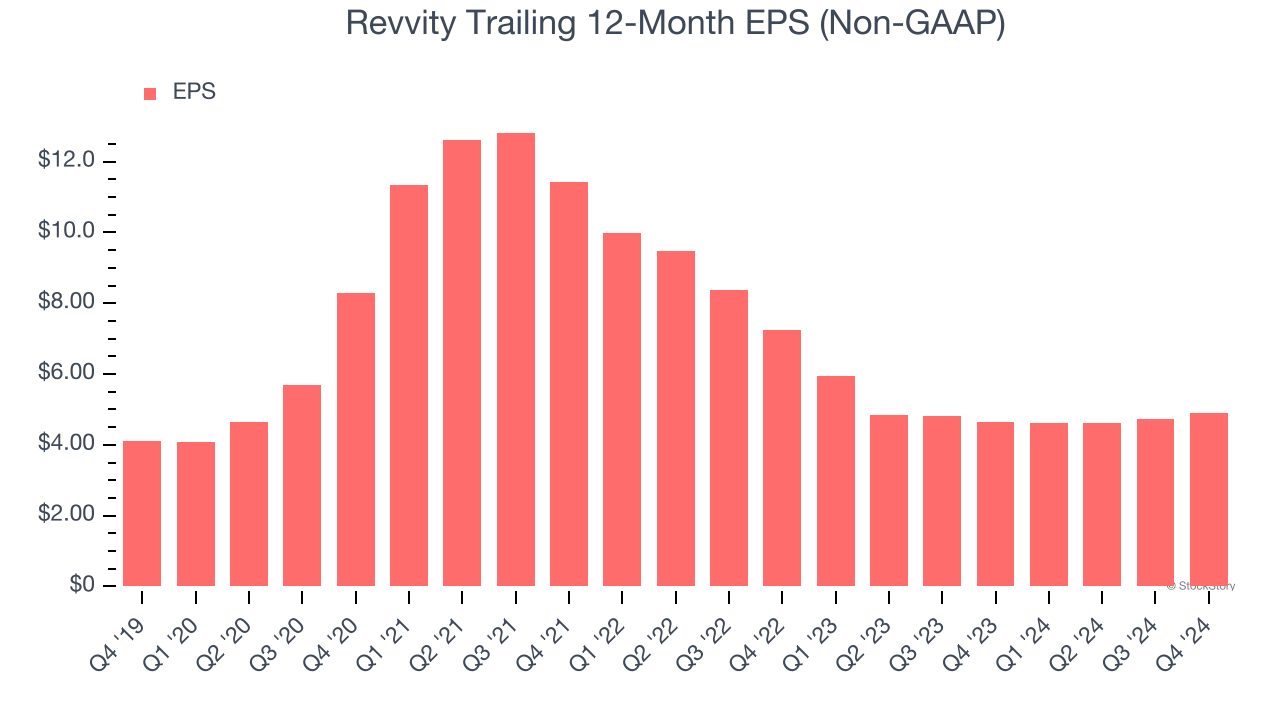

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Revvity’s EPS grew at an unimpressive 3.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

We can take a deeper look into Revvity’s earnings to better understand the drivers of its performance. As we mentioned earlier, Revvity’s adjusted operating margin expanded by 1.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Revvity reported EPS at $1.42, up from $1.25 in the same quarter last year. This print beat analysts’ estimates by 3.1%. Over the next 12 months, Wall Street expects Revvity’s full-year EPS of $4.90 to grow 1.9%.

Key Takeaways from Revvity’s Q4 Results

It was good to see Revvity narrowly top analysts’ organic revenue expectations this quarter. On the other hand, its full-year revenue and EPS guidance slightly missed. Overall, this was a weaker quarter. The stock remained flat at $126.12 immediately after reporting.

Revvity may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.