Life sciences company Neogen (NASDAQ:NEOG) beat Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $231.3 million. Its non-GAAP profit of $0.11 per share was in line with analysts’ consensus estimates.

Is now the time to buy Neogen? Find out by accessing our full research report, it’s free.

Neogen (NEOG) Q4 CY2024 Highlights:

- Revenue: $231.3 million vs analyst estimates of $228.1 million (flat year on year, 1.4% beat)

- Adjusted EPS: $0.11 vs analyst estimates of $0.11 (in line)

- Operating Margin: 1.7%, down from 6.3% in the same quarter last year

- Free Cash Flow was $23.1 million, up from -$8.7 million in the same quarter last year

- Market Capitalization: $2.49 billion

"The second quarter reflected steady progress, as we saw improvement across the business compared to the first quarter, with core revenue growth accelerating in both of our segments, sequential margin expansion and significantly better free cash flow," said John Adent, Neogen's President and Chief Executive Officer.

Company Overview

Founded in 1982, Neogen (NASDAQ:NEOG) provides a broad range of products and services to ensure food safety and animal health, including diagnostic tests, food safety equipment, and veterinary pharmaceuticals.

Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

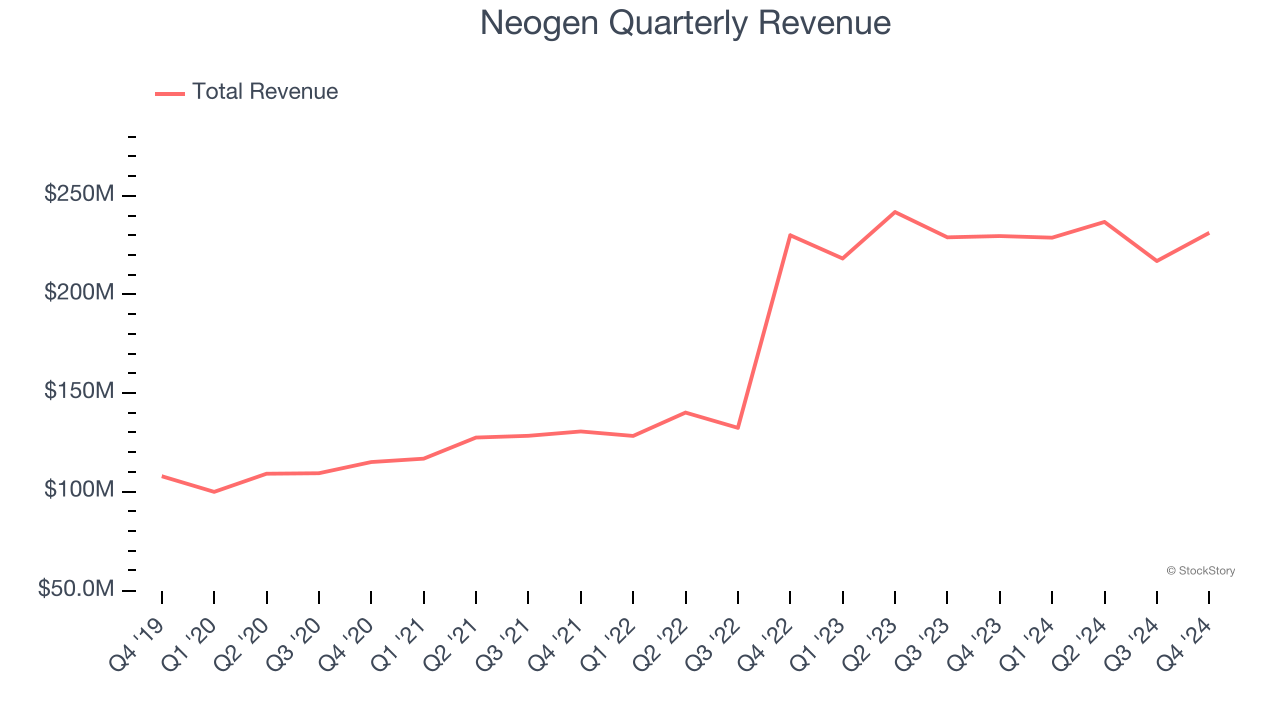

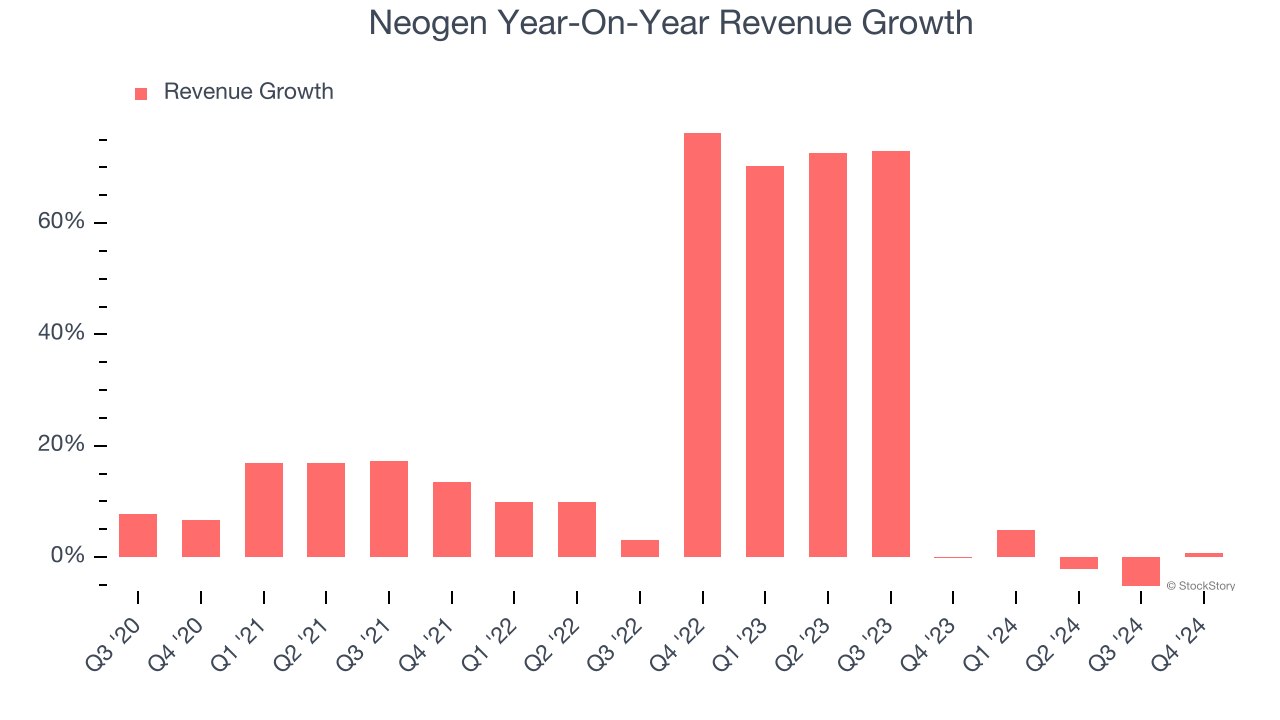

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Neogen grew its sales at a solid 16.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Neogen’s annualized revenue growth of 20.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Neogen’s $231.3 million of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

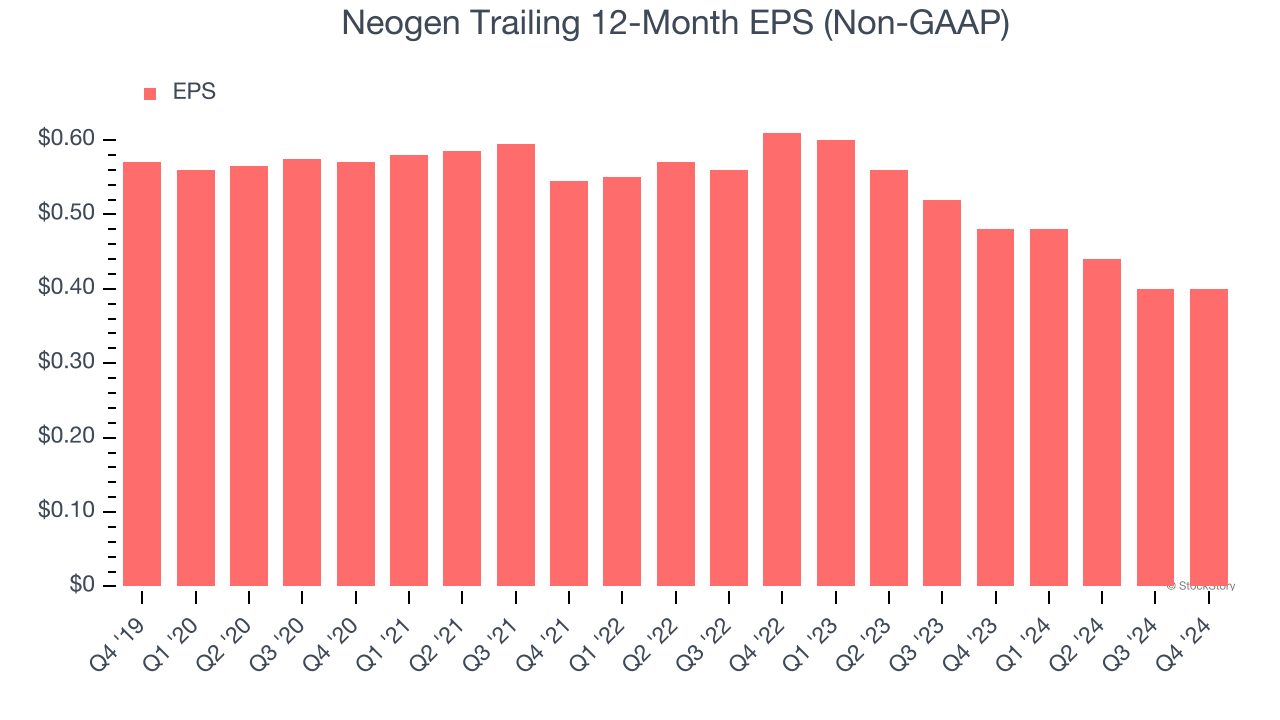

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Neogen, its EPS declined by 6.8% annually over the last five years while its revenue grew by 16.5%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Neogen reported EPS at $0.11, in line with the same quarter last year. This print beat analysts’ estimates by 4.8%. Over the next 12 months, Wall Street expects Neogen’s full-year EPS of $0.40 to grow 37.5%.

Key Takeaways from Neogen’s Q4 Results

It was good to see Neogen narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS was in line. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.