Health insurance provider Elevance Health (NYSE:EVH) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 6.6% year on year to $45.44 billion. Its non-GAAP profit of $3.84 per share was in line with analysts’ consensus estimates.

Is now the time to buy Elevance Health? Find out by accessing our full research report, it’s free.

Elevance Health (ELV) Q4 CY2024 Highlights:

- Revenue: $45.44 billion vs analyst estimates of $45.34 billion (6.6% year-on-year growth, in line)

- Adjusted EPS: $3.84 vs analyst expectations of $3.85 (in line)

- Adjusted EBITDA: $1.78 billion vs analyst estimates of $1.64 billion (3.9% margin, 8.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $34.50 at the midpoint, missing analyst estimates by 1%

- Operating Margin: 2.6%, down from 4.3% in the same quarter last year

- Free Cash Flow was $384 million, up from -$3.3 billion in the same quarter last year

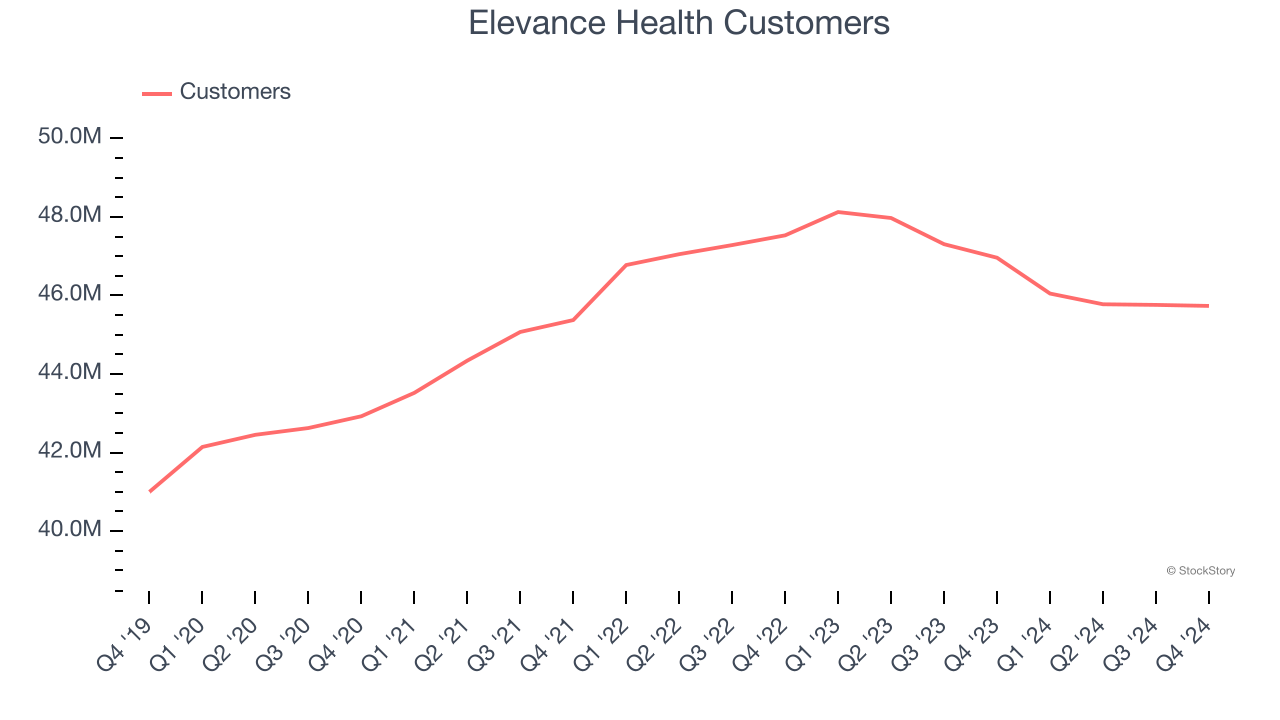

- Customers: 45.73 million, down from 45.76 million in the previous quarter

- Market Capitalization: $92.61 billion

“As part of our commitment to elevating whole health and advancing health beyond healthcare, we deliver value to the members and care providers we serve by ensuring simple, affordable, and accessible care. Our fourth quarter results demonstrate tangible progress in improving our operations in response to the dynamic environment facing the industry. As we look to 2025, we remain resolute in our goal to simplify the healthcare experience, deepen the impact of Carelon, and deploy innovative care models, positioning us to achieve sustainable growth over the long run."

Company Overview

Known for its Blue Cross and Blue Shield brand, Elevance Health (NYSE:EVH) is a health insurance company formerly known as Anthem.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Sales Growth

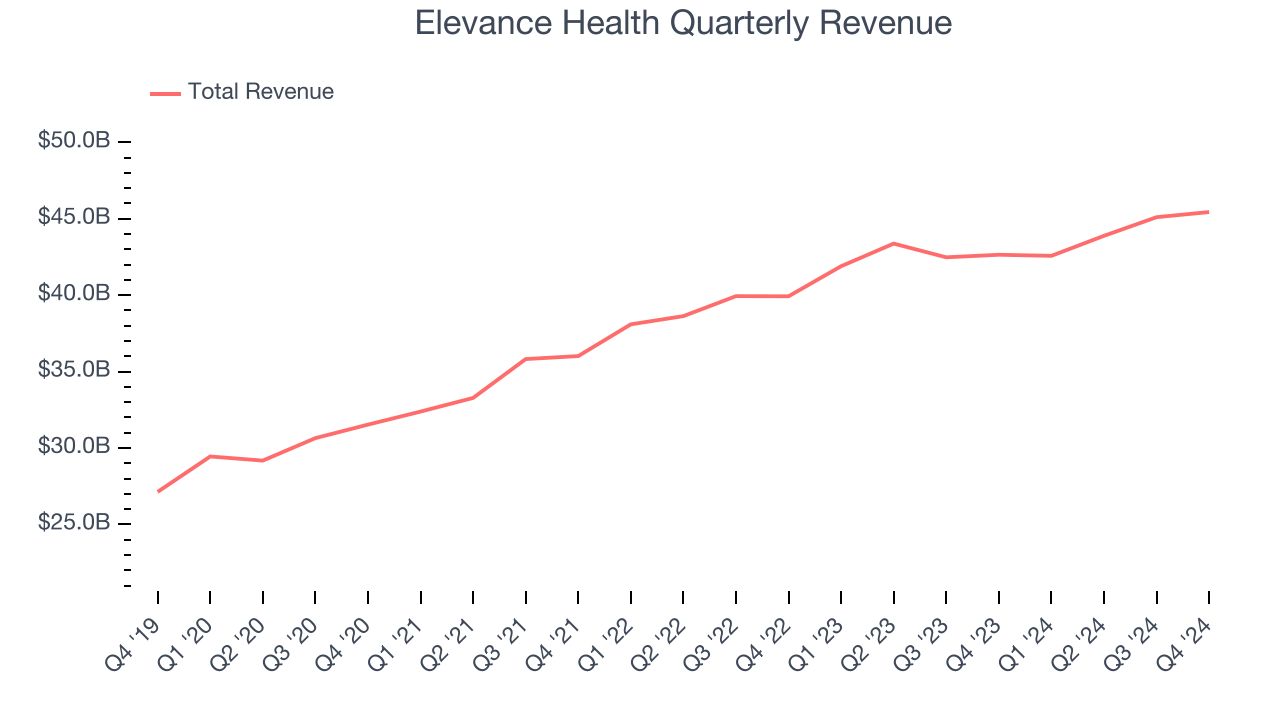

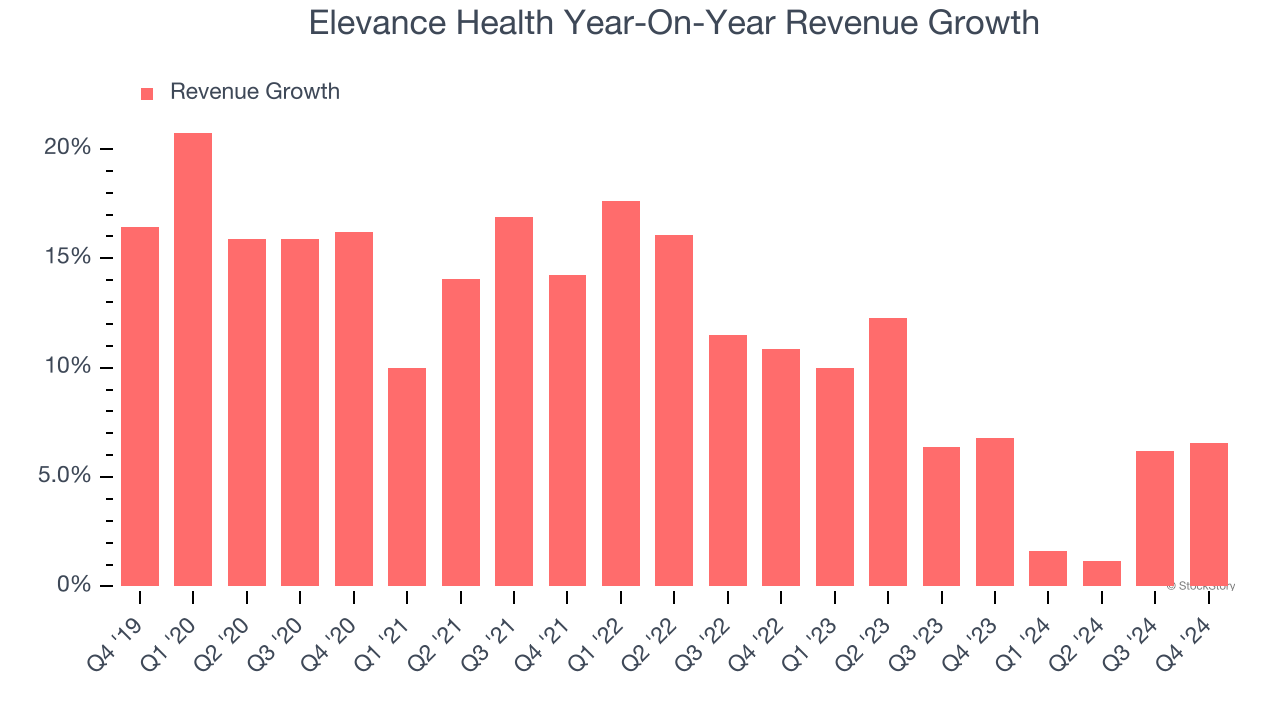

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Elevance Health grew its sales at a decent 11.4% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Elevance Health’s recent history shows its demand slowed as its annualized revenue growth of 6.3% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 45.73 million in the latest quarter. Over the last two years, Elevance Health’s customer base averaged 1.4% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Elevance Health grew its revenue by 6.6% year on year, and its $45.44 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and implies its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

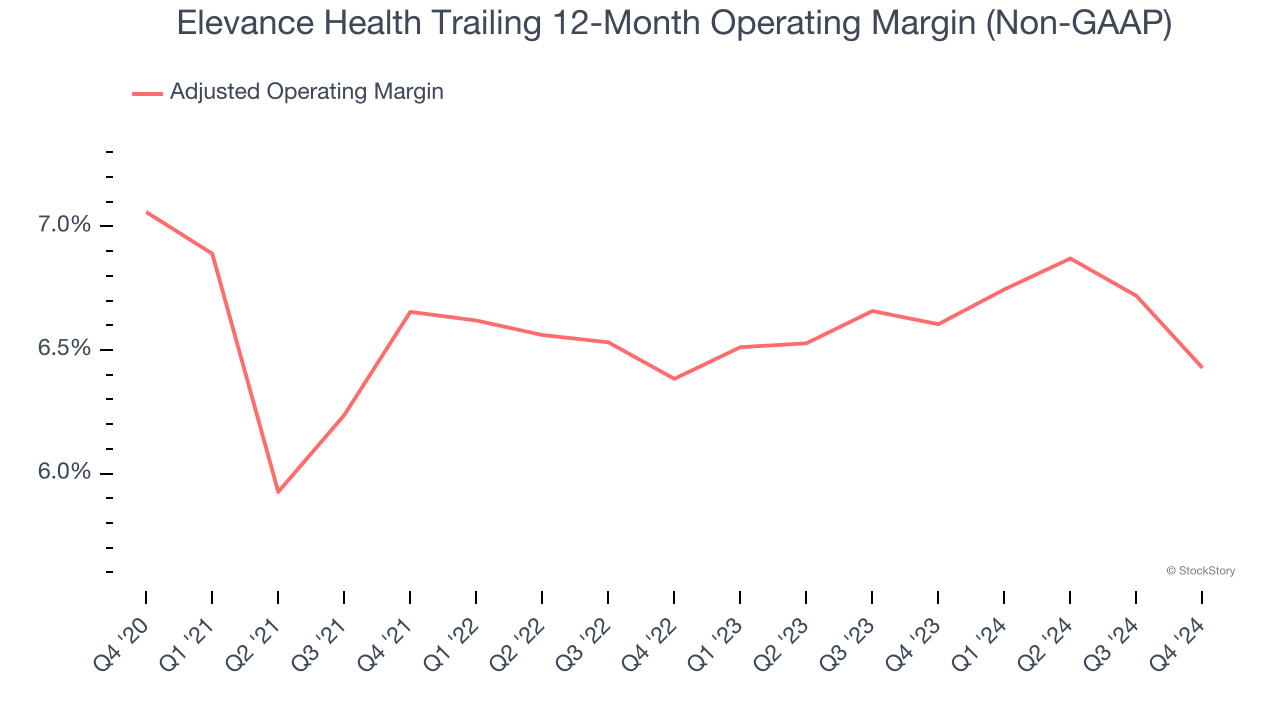

Elevance Health was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 6.6% was weak for a healthcare business.

Looking at the trend in its profitability, Elevance Health’s adjusted operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, Elevance Health generated an adjusted operating profit margin of 3.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

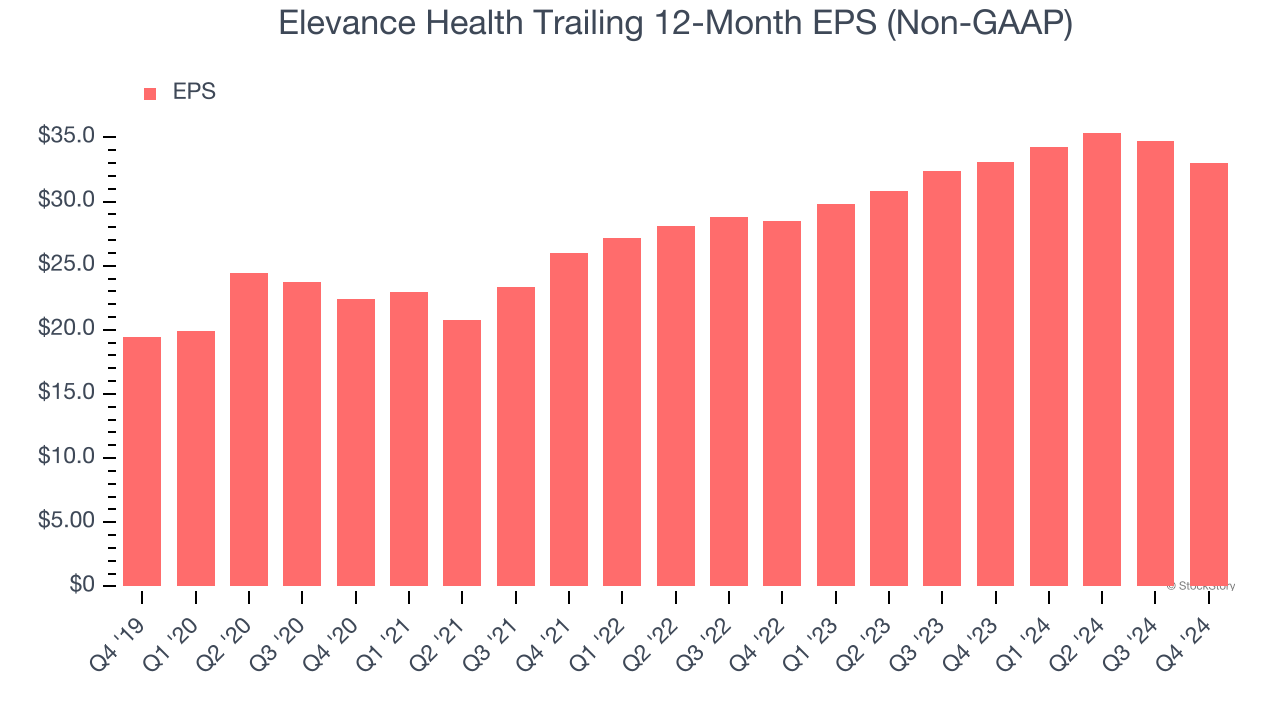

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Elevance Health’s remarkable 11.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Elevance Health reported EPS at $3.84, down from $5.62 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Elevance Health’s full-year EPS of $32.97 to grow 4.5%.

Key Takeaways from Elevance Health’s Q4 Results

We struggled to find many positives in these results as its EPS was in line and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter.

Elevance Health’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.