Healthcare product and device company Abbott Laboratories (NYSE:ABT) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 7.2% year on year to $10.97 billion. Its non-GAAP profit of $1.34 per share was in line with analysts’ consensus estimates.

Is now the time to buy Abbott Laboratories? Find out by accessing our full research report, it’s free.

Abbott Laboratories (ABT) Q4 CY2024 Highlights:

- Revenue: $10.97 billion vs analyst estimates of $11.02 billion (7.2% year-on-year growth, in line)

- Adjusted EPS: $1.34 vs analyst estimates of $1.34 (in line)

- Adjusted EBITDA: $3.01 billion vs analyst estimates of $3.07 billion (27.4% margin, 2% miss)

- Operating Margin: 17.4%, in line with the same quarter last year

- Free Cash Flow Margin: 66%, up from 22.3% in the same quarter last year

- Organic Revenue rose 8.8% year on year (2.1% in the same quarter last year)

- Market Capitalization: $223.4 billion

"We finished the year with very strong momentum. Sales growth and earnings per share growth in the fourth quarter were the highest of the year," said Robert B. Ford, chairman and chief executive officer, Abbott.

Company Overview

Founded in 1888 as a small pharmaceutical company, Abbott Laboratories (NYSE:ABT) develops and sells a wide range of nutrition products, medical devices, and branded pharmaceuticals.

Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Sales Growth

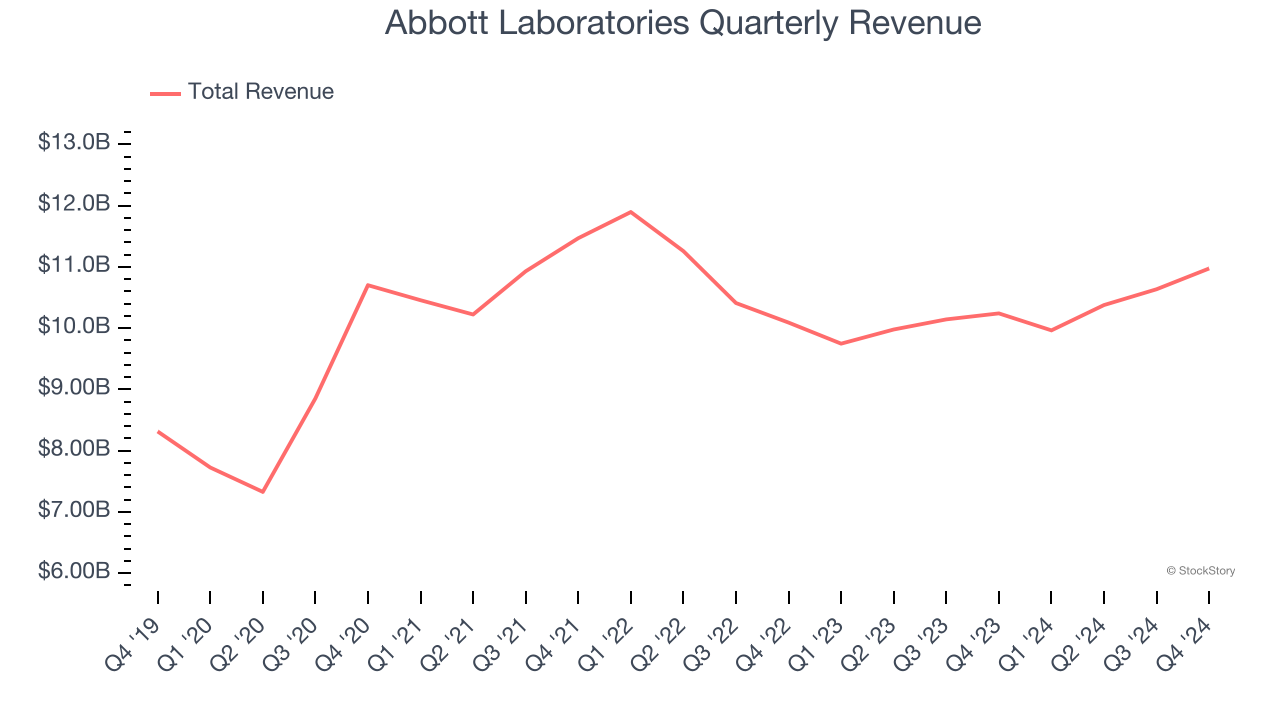

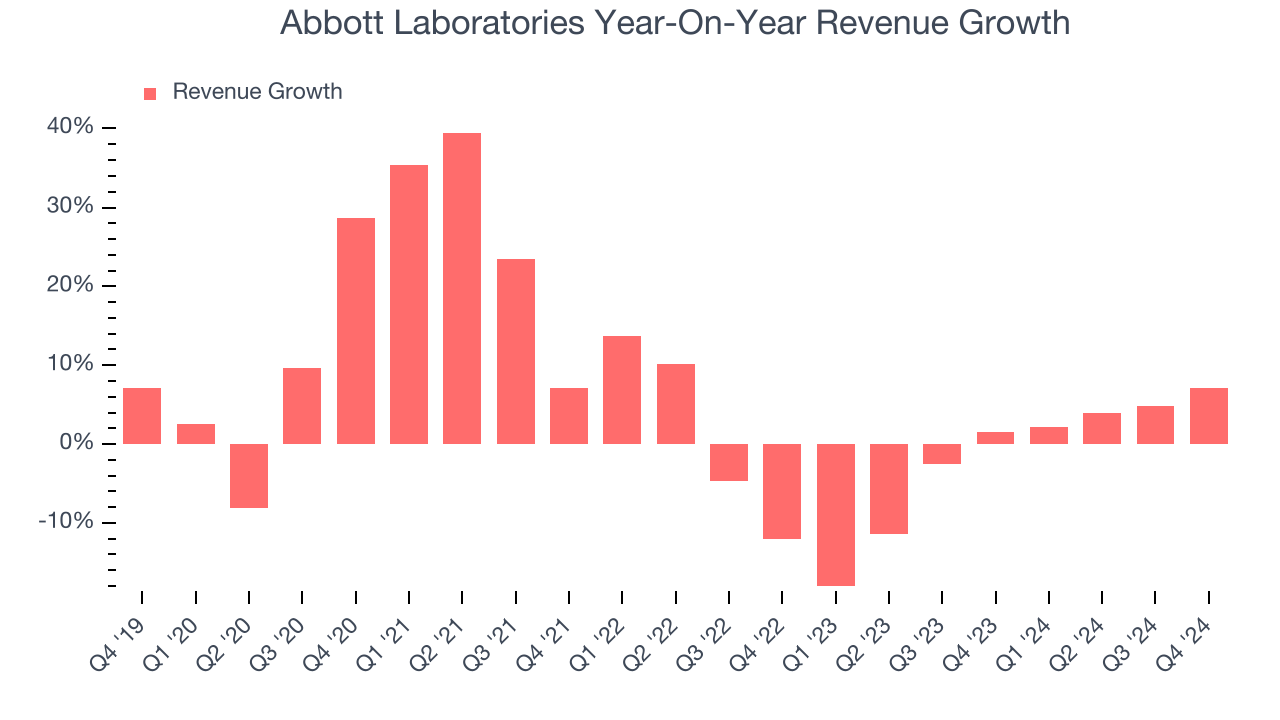

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Abbott Laboratories’s sales grew at a mediocre 5.6% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector, but there are still things to like about Abbott Laboratories.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Abbott Laboratories’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

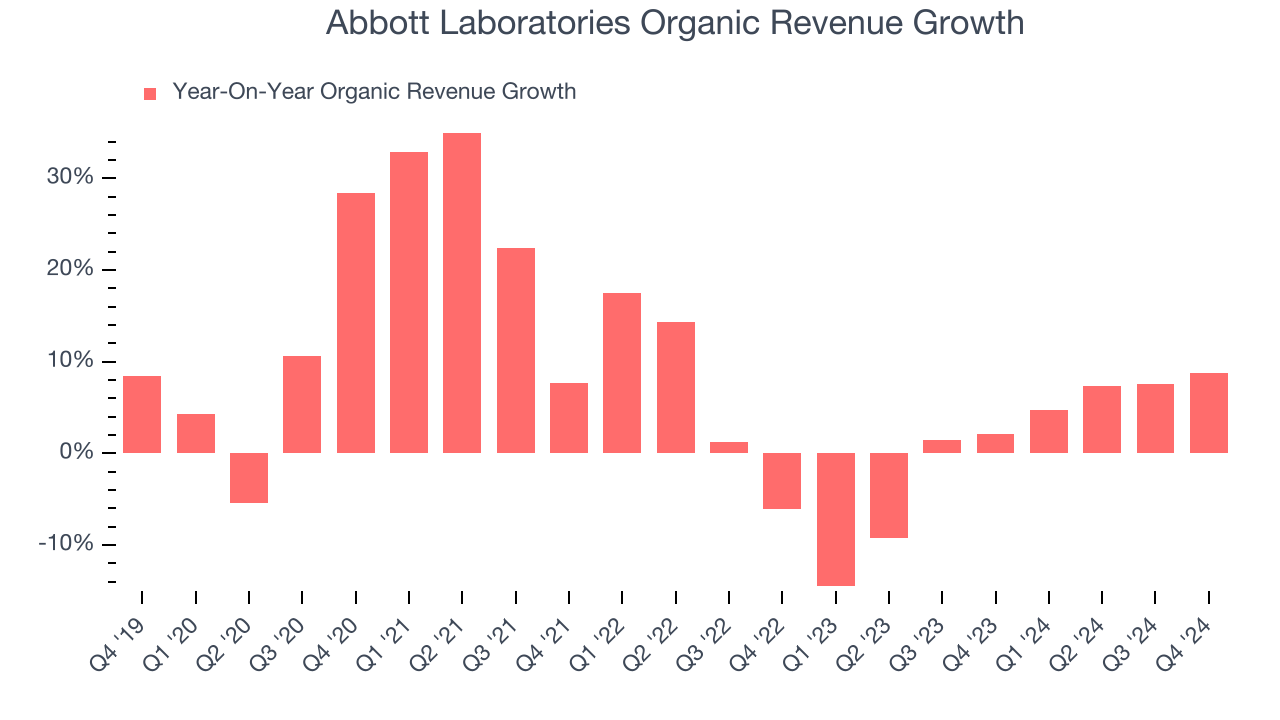

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Abbott Laboratories’s organic revenue averaged 1.1% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Abbott Laboratories grew its revenue by 7.2% year on year, and its $10.97 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

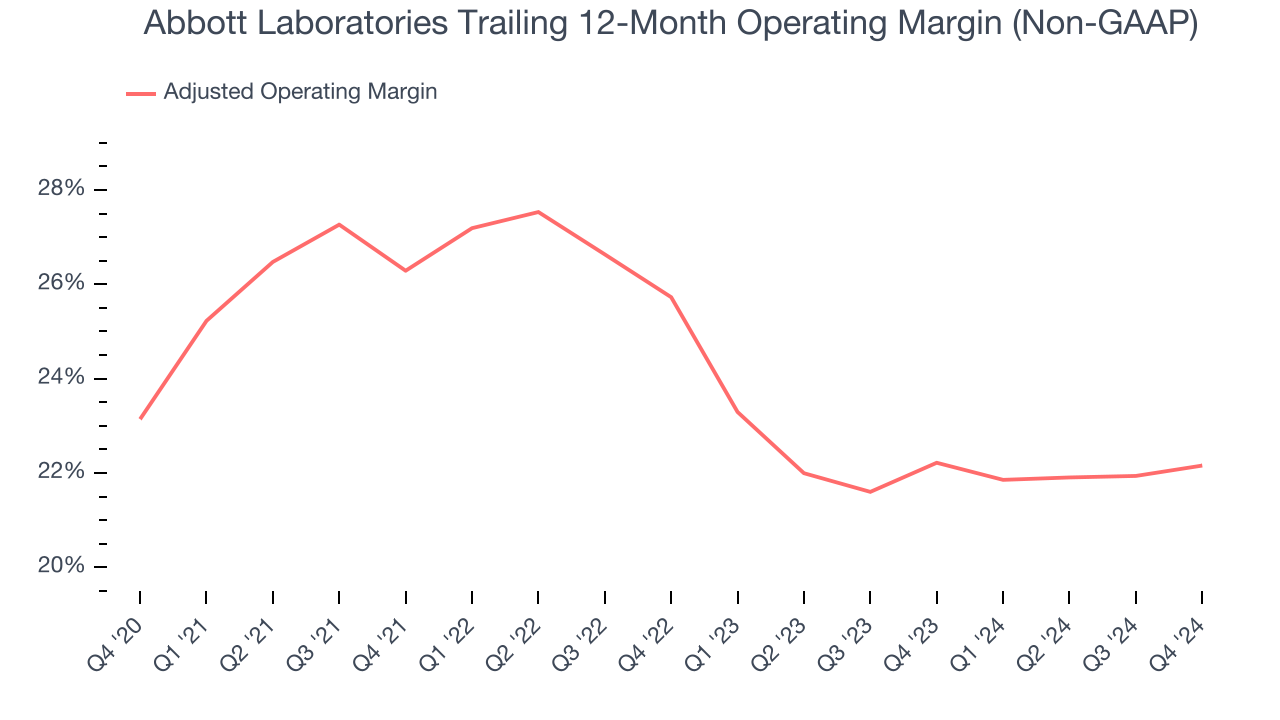

Abbott Laboratories has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 24%.

Looking at the trend in its profitability, Abbott Laboratories’s adjusted operating margin of 22.2% for the trailing 12 months may around the same as five years ago, but it has decreased by 3.6 percentage points over the last two years. This dynamic unfolded because it failed to adjust its fixed costs while demand fell. Still, we’re optimistic that Abbott Laboratories can correct course and expand its profitability on a longer-term horizon.

This quarter, Abbott Laboratories generated an adjusted operating profit margin of 24.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

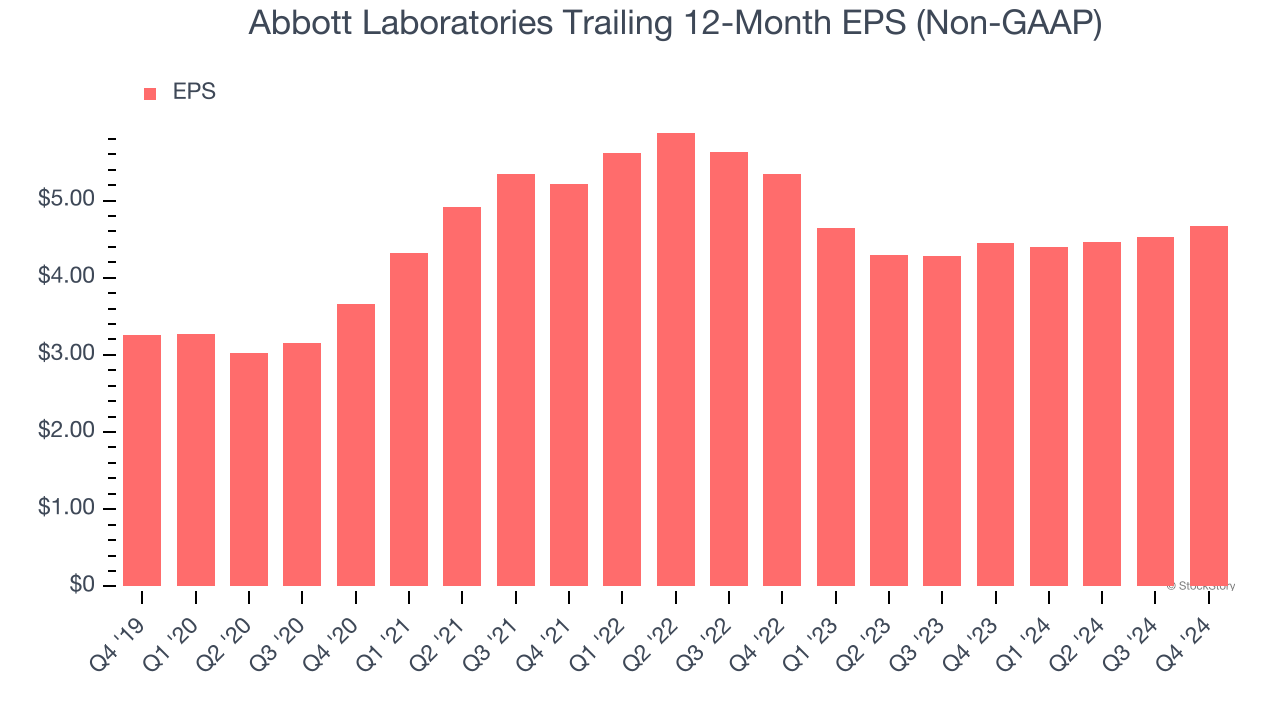

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

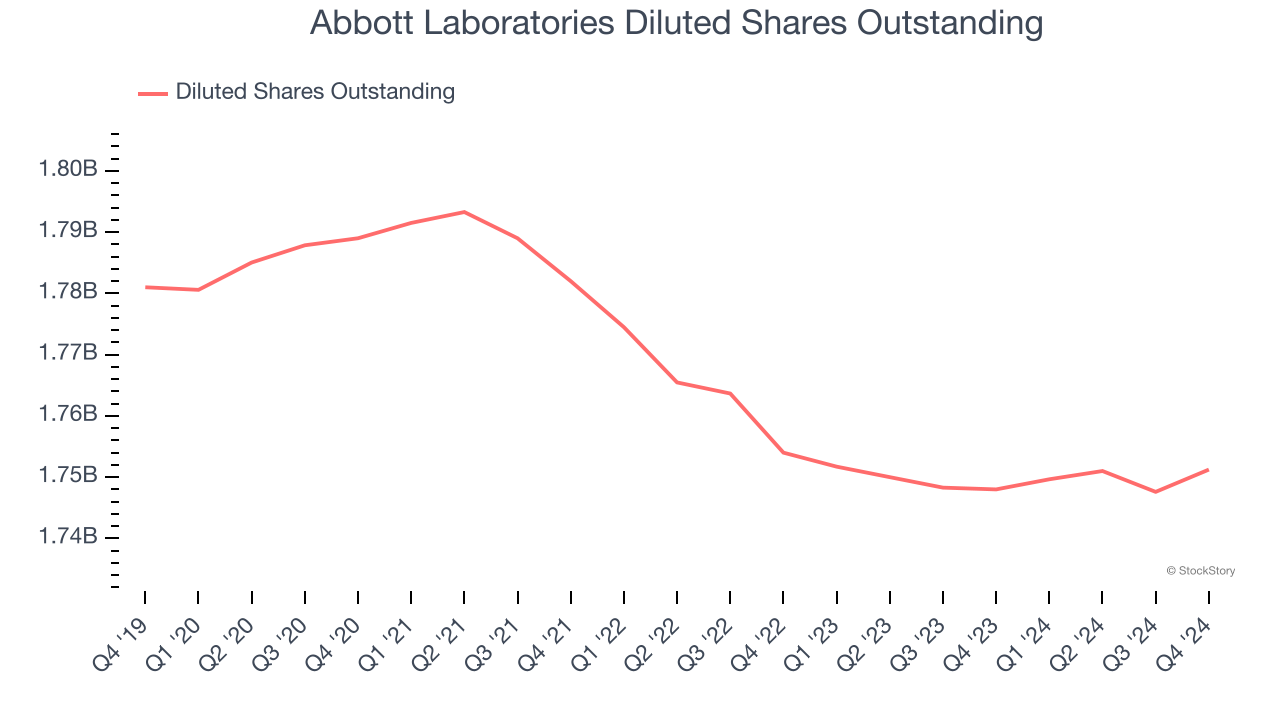

Abbott Laboratories’s EPS grew at a solid 7.5% compounded annual growth rate over the last five years, higher than its 5.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t expand.

We can take a deeper look into Abbott Laboratories’s earnings quality to better understand the drivers of its performance. A five-year view shows that Abbott Laboratories has repurchased its stock, shrinking its share count by 1.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Abbott Laboratories reported EPS at $1.34, up from $1.20 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Abbott Laboratories’s full-year EPS of $4.68 to grow 10.2%.

Key Takeaways from Abbott Laboratories’s Q4 Results

It was good to see Abbott Laboratories meet analysts’ organic revenue expectations this quarter. On the other hand, its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better.

Abbott Laboratories’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.