Looking back on shelf-stable food stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including B&G Foods (NYSE:BGS) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 19 shelf-stable food stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

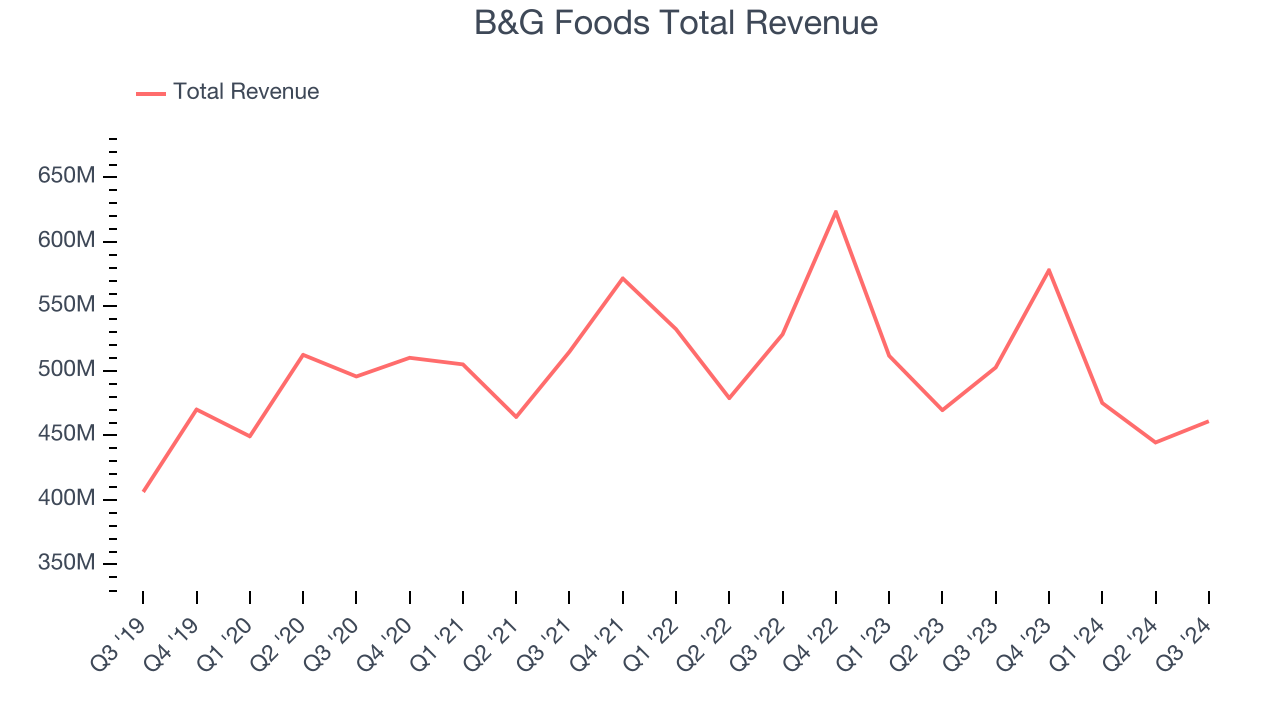

B&G Foods (NYSE:BGS)

Started as a small grocery store in New York City, B&G Foods (NYSE:BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

B&G Foods reported revenues of $461.1 million, down 8.3% year on year. This print fell short of analysts’ expectations by 2.2%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Commenting on the results, Casey Keller, President and Chief Executive Officer of B&G Foods, stated, “B&G Foods’ third quarter results reflected a slower than expected recovery in sales trends, consistent with the center store packaged food industry. We expect trends to gradually improve and stabilize into the first half of 2025 as we lap consumer reaction to higher prices across food categories.”

B&G Foods delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 22.4% since reporting and currently trades at $6.85.

Read our full report on B&G Foods here, it’s free.

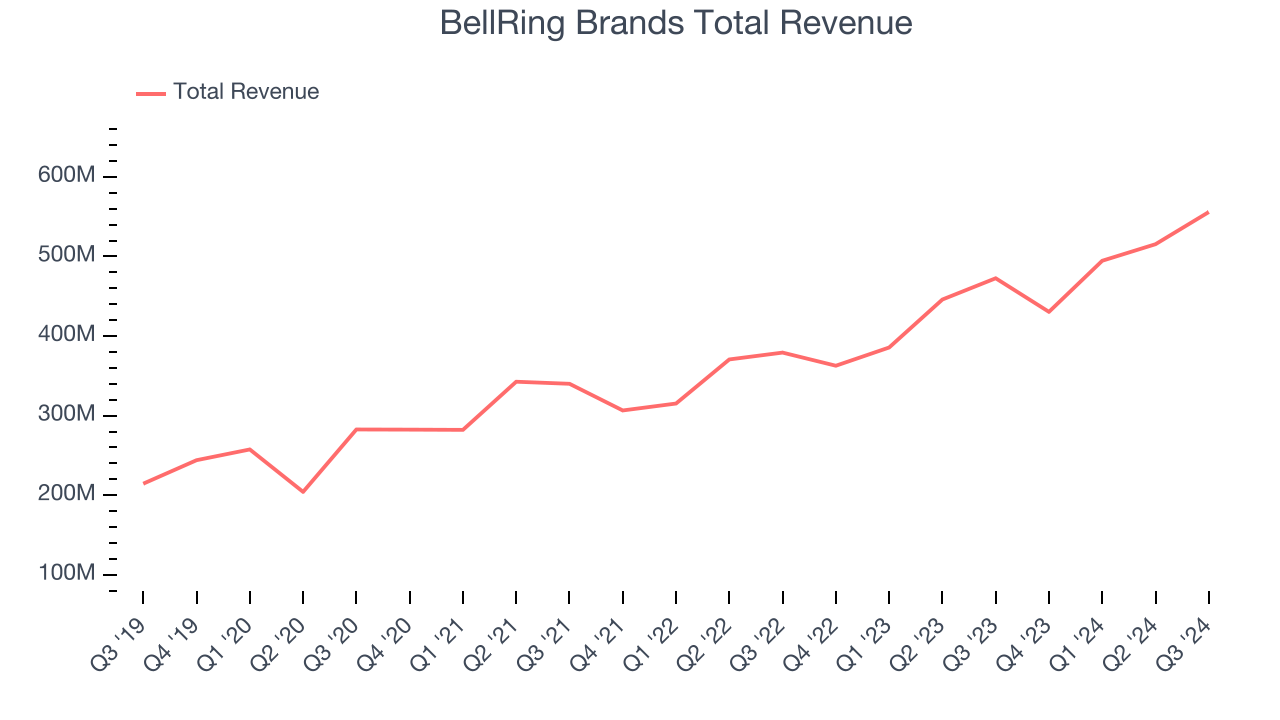

Best Q3: BellRing Brands (NYSE:BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $555.8 million, up 17.6% year on year, outperforming analysts’ expectations by 2%. The business had a very strong quarter with full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ gross margin estimates.

BellRing Brands achieved the fastest revenue growth and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 4.7% since reporting. It currently trades at $76.86.

Is now the time to buy BellRing Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: J&J Snack Foods (NASDAQ:JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $426.8 million, down 3.9% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates.

The stock is flat since the results and currently trades at $172.84.

Read our full analysis of J&J Snack Foods’s results here.

Hershey (NYSE:HSY)

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

Hershey reported revenues of $2.99 billion, down 1.4% year on year. This result came in 2.8% below analysts' expectations. It was a softer quarter as it also produced a miss of analysts’ EPS and organic revenue estimates.

The stock is up 1.8% since reporting and currently trades at $179.98.

Read our full, actionable report on Hershey here, it’s free.

Post (NYSE:POST)

Founded in 1895, Post (NYSE:POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Post reported revenues of $2.01 billion, up 3.3% year on year. This print topped analysts’ expectations by 2.2%. It was a strong quarter as it also put up an impressive beat of analysts’ EPS estimates and a decent beat of analysts’ adjusted operating income estimates.

The stock is up 10.8% since reporting and currently trades at $119.50.

Read our full, actionable report on Post here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.