Old Dominion Freight Line has been treading water for the past six months, recording a small return of 4.5% while holding steady at $184. This is close to the S&P 500’s 9.2% gain during that period.

Is there a buying opportunity in Old Dominion Freight Line, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're cautious about Old Dominion Freight Line. Here are three reasons why ODFL doesn't excite us and a stock we'd rather own.

Why Is Old Dominion Freight Line Not Exciting?

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ:ODFL) delivers less-than-truckload (LTL) and full-container load freight.

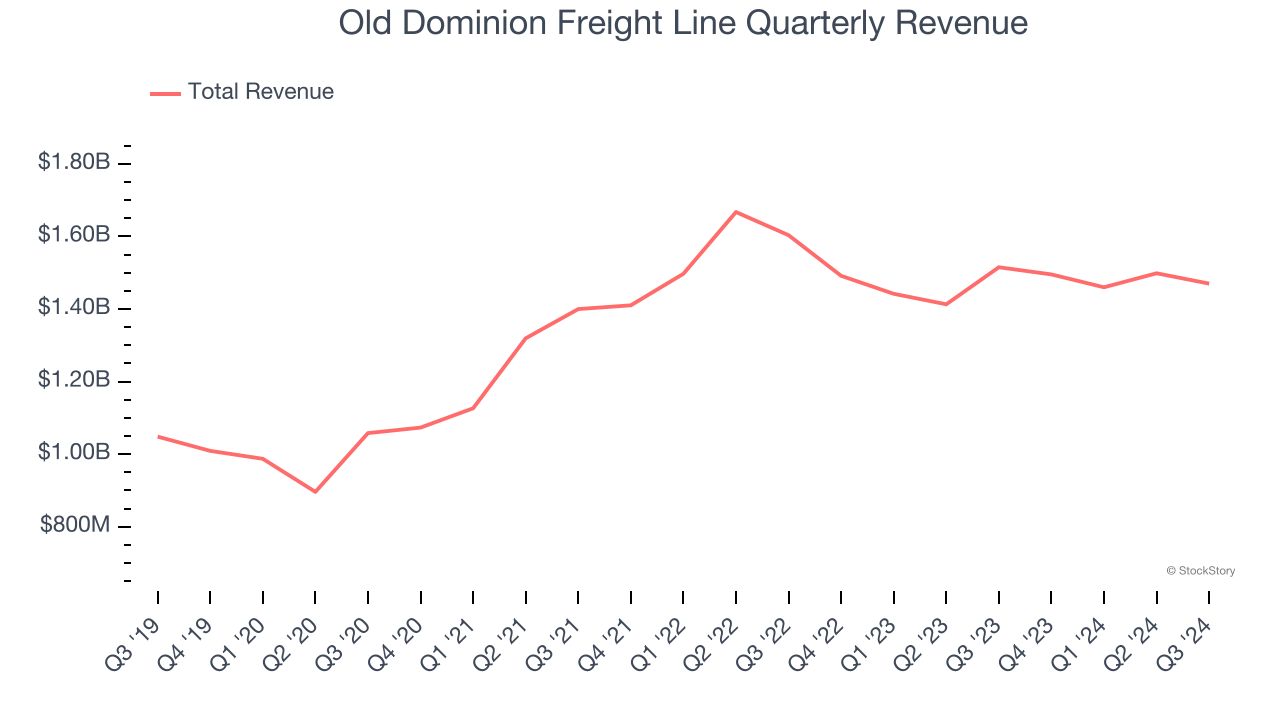

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Old Dominion Freight Line’s 7.5% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector.

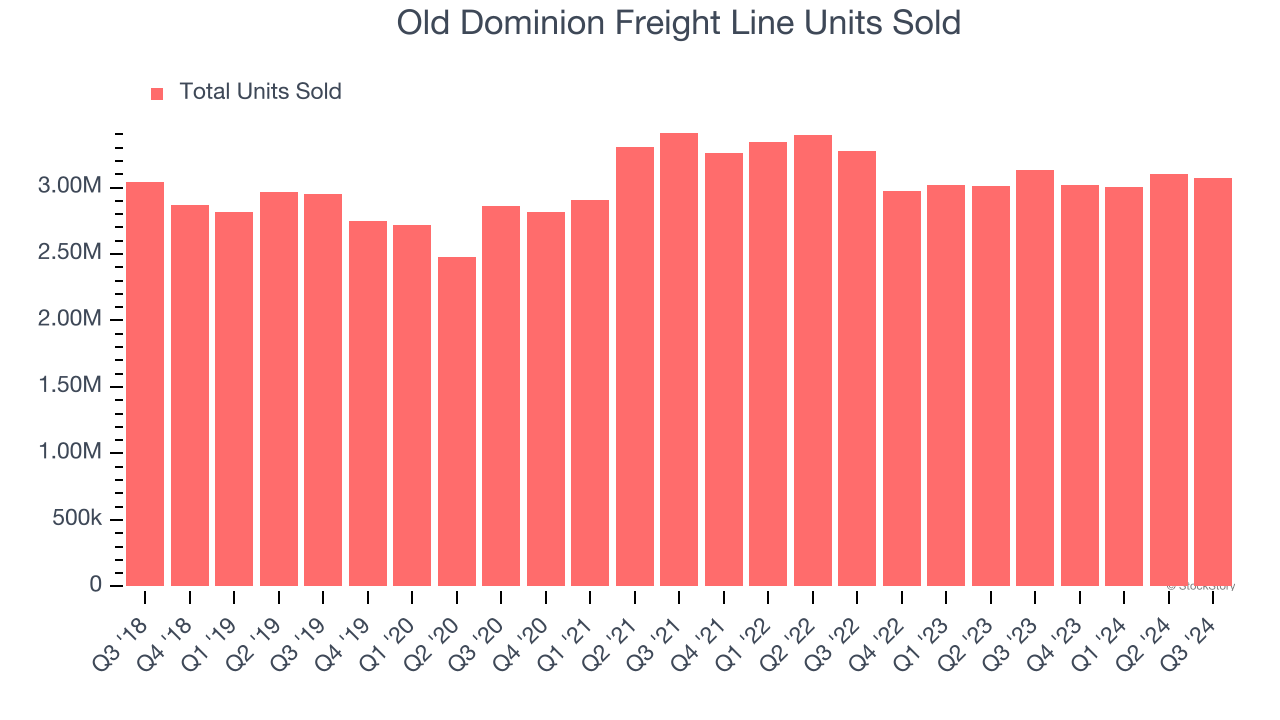

2. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Ground Transportation company because there’s a ceiling to what customers will pay.

Old Dominion Freight Line’s units sold came in at 3.07 million in the latest quarter, and they averaged 4% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Old Dominion Freight Line might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

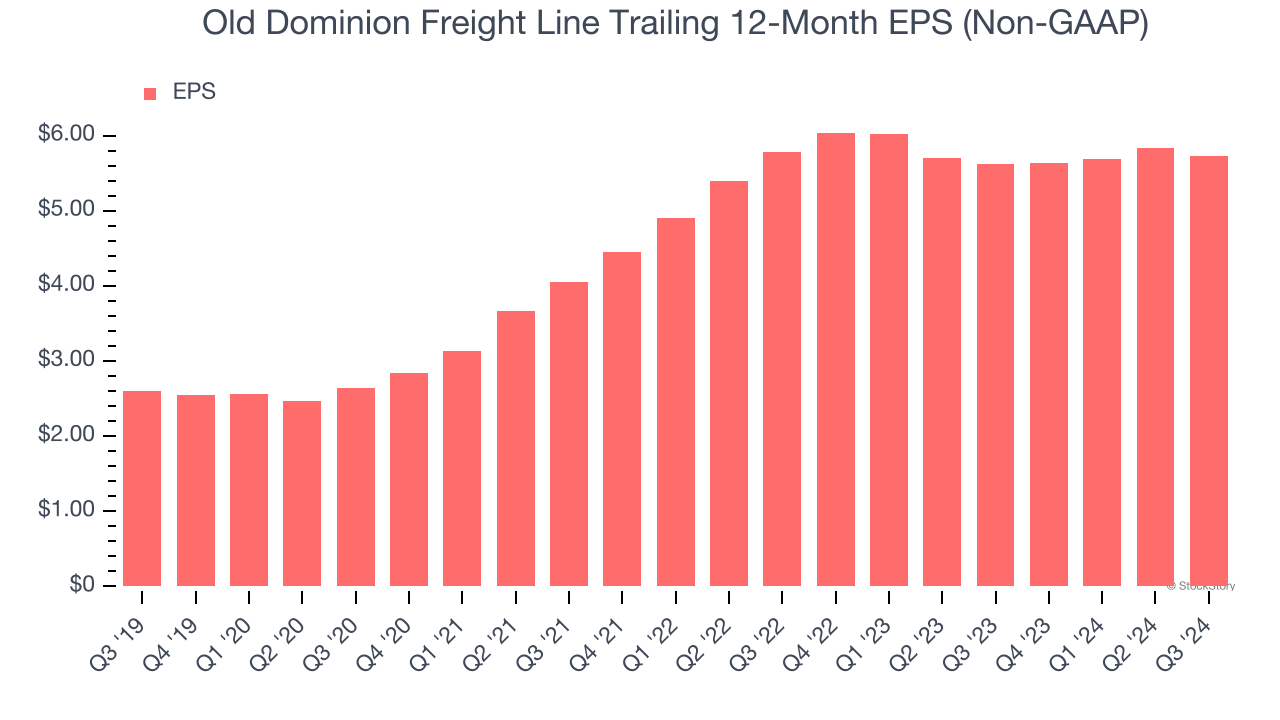

3. EPS Growth Has Stalled Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Old Dominion Freight Line’s flat EPS over the last two years was weak. On the bright side, this performance was better than its 2.1% annualized revenue declines.

Final Judgment

Old Dominion Freight Line isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 30.7× forward price-to-earnings (or $184 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at Uber, whose profitability just reached an inflection point.

Stocks We Like More Than Old Dominion Freight Line

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.