IDEX has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 5.8% to $215 per share while the index has gained 6.1%.

Is there a buying opportunity in IDEX, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're sitting this one out for now. Here are three reasons why we avoid IEX and a stock we'd rather own.

Why Do We Think IDEX Will Underperform?

Founded in 1988, IDEX (NYSE:IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

1. Core Business Falling Behind as Demand Plateaus

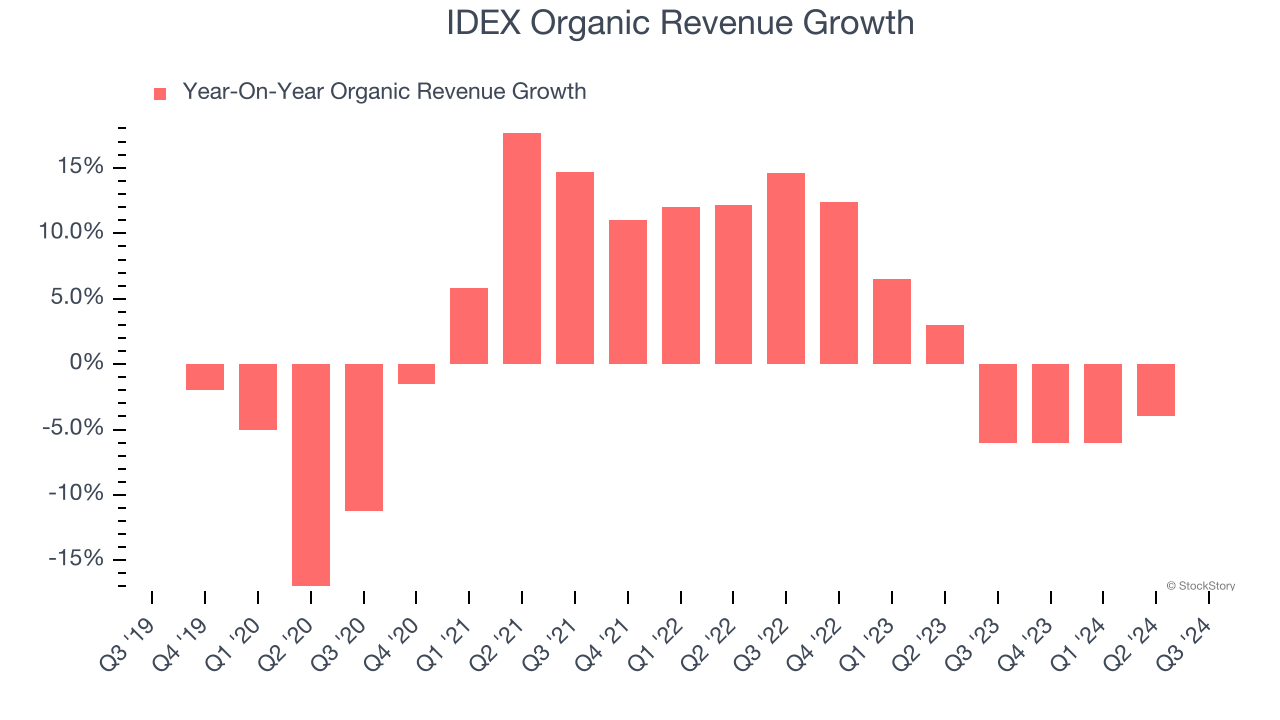

In addition to reported revenue, organic revenue is a useful data point for analyzing Gas and Liquid Handling companies. This metric gives visibility into IDEX’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, IDEX failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests IDEX might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Barely Growing

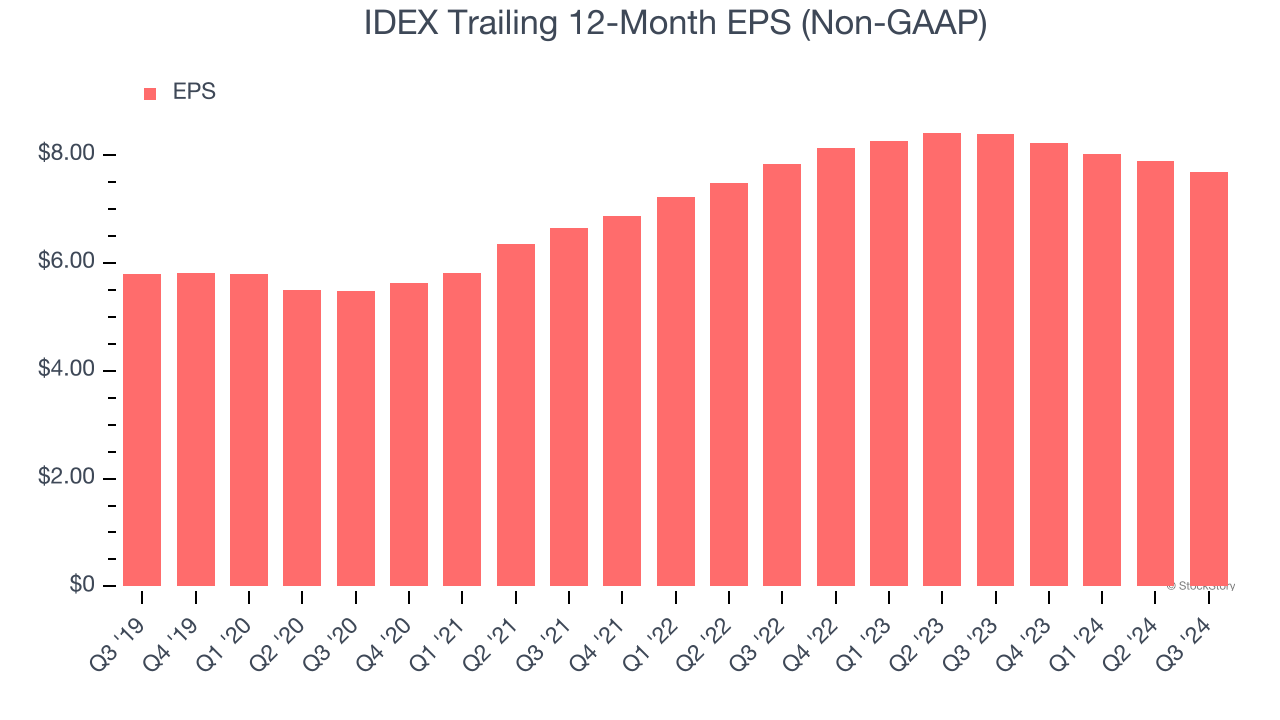

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

IDEX’s unimpressive 5.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

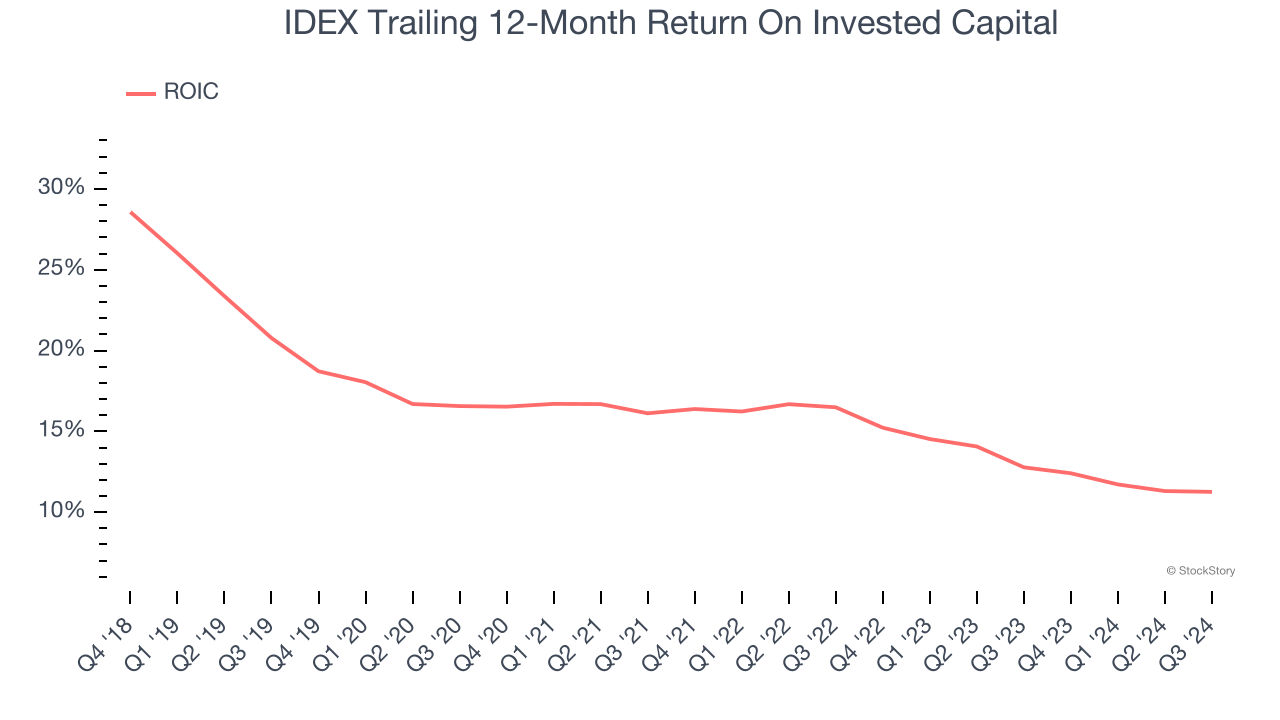

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, IDEX’s ROIC averaged 4.3 percentage point decreases over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

IDEX doesn’t pass our quality test. That said, the stock currently trades at 25× forward price-to-earnings (or $215 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than IDEX

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.