Over the past six months, Oshkosh’s shares (currently trading at $99.33) have posted a disappointing 6.5% loss, well below the S&P 500’s 10.6% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Oshkosh, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the more favorable entry price, we don't have much confidence in Oshkosh. Here are three reasons why there are better opportunities than OSK and a stock we'd rather own.

Why Is Oshkosh Not Exciting?

Oshkosh (NYSE:OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

1. Long-Term Revenue Growth Disappoints

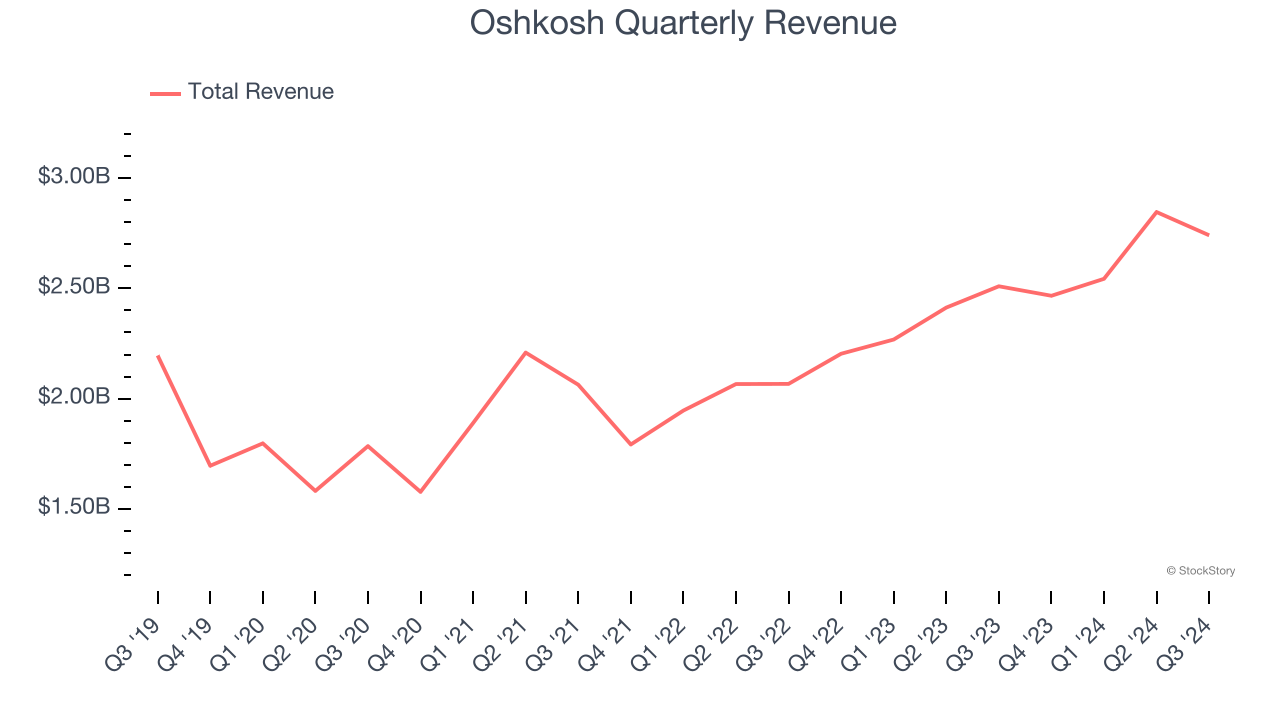

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Oshkosh’s 4.2% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector.

2. Low Gross Margin Reveals Weak Structural Profitability

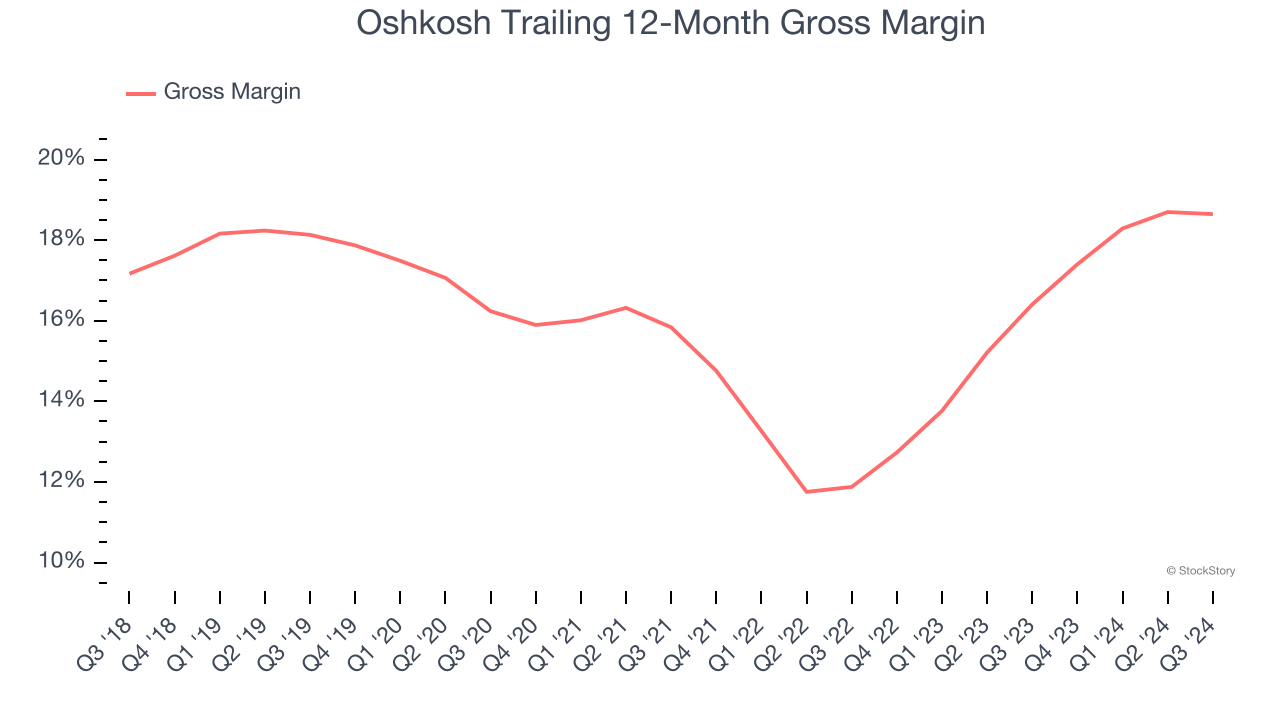

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Oshkosh has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 16% gross margin over the last five years. That means Oshkosh paid its suppliers a lot of money ($84.00 for every $100 in revenue) to run its business.

3. Free Cash Flow Margin Dropping

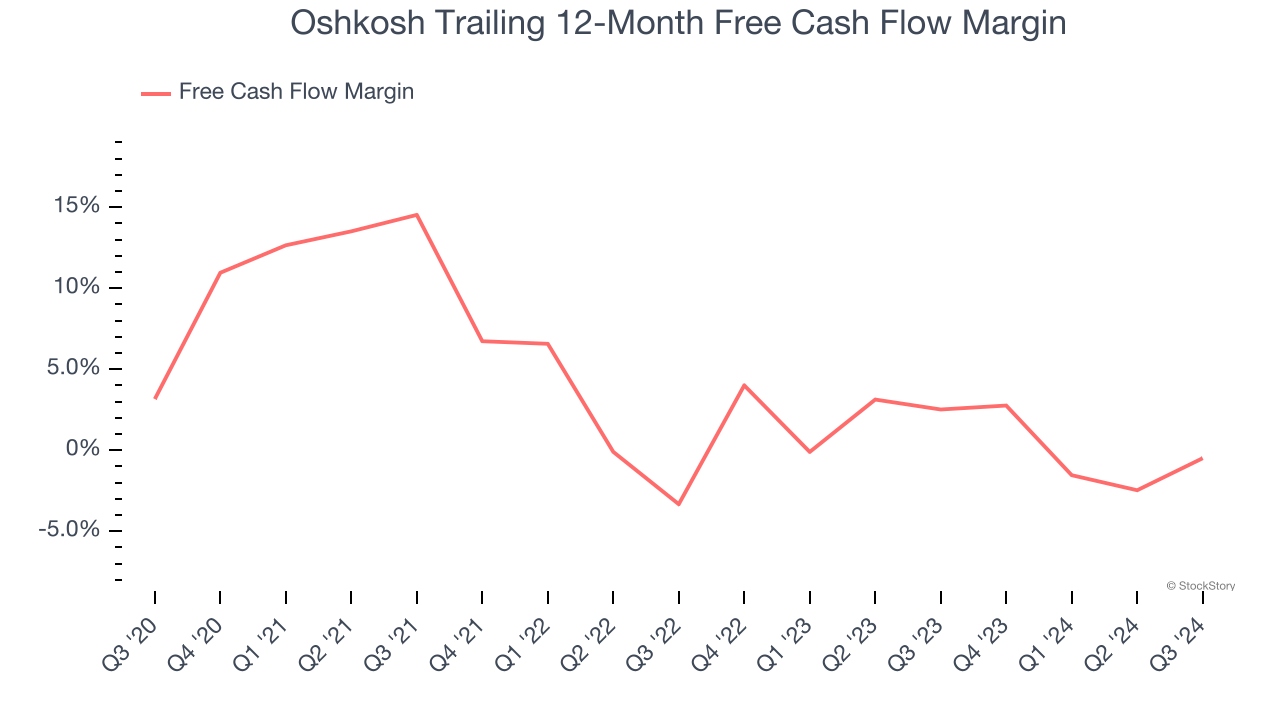

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Oshkosh’s margin dropped by 3.7 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Oshkosh’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Oshkosh isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 9× forward price-to-earnings (or $99.33 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. We’d recommend looking at MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than Oshkosh

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.