Over the past six months, Asure has been a great trade, beating the S&P 500 by 20.3%. Its stock price has climbed to $9.96, representing a healthy 30.7% increase. This performance may have investors wondering how to approach the situation.

Is now the time to buy Asure, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on Asure for now. Here are three reasons why you should be careful with ASUR and a stock we'd rather own.

Why Do We Think Asure Will Underperform?

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

1. Declining Billings Reflect Product and Sales Weakness

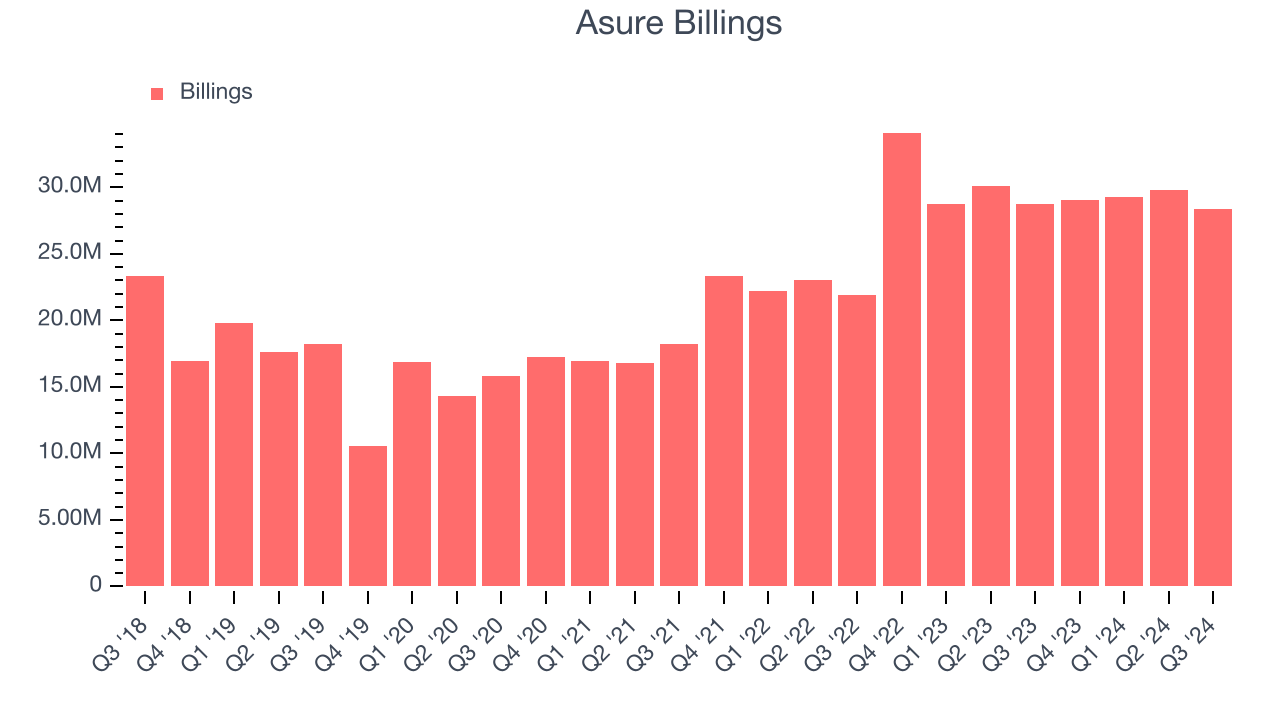

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Asure’s billings came in at $28.36 million in Q3, and it averaged 3.8% year-on-year declines over the last four quarters. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

2. Operating Margin Falling

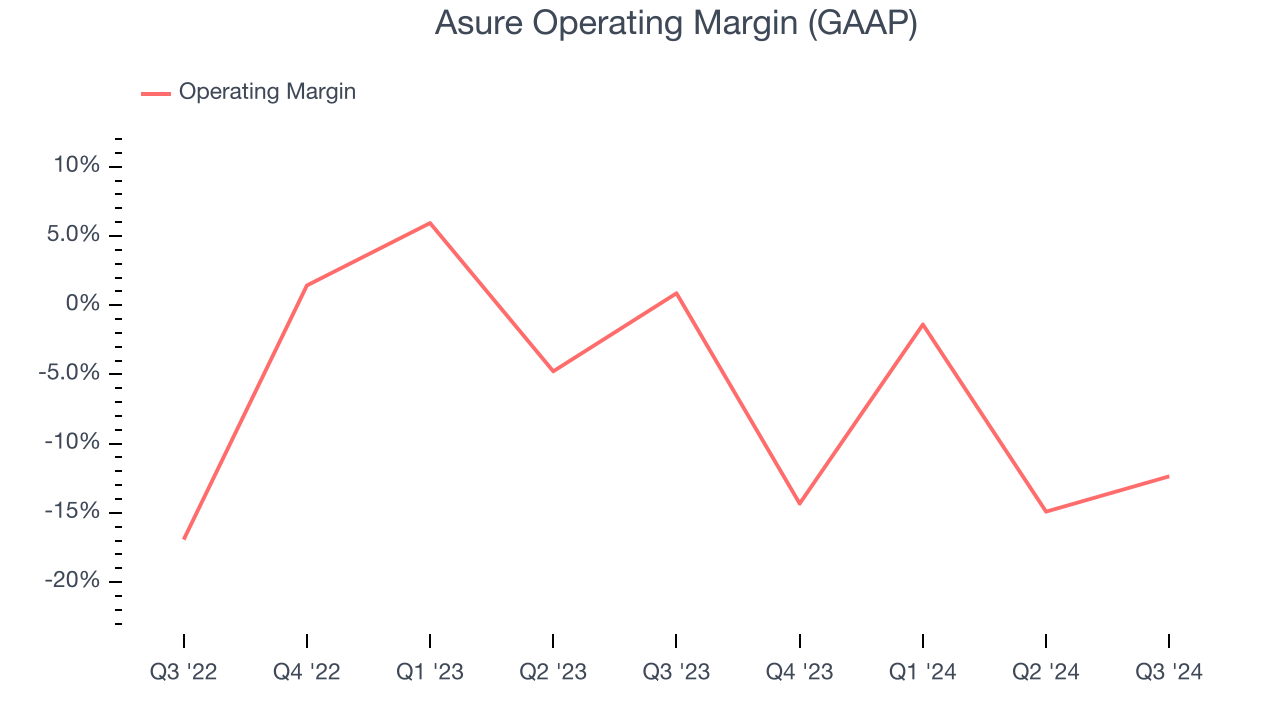

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Asure’s operating margin decreased by 11.4 percentage points over the last year. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its operating margin for the trailing 12 months was negative 10.4%.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

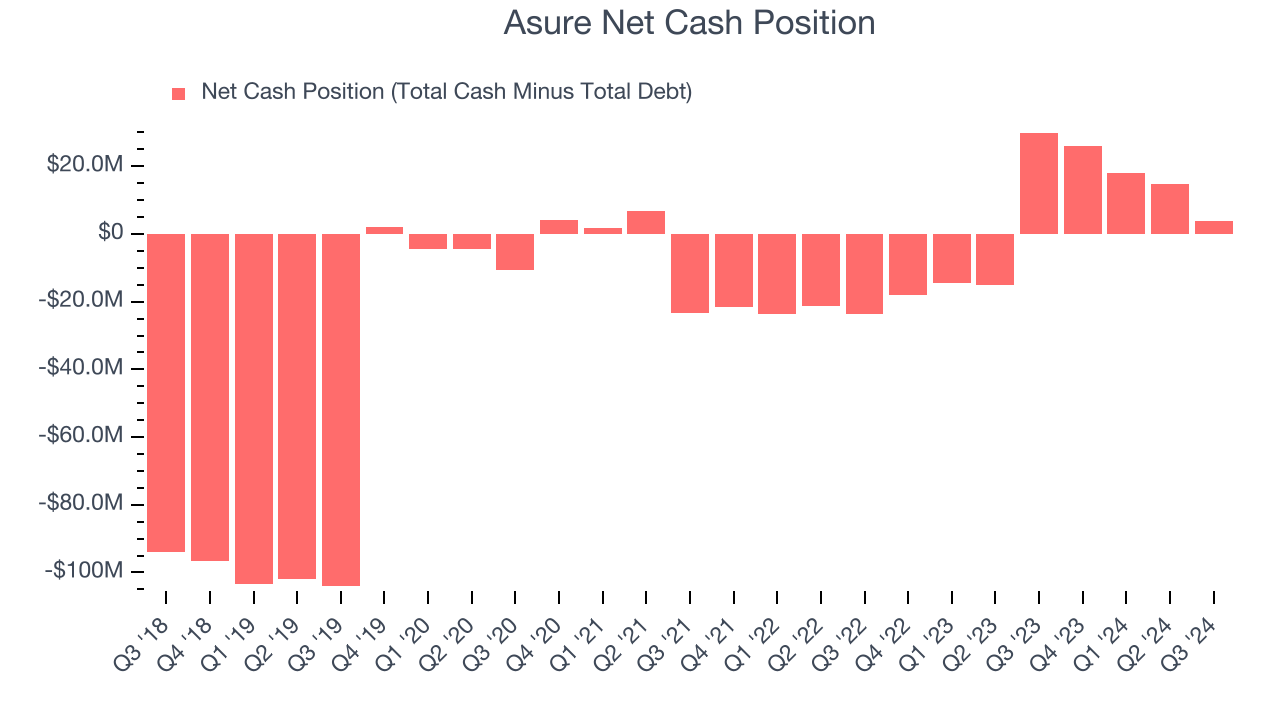

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Asure burned through $3.77 million of cash over the last year. With $11.25 million of cash and $7.51 million of debt on its balance sheet, the company has around 12 months of runway left.

Unless the Asure’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Asure until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We see the value of companies addressing major business pain points, but in the case of Asure, we’re out. With its shares topping the market in recent months, the stock trades at 1.9× forward price-to-sales (or $9.96 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now. Let us point you toward ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Would Buy Instead of Asure

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.