CECO currently trades at $31 and has been a dream stock for shareholders. It’s returned 282% since December 2019, more tripling the S&P 500’s 91.2% gain. The company has also beaten the index over the past six months as its stock price is up 28.6%.

Is it too late to buy CECO? Find out in our full research report, it’s free.

Why Is CECO Not Exciting?

Started in a Cincinnati garage, CECO (NASDAQ:CECO) is a global provider of industrial air quality and fluid handling systems.

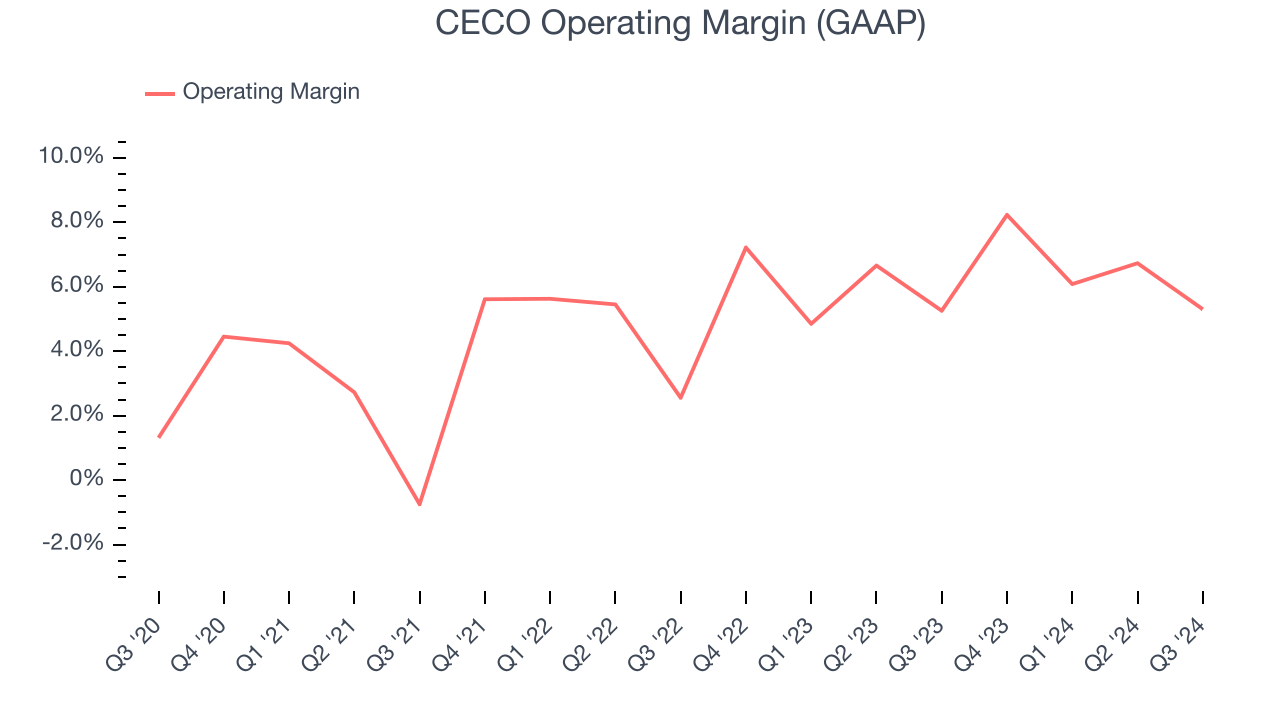

1. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

CECO was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business.

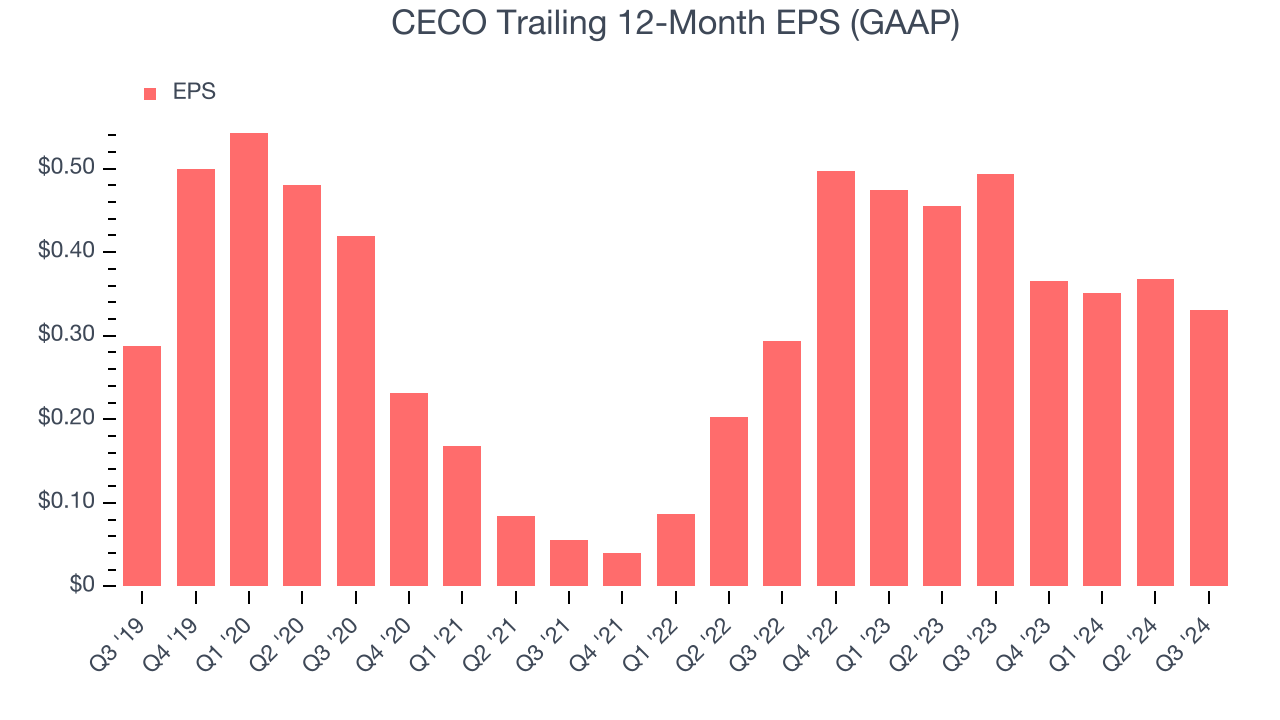

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CECO’s EPS grew at a weak 2.8% compounded annual growth rate over the last five years, lower than its 9.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

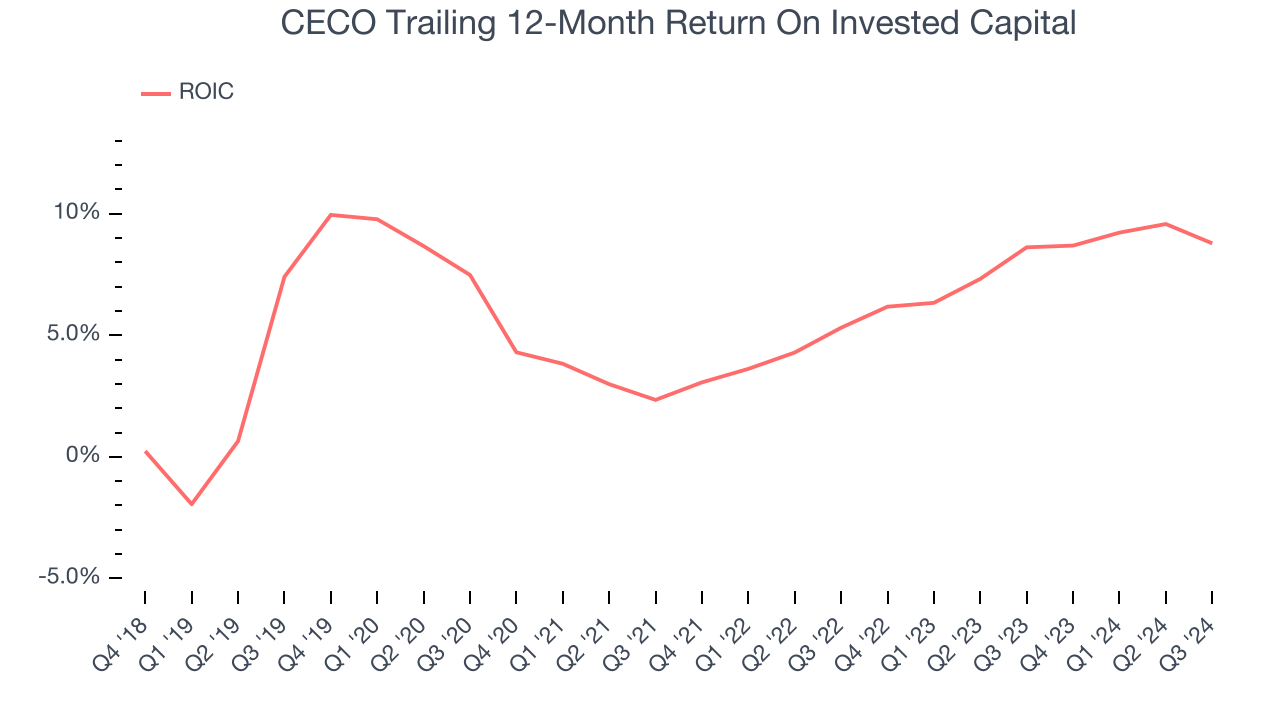

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although CECO has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

, and with its shares beating the market recently, the stock trades at 19× forward EV-to-EBITDA (or $31 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than CECO

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.