Over the past six months, Molson Coors has been a great trade, beating the S&P 500 by 9.3%. Its stock price has climbed to $60.94, representing a healthy 21.2% increase. This performance may have investors wondering how to approach the situation.

Is now the time to buy Molson Coors, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we're cautious about Molson Coors. Here are three reasons why we avoid TAP and a stock we'd rather own.

Why Is Molson Coors Not Exciting?

Sporting an impressive roster of iconic beer brands, Molson Coors (NYSE:TAP) is a global brewing giant with a rich history dating back more than two centuries.

1. Sales Volumes Stall, Demand Waning

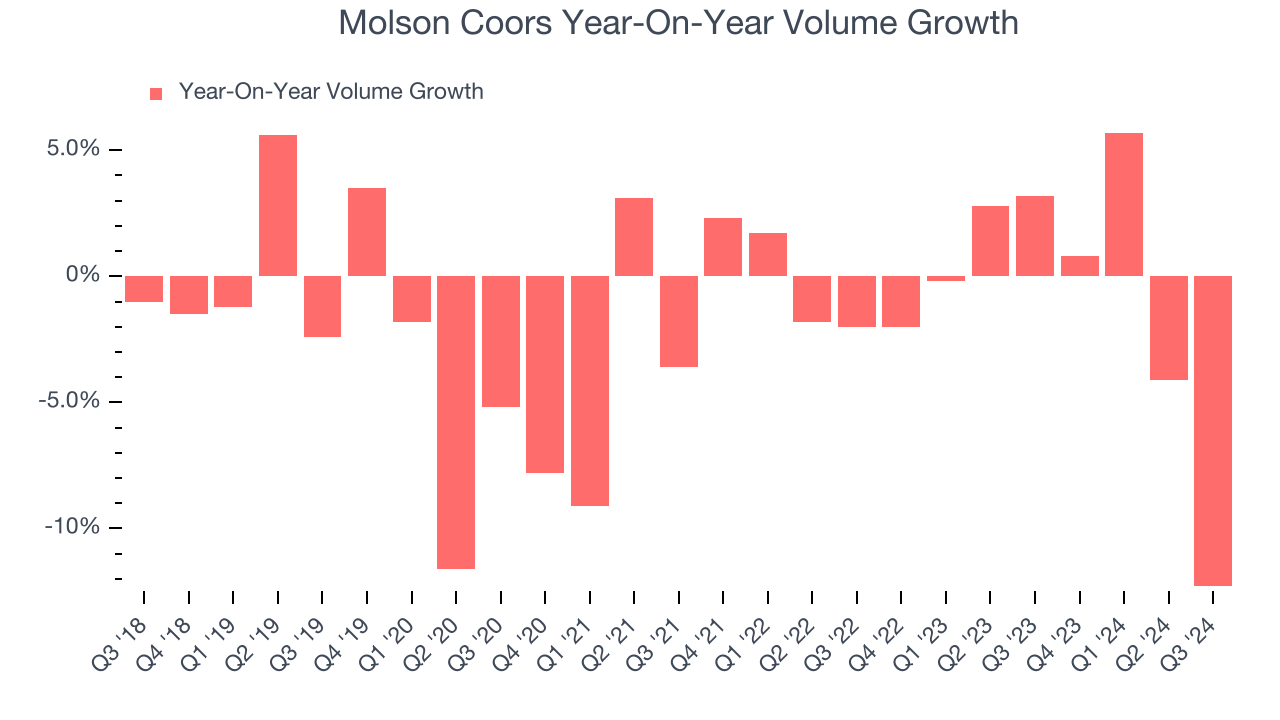

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Molson Coors’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

2. Free Cash Flow Margin Dropping

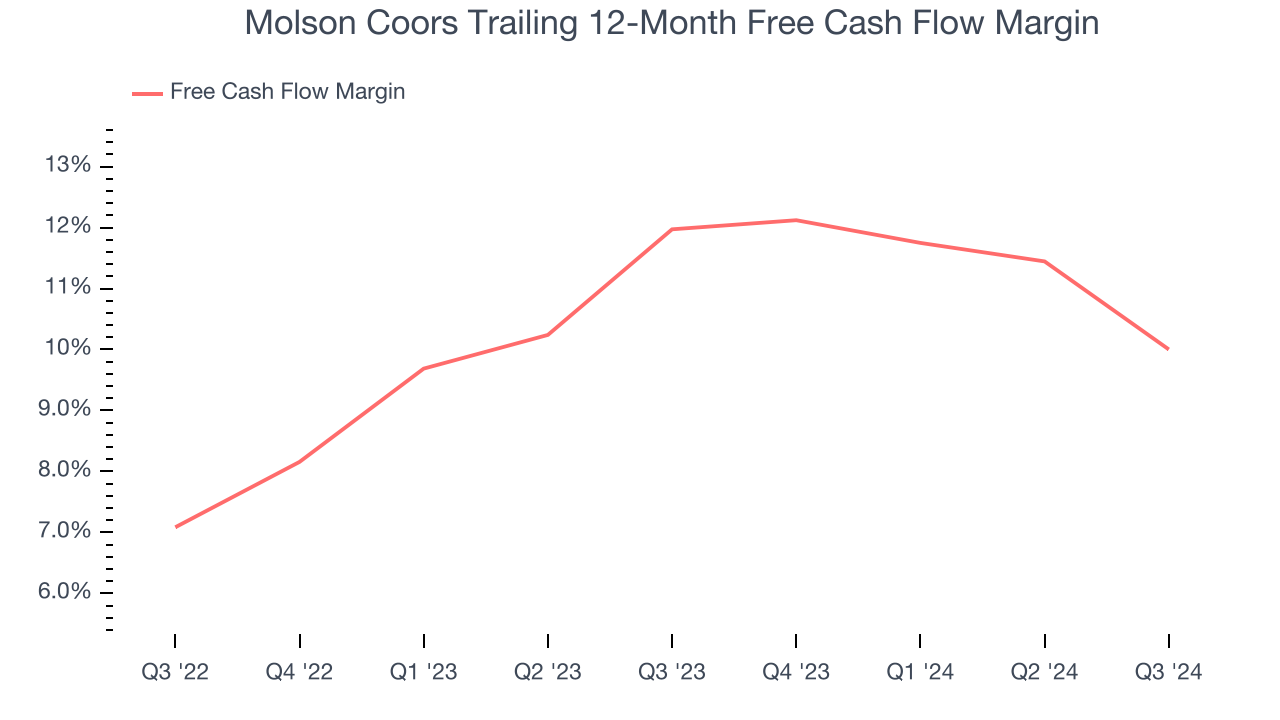

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Molson Coors’s margin dropped by 2 percentage points over the last year. If its declines continue, it could signal higher capital intensity. Molson Coors’s free cash flow margin for the trailing 12 months was 10%.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Molson Coors historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.2%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

Molson Coors isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 6.3× forward EV-to-EBITDA (or $60.94 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Molson Coors

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.