Luxury fashion conglomerate Tapestry (NYSE:TPR) reported Q3 CY2024 results topping the market’s revenue expectations, but sales were flat year on year at $1.51 billion. The company expects the full year’s revenue to be around $6.75 billion, close to analysts’ estimates. Its GAAP profit of $0.79 per share was 9.7% below analysts’ consensus estimates.

Is now the time to buy Tapestry? Find out by accessing our full research report, it’s free.

Tapestry (TPR) Q3 CY2024 Highlights:

- Revenue: $1.51 billion vs analyst estimates of $1.47 billion (2.4% beat)

- EPS: $0.79 vs analyst expectations of $0.88 (9.7% miss)

- EBITDA: $292.9 million vs analyst estimates of $309.8 million (5.4% miss)

- The company slightly lifted its revenue guidance for the full year to $6.75 billion at the midpoint from $6.7 billion

- EPS (GAAP) guidance for the full year is $4.53 at the midpoint, beating analyst estimates by 9.6%

- Gross Margin (GAAP): 75.3%, up from 72.5% in the same quarter last year

- Operating Margin: 16.7%, in line with the same quarter last year

- EBITDA Margin: 19.4%, down from 21% in the same quarter last year

- Free Cash Flow Margin: 6.2%, up from 3.6% in the same quarter last year

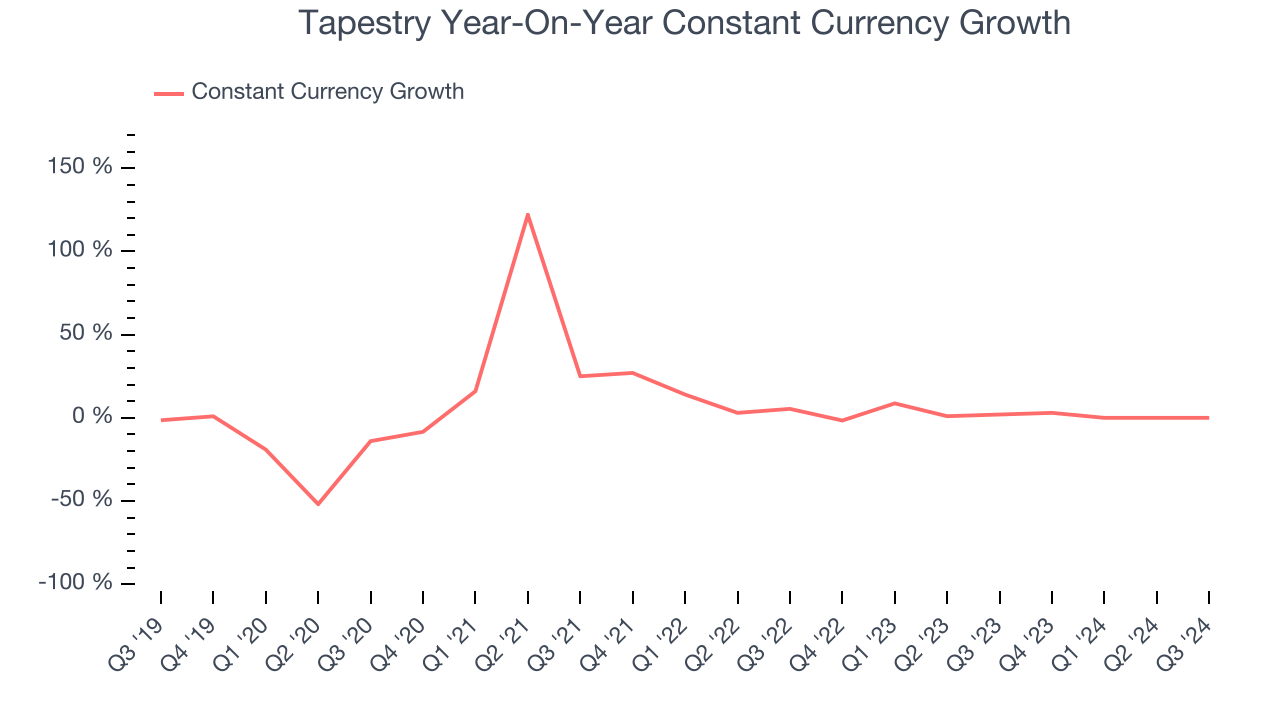

- Constant Currency Revenue was flat year on year (2% in the same quarter last year)

- Market Capitalization: $11.58 billion

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, “Our first quarter results outperformed expectations, showcasing the brand magic and operational excellence that fuel our strategic growth agenda. Our talented global teams fostered consumer connections through innovative products, experiences, and storytelling, while managing our business with focus and discipline against a dynamic backdrop. We remain in a position of strength, with distinctive brands, an agile platform, and robust cash flow that provide us with strategic and financial flexibility to deliver accelerated organic growth and enhanced value creation in FY25 and for years to come.”

Company Overview

Originally founded as Coach, Tapestry (NYSE:TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

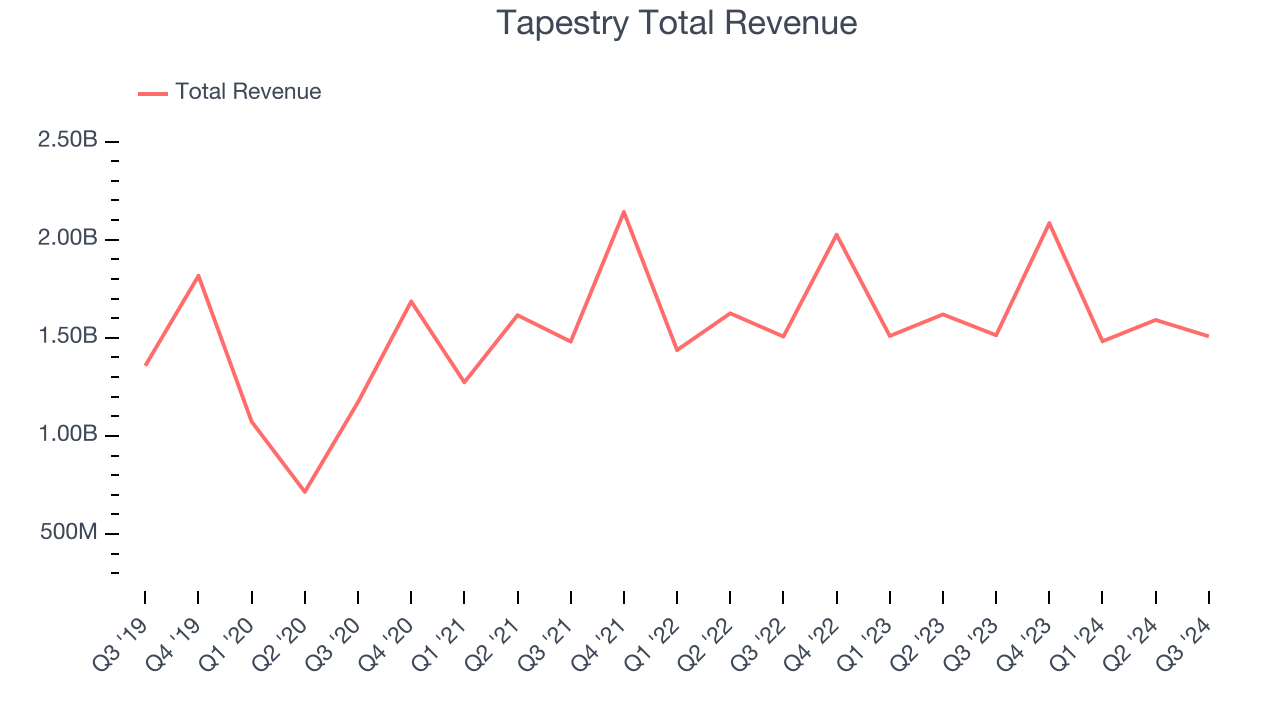

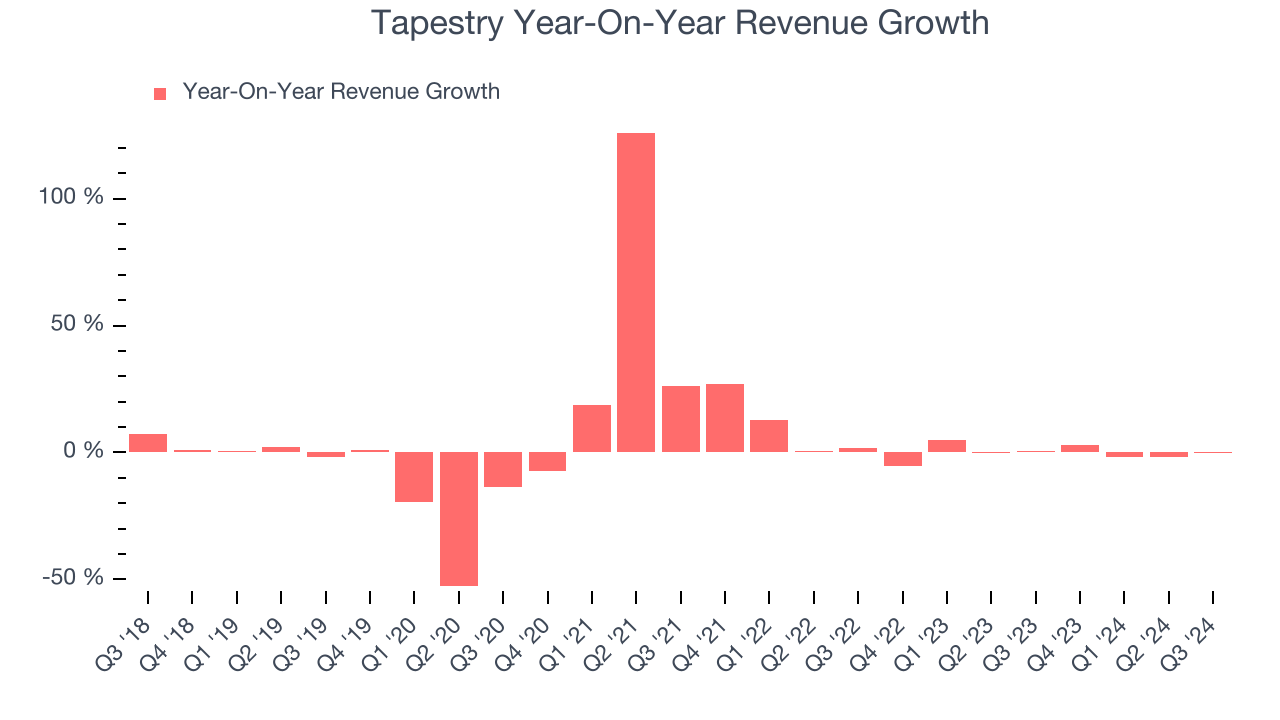

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Tapestry’s sales grew at a weak 2.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Tapestry’s recent history shows its demand slowed as its revenue was flat over the last two years.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 1.6% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Tapestry.

This quarter, Tapestry’s $1.51 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.4%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

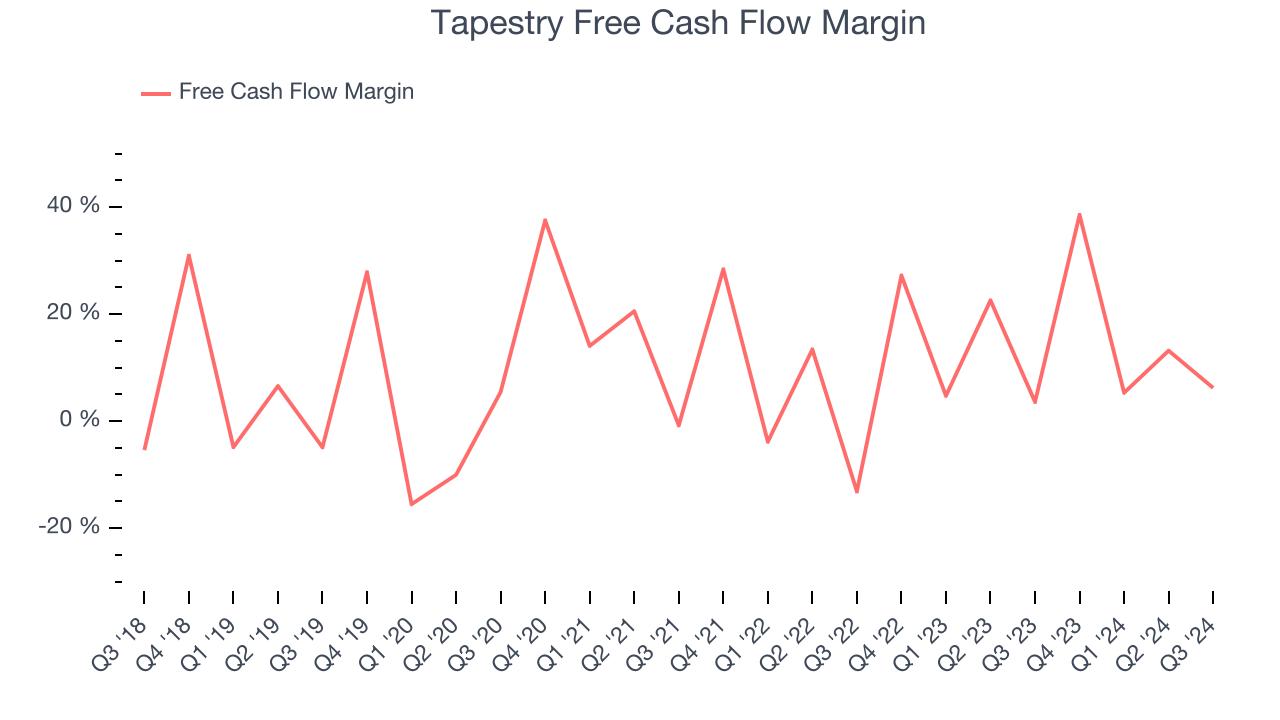

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Tapestry has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.7% over the last two years, quite impressive for a consumer discretionary business.

Tapestry’s free cash flow clocked in at $93.9 million in Q3, equivalent to a 6.2% margin. This result was good as its margin was 2.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Key Takeaways from Tapestry’s Q3 Results

It was great to see Tapestry lift its full-year revenue and EPS forecast. We were also glad its constant currency revenue outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 5.1% to $52.30 immediately following the results.

So do we think Tapestry is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.