Timeshare vacation company Hilton Grand Vacations (NYSE:HGV) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 28.3% year on year to $1.31 billion. Its GAAP profit of $0.28 per share was 60.2% below analysts’ consensus estimates.

Is now the time to buy Hilton Grand Vacations? Find out by accessing our full research report, it’s free.

Hilton Grand Vacations (HGV) Q3 CY2024 Highlights:

- Revenue: $1.31 billion vs analyst estimates of $1.29 billion (1.1% beat)

- EPS: $0.28 vs analyst estimates of $0.70 (-$0.42 miss)

- EBITDA: $307 million vs analyst estimates of $283.2 million (8.4% beat)

- Gross Margin (GAAP): 41%, up from 37.5% in the same quarter last year

- Operating Margin: 37.7%, up from 17.7% in the same quarter last year

- EBITDA Margin: 23.5%, down from 26.4% in the same quarter last year

- Free Cash Flow Margin: 4.5%, down from 25.2% in the same quarter last year

- Members: 722,000, up 196,085 year on year

- Market Capitalization: $4.08 billion

“We’re pleased with our third quarter results, which were in line with our expectations,” said Mark Wang, CEO of Hilton Grand Vacations.

Company Overview

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

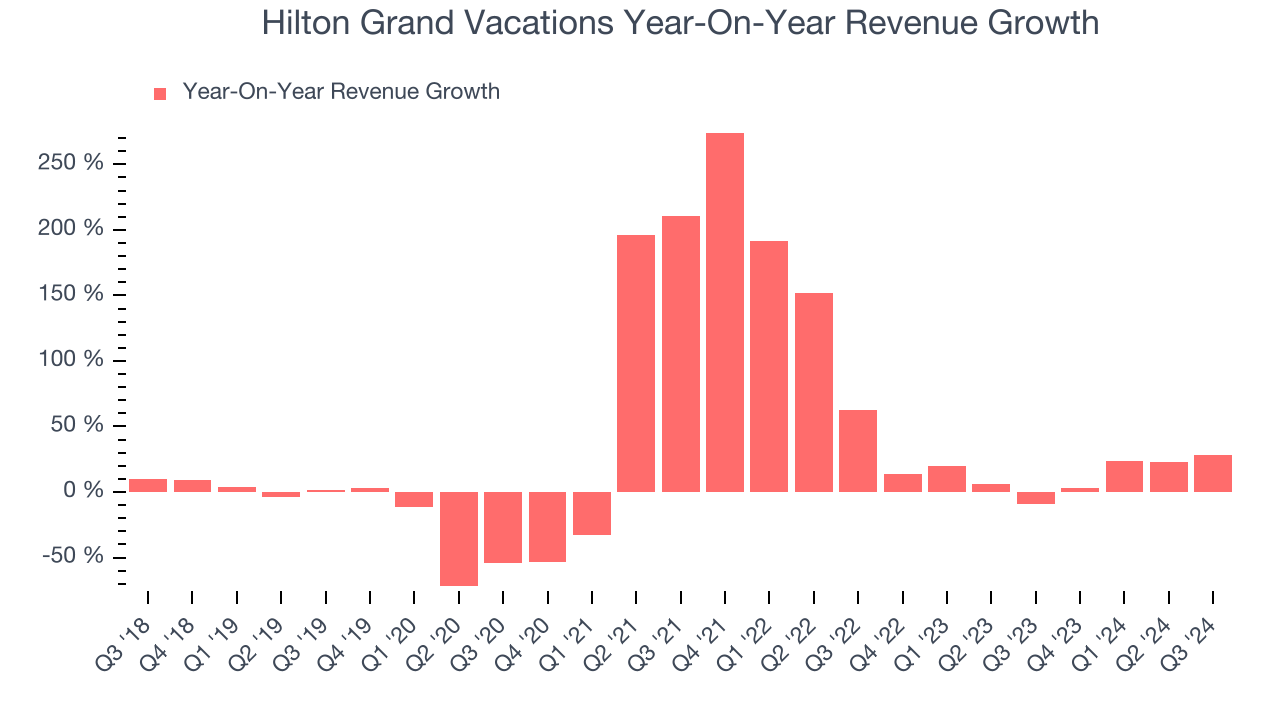

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Hilton Grand Vacations’s 20.3% annualized revenue growth over the last five years was solid. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Hilton Grand Vacations’s recent history shows its demand slowed as its annualized revenue growth of 12.7% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of members, which reached 722,000 in the latest quarter. Over the last two years, Hilton Grand Vacations’s members averaged 16% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Hilton Grand Vacations reported robust year-on-year revenue growth of 28.3%, and its $1.31 billion of revenue topped Wall Street estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 10.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates the market believes its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

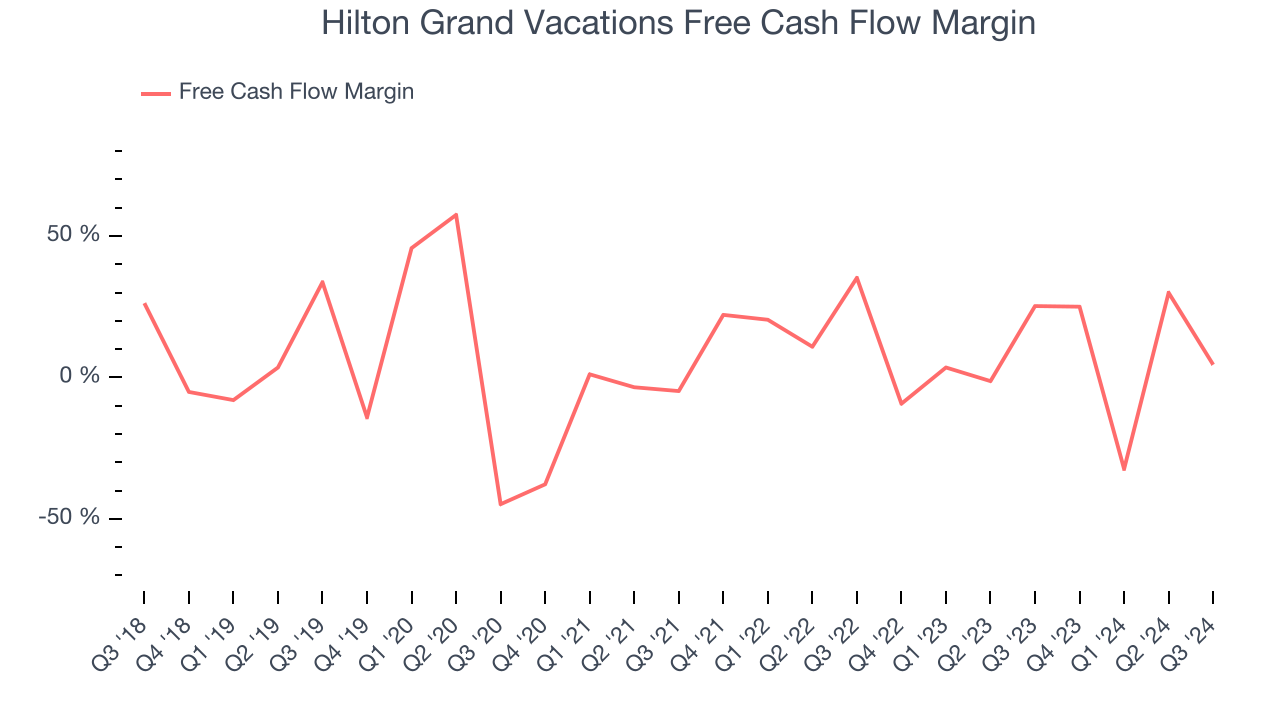

Hilton Grand Vacations has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.7%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Hilton Grand Vacations to make large cash investments in working capital and capital expenditures.

Hilton Grand Vacations’s free cash flow clocked in at $59 million in Q3, equivalent to a 4.5% margin. The company’s cash profitability regressed as it was 20.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Hilton Grand Vacations’s Q3 Results

It was good to see Hilton Grand Vacations beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock traded down 2.9% to $39 immediately following the results.

Hilton Grand Vacations’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.