Luxury hotels and casino operator Wynn Resorts (NASDAQ:WYNN) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.3% year on year to $1.69 billion. Its non-GAAP profit of $0.90 per share was also 17.9% below analysts’ consensus estimates.

Is now the time to buy Wynn Resorts? Find out by accessing our full research report, it’s free.

Wynn Resorts (WYNN) Q3 CY2024 Highlights:

- Revenue: $1.69 billion vs analyst estimates of $1.73 billion (2% miss)

- Adjusted EPS: $0.90 vs analyst expectations of $1.10 (17.9% miss)

- EBITDA: $290.8 million vs analyst estimates of $552.9 million (47.4% miss)

- Gross Margin (GAAP): 42.3%, down from 67.5% in the same quarter last year

- Operating Margin: 7.9%, up from 3.7% in the same quarter last year

- EBITDA Margin: 17.2%, down from 26.5% in the same quarter last year

- Market Capitalization: $10.53 billion

Company Overview

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ:WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

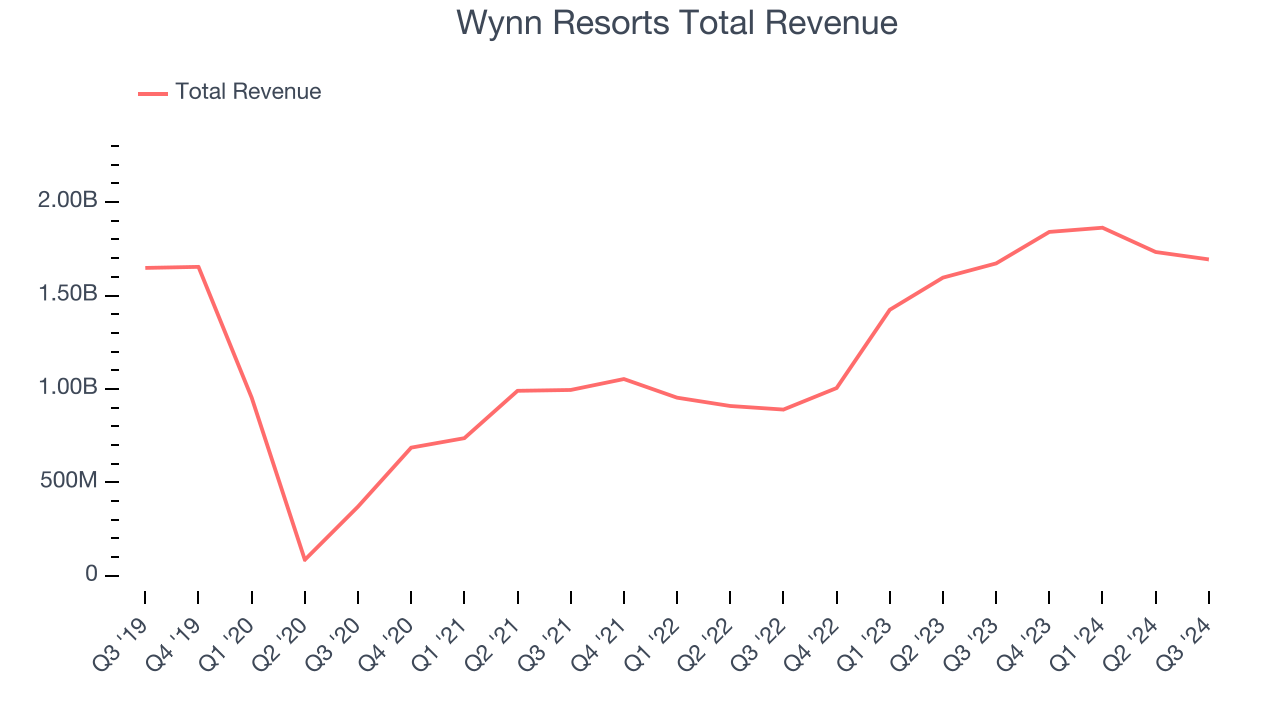

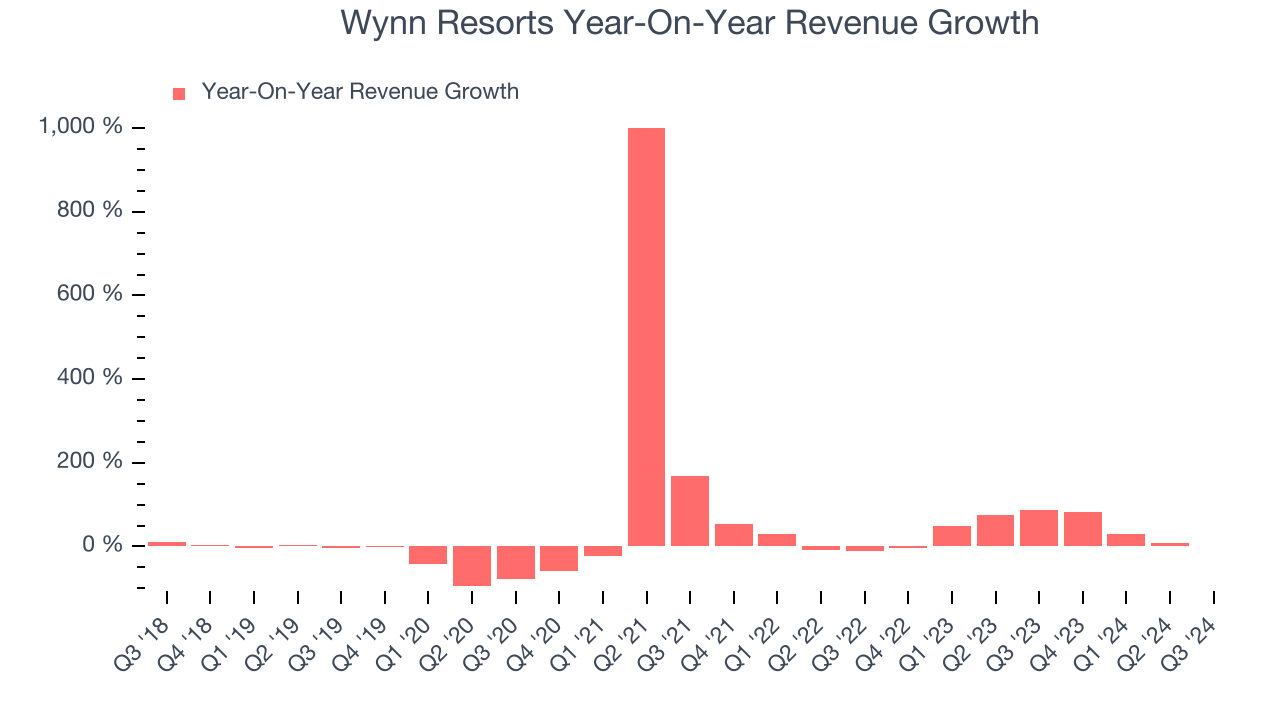

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Wynn Resorts grew its sales at a weak 1.4% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Wynn Resorts’s annualized revenue growth of 36.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Wynn Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Casino, Hotel, and Dining and Entertainment, which are 60.2%, 16.8%, and 15.5% of revenue. Over the last two years, Wynn Resorts’s revenues in all three segments increased. Its Casino revenue (Poker, slots) averaged year-on-year growth of 72% while its Hotel (overnight bookings) and Dining and Entertainment (food, beverage, Wynn Interactive) revenues averaged 29.4% and 9.3%.

This quarter, Wynn Resorts’s revenue grew 1.3% year on year to $1.69 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

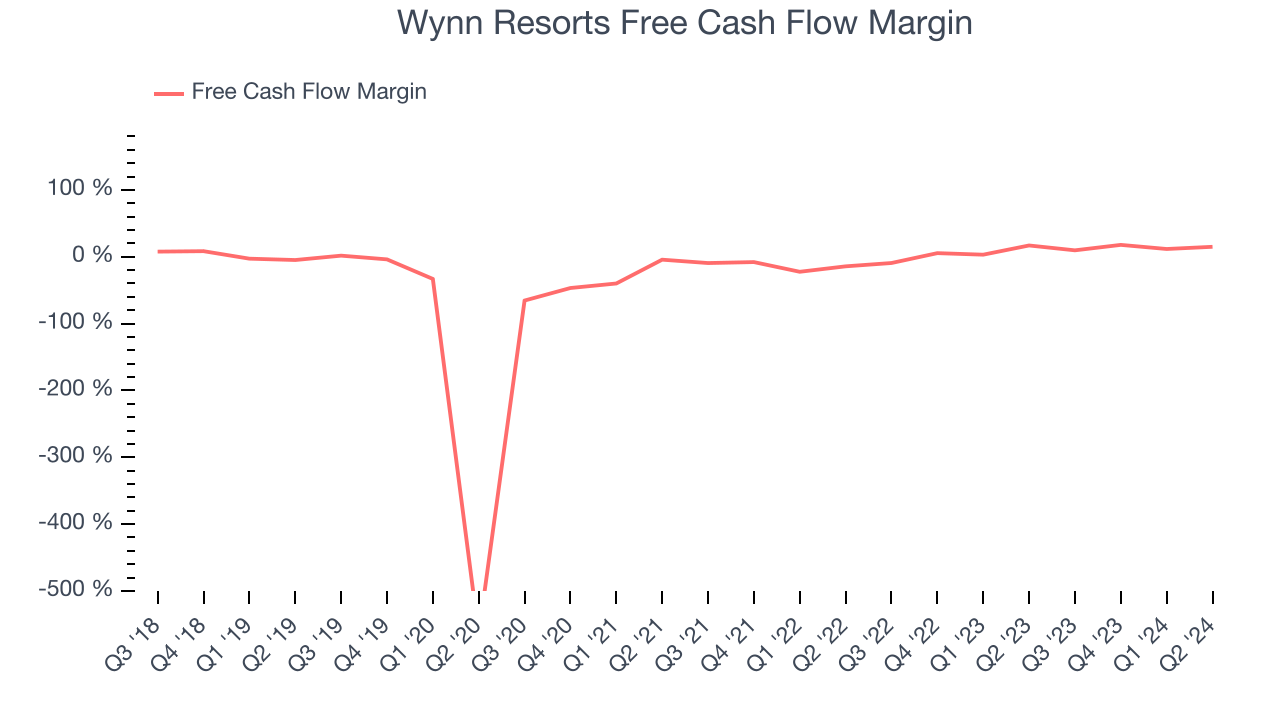

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Wynn Resorts has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12% over the last two years, slightly better than the broader consumer discretionary sector.

Key Takeaways from Wynn Resorts’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.2% to $93.61 immediately following the results.

The latest quarter from Wynn Resorts’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.