Broadband and telecommunications services provider WideOpenWest (NYSE:WOW) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 8.7% year on year to $158 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $631 million at the midpoint. Its GAAP loss of $0.27 per share was 162% below analysts’ consensus estimates.

Is now the time to buy WideOpenWest? Find out by accessing our full research report, it’s free.

WideOpenWest (WOW) Q3 CY2024 Highlights:

- Revenue: $158 million vs analyst estimates of $157.5 million (in line)

- EPS: -$0.27 vs analyst estimates of -$0.10 (-$0.17 miss)

- EBITDA: $77.3 million vs analyst estimates of $69.4 million (11.4% beat)

- EBITDA guidance for the full year is $286 million at the midpoint, above analyst estimates of $275.7 million

- Gross Margin (GAAP): 60.4%, up from 56.3% in the same quarter last year

- Operating Margin: 1.5%, up from -70% in the same quarter last year

- EBITDA Margin: 48.9%, up from -41.4% in the same quarter last year

- Free Cash Flow was $5.7 million, up from -$15.3 million in the same quarter last year

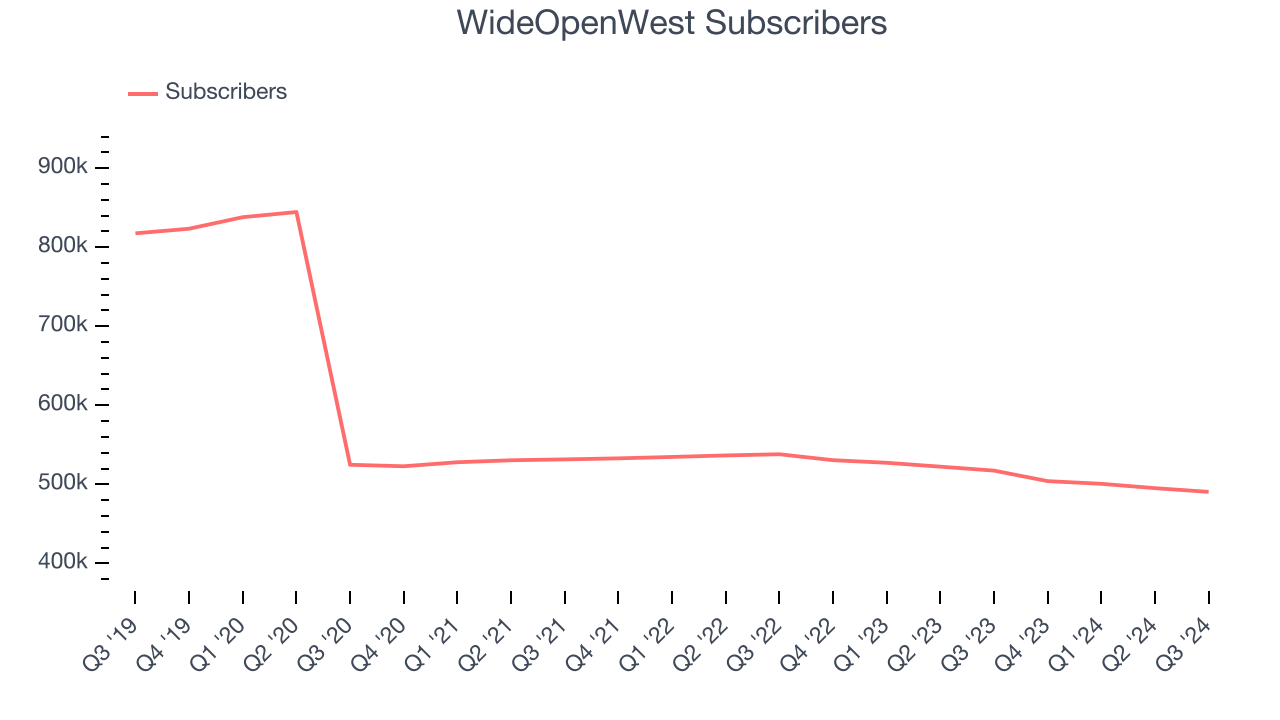

- Subscribers: 490,500, down 26,900 year on year

- Market Capitalization: $423.7 million

"During the third quarter we demonstrated the strength of our strategy in our expansion markets where we increased penetration rates to higher levels and grew ARPU," said Teresa Elder, WOW!'s CEO.

Company Overview

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Sales Growth

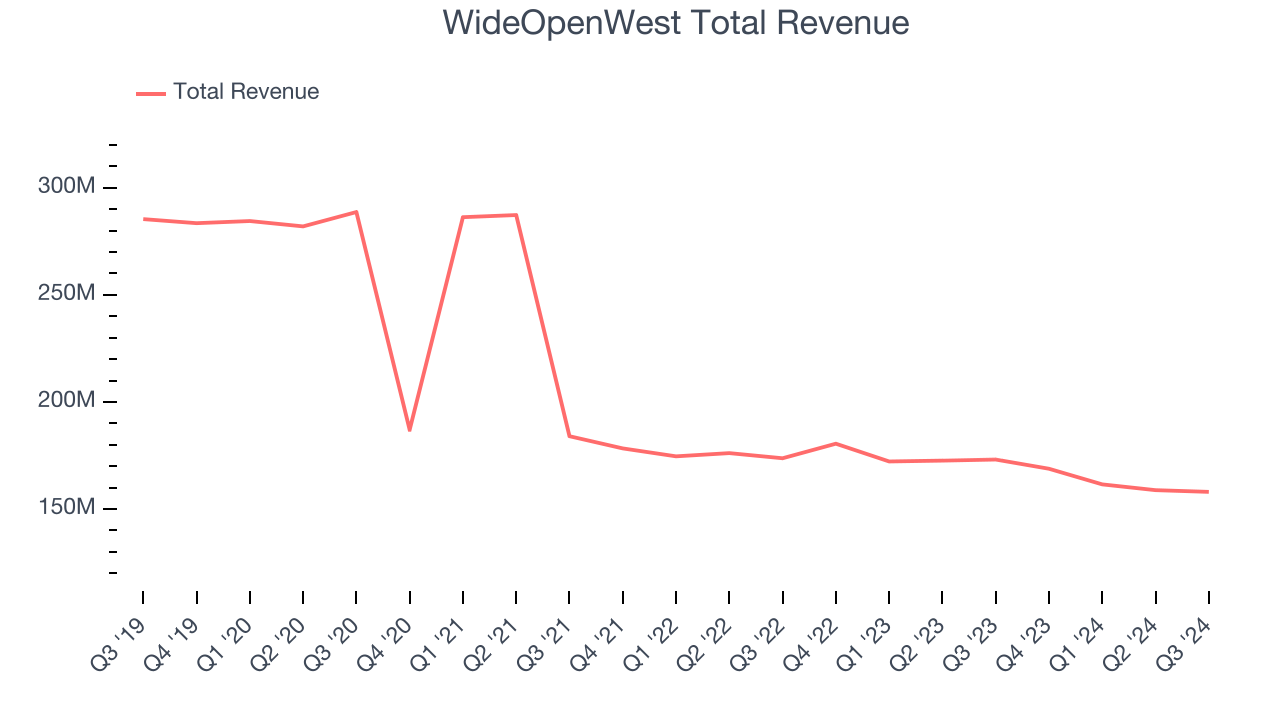

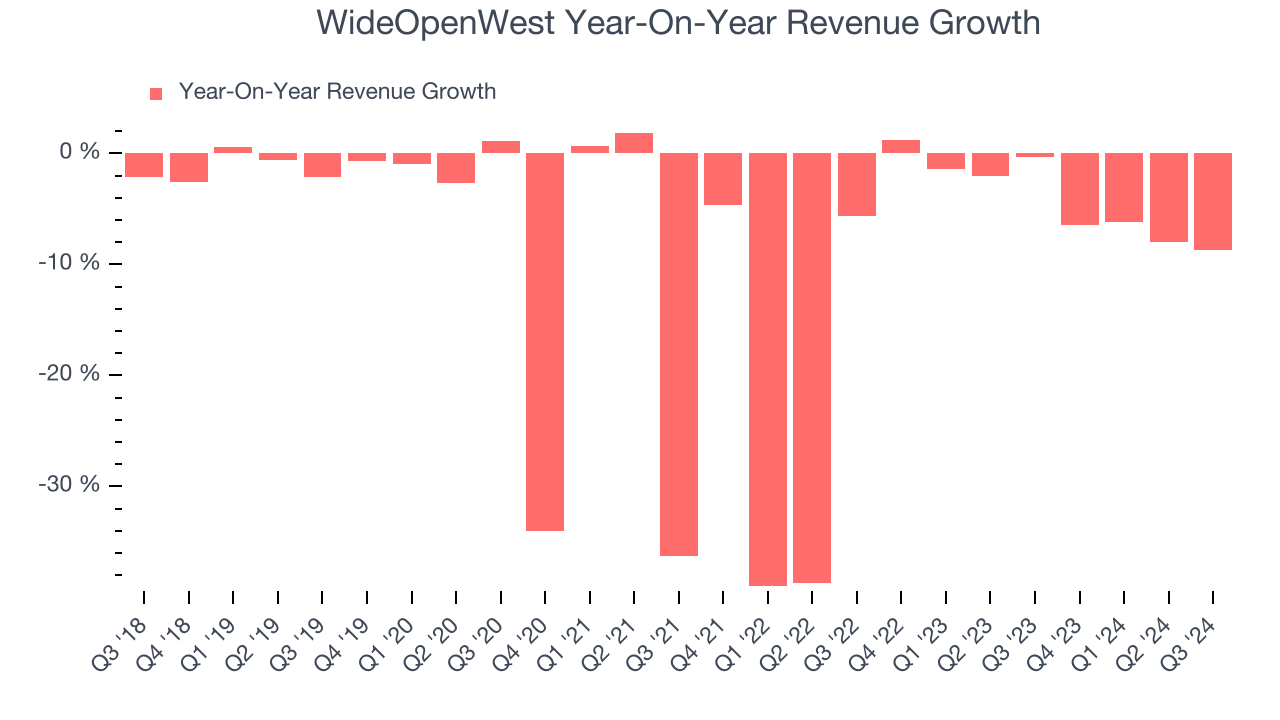

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. WideOpenWest’s demand was weak over the last five years as its sales fell by 10.8% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. WideOpenWest’s annualized revenue declines of 4% over the last two years suggest its demand continued shrinking.

WideOpenWest also discloses its number of subscribers, which reached 490,500 in the latest quarter. Over the last two years, WideOpenWest’s subscribers averaged 3.6% year-on-year declines. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, WideOpenWest reported a rather uninspiring 8.7% year-on-year revenue decline to $158 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline 7.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates the market thinks its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

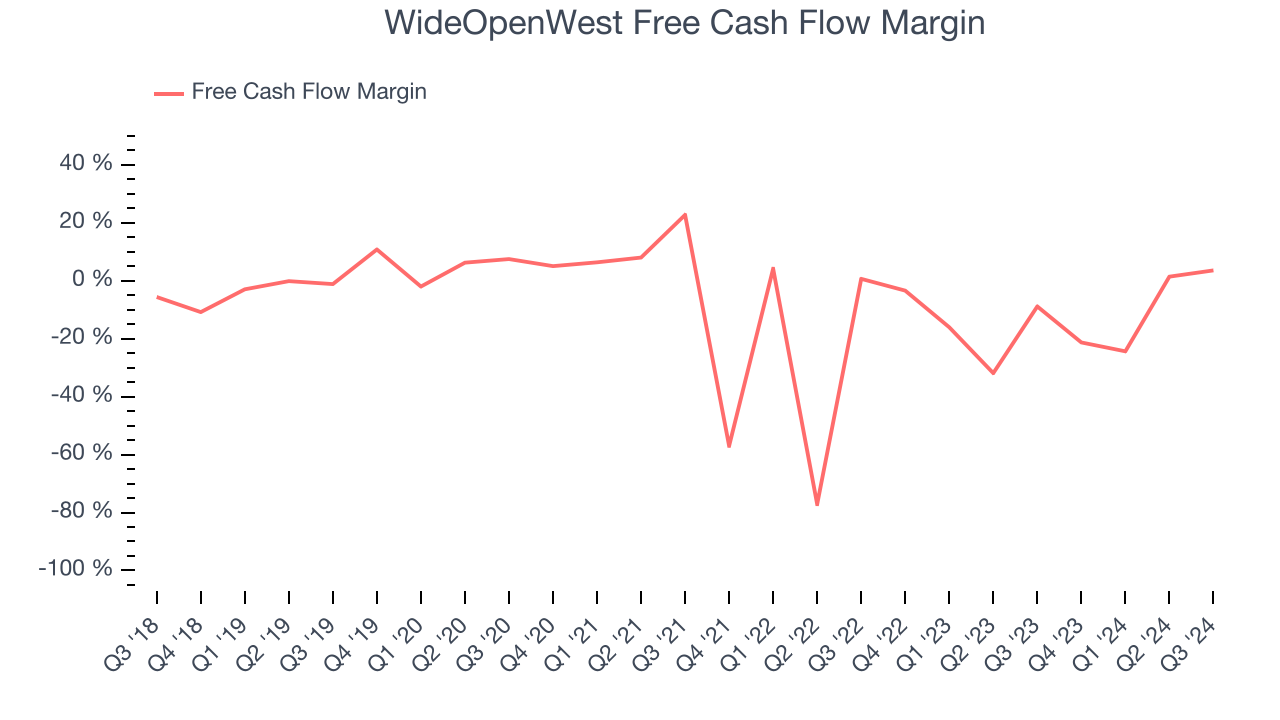

While WideOpenWest posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, WideOpenWest’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 12.7%, meaning it lit $12.72 of cash on fire for every $100 in revenue.

WideOpenWest’s free cash flow clocked in at $5.7 million in Q3, equivalent to a 3.6% margin. Its cash flow turned positive after being negative in the same quarter last year

Over the next year, analysts predict WideOpenWest’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 10.4% for the last 12 months will increase by 10.3 percentage points.

Key Takeaways from WideOpenWest’s Q3 Results

It was good to see WideOpenWest beat analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter was decent. The stock remained flat at $5.30 immediately after reporting.

So should you invest in WideOpenWest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.