Vehicle systems manufacturer Commercial Vehicle Group (NASDAQ:CVGI) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 30.4% year on year to $171.8 million. The company’s full-year revenue guidance of $725 million at the midpoint came in 19.8% below analysts’ estimates. Its GAAP loss of $0.03 per share was also 175% below analysts’ consensus estimates.

Is now the time to buy Commercial Vehicle Group? Find out by accessing our full research report, it’s free.

Commercial Vehicle Group (CVGI) Q3 CY2024 Highlights:

- Revenue: $171.8 million vs analyst estimates of $222.1 million (22.6% miss)

- EPS: -$0.03 vs analyst estimates of $0.04 (-$0.07 miss)

- EBITDA: $4.3 million vs analyst estimates of $9.46 million (54.6% miss)

- The company dropped its revenue guidance for the full year to $725 million at the midpoint from $930 million, a 22% decrease

- EBITDA guidance for the full year is $22.5 million at the midpoint, below analyst estimates of $42.22 million

- Gross Margin (GAAP): 9.6%, down from 13.8% in the same quarter last year

- Operating Margin: -0.6%, down from 5% in the same quarter last year

- EBITDA Margin: 2.5%, down from 6.5% in the same quarter last year

- Free Cash Flow was -$7.07 million, down from $12.45 million in the same quarter last year

- Market Capitalization: $97.41 million

James Ray, President and Chief Executive Officer, said, “Since taking over the CEO role eleven months ago, we have been tirelessly focused on reshaping the CVG operating model to create a more streamlined, lower cost, and customer-focused company. Our CVG team has been working diligently to divest non-strategic portfolio assets like Cab Structures and Industrial Automation, execute new program launches in Vehicle Solutions, initiate restructuring actions, pay down debt, and expand our global footprint in critical regions of Mexico and Morocco. Market conditions have made this transformation process even more difficult this year, as weaker customer demand and shifting production schedules have created operational and supply chain challenges. As a result of both market conditions and our portfolio actions, we have experienced incremental operational inefficiencies this year affecting our financial performance, especially during the third quarter. We are not happy with our performance and have taken significant steps to change the forward direction with expected performance improvement.”

Company Overview

Formed from a partnership between two distinct companies, CVG (NASDAQ:CVGI) offers various components used in vehicles and systems used in warehouses.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

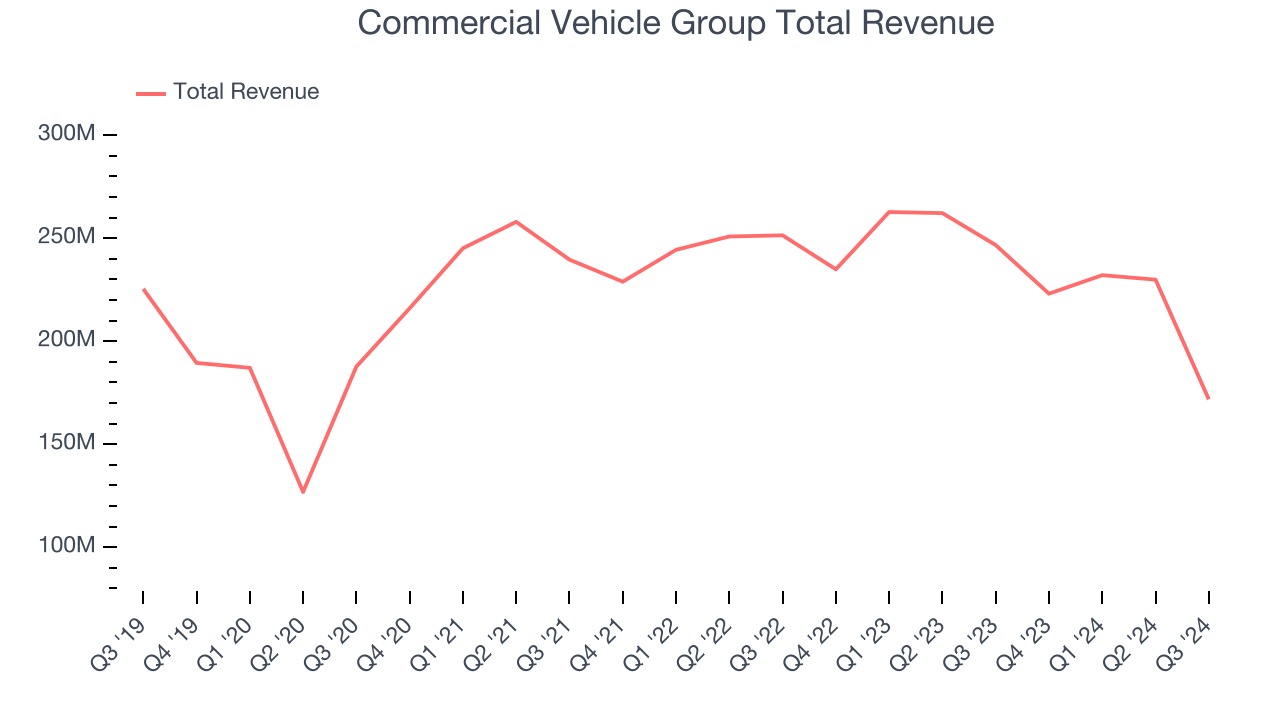

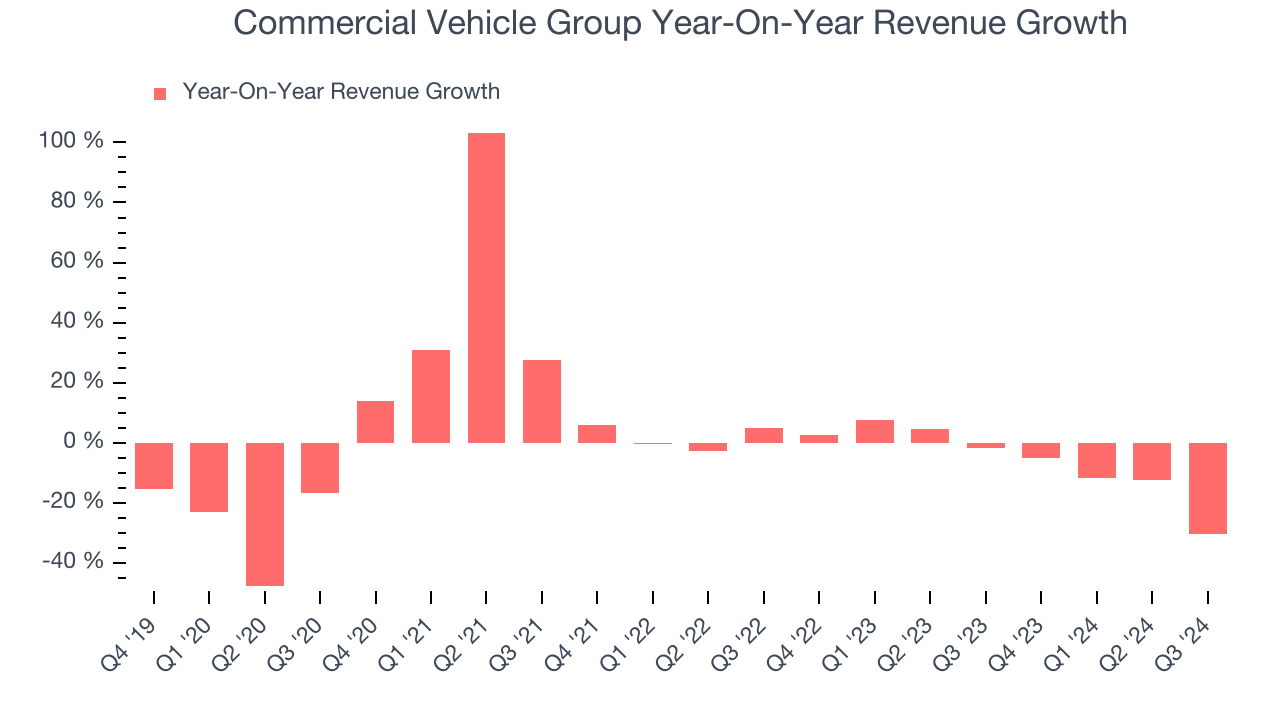

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Commercial Vehicle Group struggled to generate demand over the last five years as its sales dropped by 1.7% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Commercial Vehicle Group’s recent history shows its demand has stayed suppressed as its revenue has declined by 6.3% annually over the last two years.

This quarter, Commercial Vehicle Group missed Wall Street’s estimates and reported a rather uninspiring 30.4% year-on-year revenue decline, generating $171.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates the market thinks its newer products and services will catalyze higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

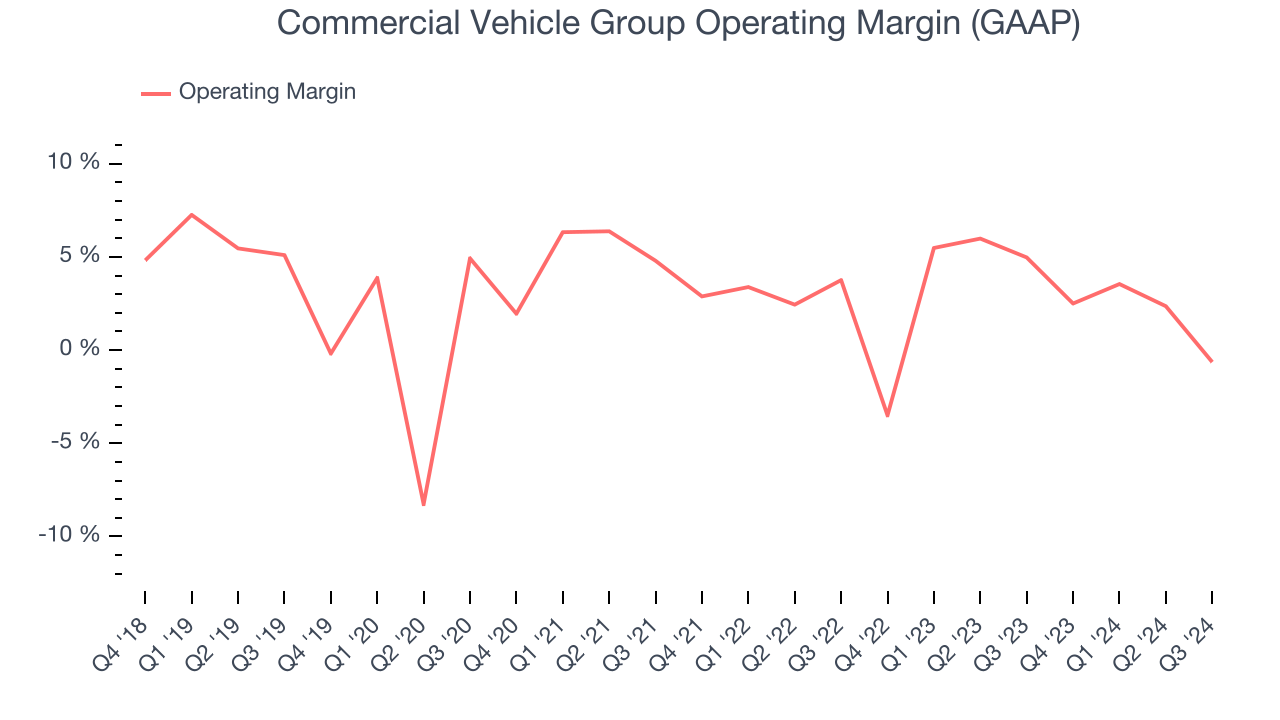

Commercial Vehicle Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Commercial Vehicle Group’s annual operating margin rose by 1.3 percentage points over the last five years.

This quarter, Commercial Vehicle Group’s breakeven margin was down 5.6 percentage points year on year. Since Commercial Vehicle Group’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

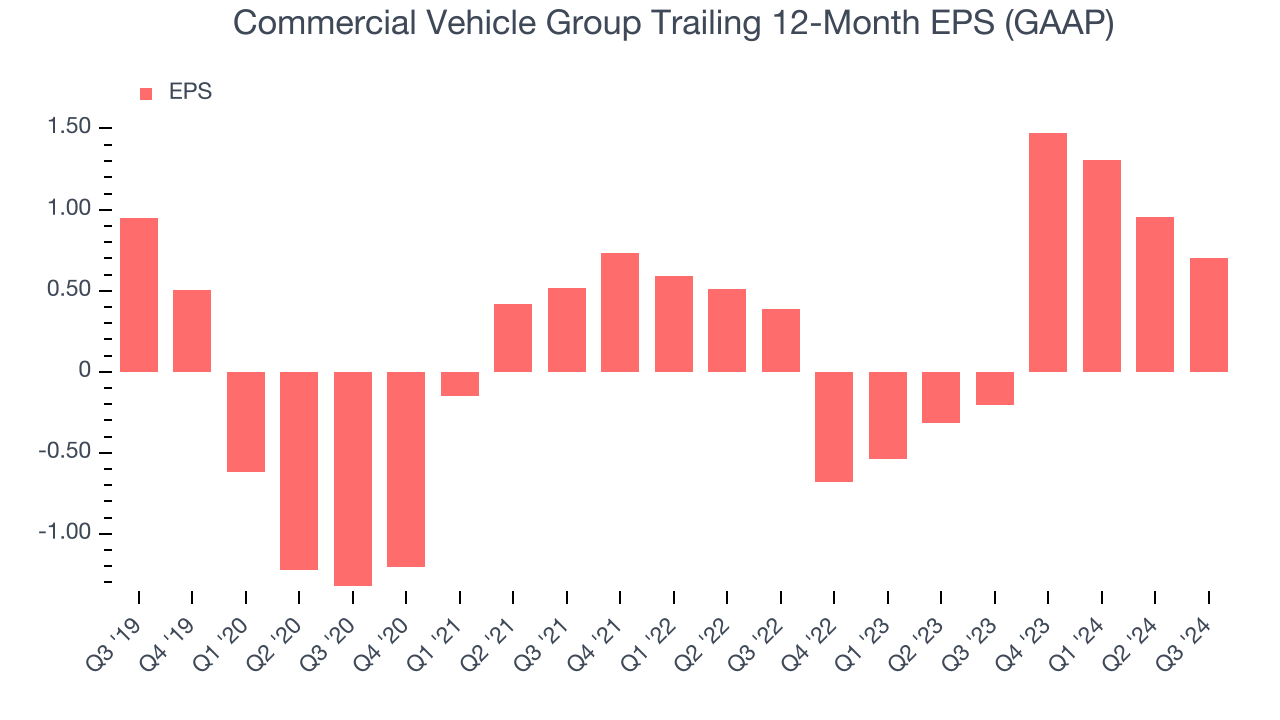

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Commercial Vehicle Group, its EPS declined by more than its revenue over the last five years, dropping 5.7% annually. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

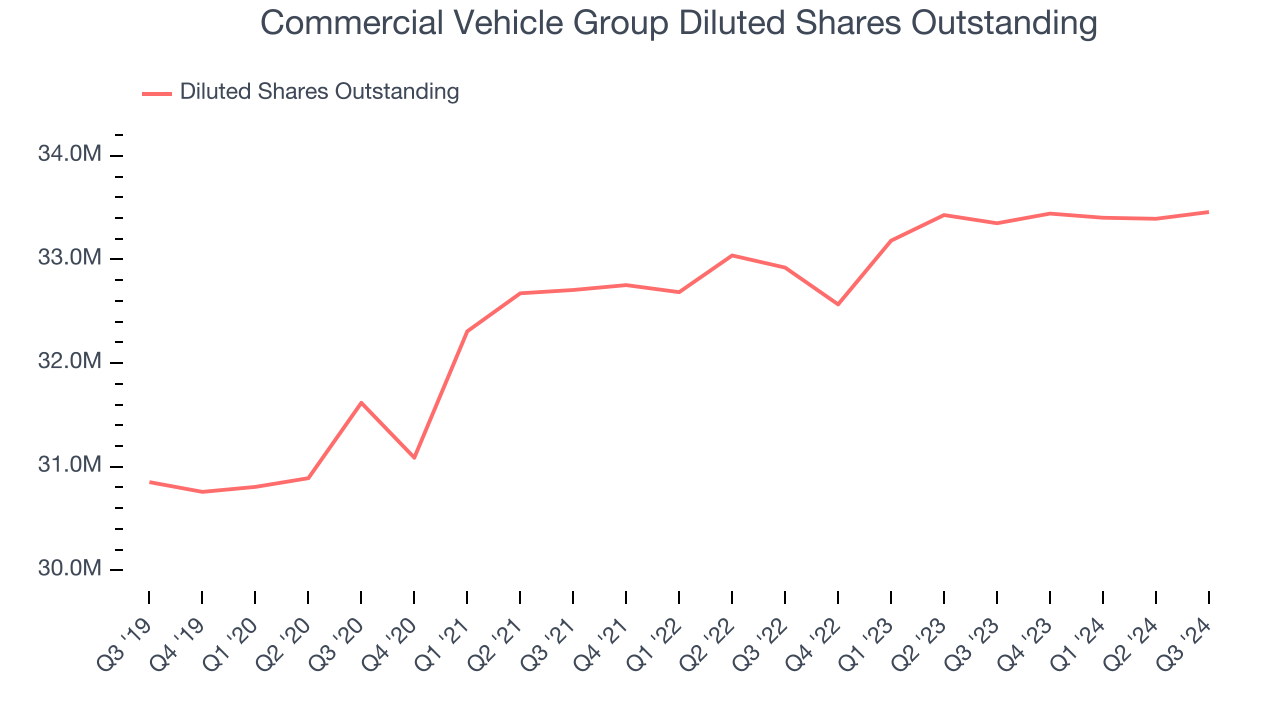

Diving into the nuances of Commercial Vehicle Group’s earnings can give us a better understanding of its performance. A five-year view shows Commercial Vehicle Group has diluted its shareholders, growing its share count by 8.4%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Commercial Vehicle Group, its two-year annual EPS growth of 34.9% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Commercial Vehicle Group reported EPS at negative $0.03, down from $0.22 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Commercial Vehicle Group’s full-year EPS of $0.71 to shrink by 7.1%.

Key Takeaways from Commercial Vehicle Group’s Q3 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance missed and its EBITDA guidance for the full year fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 10.7% to $2.75 immediately after reporting.

Commercial Vehicle Group didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.