As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the construction and engineering industry, including Ameresco (NYSE:AMRC) and its peers.

Construction and engineering companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, sprinkler systems need to be maintained every three years. More recently, services addressing energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and engineering companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives topline performance for these companies.

The 20 construction and engineering stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 1.9% below.

Luckily, construction and engineering stocks have performed well with share prices up 14.8% on average since the latest earnings results.

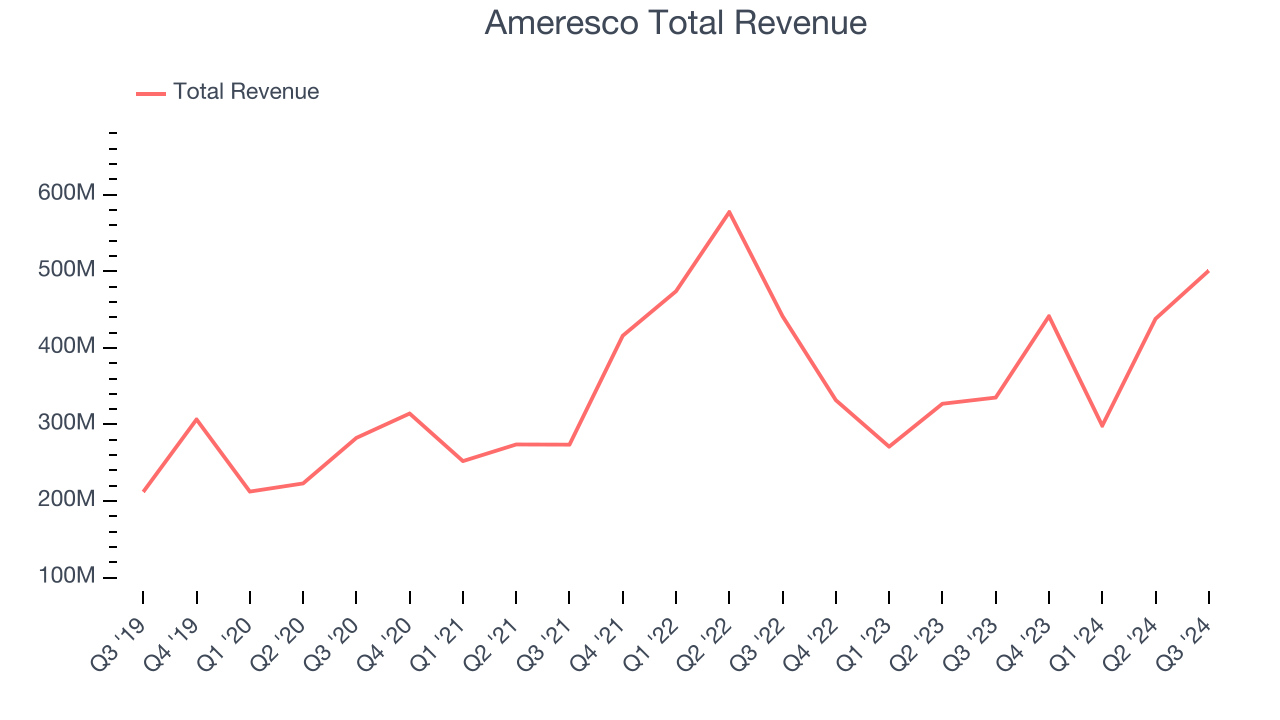

Ameresco (NYSE:AMRC)

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

Ameresco reported revenues of $500.9 million, up 49.4% year on year. This print exceeded analysts’ expectations by 3%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ adjusted operating income.

CEO George Sakellaris commented, “Our team continued to deliver excellent results with year-on-year quarterly revenue growth of 49% and record Adjusted EBITDA of over $62 million, growing 44% in the third quarter, reflecting strong demand for Ameresco’s unique blend of services across our customer base. "

Unsurprisingly, the stock is down 11.5% since reporting and currently trades at $28.

Read our full report on Ameresco here, it’s free.

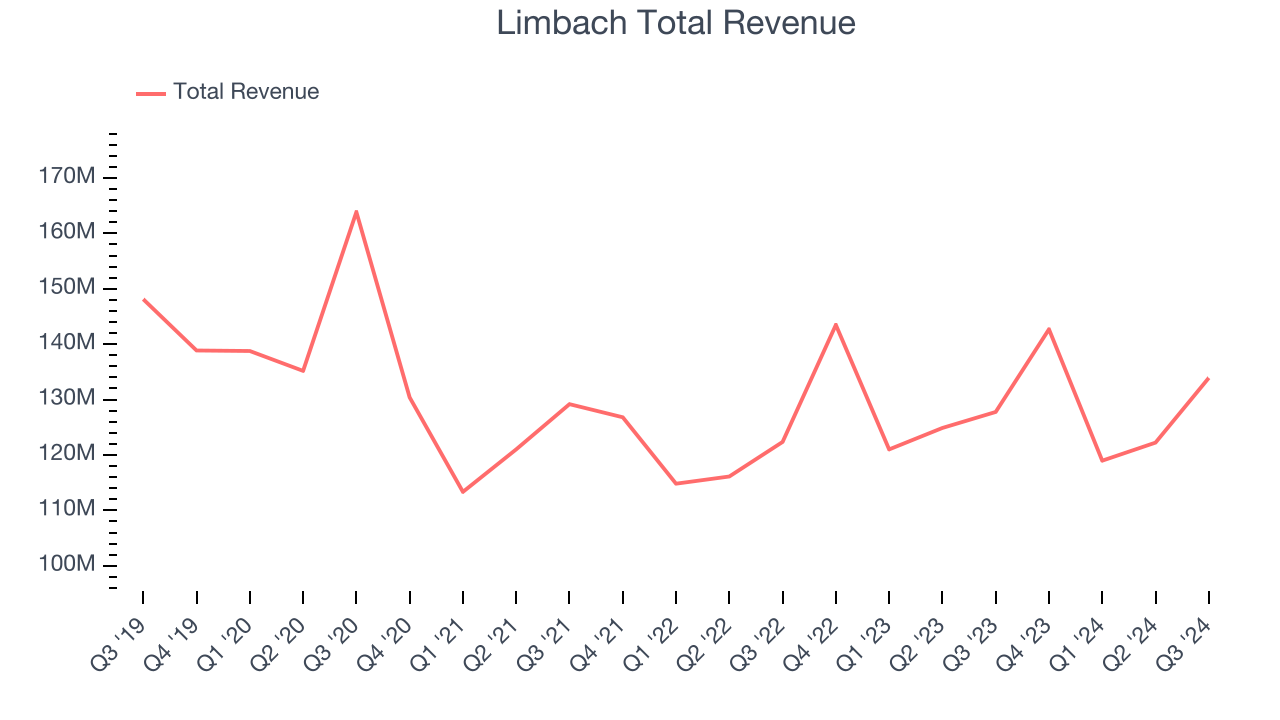

Best Q3: Limbach (NASDAQ:LMB)

Established in 1901, Limbach (NASDAQ: LMB) provides integrated building systems solutions, including mechanical, electrical, and plumbing services.

Limbach reported revenues of $133.9 million, up 4.8% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

Limbach pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 31.9% since reporting. It currently trades at $102.88.

Is now the time to buy Limbach? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Tutor Perini (NYSE:TPC)

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE:TPC) is a civil and building construction company offering diversified general contracting and design-build services.

Tutor Perini reported revenues of $1.08 billion, up 2.1% year on year, falling short of analysts’ expectations by 7.2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 5.6% since the results and currently trades at $28.57.

Read our full analysis of Tutor Perini’s results here.

MasTec (NYSE:MTZ)

Involved in the 1996 Olympic Games MasTec (NYSE:MTZ) is an infrastructure construction company that specializes in the telecommunications, energy, and utility industries.

MasTec reported revenues of $3.25 billion, flat year on year. This number missed analysts’ expectations by 5.4%. In spite of that, it was a strong quarter as it put up an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 15.5% since reporting and currently trades at $142.07.

Read our full, actionable report on MasTec here, it’s free.

Great Lakes Dredge & Dock (NASDAQ:GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $191.2 million, up 63.1% year on year. This print beat analysts’ expectations by 3.5%. Aside from that, it was a slower quarter as it produced a significant miss of analysts’ EBITDA and EPS estimates.

Great Lakes Dredge & Dock delivered the fastest revenue growth among its peers. The stock is up 6.8% since reporting and currently trades at $12.40.

Read our full, actionable report on Great Lakes Dredge & Dock here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.