Leading designer of graphics chips Nvidia (NASDAQ:NVDA) announced better-than-expected revenue in Q3 CY2024, with sales up 93.6% year on year to $35.08 billion. Guidance for next quarter’s revenue was better than expected at $37.5 billion at the midpoint, 1.3% above analysts’ estimates. Its non-GAAP profit of $0.81 per share was 8.6% above analysts’ consensus estimates.

Is now the time to buy Nvidia? Find out by accessing our full research report, it’s free.

Nvidia (NVDA) Q3 CY2024 Highlights:

- Revenue: $35.08 billion vs analyst estimates of $33.13 billion (93.6% year-on-year growth, 5.9% beat)

- Adjusted EPS: $0.81 vs analyst estimates of $0.75 (8.6% beat)

- Adjusted Operating Income: $23.28 billion vs analyst estimates of $21.86 billion (66.3% margin, 6.5% beat)

- Revenue Guidance for Q4 CY2024 is $37.5 billion at the midpoint, above analyst estimates of $37.03 billion

- Gross Margin (non-GAAP) Guidance for Q4 CY2024 is 73.5%, slightly above analyst estimates of 73.4%

- Operating Margin: 62.3%, up from 57.5% in the same quarter last year

- Free Cash Flow Margin: 47.9%, up from 38.9% in the same quarter last year

- Inventory Days Outstanding: 78, down from 81 in the previous quarter

- Market Capitalization: $3.60 trillion

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” said Jensen Huang, founder and CEO of NVIDIA.

Company Overview

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

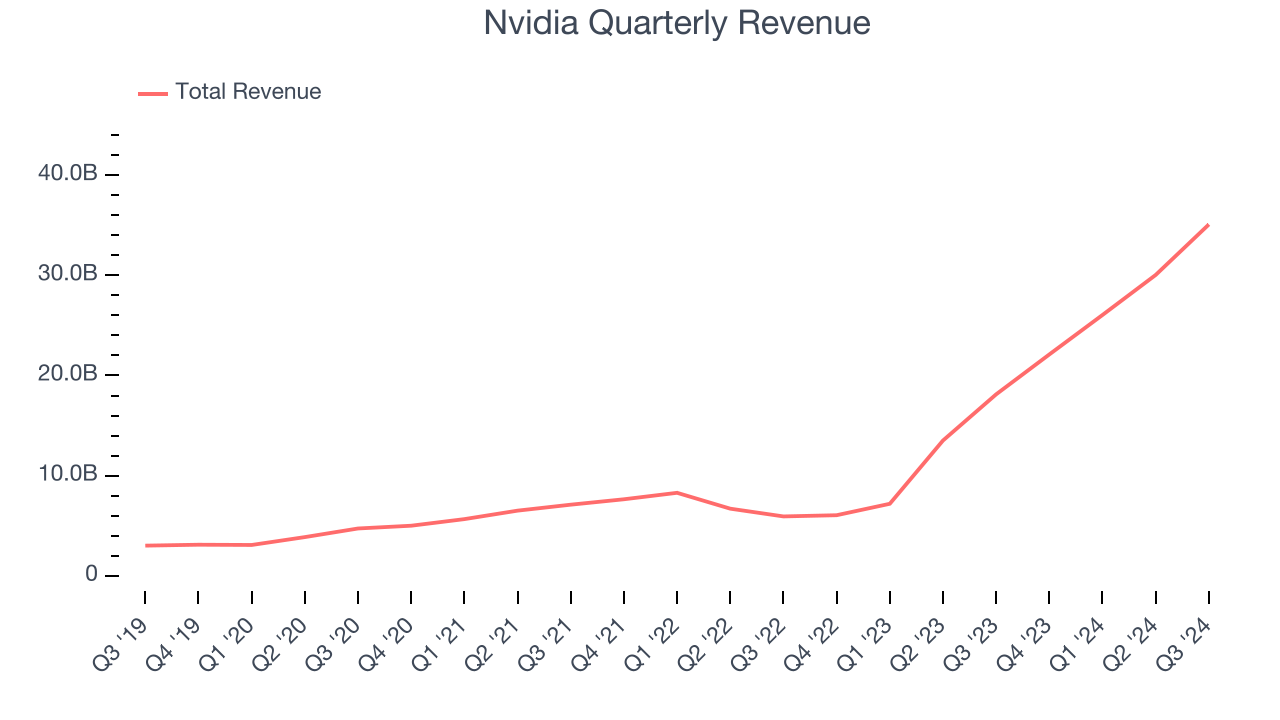

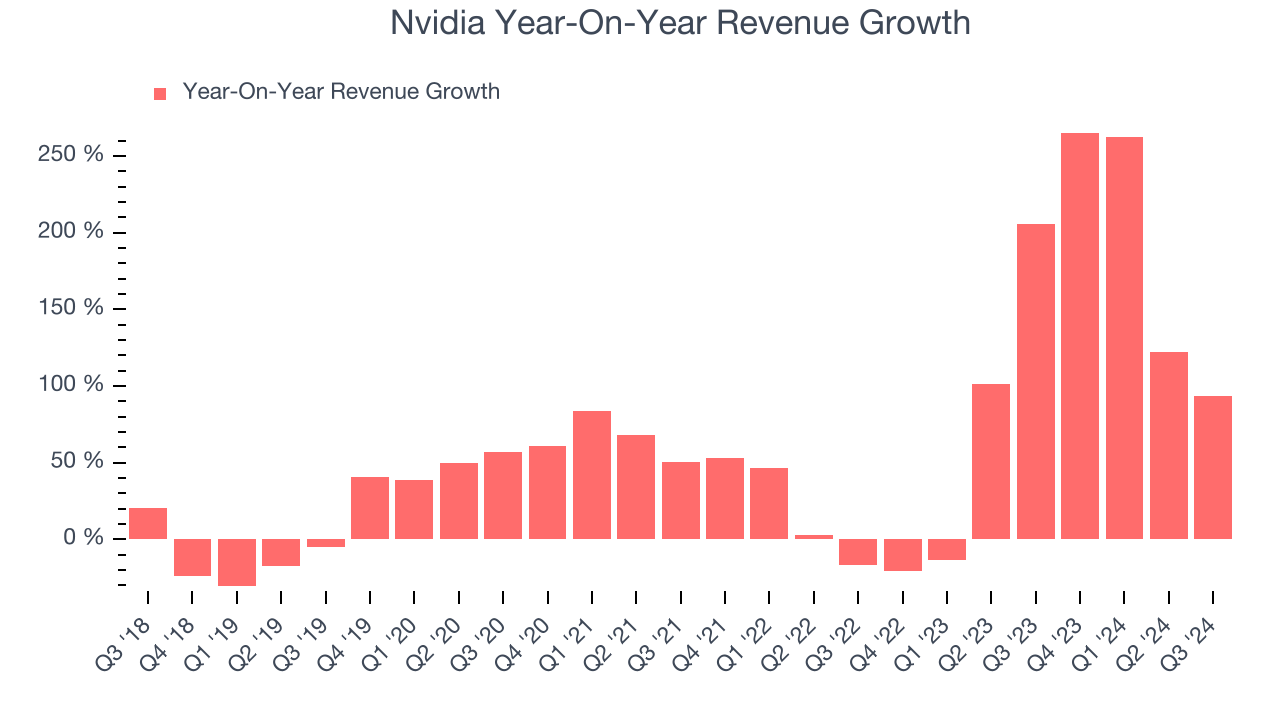

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Nvidia’s sales grew at an incredible 62.4% compounded annual growth rate over the last five years. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Nvidia’s annualized revenue growth of 99.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Nvidia reported magnificent year-on-year revenue growth of 93.6%, and its $35.08 billion of revenue beat Wall Street’s estimates by 5.9%. Company management is currently guiding for a 69.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 49.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive and implies the market is factoring in success for its products and services. Some tapering/deceleration is natural given the magnitude of its revenue base.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

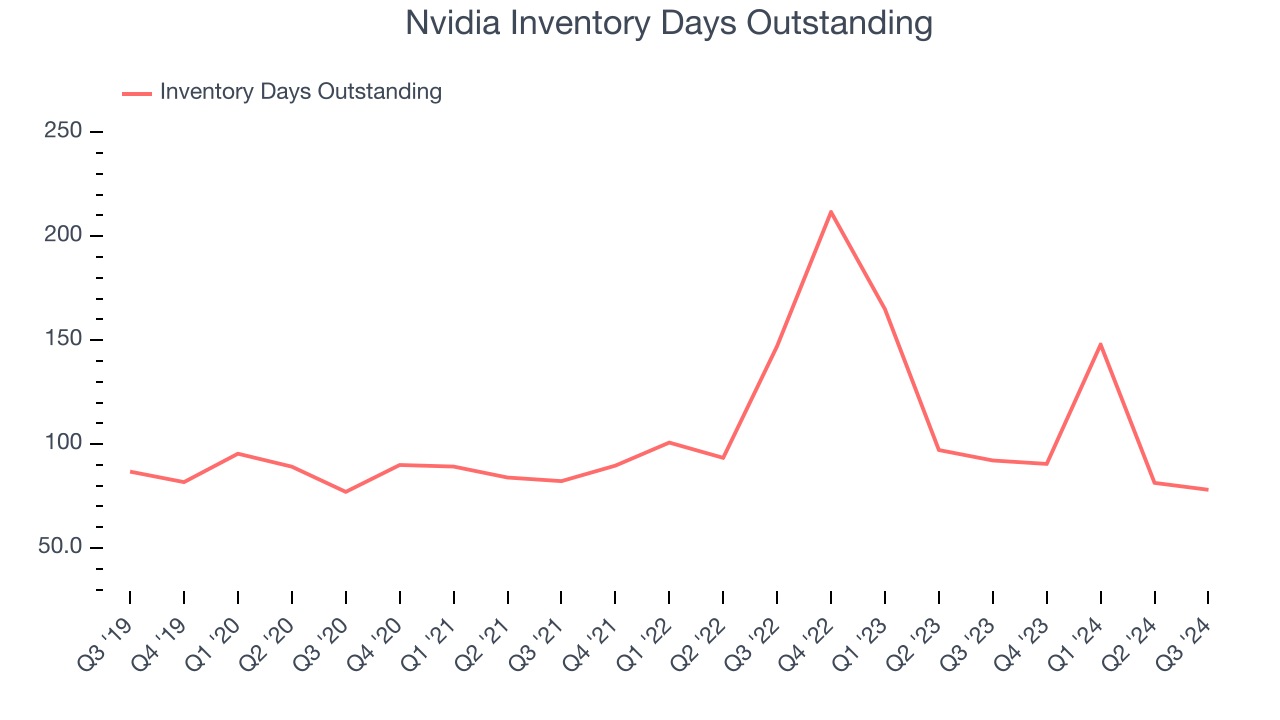

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Nvidia’s DIO came in at 78, which is 26 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Nvidia’s Q3 Results

We were impressed by how meaningfully Nvidia exceeded analysts’ revenue, operating income, and EPS expectations this quarter. Demand for its chips, which are seeing major tailwinds from AI, remains extremely robust. Looking ahead, the company gave revenue guidance that topped expectations. However, was the 1% revenue guidance beat enough to get the market excited? Zooming out, we think this was a solid quarter. However, it seems like the magnitude of the guidance beat was a negative in the eyes of the market, and the stock traded down 2.6% to $142.20 immediately following the results.

So do we think Nvidia is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.