Boat and marine products retailer OneWater Marine (NASDAQ:ONEW) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 16.2% year on year to $377.9 million. The company’s full-year revenue guidance of $1.78 billion at the midpoint came in 6.1% below analysts’ estimates. Its non-GAAP loss of $0.36 per share was significantly below analysts’ consensus estimates.

Is now the time to buy OneWater? Find out by accessing our full research report, it’s free.

OneWater (ONEW) Q3 CY2024 Highlights:

- Revenue: $377.9 million vs analyst estimates of $419.9 million (10% miss)

- Adjusted EPS: -$0.36 vs analyst estimates of -$0.46 (miss)

- Adjusted EBITDA: $7.85 million vs analyst estimates of $18.78 million (58.2% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.78 billion at the midpoint, missing analyst estimates by 6.1% and implying 0.1% growth (vs -8.1% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.50 at the midpoint, missing analyst estimates by 45%

- EBITDA guidance for the upcoming financial year 2025 is $95 million at the midpoint, below analyst estimates of $124.2 million

- Gross Margin (GAAP): 24%, down from 26.4% in the same quarter last year

- Operating Margin: 1.2%, up from -26% in the same quarter last year

- EBITDA Margin: 2.1%, down from 6.2% in the same quarter last year

- Locations: 96 at quarter end, down from 98.5 in the same quarter last year

- Same-Store Sales fell 17% year on year (14.6% in the same quarter last year)

- Market Capitalization: $346.7 million

“Our team demonstrated remarkable resilience and execution amidst a challenging retail environment as consumer behavior and industry inventory reset in fiscal 2024. Our revenue and brand diversification, coupled with our geographic reach, helped mitigate the impact of macroeconomic uncertainty and severe weather, underscoring the strength of our business model,” commented Austin Singleton, Chief Executive Officer at OneWater.

Company Overview

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

OneWater is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

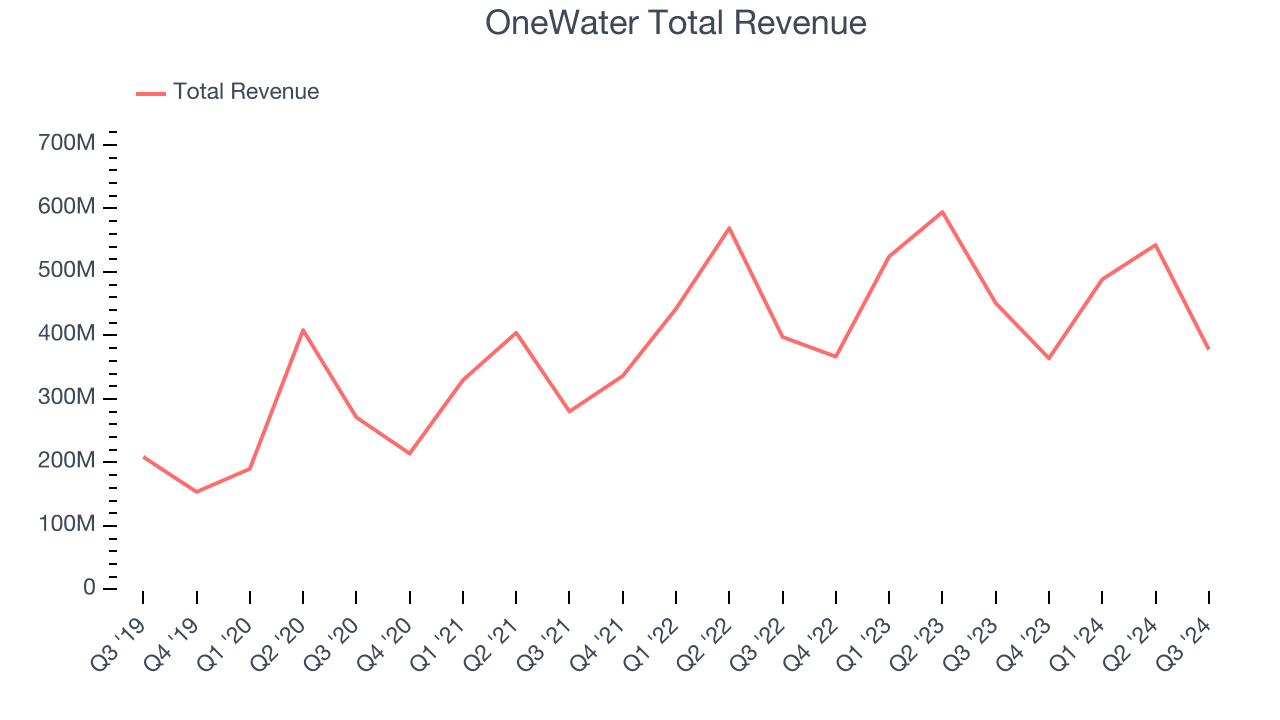

As you can see below, OneWater grew its sales at an excellent 18.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, OneWater missed Wall Street’s estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $377.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last five years. Still, this projection is admirable and implies the market sees success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Store Performance

Number of Stores

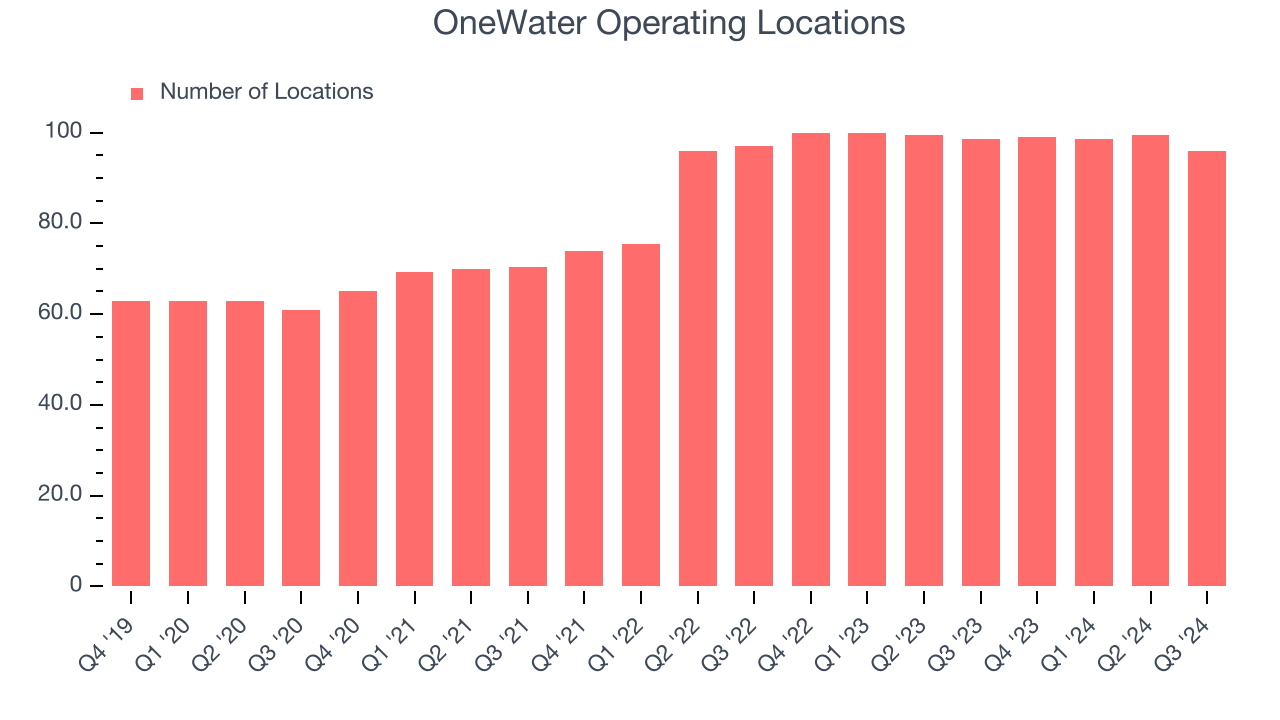

A retailer’s store count often determines how much revenue it can generate.

OneWater sported 96 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip and averaged 8.5% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

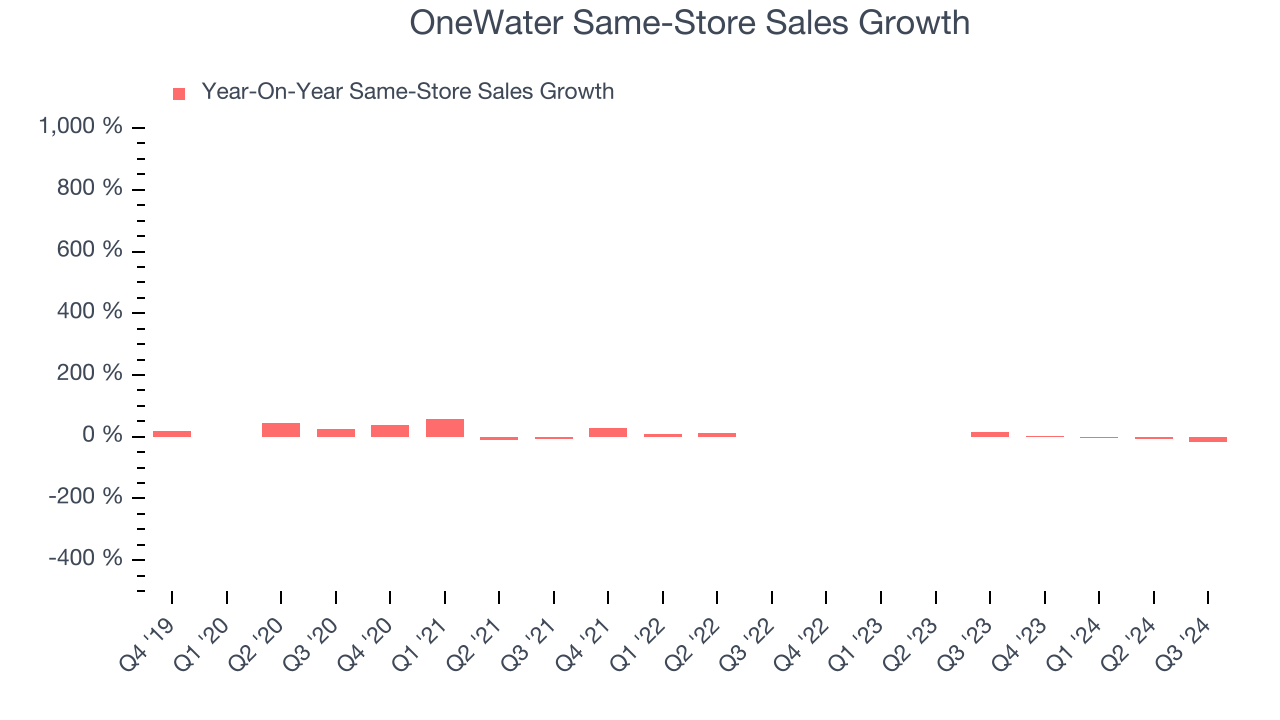

OneWater has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 16,711,490,311%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives OneWater multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, OneWater’s same-store sales fell by 17% year on year. This decline was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

Key Takeaways from OneWater’s Q3 Results

We struggled to find many resounding positives in these results. Its full-year revenue guidance missed significantly and its full-year EPS guidance fell meaningfully short of Wall Street’s estimates. Overall, this was a weaker quarter. Still, the stock traded up 4.2% to $24.79 immediately after reporting, potentially showing very low expectations going into the quarter.

Big picture, is OneWater a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.