As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the personal care industry, including e.l.f. (NYSE:ELF) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 16.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.8% since the latest earnings results.

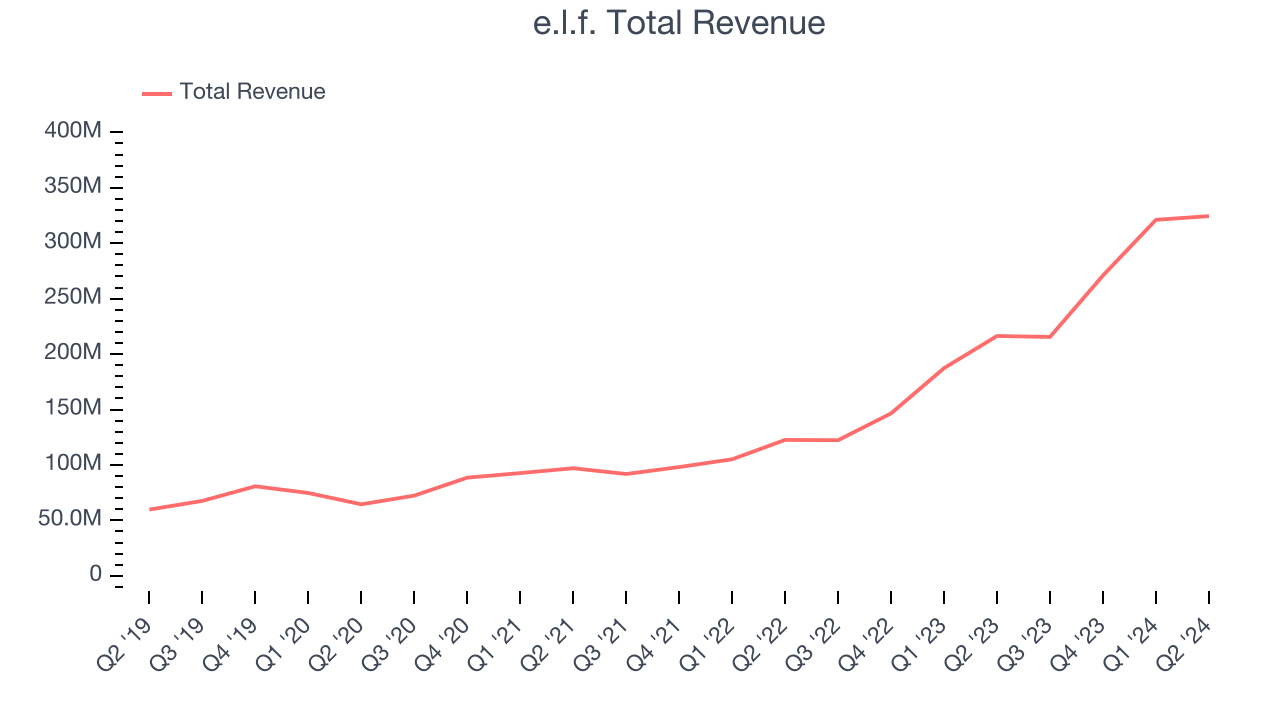

e.l.f. (NYSE:ELF)

e.l.f. Beauty (NYSE:ELF), which stands for ‘eyes, lips, face’, offers high-quality beauty products at accessible price points.

e.l.f. reported revenues of $324.5 million, up 50% year on year. This print exceeded analysts’ expectations by 6.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA and earnings estimates.

“We are off to a strong start this fiscal year, delivering 50% net sales growth and 260 basis points of market share gains in Q1,” said Tarang Amin, e.l.f.

e.l.f. achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 43.6% since reporting and currently trades at $105.96.

Is now the time to buy e.l.f.? Access our full analysis of the earnings results here, it’s free.

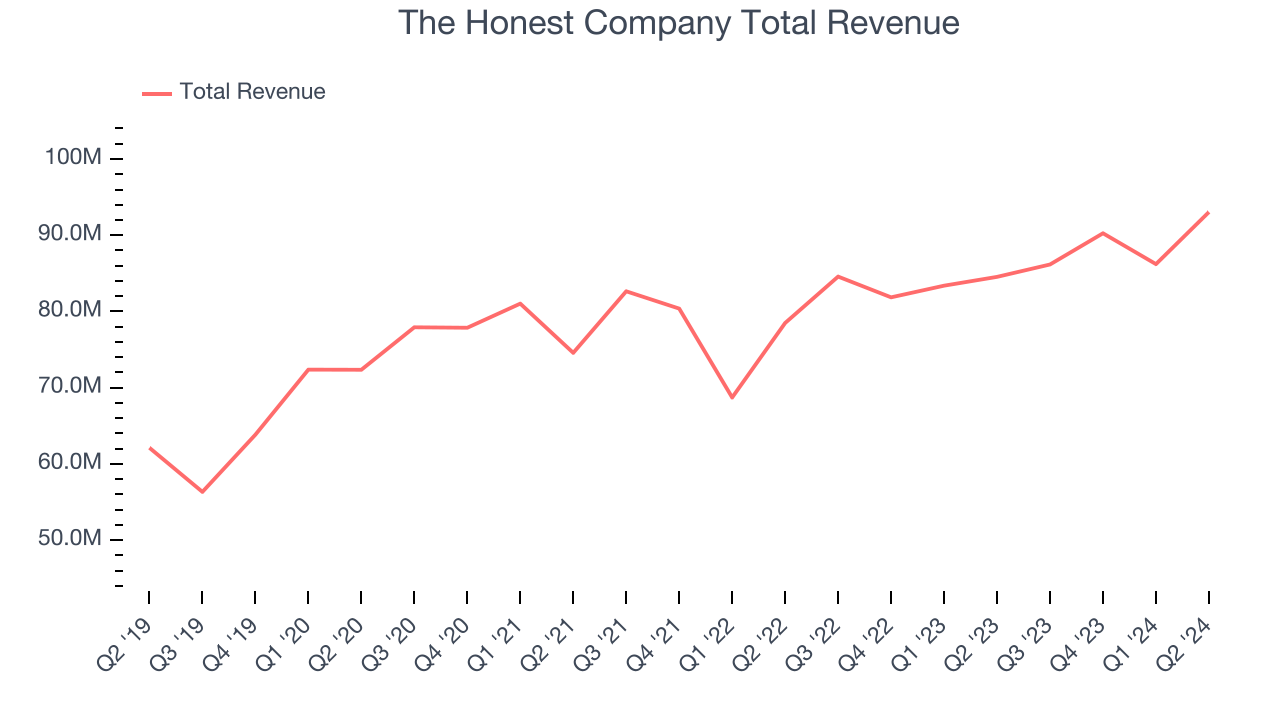

Best Q2: The Honest Company (NASDAQ:HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $93.05 million, up 10.1% year on year, outperforming analysts’ expectations by 6.8%. The business had an exceptional quarter with an impressive beat of analysts’ earnings and gross margin estimates.

The Honest Company scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 19% since reporting. It currently trades at $3.86.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: BeautyHealth (NASDAQ:SKIN)

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

BeautyHealth reported revenues of $90.59 million, down 22.9% year on year, falling short of analysts’ expectations by 8%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

BeautyHealth delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 24.8% since the results and currently trades at $1.61.

Read our full analysis of BeautyHealth’s results here.

Nu Skin (NYSE:NUS)

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE:NUS) is a personal care and dietary supplements company that engages in direct selling.

Nu Skin reported revenues of $439.1 million, down 12.2% year on year. This result surpassed analysts’ expectations by 1.7%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but underwhelming earnings guidance for the full year.

Nu Skin delivered the highest full-year guidance raise among its peers. The stock is down 40.3% since reporting and currently trades at $6.19.

Read our full, actionable report on Nu Skin here, it’s free.

Olaplex (NASDAQ:OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $103.9 million, down 4.8% year on year. This print was in line with analysts’ expectations. Aside from that, it was a slower quarter as it logged a miss of analysts’ gross margin and EBITDA estimates.

The stock is up 3.5% since reporting and currently trades at $1.90.

Read our full, actionable report on Olaplex here, it’s free.

Market Update

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.