Wrapping up Q2 earnings, we look at the numbers and key takeaways for the apparel, accessories and luxury goods stocks, including Stitch Fix (NASDAQ:SFIX) and its peers.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 12.6% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, apparel, accessories and luxury goods stocks have held steady with share prices up 2.5% on average since the latest earnings results.

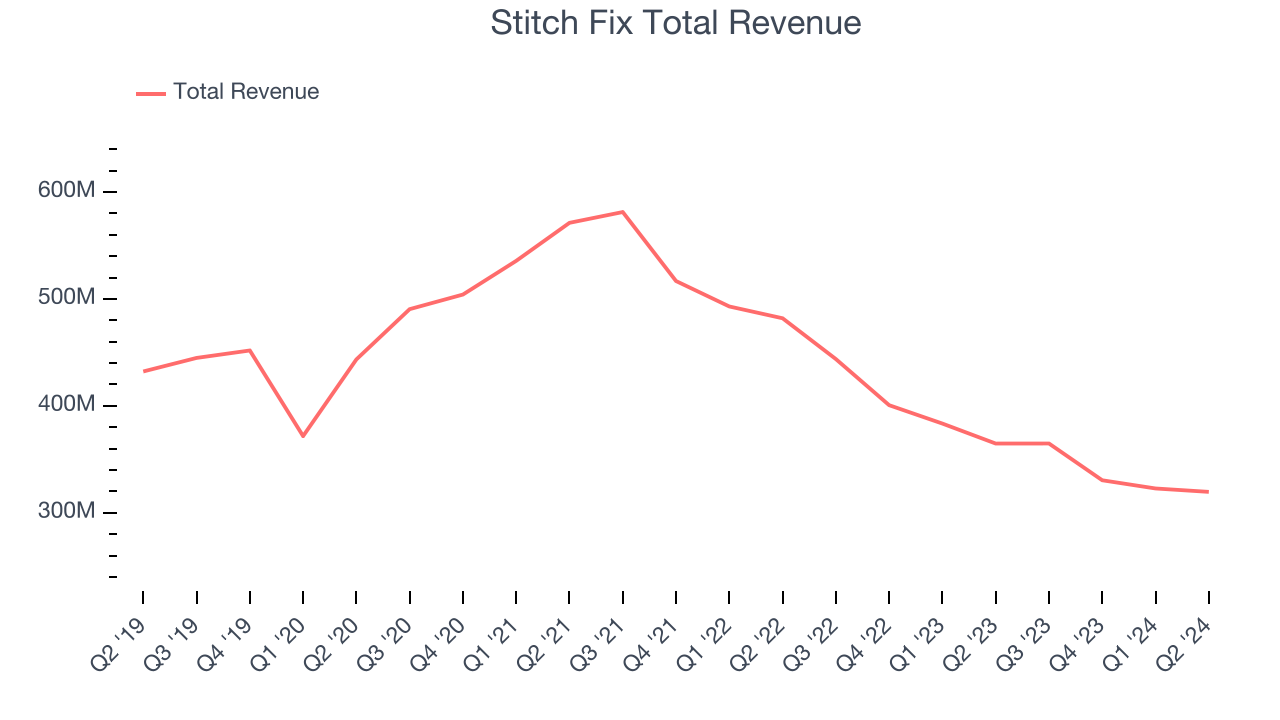

Weakest Q2: Stitch Fix (NASDAQ:SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Stitch Fix reported revenues of $319.6 million, down 12.4% year on year. This print was in line with analysts’ expectations, but overall, it was a disappointing quarter for the company with a miss of analysts’ operating margin estimates.

“We are executing our transformation strategy with discipline and, during the fourth quarter, we delivered results at the high end of our guidance on both the top and bottom line,” said Matt Baer, Chief Executive Officer, Stitch Fix.

Stitch Fix delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 21.7% since reporting and currently trades at $2.93.

Read our full report on Stitch Fix here, it’s free.

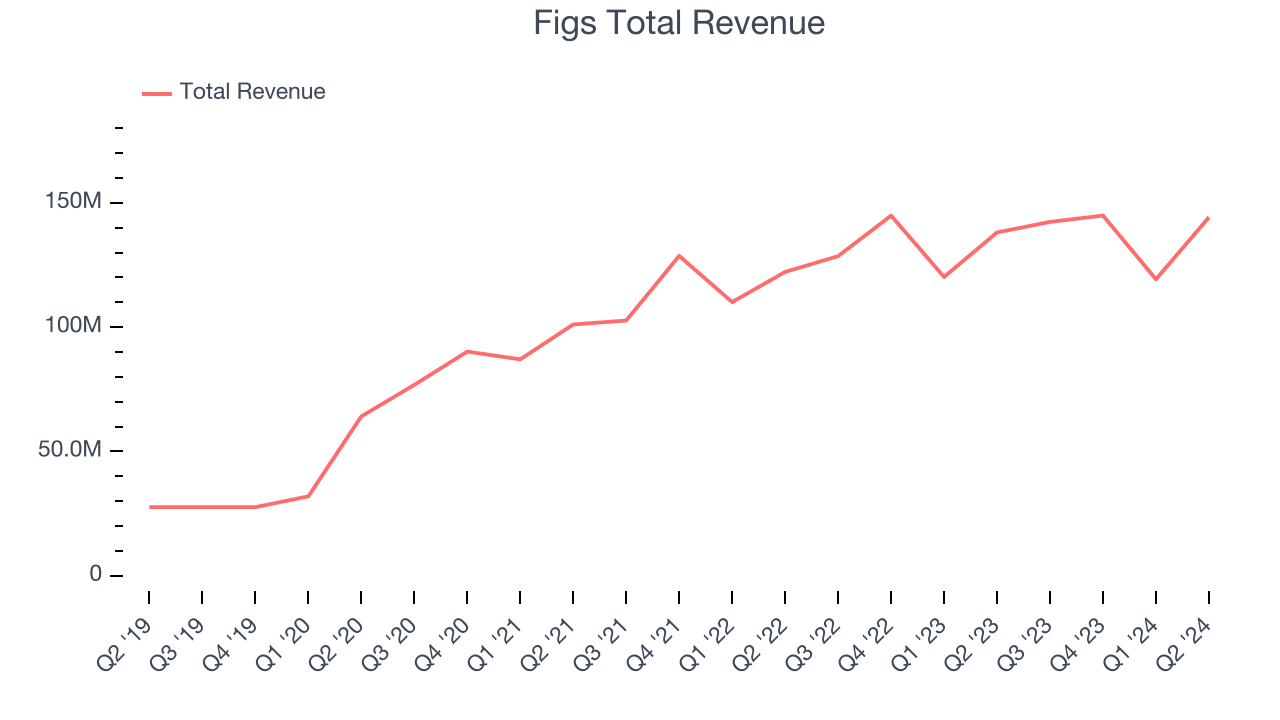

Best Q2: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $144.2 million, up 4.4% year on year, outperforming analysts’ expectations by 1.4%. The business had a very strong quarter with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 8.2% since reporting. It currently trades at $6.18.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free.

Guess (NYSE:GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $732.6 million, up 10.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted underwhelming earnings guidance for the next quarter.

As expected, the stock is down 8% since the results and currently trades at $18.58.

Read our full analysis of Guess’s results here.

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $419.9 million, flat year on year. This number missed analysts’ expectations by 4.2%. Overall, it was a disappointing quarter as it also logged underwhelming earnings guidance for the full year.

The stock is down 9.5% since reporting and currently trades at $75.61.

Read our full, actionable report on Oxford Industries here, it’s free.

Hanesbrands (NYSE:HBI)

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

Hanesbrands reported revenues of $995.4 million, down 3.8% year on year. This print came in 26.4% below analysts' expectations. It was a softer quarter as it also produced underwhelming earnings guidance for the full year.

Hanesbrands had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 36.6% since reporting and currently trades at $7.09.

Read our full, actionable report on Hanesbrands here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.