Power conversion and control solutions provider Vicor Corporation (NASDAQ:VICR) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell 13.6% year on year to $93.17 million. Its GAAP profit of $0.26 per share was also above analysts’ consensus estimates.

Is now the time to buy Vicor? Find out by accessing our full research report, it’s free.

Vicor (VICR) Q3 CY2024 Highlights:

- Revenue: $93.17 million vs analyst estimates of $85.23 million (9.3% beat)

- EPS: $0.26 vs analyst estimates of $0.10 ($0.17 beat)

- Gross Margin (GAAP): 49.1%, down from 51.8% in the same quarter last year

- Backlog: $150.6 million at quarter end

- Market Capitalization: $2.01 billion

Commenting on third quarter performance, Chief Executive Officer Dr. Patrizio Vinciarelli stated: “Revenues and cash flow improved in Q3 while gross margins were impacted primarily by product mix. We are close to initial deliveries of 2nd generation, high density VPD systems for leading AI applications with current multipliers achieving superior density, bandwidth and signal integrity. Vicor’s VPD will enable AI processors setting new standards for compute performance and power system efficiency.”

Company Overview

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

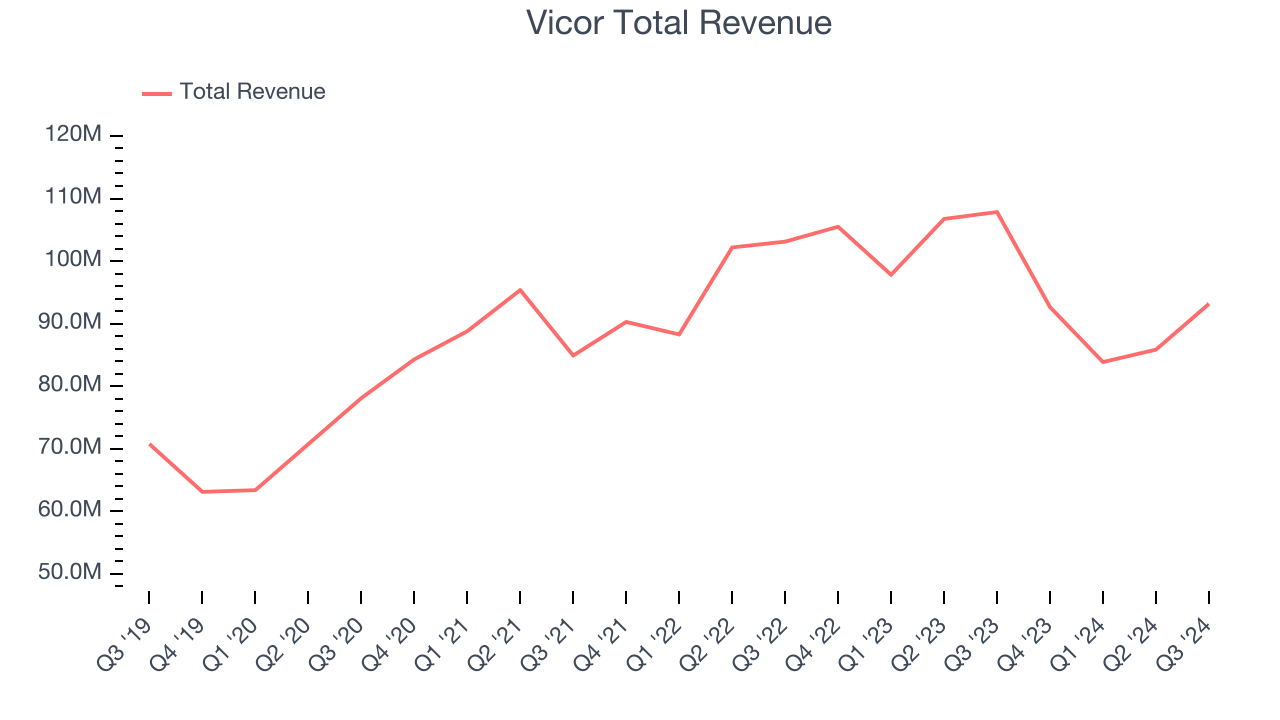

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Vicor grew its sales at a tepid 5.6% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Vicor’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.8% annually. Vicor isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Vicor’s revenue fell 13.6% year on year to $93.17 million but beat Wall Street’s estimates by 9.3%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, an acceleration versus the last two years. While this projection indicates the market thinks its newer products and services will spur better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

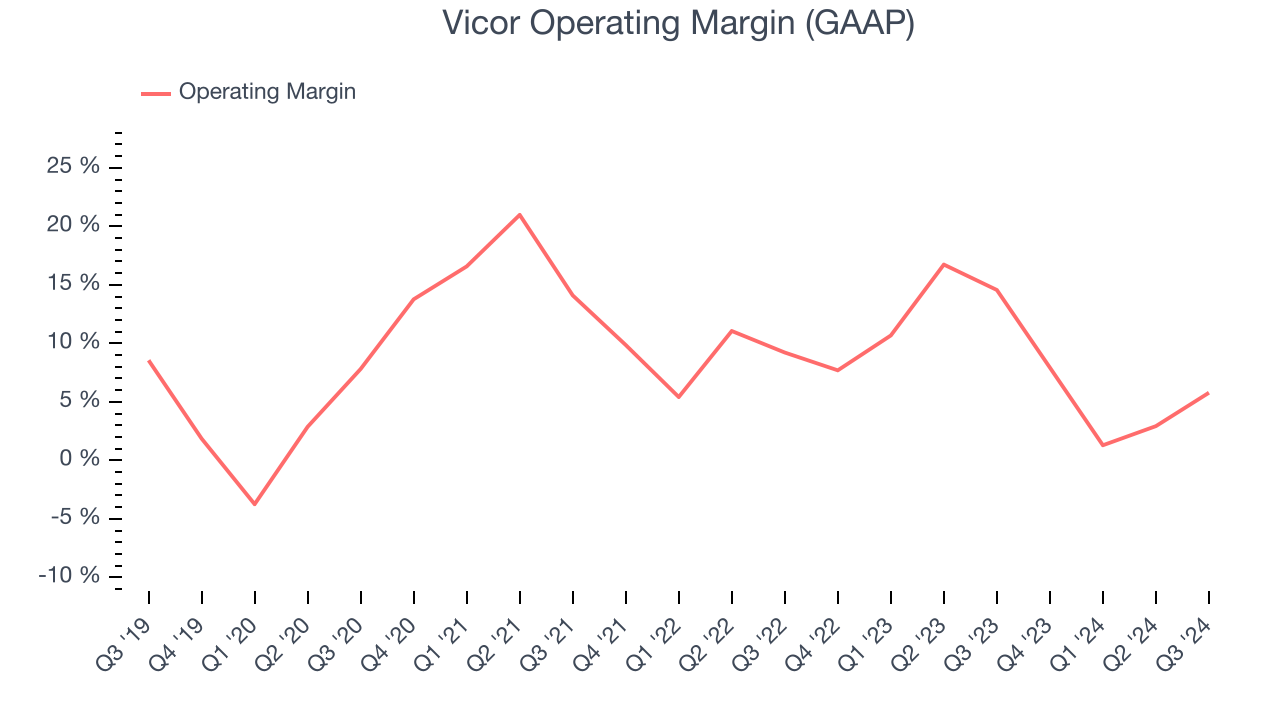

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Vicor’s annual operating margin rose by 2.1 percentage points over the last five years, showing its efficiency has improved.

In Q3, Vicor generated an operating profit margin of 5.8%, down 8.8 percentage points year on year. Since Vicor’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

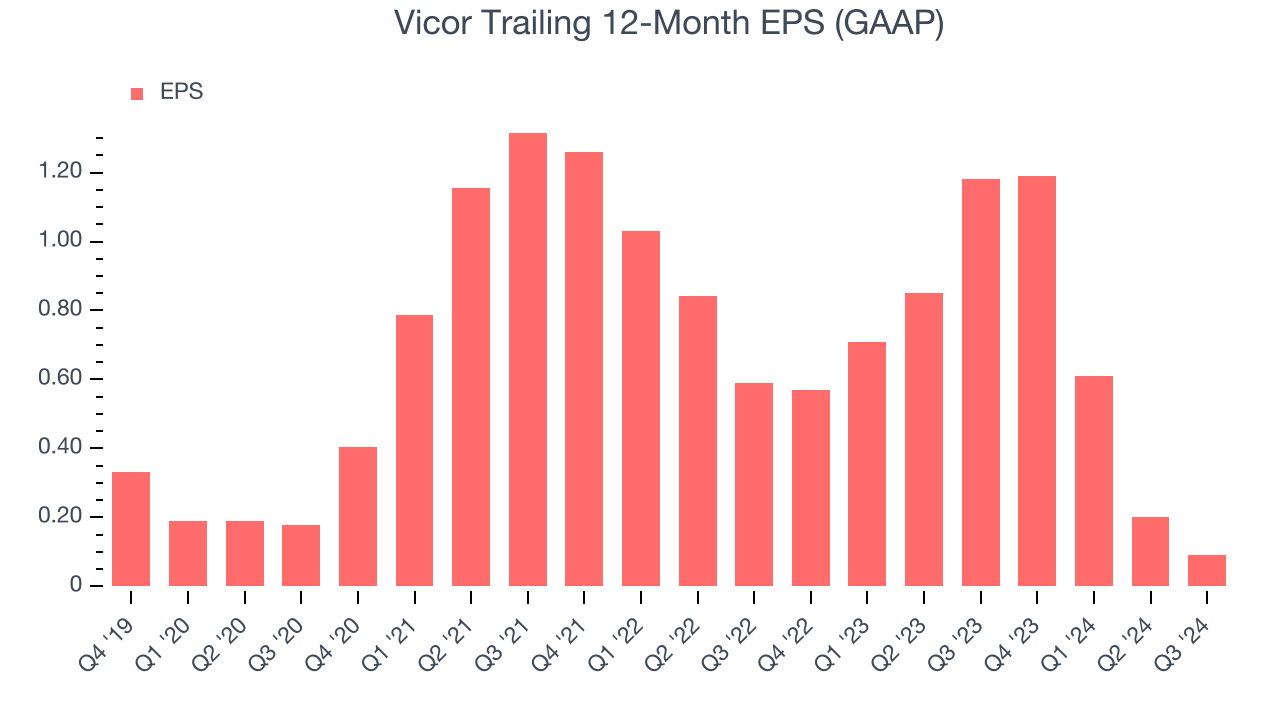

Earnings Per Share

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

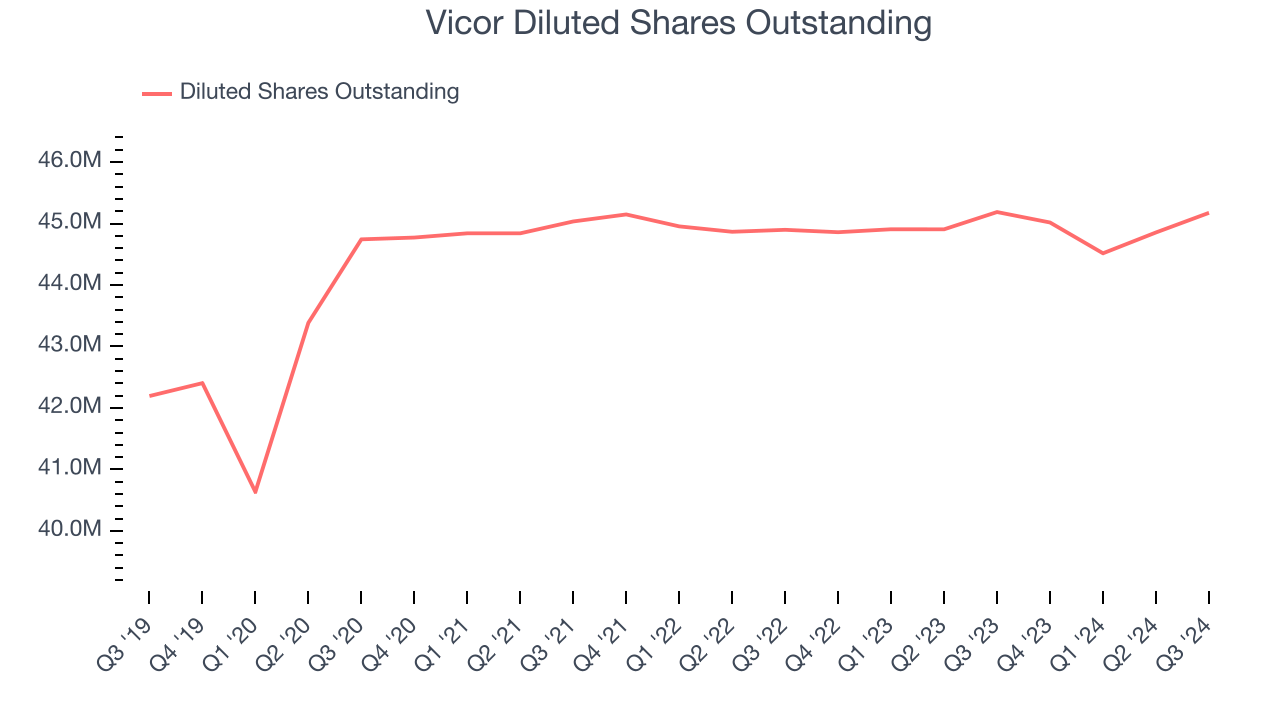

Sadly for Vicor, its EPS declined by 18.5% annually over the last five years while its revenue grew by 5.6%. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Diving into the nuances of Vicor’s earnings can give us a better understanding of its performance. A five-year view shows Vicor has diluted its shareholders, growing its share count by 7.1%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For Vicor, its two-year annual EPS declines of 61% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Vicor reported EPS at $0.26, down from $0.37 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Vicor’s full-year EPS of $0.09 to grow by 716%.

Key Takeaways from Vicor’s Q3 Results

We were impressed by how significantly Vicor blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 15% to $49.90 immediately following the results.

Sure, Vicor had a solid quarter, but if we look at the bigger picture, is this stock a buy?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.