Global payment technology company Visa (NYSE: V) stock is up 2.7% year-to-date (YTD), underperforming the 16.62% gain for the S&P 500 index. The Federal Reserve Bank of New York reported a $27 billion rise in credit card debt to a record $1.14 trillion. Credit bureau TransUnion reported the average credit card balance per consumer rose 4.7% YoY to $6,329. With record credit card debt levels, investors would believe that the world's second-largest payment processor, Visa stock, should be performing much stronger than it is.

Visa operates in the business services sector and competes with Mastercard Inc. (NYSE: MA), Discovery Financial Services Inc. (NYSE: DFS), and American Express Co. (NYSE: AXP).

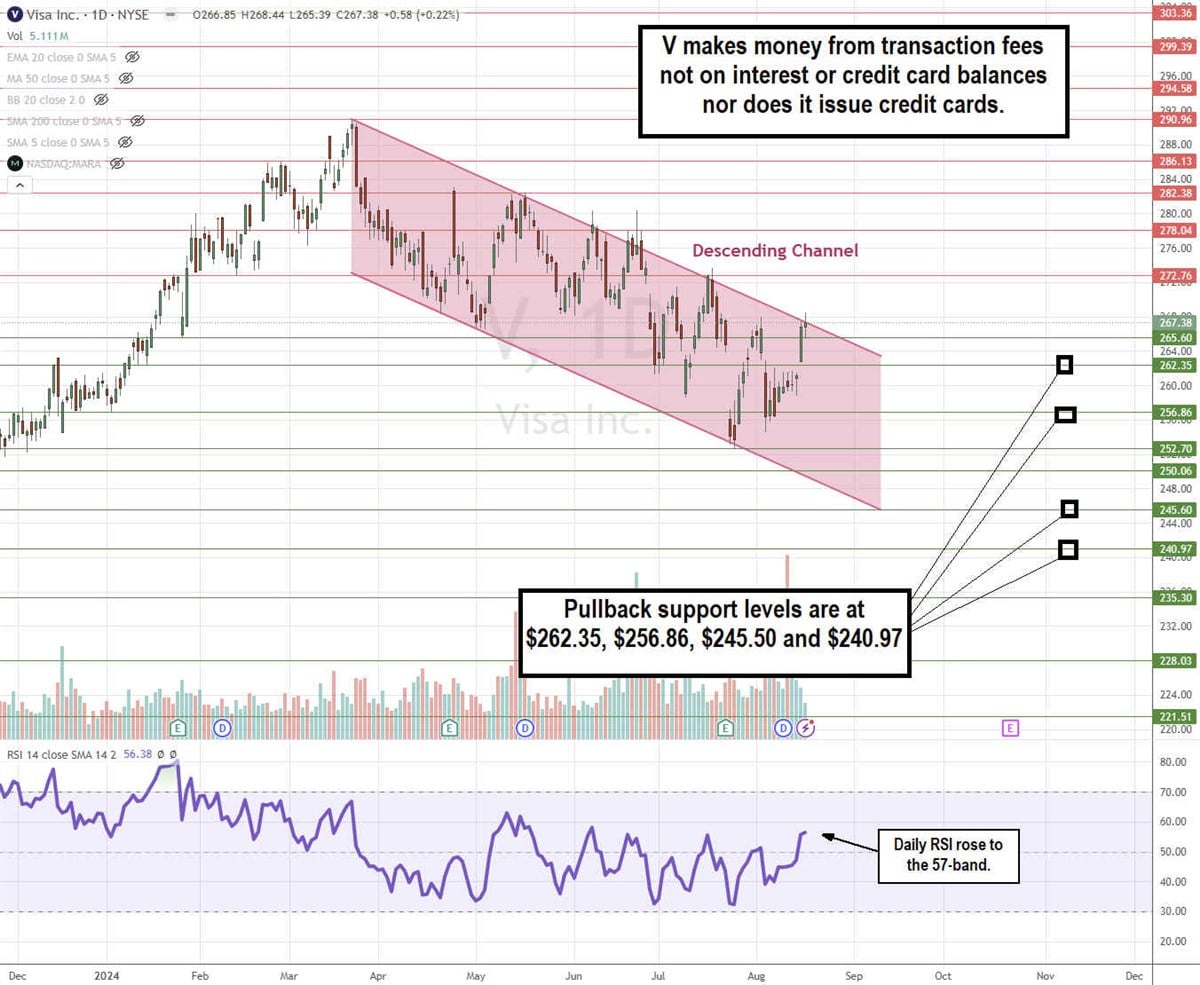

Visa Doesn’t Issue Credit Cards

There is a misconception that Visa issues credit cards. This is not the case. Visa is a network that facilitates electronic funds transfers (EFTs) between consumers, merchants, and financial institutions. Visa is a middleman enabling security and convenient digital payments. It’s an asset-light business whose core function is to process payments and transactions made using Visa-branded credit, debit, and prepaid cards through the Visa network. Visa generates revenues through service and transaction fees charged to merchants and financial institutions. This is similar to PayPal Holding Inc. (NASDAQ: PYPL), which is both a competitor and partner with Visa.

Is Record Credit Card Debt Good for Visa?

Visa collects fees from transactions like purchases using a Visa-branded card. The interest charged on the credit card balance is collected by the issuing financial institution. In other words, Visa doesn't make money on credit balances or the interest charged on them. Therefore, record-high credit card debt doesn't necessarily mean it benefits Visa. Retail spending has a more direct impact on Visa since they collect transaction fees from merchants.

Is Visa Impacted by High Interest Rates, Credit Card Balances, or Credit Card Chargebacks?

High interest rates compound existing credit card debt, contributing to record levels. Therefore, credit card debt rises even without the consumer making Visa card purchases. Soft consumer spending due to inflation and high interest rates is actually bad for Visa. On the flip side, Visa isn't directly hurt by credit card defaults, delinquencies, and charge-offs. Indirectly, Visa gets hit when consumers face financial difficulties, which leads to reduced transaction volumes as spending gets reigned in.

Visa Stock Is in a Descending Channel Pattern

The daily candlestick chart for Visa indicated a descending price channel comprised of lower highs and lower lows. The descending upper trendline connects the highs, while the parallel descending lower trendline connects the lows. The channel commences after hitting its $290.96 all-time high on March 21, 2024. The daily relative strength index (RSI) is trying to bounce through the 56-band. Pullback support levels are at $262.35, $256.88, $245.50, and $240.97.

Sluggish Discretionary Spending Becomes More Evident

Visa reported Q3 2024 EPS of $2.42, matching consensus estimates. Revenues rose 9.6% YoY to $8.9 billion, missing the consensus estimates of $8.92 billion. Total processed transactions rose 10% YoY.

Payments volume increased by 7% YoY, indicating a slowdown. Travel-related volume growth tapered off as cross-volume growth slowed to 13%, down from 14%. Credit and debit card payment volumes slowed to 7%, down from 8% in the year-ago period. During the conference call, they noted that U.S. payments volume through July 21, 2024, rose just 4% YoY, with deceleration attributed to weather, the timing of promotional shopping events, and the technology outage.

Visa Reaffirms In-Line Q4 2024 Forecasts

Visa expects Q4 2024 revenue growth in the low double digits, operating expense growth in the high single digits, and diluted EPS growth at the higher end of the low double digits.

VISA CEO Ryan McInerney concluded, “…we continue to see strong growth in client demand for our consulting and marketing services, particularly around marquee events such as the Olympic and Paralympic Games. Our value-added services portfolio solutions is strong and is driving meaningful growth for our clients and for Visa.”

Visa analyst ratings and price targets are at MarketBeat. There are 27 analyst ratings on V stock, comprised of one Strong Buy, 20 Buys, and six Holds. Consensus analyst price targets point to a 15% upside at $307.25. The stock also pays a 0.78% annual dividend yield.