The race for air taxis is taking off. These machines are technically called electric vertical take-off and landing (eVTOL) aircraft. What was once just a science fiction fantasy is gaining momentum towards becoming a regulated reality. Archer Aviation Inc. (NYSE: ACHR) is a leading company that develops and manufactures eVTOL aircraft. Famed fund manager Cathie Wood is a believer, as her ARK Investing funds purchased another 406,912 shares on July 2, 2024.

Archer Aviation operates in the aerospace sector and competes with eVTOL companies, including Joby Aviation Inc. (NYSE: JOBY), EHang Holdings Ltd. (NASDAQ: EH), and Lillium N.V. (NASDAQ: LILM).

Why Take an Air Taxi?

Archer Aviation’s goal is to “transform” urban travel. It hopes its eVTOL aircraft will replace the 60- to 90-minute commutes with a car through traffic with a 10-- to 20-minute electric air taxi ride. Its lead prototype, Midnight, has a human pilot and seats four passengers. It’s designed to perform rapid back-to-back flights with minimal charging between flights.

Cathie Wood is a Big Believer in Archer Aviation

The 406,912 share purchase on July 2, 2024, was a drop in the bucket compared to her total position of 28.3 million shares valued at around $143 million. This makes Ark Invest a 9.9% owner. Archer Aviation is her 27th largest holding, making up 1.10% of the portfolio. Wood started acquiring Archer Aviation shares in Q2 2021 and growing her net position. The total estimated purchase price is $181 million, equating to a 21% loss on paper. Wood is not alone in her enthusiasm for Archer’s prospects.

Stellantis Invests $55 Million

Automobile giant Stellantis N.V. (NYSE: STLA) invested another $55 million under its strategic funding agreement. In 2023, Stellantis initially invested $110 million in the company under its strategic funding agreement and open stock market purchases. Archer is constructing a high-volume manufacturing plant in Georgia, which it plans to have completed by year's end. Stellantis is partnered with Archer to help improve its production capacity so it can produce at scale as needed.

Archer is Leading the Pack

The regulatory landscape for urban air mobility continues to evolve with standards and rules to adapt to quickly advancing technologies. The Federal Aviation Administration (FAA) is the chief watchdog, and any company looking to enter the industry requires a certification. Archer's leading 12-engine model carries twice that of Joby's 6-engine eVTOL aircraft.

Archer's subsidiary, Archer Air, received its FAA Part 135 Air Carrier & Operator Certificate in addition to its Part 145 certificate from the FAA, enabling them to perform specialized aircraft repair services. This enables Archer to commence operating aircraft commercially to test and refine its systems and procedures ahead of launching its Midnight eVTOL aircraft for United Airlines Holdings Inc. (NASDAQ: UAL). Archer also signed a memorandum of understanding (MOU) with Southwest Airlines Co. (NYSE: LUV) to develop operational plans for electric air taxi networks utilizing Archer’s eVTOL at California airports.

Archer Aviation Founder and CEO Adam Goldstein expressed, “We are honored to receive the Part 135 Air Carrier & Operator Certificate from the FAA, which is another important stepping stone on the way to commencing commercial air taxi operations with our Midnight aircraft.”

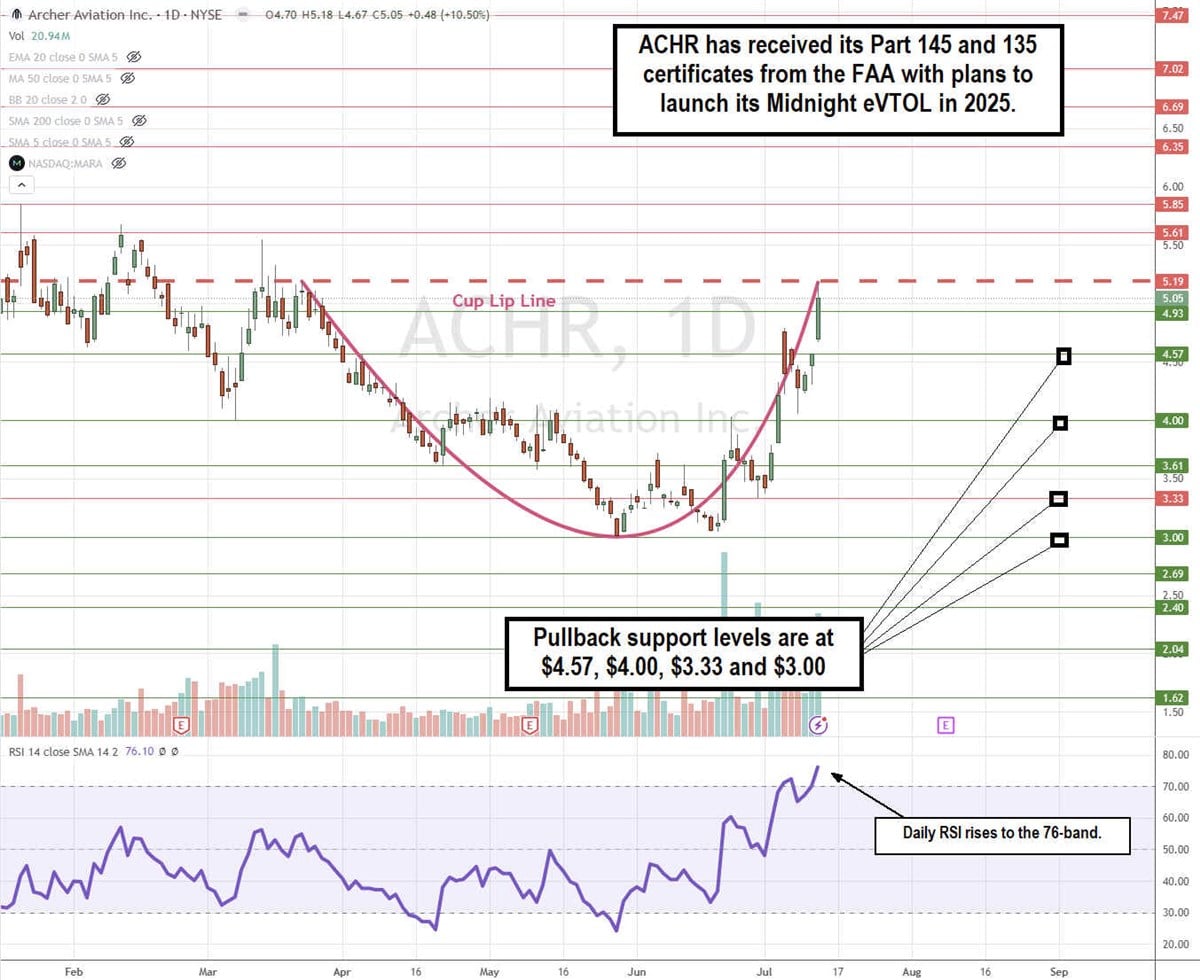

ACHR Completes a Daily Cup Pattern

The daily candlestick chart for ACHR illustrates the completion of a cup pattern. The cup lip line formed at $5.19 on March 21, 2024. ACHR fell to a low of $3.00 on May 29, 2024. ACHR staged a rally after breaking out through the $3.61 resistance, driving shares towards the $5.19 cup lip line. Upon peaking there, ACHR may pull back to form the handle, setting up a cup and handle breakout through the cup lip line. The daily relative strength index (RSI) has bounced up to the 76-band. Pullback support levels are at $4.57, $4.00, $3.33, and $3.00.

The Next Steps to Commercialization

Archer must undergo rigorous and extensive test flights demonstrating safety and reliability to secure FAA certification. This enables Archer to start commercial operations. The company also has to refine its production process. Archer estimates its first commercial flights in 2025 in collaboration with United Airlines.

Archer Aviation analyst ratings and price targets are at MarketBeat. The consensus analyst price target of $8.10 implies a 60.04% upside.