Network cybersecurity provider Palo Alto Networks Inc. (NASDAQ: PANW) stock has recovered from its fiscal Q3 2024 earnings report. While the results weren't bad, shares took a tumble on its forward guidance. However, the markets can smell a bargain when they see one, and shares have recovered to a 15% year-to-date (YTD) performance. The company integrates its proprietary artificial intelligence (AI) into its comprehensive suite of products and services.

Palo Alto Networks operates in the computer and technology sector, competing with cybersecurity companies like Crowdstrike Holdings Inc. (NASDAQ: CRWD), Zscaler Inc. (NASDAQ: ZS) and Sentinel One, Inc.(NYSE: S).

Precision AI is Integrated Into Palo Alto's Platform

Precision AI is Palo Alto’s proprietary AI that uses data gathered from the cloud, endpoint, and network to automate cybersecurity defense. Machine learning (ML) has been built into many of its products for over a decade. Its ML enables its security applications to predict, prevent, and remediate security problems. It uses deep learning to build predictive models that help to anticipate and detect security issues. Generative AI enhances tools to simplify user experience and summarize large volumes of threat intelligence in "human speak."

Palo Alto's Precision AI: Battling Adversarial AI Threats

Palo Alto's Precision AI contends with adversarial AI from bad actors. AI cuts both ways. Hackers are always trying to find new ways to exploit cybersecurity vulnerabilities. Cybercriminals are already implementing AI to accelerate, scale up, and improve existing attack methods like prompt injection attacks and phishing. Adversarial AI expands the attack surface, providing criminals with new vectors to target. The best defense is a good offense, pitting AI against AI.

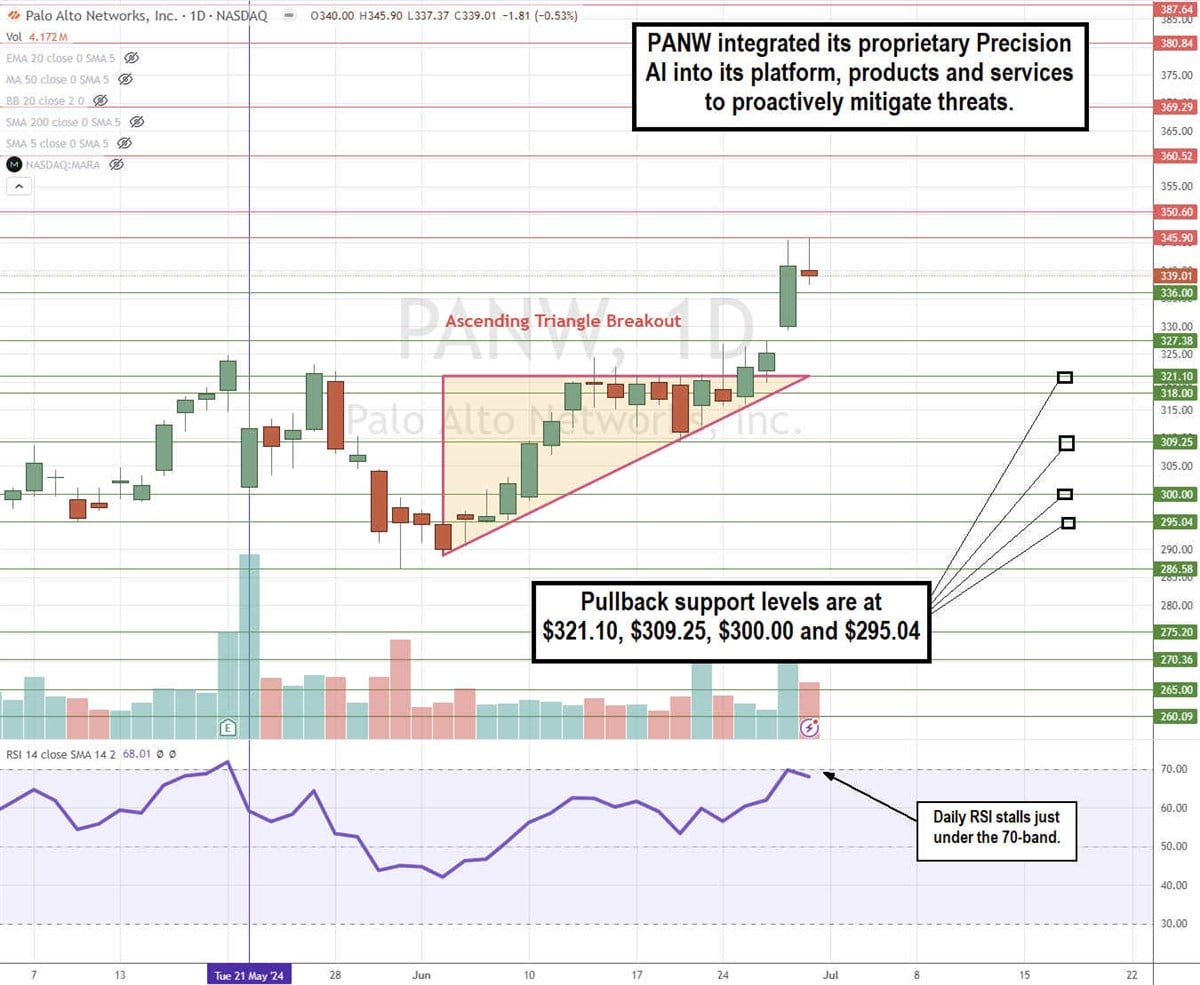

PANW Stock Triggered an Ascending Triangle Breakout

The daily candlestick chart for PANW illustrates an ascending triangle breakout pattern. The upper flat-top trendline held the resistance at $321.10, while the ascending trendline, comprised of higher lows on pullbacks, closed the distance. The breakout was triggered when PANW surged through $321.10 as shares climbed up to $345.90. The daily relative strength index (RSI) rose to the 70-band but hasn’t been able to pierce it yet. Pullback supports are at $321.10, $309.25, $300.00 and $295.04.

Palo Alto reported fiscal Q3 2024 EPS of $1.32, beating consensus analyst estimates by 7 cents. Revenues grew 15.1% YoY to $1.98 billion, beating $1.97 billion consensus estimates.

Platformization is Driving Growth

Platformization encourages customers to adopt a broader range of security solutions to build upon overall security infrastructure. This includes network security (NetSec) platforms with next-gen firewalls, a cloud security platform with Prisma Cloud, and endpoint security with Cortex XDR to secure endpoints. SecOps with security information and event management (SIEM) is like an "eye in the sky," providing a complete bird' s-eye view across the entire computer network. Palo Alto partnered with International Business Machines Co. (NYSE: IBM) to drive platformization.

Big Deals Continue to Grow for Palo Alto

In Q3 2024, the size of deals continued to grow, including an 8-figure deal with a financial services company expanding NetSec to Cortex. Palo Alto beat out more than ten cybersecurity vendors to secure a 9-figure deal with a healthcare provider consolidating NetSec and SecOps. Accounts generating more than $1 million rose 22% YoY to 397. Accounts generating over $5 million rose 17% YoY to 84. Accounts generating more than $10 million annually rose 28% to 32.

Palo Alto Issues In-Line Guidance

The company provides fiscal Q4 2024 EPS guidance of $1.40 to $1.42 versus $1.41 consensus estimates. Q4 revenues are expected to be between $2.15 and $2.17 billion versus $2.16 billion. Total billings for Q4 are expected to be between $3.43 billion and $3.48 billion, representing 9% to 10% YoY growth. Full-year 2024 billings guidance was narrowed to $10.13 billion to $10.18 billion, from the previous $10.10 billion to $10.20 billion. The billings guidance was responsible for the stock price gap the following morning.

Palo Alto Networks CEO Nikesh Arora commented, "We are pleased with the enthusiastic response to platformization from our customers in Q3. Platformization is a long-term strategy that addresses the increasing sophistication and volume of threats and the need for AI-infused security outcomes."

Palo Alto Networks analyst ratings and price targets are at MarketBeat.