General Mills (NYSE: GIS), WK Kellogg (NYSE: KLG) and Conagra (NYSE: CAG) are among the stocks with the lowest ratings tracked by Marketbeat. Their analysts are more pessimistic than most other stocks the platform tracks, yet they are rebounding because their industry and businesses are on track to pivot this year. The pivot returns to growth from contraction with the critical detail cash flow. The solid cash flow supports robust capital return outlooks for these high-yield stocks, which are also cheap.

The high yield is relative to the consumer staples sector and the broader market. All three of these stocks yield more than The Consumer Staples Sector ETF (XLP), which itself yields 2.8%, more than double the broad market. These stocks also come at a value, trading below 15x and as low as 12x earnings compared to an average of 22x for the S&P 500 and 25x to 30x for the most highly-valued consumer staples stocks. And don't forget, this sector provides low-beta insulation from market downturns and volatility.

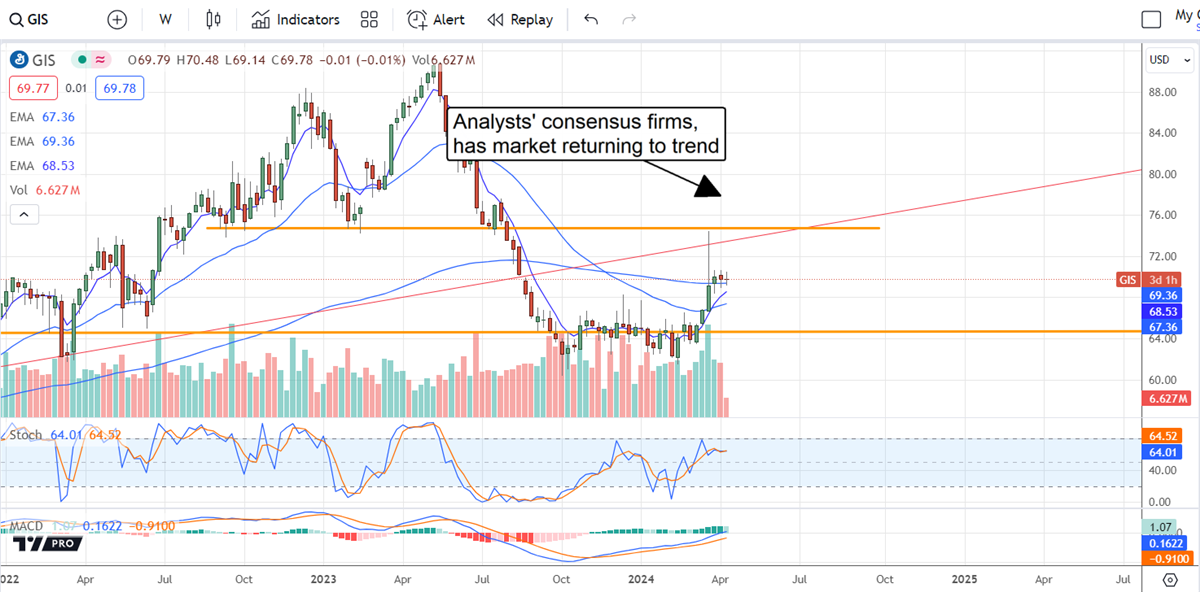

General Mills Advances from Double-Bottom and is Returning to Trend

General Mills' stock price fell hard in 2023 but formed a double-bottom still in play. After rebounding from lows, the market broke above critical resistance to confirm a reversal within a larger trading range. The market is poised to move to the top of the range near $75 and may break through to higher prices. A move above $75 would put the market back on trend and open the door to higher prices later this year.

The latest results and guidance were mixed, resulting in numerous analysts' price target increases but lessening expectations for current quarter earnings. The takeaway is that the bar is set low for Q4, and a pivot back to growth is expected this year.

The forecast is for top and bottom-line growth aided by pricing power and margin expansion. Because the bar is set low, the company may outperform and/or provide favorable guidance. In this scenario, the analysts will continue to boost the price action and drive the market higher. Until then, General Mills' 3.35% dividend yield is trading at 15x earnings.

Conagra Brands has a Deeper Value and Higher Yield

Conagra Brands is similarly poised to rebound this year, with shares up off of their bottom and on track to break a critical resistance point soon. This market is supported by improving internal economics and an outlook for profitability that plays into the dividend. The stock is among the highest-yielding consumer staples, with a payout near 4.5%, and it is reliable. The company pays about 50% of its earnings and maintains a solid balance sheet to continue making annual increases.

Analysts rate Conagra at Hold and are leading the market to higher price points. The few revisions to come out since the FQ3 results all include price target revisions that put the market above consensus. Consensus implies about a 6% upside. A move to the $33 consensus target would break the market out of its trading range and put it above critical resistance.

WK Kellogg Melts Up and Approaches a Critical Level

WK Kellogg is a slightly different story; this stock imploded following the spin-off of its global snacking business but is now rebounding. The technical action has the market near the critical pivot point of its post-split opening trade. It could advance another $10, or 50%, if the market can move above that level. Drivers include the low 13x earnings multiple, healthy balance sheet and 3% yield.

The caveat is that analysts present a headwind to cap gains. The market for KLG is trading well above the high end of the analysts' range, suggesting the stock is overvalued. However, analysts may have been cautious with their initial targets and could raise them if solid results were provided. Still, the consensus for current quarter results is for sequential growth and the highest revenue since the split, which is a high bar to beat.