Dividend stocks play a significant role in a diversified portfolio. They're also a time-honored way to accumulate wealth that can provide some protection against inflation. But even experienced investors may wonder how to pick the best dividend stocks. The good news is that investors can find good dividend stocks in many ways. But there is no one size fits all solution. Often, the right dividend stock is personal to your investment objectives.

In this article, we'll look at some metrics investors use to find the best dividend stocks. We'll also give you some steps you can take to pick the right dividend stocks for your portfolio.

Determining the Best Dividend Stocks

What makes a dividend stock one of the "best" for investors? Two key metrics to understand are dividend yield and dividend payout ratio.

Many investors look for stocks with a good dividend yield. The dividend yield measures the company's dividend as a percentage of its stock price. The dividend yield calculator by MarketBeat does the math for you. But if you want to do it yourself (and you can), the formula for calculating dividend yield is as follows:

Dividend yield = Current annual dividend (per share)/Current stock price

Here are a few examples:

- The Clorox Company (NYSE: CLX) pays a total annual dividend of $4.72 per share. Its stock price is $154.14. The dividend yield for CLX stock is: 4.72/154.14 = 3.06%

- Duke Energy Corp. (NYSE: DUK) pays a total annual dividend of $4.02 per share. Its stock price is $97.87. The dividend yield for DUK stock is: 4.02/97.87 = 4.11%

- Lowe's Companies Inc. (NYSE: LOW) pays a total annual dividend of $4.20 per share. Its stock price is $208.18. The dividend yield for LOW stock is: 4.2/208.18 = 2.08%

There are two things that these examples highlight about dividend yield. First, it's dynamic. A company may only change its dividend payout once every year, but its stock price will change daily. And if the stock price changes sharply in one direction or another, it will change the dividend yield.

Second, dividend yield doesn't indicate whether or not a company can sustain its current dividend. That's why dividend yield should not be your only consideration when picking the best dividend stocks.

Another consideration that you can consider in addition to dividend yield is a stock's dividend payout ratio or the amount of a company's net income that goes towards dividends. The payout ratio can give investors a good picture of a company's free cash flow based on their willingness to offer a dividend.

On average, you should look for dividend payout ratios between 30% and 60%, although some may say it should be no higher than 50%. However, this can depend on factors such as the sector a company's in and the strength of its balance sheet.

Examples of the Best Dividend Stocks

One of the best reasons to get a subscription to MarketBeat All-Access is to get access to its full array of stock screeners. Here are some results from using MarketBeat's data dividend screener.

Stocks with Dividend Yields of Over 2% and Annual Growth of Over 5%

Some stocks that meet these criteria include:

- Johnson & Johnson (NYSE: JNJ):

- Yield: 2.86%

- Annual payout: $4.52

- Dividend payout ratio: 41.51%

- Three-year dividend growth: 5.87%

- Chevron Co. (NYSE: CVX):

- Yield: 3.75%

- Annual payout: $6.04

- Dividend payout ratio: 41.71%

- Three-year dividend growth: 6.07%

- PepsiCo Inc. (NASDAQ: PEP):

- Yield: 2.61%

- Annual payout: $4.60

- Dividend payout ratio: 58.23%

- Three-year dividend growth: 6.06%

Utility Stocks

Utility stocks are one of the first sectors that come to mind regarding dividends because their revenue is regulated and consistent. These companies are generally known for paying consistent dividends. Here are some stocks that use the same criteria as above:

- NextEra Energy Inc. (NYSE: NEE):

- Yield: 2.31%

- Annual payout: $1.70

- Dividend payout ratio: 50.30%

- Three-year dividend growth: 10.79%

- American Electric Power Co. Inc. (NYSE: AEP):

- Yield: 3.65%

- Annual payout: $3.32

- Dividend payout ratio: 58.87%

- Three-year dividend growth: 5.37%

- Xcel Energy Inc. (NASDAQ: XEL):

- Yield: 2.90%

- Annual payout: $1.95

- Dividend payout ratio: 54.02%

- Three-year dividend growth: 6.38%

Tech Stocks

When thinking of how to pick the best dividend stocks, tech stocks don't come to mind. But here are a few tech stocks that also pay attractive dividends.

- Broadcom Inc. (NASDAQ: AVGO):

- Yield: 3.16%

- Annual payout: $18.40

- Dividend payout ratio: 69.43%

- Three-year dividend growth: 14.70%

- Cisco Systems Inc. (NASDAQ: CSCO):

- Yield: 3.10%

- Annual payout: $1.52

- Dividend payout ratio: 55.68%

- Three-year dividend growth: 2.78%

- Texas Instruments Inc. (NASDAQ: TXN):

- Yield: 2.90%

- Annual payout: $4.96

- Dividend payout ratio: 52.77%

- Three-year dividend growth: 13.47%

Dividend Aristocrats

The Dividend Aristocrats are an exclusive list of companies that have increased their dividend for at least 25 consecutive years. As of 2022, there were 64 Dividend Aristocrats. One example is Caterpillar Inc. (NYSE: CAT), which has increased its dividend for 30 consecutive years as of February 2023.

Dividend Kings

The Dividend Kings is an exclusive list of companies that have increased their dividend for at least 50 consecutive years. As of February 2023, there are 47 Dividend Kings. One example is AbbVie Inc. (NYSE: ABBV), which has a yield of 3.87%, an annual payout of $5.92, a dividend payout ratio of 89% and three-year dividend growth of 9.16%.

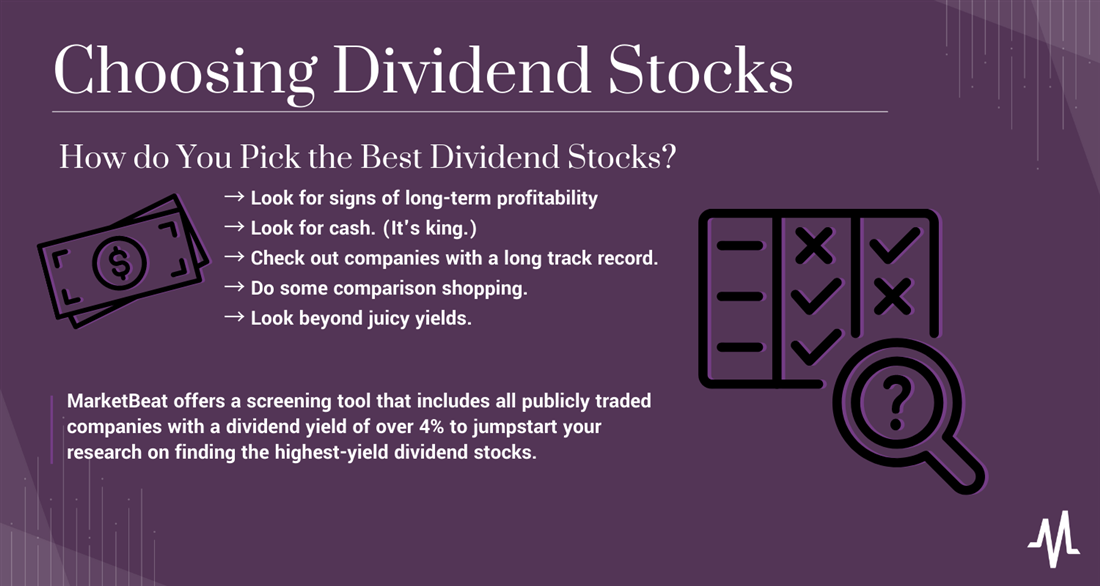

How to Pick the Best Dividend Stocks

Picking the best dividend stocks can take work, but some tried-and-true principles can help narrow your search. Some will require you to look at a company's financial documents. But don't worry. You don't need a finance degree. We'll show you a few items to look for and how to interpret them.

Step 1: Look for signs of long-term profitability.

A dividend is simply a portion of a company's profits that they distribute to shareholders. It stands to reason that one of the first things you should look for is a company's ability to generate profits consistently.

Better still, you're looking for companies consistently growing their earnings yearly. Ideally, you're looking for a growth rate of between 5% and 15% per year. Earnings growing at more than 15% is typically not sustainable, and if the company misses on earnings, it may have to cut its dividend.

Every publicly traded company reports earnings (usually every quarter). At that time, they typically issue guidance for their profits in the coming quarter and for the full year. For most companies, this information is also available on MarketBeat. Go to a company's profile page and click on the "earnings" tab.

Step 2: Look for cash. (It's king.)

Ultimately companies need cash to pay dividends. A key measure is a company's free cash flow (FCF), the cash it generates from its normal business operations after subtracting the money it spends on capital expenditures.

However, if a company is spending too much of its FCF on dividend payments, it could suggest that it is not growing, which is negative for its stock price.

A company will likely use its FCF for other things besides dividend payments. This could include share buybacks or investing in the company's growth.

Step 3: Look for companies with a track record.

At a minimum, you want to find companies with a history of paying dividends for at least five consecutive years. But what you look for in a good dividend stock is the ability of a company to increase its dividend year after year.

The companies that do this for the most consecutive years become Dividend Aristocrats or Dividend Kings, meaning they've increased their dividends for at least 25 or 50 years, respectively.

Step 4: Look into company debt.

In your finances, excessive debt can limit your ability to save and invest. It's the same with a company. Too much debt will mean they must use their earnings to pay down debt. You want to look at a company's debt-to-equity ratio to check this. Anything over 2.00 is usually too high.

Other investors may look at metrics like a company's current and/or quick ratios. Both of these ratios measure the liquidity of a company. In other words, it's the ability to have enough cash to meet its short-term financial obligations, including payroll.

Step 5: Do some comparison shopping.

After you've done the first four steps, you'll want to check how a company's number compares to other companies in its sector. For example, if you're researching The Home Depot Inc. (NYSE: HD), you'll want to see how it compares to Lowe's as opposed to McDonald's Corporation (NYSE: MCD).

Also, companies such as real estate investment trusts (REITs) and many master limited partnerships (MLPs) must disperse a specific percentage of their profits as dividends, which usually makes for higher dividend yields. It would be unfair to compare these companies with a company like

Step 6: Look beyond juicy yields.

One mistake that even experienced investors make is getting seduced by a juicy dividend yield. By itself, finding the highest yield stock dividends is not a problem. But if the dividend isn't sustainable, investors can find themselves in a yield trap. That's why you need to look at things such as debt and a company's earnings track record.

So what is a good annual dividend yield and what is a good average dividend yield?

Consistent singles and doubles are better than home runs and strikeouts.

Generally, a good dividend yield will be between 2% and 5%. If they correlate with sector averages, they are usually strong enough to generate the income that investors want while suggesting that the dividend is not at risk if the company has a few quarters of down performance.

MarketBeat offers a screening tool that includes all publicly traded companies with a dividend yield of over 4% to jumpstart your research on finding the highest-yield dividend stocks.

Picking the Best Dividend Stocks: Easier than You Think

Dividend stocks provide you with a reliable source of income in addition to the opportunity for stock price growth. Dividend-paying stocks can be a good way to preserve wealth and keep your portfolio ahead of inflation. With a resource like MarketBeat, you have the tools to help you find the best dividend stocks that best fit your investment objectives.

FAQs

You may still have some questions if you're new to dividend stocks. Here are some of the answers to frequently asked questions.

How do I find the best dividend stocks?

MarketBeat is one of the best sources for finding dividend stocks and companies. The site has a range of screeners and calculators, bringing all your research into one easy-to-use space. With just a few keystrokes, you can sort and compare dividend stocks that fit your investment objectives.

What stock gives the highest dividend?

The answer to this question will be different on any trading day. But you should look for more than just the highest dividend. It would be best to look for the stocks more likely to produce the highest return over time. You can use the dividend calculator from MarketBeat to help you find high-dividend stocks based on your objectives.

What are the best dividend stocks to buy and hold?

In many cases, the best dividend stocks to buy and hold will be companies with a history of increasing their dividend annually. The best companies are Dividend Aristocrats and Dividend Kings, which have increased their dividends for at least 25 and 50 years, respectively.